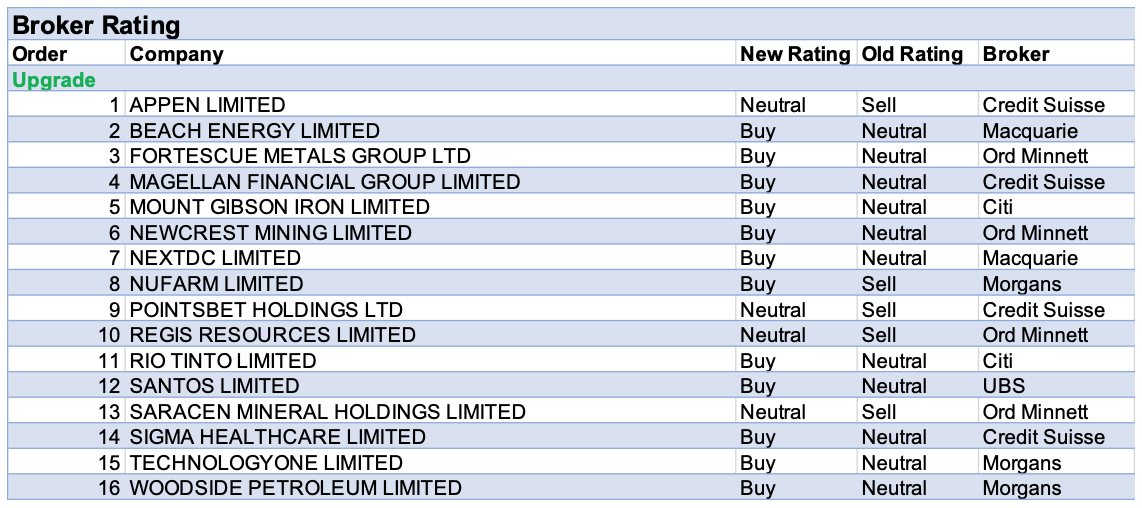

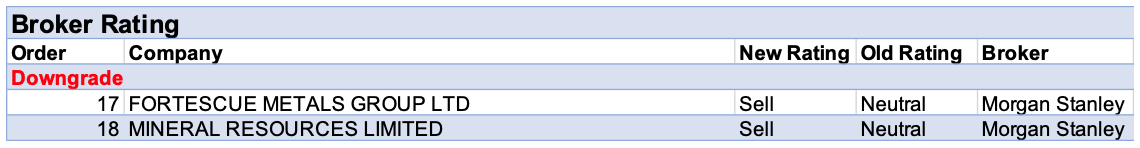

The week ending Friday 11 September proved a positive one for stockbroking analysts’ company ratings on individual ASX-listed stocks. There were 16 upgrades, of which 12 went to a direct Buy and only two downgrades, all to a direct Sell.

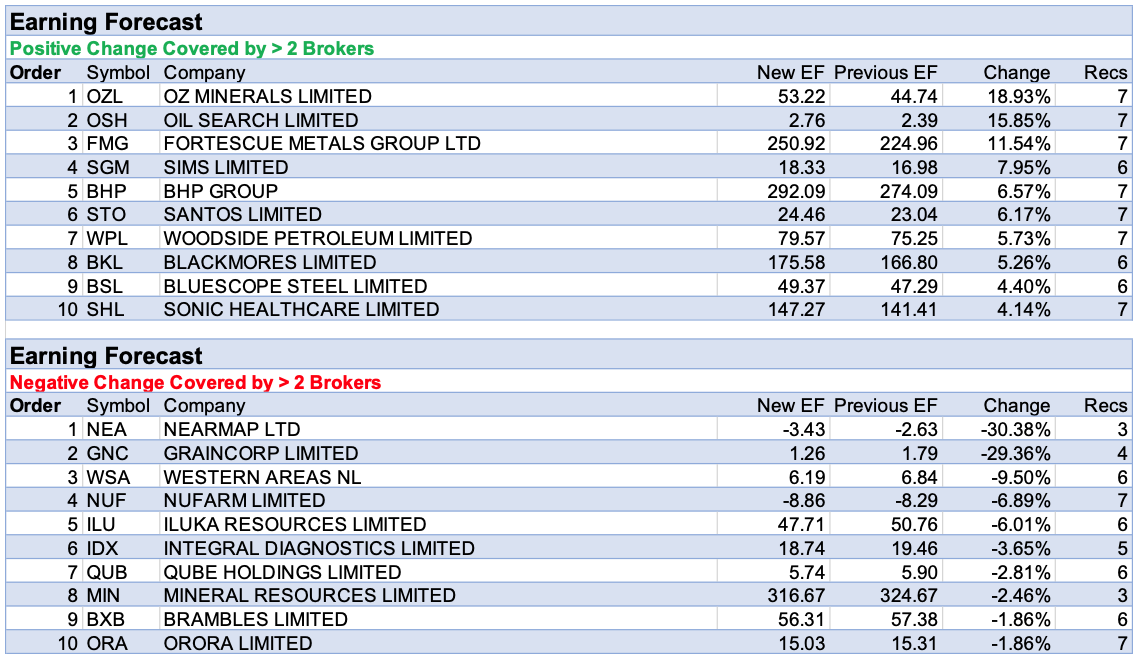

Most of the upgrades related to the mining sector. This mining bent was in evidence when reviewing the largest percentage change in earnings forecasts for the week. OZ Minerals had the largest change, driven by the company’s unique growth options and the bullish outlook for copper. There is no such optimism for the oil price. However, Oil Search is benefiting from downsizing its Alaskan Nanushuk oil development to phased self-funding. Third on the table for a percentage earnings increase is Fortescue Metals Group after brokers raised iron ore price forecasts.

Nearmap led percentage earnings downgrades for the week after announcing a capital raising. This will both support the balance sheet and allow the acceleration of growth plans in the US. Graincorp came second on the table for percentage downgrades. Brokers weighed up an increase to the winter crop forecast versus the insurance payout required by the company, as it attempts to smooth earnings in good years and bad.

In the good books

APPEN LIMITED (APX) was upgraded to Neutral from Underperform by Credit Suisse B/H/S: 3/2/0

Credit Suisse has become more balanced in its view of the stock and upgrades to Neutral from Underperform. The rating change is more about the share price than any fundamental difference. Valuation still appears stretched at 51x 2020 price/earnings, although the broker notes the industry structure remains healthy. Credit Suisse increases 2021 sales forecasts on higher productivity assumptions. Target is raised to $30 from $29. At this stage, the broker believes guidance for 2020 is achievable and leaves its forecast for $125.5m in operating earnings unchanged.

MOUNT GIBSON IRON LIMITED (MGX) was upgraded to Buy from Neutral by Citi B/H/S: 2/0/0

Citi expects a modest pullback in the iron ore price in the near-term but believes the price will be rangebound between US$100-US$120/t range for the rest of 2020. Iron ore price forecasts for 2021-23 have been lifted due to a more constructive Chinese steel demand outlook. The broker notes pure-play iron ore names like Mount Gibson Iron will benefit the most from higher prices with near term earnings almost doubling. Citi upgrades its rating to Buy from Neutral given the expectation of strong free cash flow generation at the new iron ore price deck. The target price rises to $1 from $0.75.

NEXTDC LIMITED (NXT) was upgraded to Outperform from Neutral by Macquarie B/H/S: 6/1/0

Macquarie upgrades its rating of NextDC from Neutral to Outperform, as the share price has retraced around -12% from recent highs. The broker explains it is one of the few companies benefiting both short and long term from COVID-19, as enterprises globally accelerate digital transformation plans. The target price is unchanged at $12.30.

POINTSBET HOLDINGS LTD (PBH) was upgraded to Neutral from Underperform by Credit Suisse B/H/S: 0/2/0

The company, in its deal with NBCUniversal, is now placed to be a national operator in the US sports betting and internet gaming industry. While the company will be paying for national advertising, Credit Suisse understands the deal allows for flexibility in terms of where the expenditure on marketing occurs. The broker increases its US sports betting market share assumptions for PointsBet to 10% in states where it becomes operational. FY23 estimates are upgraded by 38% as costs are offset by increased revenue forecasts. Rating is upgraded to Neutral from Underperform and the target lifted to $10.50 from $6.50.

RIO TINTO LIMITED (RIO) was upgraded to Buy from Neutral by Citi B/H/S: 3/3/1

Citi expects a modest pullback in the iron ore price in the near-term but believes the price will be rangebound between US$100-US$120/t range for the rest of 2020. Iron ore price forecasts for 2021-23 have been lifted due to a more constructive Chinese steel demand outlook. The broker forecasts Rio Tinto to have the highest absolute increase in earnings given the size of its iron ore footprint. Rio is Citi’s preferred pick for iron ore exposure given a very under-geared balance sheet presenting an opportunity for higher dividends over the next 3 years. Citi upgrades its rating to Buy from Neutral with the target price increasing to $115 from $100.

SIGMA HEALTHCARE LIMITED (SIG) was upgraded to Outperform from Neutral by Credit Suisse B/H/S: 2/1/1

Sigma Healthcare’s -8% fall in underlying earnings was a solid result under the circumstances, Credit Suisse suggests. No dividend was declared and no guidance offered. The broker forecasts 21% compound earnings growth over FY20-23 driven by cost-outs, the full ramp-up of the Chemist Warehouse contract and continued above-market growth in retail, aided by diminished regulatory headwinds. The end of the company’s capex investment cycle leaves sufficient balance sheet capacity for growth. Credit Suisse upgrades to Outperform from Neutral. Target rises to 70c from 64c.

SANTOS LIMITED (STO) was upgraded to Buy from Neutral by UBS B/H/S: 6/1/0

UBS expects Santos to achieve its target free cash flow breakeven in 2020, which will help it reduce its gearing levels over FY20-22. The broker points out Santos has better access to existing infrastructure than its peers that will help it reduce its capex. The company has three diversified growth projects that are near-term catalysts and provide Santos the best leverage to near-term growth, highlights the broker. Considering Santos as its most preferred energy exposure stock, UBS upgrades its rating to Buy with the target price increasing to $6.50 from $6.

TECHNOLOGYONE LIMITED (TNE) was upgraded to Add from Hold by Morgans B/H/S: 1/1/1

The FY20 result for TechnologyOne is due on November 24 and Morgans expects it to be in-line with guidance and to contain no major surprises. The broker notes the share price has fallen around -20% in the last four months, despite nothing much changing for the business. The analyst reiterates key strengths including a resilient business model, which comes from having long sales cycles and deeply embedded enterprise grade software. Additionally, the customer base is large, diversified and very well-funded. Some concerns may have arisen over the company’s education vertical and weakness in international students. Morgans reminds investors that the company’s revenue stream is not linked to international students. The rating is upgraded to Add from Hold and the target price is decreased to $8.76 from $9.16.

WOODSIDE PETROLEUM LIMITED (WPL) was upgraded to Add from Hold by Morgans B/H/S: 5/2/0

Morgans views Woodside Petroleum’s share price as trading at a discount to the value of its existing operations. As a result the broker upgrades the rating to Add from Hold and maintains the target price of $23.40. The pursuit of growth opportunities and maintenance of an elevated dividend payout ratio raises the spectre of the need for additional external capital, the broker acknowledges. However, under various equity raise scenarios, Morgans shows the company’s value is more sensitive to an eventual recovery versus future dilution risk. The analyst points out a key risk would be a more severe regional economic hit from covid-19, than currently assumed by the broker.

In the not-so-good books

FORTESCUE METALS GROUP LTD (FMG) was downgraded to Underweight from Equal-weight by Morgan Stanley B/H/S: 3/2/2

Morgan Stanley expects the iron ore market to be in surplus from the last quarter of 2020. However, the broker also expects stronger steel production in China and dismisses concerns about any build-up in China’s port ore stocks. This also prompts Morgan Stanley to raise its fourth-quarter 2020 and 2021 iron ore price forecasts to US$100/t and US$81/t but long-term projections remain unchanged. The broker notes some equity valuations are starting to look stretched like Fortescue Metals Group. This translates to a negative risk-reward skew, believes the broker, downgrading its rating to Underweight from Equal-weight. The target price rises to $14.50 from $12.70. Industry view is Attractive.

MINERAL RESOURCES LIMITED (MIN) was downgraded to Underweight from Equal-weight by Morgan Stanley B/H/S: 1/0/1

Morgan Stanley expects the iron ore market to be in surplus from the last quarter of 2020. However, the broker also expects stronger steel production in China and dismisses concerns about any build-up in China’s port ore stocks. This also prompts Morgan Stanley to raise its fourth-quarter 2020 and 2021 iron ore price forecasts to US$100/t and US$81/t but long-term projections remain unchanged. The broker notes valuation for Mineral Resources is starting to look stretched. This translates to a negative risk-reward skew, believes the broker, downgrading its rating to Underweight from Equal-weight. The target price rises to $23.50 from $21. Industry view: Attractive.

Earnings forecast

Listed below are the companies that have had their forecast current year earnings raised or lowered by the brokers last week. The qualification is that the stock must be covered by at least two brokers. The table shows the previous forecast on an earnings per share basis, the new forecast, and the percentage change.

The above was compiled from reports on FNArena. The FNArena database tabulates the views of seven major Australian and international stockbrokers: Citi, Credit Suisse, Macquarie, Morgan Stanley, Morgans, Ord Minnett and UBS. Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.