It was the final week of the local February reporting season and boy, there was frantic activity everywhere. Investors were selling shares on Covid 19 uncertainty and recession fears, while stockbroking analysts were digesting fresh corporate updates and remodeling accordingly.

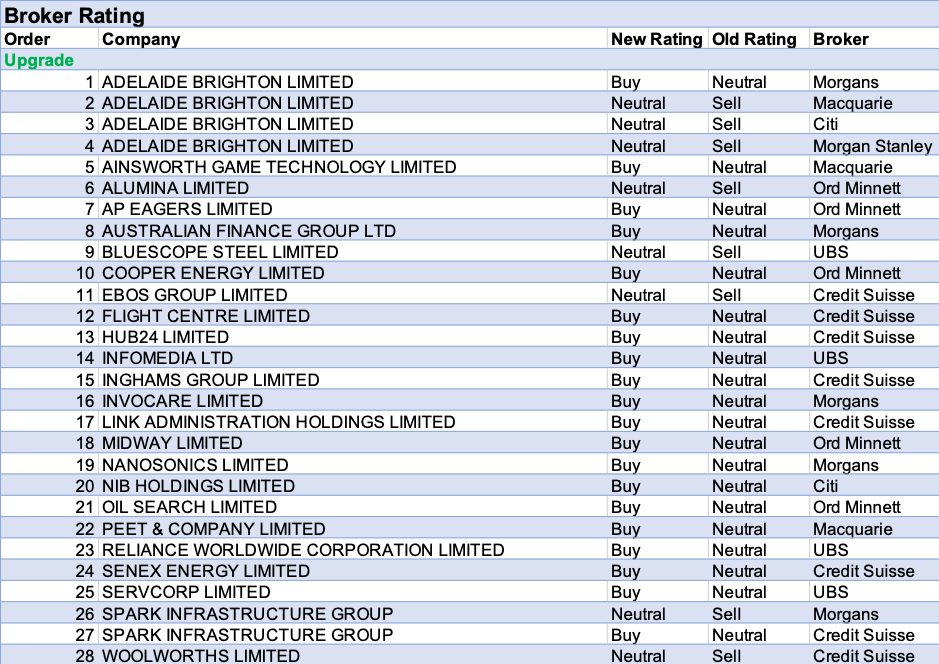

For the week ending Friday, 28th February 2020, FNArena registered no less than 28 upgrades in ratings for individual ASX-listed stocks, against only seven downgrades. Star of the week was building materials stalwart Adelaide Brighton which received four upgrades, though three of those only went up to Neutral/Hold.

Spark Infrastructure is the only other stock that received multiple upgrades during the week. Of the two, only one upgrade moved to Buy.

Equally noteworthy is that of the seven downgrades for the week, none shifted to Sell.

The combined ratios for the seven stockbrokers monitored daily by FNArena are: 45% of all ratings are Neutral/Hold, 39.60% of all ratings are Buy/Outperform and the remaining 15%-plus consists of Sell recommendations. The latter group has remained fairly stable for quite a while, so the main dynamic consists of changes between Buy and Hold with the latter representing most stocks as the robust upswing throughout calendar 2019 matured.

Dynamics for valuations and price targets on one hand and earnings estimates on the other remain in contradiction with each other. The trend for the former remains more positive than negative, while the overall trend for profit forecasts has once again made a decisive swing to the downside.

As such, the February reporting season can hardly be regarded a positive exercise for corporate Australia, regardless of the macro-economic concerns that have clouded the outlook.

When it comes to the week’s upgrades to profit forecasts, lots of fireworks are on show, with OceanaGold the week’s primus inter pares, at considerable distance followed by Galaxy Resources, Costa Group, Appen, and Santos. But there were equally enormous (if not gigantic) reductions to forecasts, with Ardent Leisure, Afterpay, Audinate Group and Zip Co the main casualties for the week.

As such, investors can take guidance from the final week of the February reporting season in that, on average, earnings forecasts are once again trending lower, with plenty of exceptions spread across multiple segments of the share market.

In the good books

ADELAIDE BRIGHTON LIMITED (ABC) was upgraded to Neutral from Sell by Citi, to Neutral from Underperform by Macquarie, to Equal-weight from Underweight by Morgan Stanley and to Add from Hold by Morgans B/H/S: 2/4/1

Citi’s statement is one for the ages: Adelaide Brighton “posted its weakest result in a decade and expects 2020 to fall a further 10%”. Luckily, for loyal shareholders, the analysts also think improvement is on the horizon. About the result released, the verdict is: FY19 is in-line (with prior profit warning), but FY20 guidance is (yet another) miss. It is Citi’s view that the next upturn in construction activity is not likely to materialise before 2021. The analysts laud the fact the company’s balance sheet has been restored, allowing the board to reinstate dividend payments, after having scrapped the interim payout earlier. On the assumption most of the bad news is now reflected in the share price, Citi upgrades to Neutral from Sell. Target price unchanged at $3. Forecasts have been reduced on weaker-than-expected guidance.

Adelaide Brighton’s -36% fall in profit was not quite as bad as Macquarie had forecast. The loss was driven by lower volumes, reduced pricing and higher input costs. 2020 guidance is for a further -10% fall, but the broker is forecasting below guidance due to ongoing complexities. That said, the stock has fallen -24% since Macquarie downgraded to Underperform last month, and with earnings expectations now re-based, residual risks are better balanced, the broker believes. Upgrade to Neutral from Underperform. Target falls to $3.00 from $3.30.

2019 results were in line with guidance on expectations. Morgan Stanley expects investor demand to improve once the impact of the implied downgrade to 2020 has passed. The broker believes it is too early to take a more positive stance but upgrades to Equal-weight from Underweight. Target is $3. Industry view: Cautious.

2019 results were in line with expectations. Cash flow and dividend were a positive surprise for Morgans. The broker considers the risk/award profile now more attractive, which compensates for the structural challenges facing the business. Rating is upgraded to Add from Hold. With the market likely to take time to gain confidence in the earnings recovery, the broker suggests investors accumulate the stock. Target is reduced to $3.30 from $3.65.

AINSWORTH GAME TECHNOLOGY LIMITED (AGI) was upgraded to Outperform from Neutral by Macquarie B/H/S: 1/0/1

Historical horse racing machine expansions in Kentucky are significant and Macquarie considers Ainsworth Game the best placed manufacturer. The broker also assumes the rest of the business stabilises. Hence, the PE of 20x FY21 estimates is considered attractive, plus there is upside earnings risk. Rating is upgraded to Outperform from Neutral. Target is steady at $0.80.

AP EAGERS LIMITED (APE) was upgraded to Accumulate from Hold by Ord Minnett B/H/S: 3/2/0

2019 underlying pre-tax profit was below Ord Minnett’s forecast. The broker assesses headwinds continue for the near term, including new vehicle sales and the exit of Holden from the market. Nevertheless, AP Eagers is considered ideally positioned to participate in industry consolidation and accelerate its market leadership. Now that a re-basing appears to have occurred in the 2019 result, and the share price is at a more realistic level, the broker upgrades to Accumulate from Hold. Target is reduced to $10.50 from $11.50.

See downgrade below.

FLIGHT CENTRE LIMITED (FLT) was upgraded to Outperform from Neutral by Credit Suisse B/H/S: 3/4/0

First half results were in line with recently issued guidance but the company has revised down earnings guidance to $240-300m for FY20 because of a broad-based slowdown in travel. Credit Suisse also downgrades FY21 first half assumptions, expecting travel to recover slowly. The broker does not believe the results quell the debate regarding the Australian leisure distribution, which is now exacerbated by coronavirus risks. A balanced view also acknowledges the potential for strong growth in corporate and the expanding presence in North America and Europe. Hence, Credit Suisse suggests stabilisation of earnings is likely to be most important for the share price performance and upgrades to Outperform from Neutral. Target is raised to $47.40 from $44.83.

INFOMEDIA LTD (IFM) was upgraded to Buy from Neutral by UBS B/H/S: 2/0/0

UBS was impressed with the revenue growth in the first half, complemented by strong operating leverage. Results were in line. The broker envisages opportunity for continued growth across multiple existing and new segments. Rating is upgraded to Buy from Neutral, as UBS recognises the business deserves a higher premium. Target is raised to $2.40 from $1.95.

INVOCARE LIMITED (IVC) was upgraded to Add from Hold by Morgans B/H/S: 2/3/1

2019 results, which were better-than-expected, were supported by rebound in the number of deaths after a soft 2018, amid a strong performance from renovated sites and contributions from acquisitions. Management continues to expect the number of deaths to revert back to the long-term trend. Morgans upgrades to Add from Hold, given increased confidence in the growth outlook. Target rises to $15.87 from $13.63.

LINK ADMINISTRATION HOLDINGS LIMITED (LNK) was upgraded to Outperform from Neutral by Credit Suisse B/H/S: 5/1/0

Operating earnings missed Credit Suisse estimates in the first half. However net profit was better, as stronger-than-expected earnings in PEXA offset the operating earnings miss. The company has provided net profit guidance for FY20 of “at least $160m”, but downgraded operating earnings guidance for continuing operations to “approximately -10% lower”. Credit Suisse was disappointed with the outcome but can envisage the benefit from owning a portfolio of businesses that contain growth in some that offsets the challenges in others. Rating is upgraded to Outperform from Neutral, predicated on a re-rating which may take some time to come as the market rebuilds confidence. Target is reduced to $5.90 from $6.90.

See downgrade below.

MIDWAY LIMITED (MWY) was upgraded to Buy from Hold by Ord Minnett B/H/S: 1/1/0

The first half result serves to remind Ord Minnett of the cyclical nature of price and volume demand in the company’s business, particularly from Chinese customers. The normalised net loss was slightly below Ord Minnett’s forecasts. Guidance has been reiterated and the company is yet to witness any significant impact arising from the coronavirus outbreak. Ord Minnett considers guidance is achievable if Asian paper production remains robust. With the share price materially below valuation, the rating is upgraded to Buy from Hold. Target edges up to $2.08 from $2.07.

NANOSONICS LIMITED (NAN) was upgraded to Add from Hold by Morgans B/H/S: 2/0/1

First half results were below forecasts. Downside risks come from pricing pressures as hospital budgets remain tight. The market remains focused on the commercial launch of the technology platform, expected in FY21. Morgans revises down near-term forecasts to reflect the delay in new product revenue but increases longer-term assumptions. Rating is upgraded to Add from Hold. Target is raised to $7.36 from $6.14.

PEET & COMPANY LIMITED (PPC) was upgraded to Outperform from Neutral by Macquarie B/H/S: 1/0/0

Peet & Co’s first half earnings were 10% above Macquarie and management indicated it was not comfortable with current FY consensus forecasts. Sales volumes increased 52% in the half. The broker forecasts a -36% fall in profit in FY20 due to a slowdown in sales in FY19, but expects earnings to bottom ahead of a step-change in FY22. FY20 earnings risk prompted a downgrade to Neutral last month but with confidence growing and an improving residential market, the broker upgrades back to Outperform. Target rises to $1.41 from $1.25.

SERVCORP LIMITED (SRV) was upgraded to Buy from Neutral by UBS B/H/S: 1/0/0

First half results were stronger than UBS expected, driven by 300 basis points of margin expansion. Outperformance in Southeast Asia was the highlight, which was partly offset by widening losses in the US. UBS considers the US business challenged but a potential upside catalyst if it can be turned around. Rating is upgraded to Buy from Neutral and the target is raised to $5.10 from $4.80.

WOOLWORTHS LIMITED (WOW) was upgraded to Neutral from Underperform by Credit Suisse B/H/S: 1/4/0

Despite the softer outlook, Credit Suisse does not believe there are issues of underperformance and the stock is a good place to be in a market that is likely to favour quality. Credit Suisse upgrades to Neutral from Underperform although prefers Coles (COL) on valuation. Target is raised to $39.70 from $35.63. The scale of wage under-payment continues to disappoint. There was a deceleration in comparable store sales growth in Australian food and continuing high capital expenditure in the first half. The second half is expected to be a challenging period for expenses.

In the not-so-good books

AP EAGERS LIMITED (APE) was downgraded to Neutral from Outperform by Macquarie B/H/S: 3/2/0

The operating business from the merged company reported underlying earnings (EBITDA) of $163.2m in 2019. Synergies are tracking ahead of the initial target, Macquarie observes. Acquisition accounting played into the underlying results, the broker points out and, although there is potential for earnings growth, the extended risk from reduced credit availability and a prolonged cyclical downturn suggests further evidence is required for a rebound. Rating is downgraded to Neutral from Outperform. The target is lowered to $9.40 from $14.00 to align with automotive comparables.

See upgrade above.

LINK ADMINISTRATION HOLDINGS LIMITED (LNK) was downgraded to Equal-weight from Overweight by Morgan Stanley B/H/S: 5/1/0

First half earnings missed expectations. The combination of another downgrade to FY20 guidance, soft new business and some client concentration risk means Morgan Stanley considers re-positioning for growth is harder than previously anticipated. While acknowledging several issues should stabilise over the next 12-24 months, Morgan Stanley downgrades to Equal-weight from Overweight. Target is reduced to $5.30 from $7.50. In-Line industry view maintained.

See upgrade above.

RAMSAY HEALTH CARE LIMITED (RHC) was downgraded to Neutral from Buy by Citi B/H/S: 1/6/0

Citi thought it was an in-line result, but incorporating AASB16 accounting is pushing down EPS forecasts by -8% and -4% for FY20 and FY21 respectively. The recommendation shifts to Neutral from Buy given recent share price increase. Ramsay Health Care’s price target has gained $1 to $75. Citi notes how management has stuck with its FY20 guidance but due to AASB16 low single-digit growth in EPS is translating into -6%. The margin in Australia is under pressure because health insurers cannot increase prices. Citi expects less decline in H2 and a subsequent reversal in FY21. Part of Citi’s future outlook for private hospital operators is based upon the view that governments cannot let the malaise in health care and insurance deteriorate indefinitely.

STEADFAST GROUP LIMITED (SDF) was downgraded to Neutral from Outperform by Credit Suisse B/H/S: 3/1/0

First half results beat Credit Suisse estimates. The broker appreciates the fact the business is setting up for sustainable earnings, but growth remains below what can be expected in a positive premium rate environment.

Following the recent outperformance of the share price and lower underlying growth, Credit Suisse downgrades to Neutral from Outperform. Target is $4.

Earnings forecast

Listed below are the companies that have had their forecast current year earnings raised or lowered by the brokers last week. The qualification is that the stock must be covered by at least two brokers. The table shows the previous forecast on an earnings per share basis, the new forecast, and the percentage change.

The above was compiled from reports on FNArena. The FNArena database tabulates the views of seven major Australian and international stock brokers: Citi, Credit Suisse, Macquarie, Morgan Stanley, Morgans, Ord Minnett and UBS. Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.