More downgrades than upgrades for ASX-listed stocks thus far into the February reporting season, with earnings estimates making an unexpected bend upwards, on balance, but also with valuations and price targets coming under intense pressure from companies who fail to live up to expectations.

Welcome to investing in the share market anno 2020.

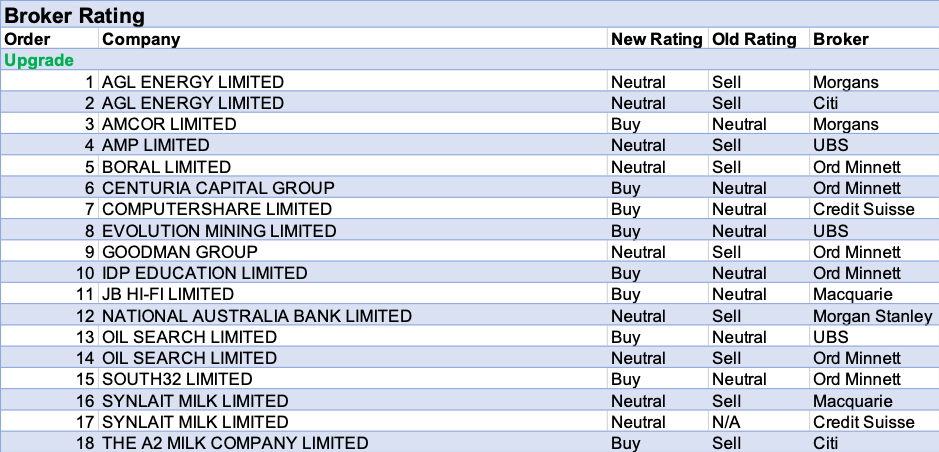

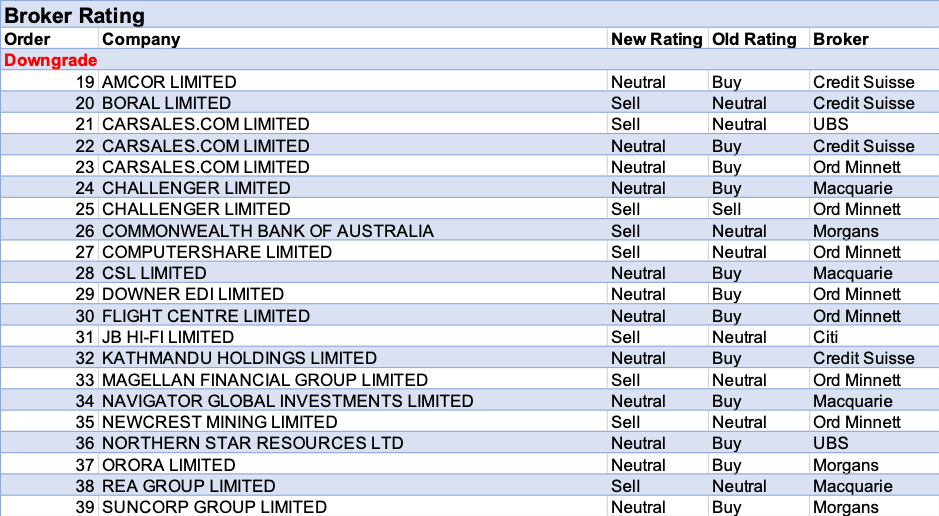

For the week ending Friday 14 February 2020, FNArena registered 18 upgrades in recommendations against 21 downgrades. Only nine of the upgrades moved to Buy (50%) while nine of the downgrades moved to Sell.

Several profit results reporters are represented on both sides of the ledger. AGL Energy received two upgrades, as did Oil Search, and Synlait Milk. Carsales received three downgrades. Challenger was downgraded twice.

Possibly the real message from the first week of the local February reporting season is that earnings forecasts have finally made a trend-break in rising during the week. Stockbroking analysts are revising upwards their valuations and price targets for those companies who do not fail. But plenty do fail, and thus reductions in price targets are larger than the increases.

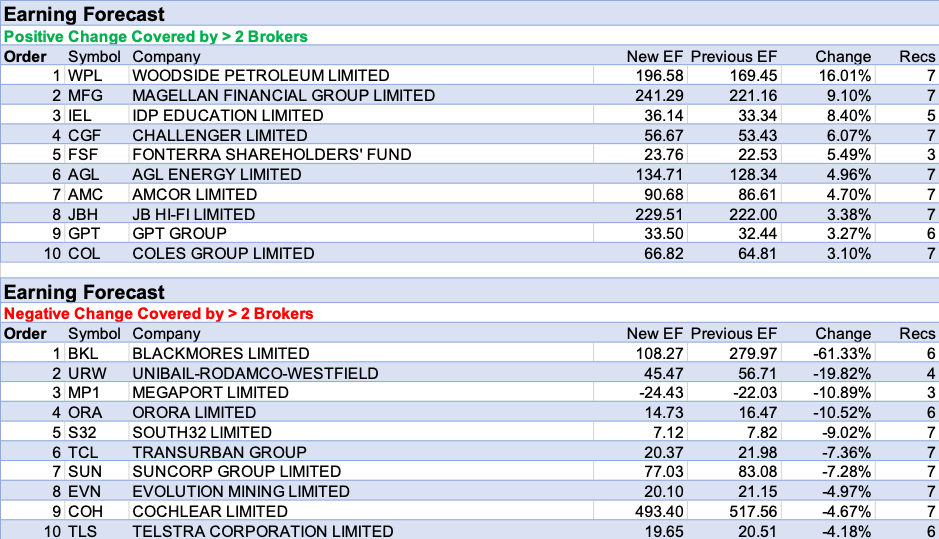

For the week, IDP Education and Challenger both enjoyed 20%-plus increases to consensus forecasts, handsomely beating companies such as a2 Milk, Magellan Financial, CSL, and Carsales (all still enjoying double digit percentage increases). On the flipside, we find Suncorp, Downer EDI and Orora as the week’s biggest losers, but their reductions pale in comparison to the gains booked on the positive side.

As stated earlier, average increases to forecasts outweigh the reductions, but for price targets the average upgrade is out-muscled by downgrades on the back of profit warnings and earnings disappointments.

The February reporting season steps up a gear (or two) from Wednesday this week onwards.

In the good books

THE A2 MILK COMPANY LIMITED (A2M) was upgraded to Buy from Sell by Citi B/H/S: 3/2/1

Citi has decided it’s time for a double-whammy upgrade; to Buy from Sell. The move is explained by the fact Citi analysts now see upside to forecasts for H2 on the back of the coronavirus outbreak. They note their ebitda forecast for FY20 sits 17% above market consensus presently. Evidence, albeit anecdotal, that consumers have begun stockpiling essential items, including infant formula, underpins Citi’s positive view. While this essentially pulls forward future sales, the analysts are not deterred and anticipate positive impact short-term. Target price jumps 18% to $17.45 on increased forecasts.

AGL ENERGY LIMITED (AGL) was upgraded to Hold from Reduce by Morgans and to Neutral from Sell by Citi B/H/S: 0/3/4

The broker had expected a weak first half from AGL Energy due to the extended outage at Loy Yang but the result surprised to the upside. That said, FY guidance implies a weaker second half, netting out the upside surprise. The company has pointed to a weakening electricity market although FY21 might enjoy a boost from a Loy Yang insurance payout. The broker sees a challenging longer-term outlook but a solid dividend and a buyback resumption should support the share price. Upgrade to Hold from Reduce, target rises to $18.38 from $17.88.

Citi analysts won’t hide their amazement today. That interim report by AGL revealed a “stellar performance”. Wholesale gas gross margin in particular helped the utility with significantly outperforming market consensus and projections at Citi. In response, Citi analysts suggest this is AGL putting its incumbency to work, and to work well. Among the factors noted, Citi observes AGL has been opportunistically buying in the relatively cheaper gas spot market. The outlook for earnings is indisputable stronger, the analysts acknowledge, even though they remain of the view structural challenges longer term remain. Upgrade to Neutral from Sell, price target jumps to $20.12 from $17.35.

AMCOR LIMITED (AMC) was upgraded to Add from Hold by Morgans B/H/S: 5/2/0

First half results were slightly weaker than expected. FY20 underlying growth guidance has been improved to 7-10%. Management has advised that the Bemis integration is progressing well, with cost synergies of US$30m delivered in the first half. Morgans upgrades to Add from Hold, believing the share price in the short term should be supported by the ongoing US$500m buyback. Target is raised to $16.62 from $14.70.

See downgrade below.

AMP LIMITED (AMP) was upgraded to Neutral from Sell by UBS B/H/S: 1/5/1

The second half outcome fell well short of UBS estimates. This largely related to AMP life which will be divested in the current half. Nevertheless, with the stock now trading at an FY21 estimated PE of 14x, and with improving growth thereafter, UBS upgrades to Neutral from Sell. Target is steady at $1.80.

CENTURIA CAPITAL GROUP (CNI) was upgraded to Accumulate from Hold by Ord Minnett B/H/S: 1/0/0

First half earnings were 40% above Ord Minnett’s forecasts. The result ticked many boxes in terms of fund manager performance. The broker incorporates the proposed acquisition of Augusta Capital for $175m. Ord Minnett believes New Zealand is an attractive market and the target has relatively strong growth prospects. Rating is upgraded to Accumulate from Hold and the target is lifted to $2.75 from $2.00.

COMPUTERSHARE LIMITED (CPU) was upgraded to Outperform from Neutral by Credit Suisse B/H/S: 1/3/2

First half results missed expectations although guidance implies a stronger second half. Credit Suisse expects 10% growth in FY21-22. The company should benefit from cost reductions and the Equatex synergies. Rating is upgraded to Outperform from Neutral as the broker believes the stock offers good value and there is a track record of delivering on guidance. Target is raised to $19.40 from $16.50.

See downgrade below.

EVOLUTION MINING LIMITED (EVN) was upgraded to Buy from Neutral by UBS B/H/S: 3/4/0

The share price has fallen -6% since November and underperformed the Australian dollar gold price and the S&P/ASX gold index. However, the pessimism on several fronts is now priced into the stock, UBS suggests, and optimism is warranted regarding the expanding Cowal underground. The broker considers the valuation attractive and upgrades to Buy from Neutral. Target is raised to $4.60 from $4.25.

GOODMAN GROUP (GMG) was upgraded to Hold from Sell by Ord Minnett B/H/S: 4/2/0

First half operating profit was well ahead of Ord Minnett’s forecasts because of materially higher development earnings. The broker’s forecasts of 13.5% growth in earnings per share are now ahead of the company’s upgraded FY20 guidance of 11%. Ord Minnett acknowledges having made a wrong call on the stock, as momentum has become far more important than valuation. While the stock remains fully priced, the broker upgrades to Hold from Sell. Target is raised to $16.10 from $12.70.

IDP EDUCATION LIMITED (IEL) was upgraded to Accumulate from Hold by Ord Minnett B/H/S: 4/0/1

First half operating earnings (EBITDA) beat Ord Minnett estimates. The broker believes the company’s lead in innovation is paying dividends. Despite the lofty valuation, Ord Minnett asserts investors cannot ignore the quality of the business and upgrades to Accumulate from Hold. Target is raised to $22.34 from $16.23.

NATIONAL AUSTRALIA BANK LIMITED (NAB) was upgraded to Equal-weight from Underweight by Morgan Stanley B/H/S: 2/4/1

The first quarter trading update builds on the bank’s recent track record, Morgan Stanley asserts. The broker believes the operating performance is sound, given the challenging environment. Housing and SME loans have slowed and the broker acknowledges it will not be easy to achieve expenses that are “broadly flat”, but margin pressure is being managed and the credit quality is good. Rating is upgraded to Equal-weight from Underweight and the target raised to $25.50 from $24.50. Industry view: In-line.

OIL SEARCH LIMITED (OSH) was upgraded to Buy from Neutral by UBS B/H/S: 2/4/1

UBS believes the market has over-reacted to the news that discussions over the P’nyang gas development have been terminated. As such the broker lifts the rating to Buy from Neutral. The broker does not believe the expansion is ruled out completely and Papua LNG remains in play. Alaska is also regarded a driver of positive news for the company in 2020. Target is raised to $7.30 from $7.10.

SOUTH32 LIMITED (S32) was upgraded to Accumulate from Hold by Ord Minnett B/H/S: 5/1/1

Operating earnings were ahead of Ord Minnett’s forecasts in the first half. The broker now expects FY21 earnings to be double FY20 levels. Additionally, on the disposal of South African Energy Coal, the company’s ESG credentials and capital efficiency will improve. Rating is upgraded to Accumulate from Hold and the target raised to $3.00 from $2.60.

In the not-so-good books

AMCOR LIMITED (AMC) was downgraded to Neutral from Outperform by Credit Suisse B/H/S: 5/2/0

First half earnings (EBIT) were slightly below Credit Suisse forecasts. Packaging growth in flexibles has been impressive, with the broker noting the company is bucking the broad trends in North America and Europe. As there was no new significant operating cash in the result, and given the recent share price rally, Credit Suisse downgrades to Neutral from Outperform. Target is $16.25.

See upgrade above.

CARSALES.COM LIMITED (CAR) was downgraded to Neutral from Outperform by Credit Suisse, to Hold from Accumulate by Ord Minnett and to Sell from Neutral by UBS B/H/S: 1/3/2

First half results were in line with expectations. Credit Suisse believes the result should alleviate any concerns that the dealer business is being directly affected by weakness in new car sales. New strategic initiatives appear priced in and the broker downgrades to Neutral from Outperform. Target is raised to $18.80 from $18.30.

First half results were in line with expectations and Ord Minnett believes Carsales.com has shown, once again, relative resilience in its core advertising segment. International businesses were also up strongly. The broker assesses the valuation is full and downgrades to Hold from Accumulate. Target is raised to $18.98 from $16.54.

The company had a tough first half but UBS believes there are signs of improvement in top-line growth rates from the second half. The broker’s estimates already factor in this improvement. Confidence in management leads UBS to factor in greater long-term upside from initiatives, but the target is still well in arrears of the current price and the rating is downgraded to Sell from Neutral. Target is raised to $17.50 from $15.00.

COMMONWEALTH BANK OF AUSTRALIA (CBA) was downgraded to Reduce from Hold by Morgans B/H/S: 0/1/6

First half net profit was better than Morgans expected, largely because of strong net interest income. The broker expects an off-market share buyback of $2.5bn will be announced in the first half of FY21. Morgans believes the home loan momentum is partly the result of good execution and places the bank in good stead. Despite believing this is a good quality business, the current share price is considered expensive and the broker downgrades to Reduce from Hold. Target is $74.

COMPUTERSHARE LIMITED (CPU) was downgraded to Lighten from Hold by Ord Minnett B/H/S: 1/3/2

First half net profit was below expectations. Ord Minnett notes significant pressure on management earnings in the first half, making it difficult to have confidence in the revised guidance. Substantial capital has been deployed into mortgage servicing rights to boost earnings, although gearing is now elevated. This forces the broker to remove the buyback from estimates. Rating is downgraded to Lighten from Hold. Target is steady at $16.

See upgrade above.

CSL LIMITED (CSL) was downgraded to Neutral from Outperform by Macquarie B/H/S: 3/4/0

CSL’s underlying profit was in line with consensus. Strength in Ig continues given robust demand and competitor shortages and albumin performed ahead of expectation, Macquarie notes. Operating leverage was nonetheless limited, with earnings growing 8% on 11% revenues growth. CSL is maintaining its competitive advantage in plasma collection and the trajectory for other key products appears favourable, the broker suggests. But at 43.2x forward earnings, it’s all in the price. Downgrade to Neutral from Outperform. Target rises to $324 from $300.

DOWNER EDI LIMITED (DOW) was downgraded to Hold from Accumulate by Ord Minnett B/H/S: 2/2/1

The weak result missed Ord Minnett’s estimates by -20%. The company has reiterated net profit guidance for FY20 of around $300m, which means earnings will be much more weighted to the second half than previously expected. Ord Minnett downgrades to Hold from Accumulate, noting the company is battling to turn around its operations on a number of fronts. Target is reduced to $7.70 from $8.90.

MAGELLAN FINANCIAL GROUP LIMITED (MFG) was downgraded to Sell from Hold by Ord Minnett B/H/S: 0/1/6

First half results were slightly ahead of expectations. Pre-tax profit in funds management was up 24%. While the retirement fund will be a disruptive offering, targeting a large and growing segment, Ord Minnett assesses timeliness in generating traction limits the earnings impact on a business already managing over $100bn. Rating is downgraded to Sell from Hold and the target raised to $60.18 from $50.41.

NEWCREST MINING LIMITED (NCM) was downgraded to Lighten from Hold by Ord Minnett B/H/S: 0/3/3

The company has maintained production guidance at the lower end of the 2.38-2.54m ounces range. Ord Minnett observes Lihir will need a strong second half to achieve this. Cadia and Lihir have increased to 78% of the broker’s valuation. Target is lowered to $26 from $28 and the rating is downgraded to Lighten from Hold.

NAVIGATOR GLOBAL INVESTMENTS LIMITED (NGI) was downgraded to Neutral from Outperform by Macquarie B/H/S: 1/1/0

Navigator Global Investments’ result beat Macquarie on stronger performance fees. A solid operating cost performance also provided support. If the fund manager can sustain its investment performance, positive net flows and improved cost discipline, then the broker sees further upside. But the stock’s recent run has Macquarie pulling back to Neutral from Outperform, while acknowledging an attractive dividend. Target falls to $3.36 from $3.39.

ORORA LIMITED (ORA) was downgraded to Hold from Add by Morgans B/H/S: 1/5/0

First half results were weaker than expected. Morgans removes fibre from earnings forecasts which reduces FY20 underlying earnings (EBIT) estimates by -26%. The sale of the fibre business is due to be completed by the end of March. Management expects challenging market conditions to persist for the remainder of FY20. Morgans believes, while the valuation is attractive, ongoing weakness in North America is a concern. Unless the company can deliver stable earnings, the share price is considered unlikely to track materially higher, although the prospect of a capital return limits downside risk. Rating is downgraded to Hold from Add. Target is reduced to $3.15 from $3.34.

Earnings forecast

Listed below are the companies that have had their forecast current year earnings raised or lowered by the brokers last week. The qualification is that the stock must be covered by at least two brokers. The table shows the previous forecast on an earnings per share basis, the new forecast, and the percentage change.

The above was compiled from reports on FNArena. The FNArena database tabulates the views of seven major Australian and international stock brokers: Citi, Credit Suisse, Macquarie, Morgan Stanley, Morgans, Ord Minnett and UBS. Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.