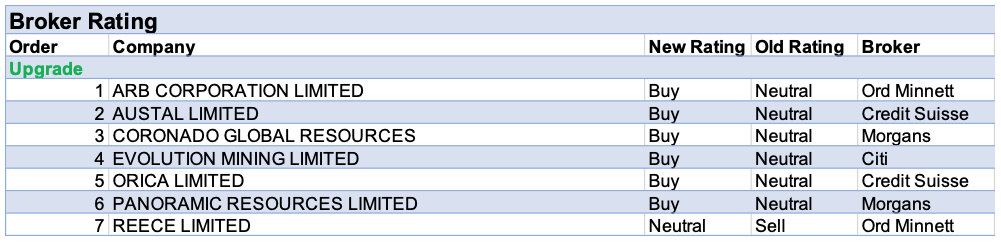

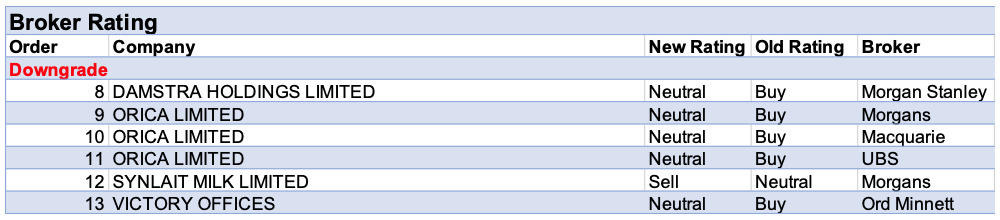

For the week ending Friday 5 March, there were 7 upgrades and 6 downgrades to ASX-listed companies by brokers in the FNArena database.

Orica received three downgrades from separate brokers. A litany of woes included China’s ban on Australian thermal coal imports, FX headwinds, lack of visibility on earnings as well as a CEO transition.

This week Morgans downgraded its rating for Synlait Milk to Reduce from Hold after assessing significant uncertainty and volatility is impacting the business. A slide in infant formula sales volumes is expected to reduce overhead recovery and increase production of lower-margin ingredient products.

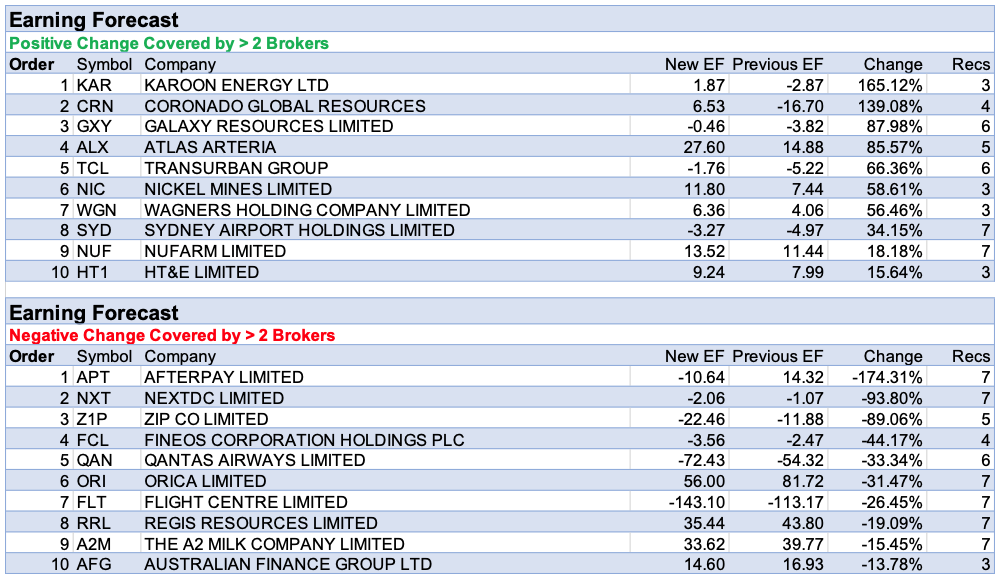

On the podium for leading forecast earnings downgrades last week were the two leading BNPL stocks in Afterpay and Zip Co.

Citi expects Afterpay’s growth will be negatively impacted by slowing e-commerce and sees competition as a risk to medium-term margins. In the prior week, UBS pointed out over $2bn in capital raisings since last July “vindicates our view that the market continues to mis-price or ignore how much capital is required to fund the company’s growth”.

Regarding Zip Co, Macquarie warned the market may only be focussing on customer growth and pointed out the risk of elevated sector multiples. While largely positive on the stock, Citi alluded to risks from competition and lack of scale internationally.

Another high PE stock in NextDC was wedged between the BNPL players on the table for the biggest percentage downgrades to earnings. As mentioned last week, Credit Suisse expects a slower ramp-up over the next couple of years with costs largely unchanged, while Macquarie cautions on the impact of rising bond yields. On the other hand, Citi enthuses that near-term earnings are already contracted and customer expansion underpins the broker’s medium-term forecasts.

There was caution around forecast earnings for Fineos Corp as FY21 guidance implies to UBS a material slowdown in the second half for organic services revenue. Several brokers, as mentioned last week, found counterbalancing positives including organic subscriber growth of 35% and the signing of a small though strategically significant cloud claims deal in Australasia.

Qantas and Flight Centre also appeared on the list for significant percentage downgrades to earnings for the week by brokers on the FNArena database. While Qantas is doing a good job managing costs, Ord Minnett notes the balance sheet is feeling the impact of a huge hit to revenue with net debt rising to $6.1bn and above target.

Last week Flight Centre suffered some broker downgrades triggered mainly by valuation concerns with a recovery seemingly already factored into the share price.

Finally, Orica also had material forecast earnings downgrades, which dovetails with the earlier explanations for ratings downgrades.

Karoon Energy was atop the table for percentage earnings upgrades by brokers last week. The reasons put forward by Macquarie last week were solid production and cash metrics which are expected to continue in FY21.

Coronado Global Resources was next on the table. Morgans believes the around -15% discount to fair value looks overdone and upgraded its rating to Add from Hold. Meanwhile, UBS forecasts positive free cash flow in 2021.

Galaxy Resources received a boost to forecast earnings after UBS forecasted 10-50% higher lithium prices in 2021 and Citi expects a return to positive gross margins in 2021 driven by higher prices and lower unit costs.

Material forecast earnings upgrades were also received by road warriors Transurban Group and Atlas Arteria last week. For the former Macquarie highlighted a rebound in Australian traffic and registration growth, while management of Atlas Arteria cited French traffic resilience and recovery potential this year.

The recently updated 2020 financial performance for Nickel Mines showed Macquarie better-than-expected metrics and the Angel Nickel acquisition is expected to underpin a doubling of nickel production by 2023.

Finally, Wagners forecast earnings upgrades are consistent with commentary above relating to the big uptick in estimated price target for the company.

In the good books

ARB CORPORATION LIMITED (ARB) was upgraded to Accumulate from Hold by Ord Minnett B/H/S: 2/2/0

Ord Minnett expects ARB Corp to benefit from an improvement in new vehicle sales along with strong demand in the Australian aftermarket sales and growth from the export markets. Also, favourable currency movements have led to better gross profit margins. The broker believes these factors will drive above-average growth in the medium term. Looking at the recent pull-back in the share price, Ord Minnett upgrades its rating to Accumulate from Hold with the target rising to $36.50 from $35.

PANORAMIC RESOURCES LIMITED (PAN) was upgraded to Add from Hold by Morgans B/H/S: 1/1/0

In the wake of half year results, Morgans increases the rating to Add from Hold after updating commodity and FX assumptions and taking into account sale proceeds from the Panton PGM project. The target price is increased to $0.16 from $0.15. Based on strong commodity prices, the broker believes the board will approve a production re-start mid-year. There’s also considered upside from more efficient, lower cost mining and processing than previously estimated.

In the not-so-good books

SYNLAIT MILK LIMITED (SM1) was downgraded to Reduce from Hold by Morgans B/H/S: 2/1/1

In the wake of the recent downgrade from The A2 Milk Co (A2M), Synlait Milk has flagged significant uncertainty and volatility is impacting its business. The company has now withdrawn FY21 guidance. Morgans makes material forecast downgrades, lowers the rating to Reduce from Hold and the target price is decreased to $2.78 from $4.18. Balance sheet risk is considered to be heightened and an equity raising not ruled out. The broker highlights a slide in infant formula sales volumes will reduce overhead recovery and increase production of lower-margin ingredient products.

Earnings forecast

Listed below are the companies that have had their forecast current year earnings raised or lowered by the brokers last week. The qualification is that the stock must be covered by at least two brokers. The table shows the previous forecast on an earnings per share basis, the new forecast, and the percentage change.

The above was compiled from reports on FNArena. The FNArena database tabulates the views of seven major Australian and international stockbrokers: Citi, Credit Suisse, Macquarie, Morgan Stanley, Morgans, Ord Minnett and UBS. Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.