The ASX remains a share market polarised by rising share prices and lack of broad earnings momentum.

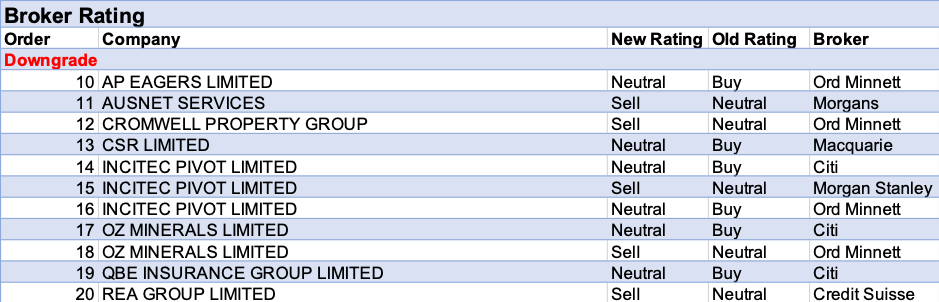

For the week ending Friday 15 November 2019, FNArena registered nine upgrades for individual ASX-listed stocks and 11 downgrades. The difference in favour of downgrades is caused by Incitec Pivot and OZ Minerals who received three and two downgrades respectively, while Domain Holdings remained the sole receiver of multiple (2x) upgrades.

Good news stems from the observation eight of the nine upgrades shifted to Buy (or an equivalent) while five of the 11 downgrades moved to Sell.

Confusing for investors, no doubt, is that high flyers such as Afterpay Touch and CSL continue to receive fresh upgrades to Buy. On the negative side of the ledger, AusNet Services, Cromwell Property Group, Incitec Pivot, OZ Minerals and REA Group all received a fresh Sell recommendation.

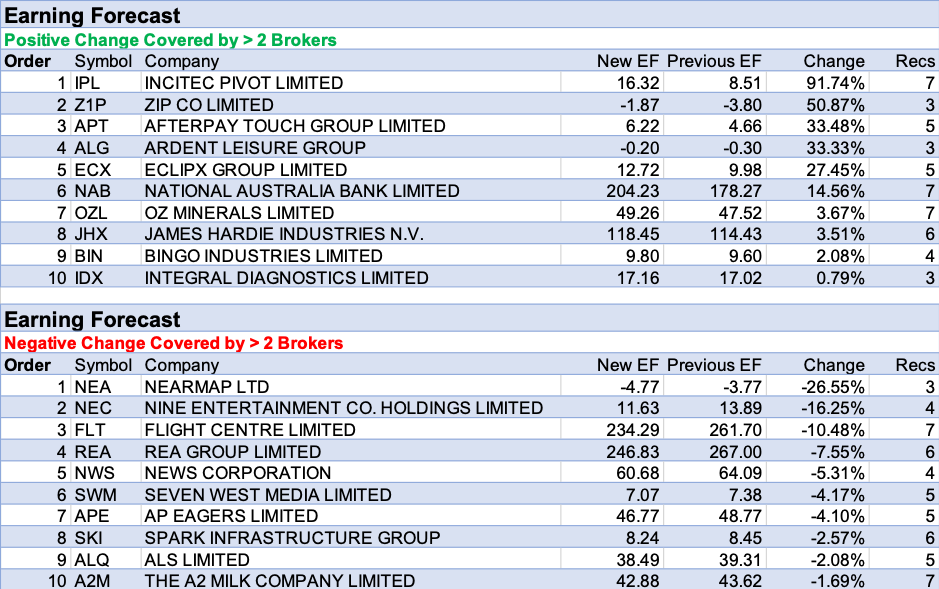

The unusual observation is that aggregate amendments to earnings forecasts had a bias to the positive side for the week past. This is not something that occurs on a regular basis in Australia. While one swallow does not a summer make, it is nevertheless something to keep an eye on. For all we know we are witnessing the early signs of a trend change that might have significant consequences down the track.

Investors will be holding their fingers crossed, especially those with portfolios filled with laggard names such as industrial cyclicals, banks, materials and energy producers.

Major honours for the week go to Incitec Pivot, followed by Zip Co, Afterpay Touch, Ardent Leisure, EclipX Group and National Australia Bank. Note the prominent absence of the sectors mentioned in the preceding sentence, NAB being the exception.

For once, the negative side has less weight to throw in the scales, though the top end (bottom) still carries large negative adjustments, including for Nearmap, Nine Entertainment (profit warning), Flight Centre (profit warning), REA Group (subdued market update) and News Corp (see REA).

Australia’s out-of-season corporate results season continues this week but company’s reporting are of a different calibre, which opens up a different kind of question: are these companies still enjoying the better operational momentum?

In the good books

1. AUB GROUP LIMITED (AUB) was upgraded to Outperform from Neutral by Credit Suisse B/H/S: 2/0/0

The company has reaffirmed its FY20 guidance. Credit Suisse was encouraged by the update and notes the share price has underperformed the market by around -30% over the last 12 months following a series of earnings downgrades. Company specific issues have had an impact and offset a favourable operating environment. With this risk passing, the broker upgrades to Outperform from Neutral. Target is raised to $12.75 from $11.45.

2. ELANOR INVESTORS GROUP (ENN) was upgraded to Accumulate from Hold by Ord Minnett B/H/S: 1/0/0

The company has announced the IPO of the Elanor Commercial Property Fund and the establishment of the Elanor Wildlife Fund along with a placement of $31m and a $5m share purchase plan at $2.10. The Wildlife Fund will be seeded from the Featherdale Wildlife Park, which Ord Minnett considers an inflection point for the business, as it re-casts the company as a pure-play fund manager as opposed to a diverse alternative investor. The broker upgrades to Accumulate from Hold, believing the business is now a more accessible investment. Target is raised to $2.32 from $2.28.

3. SPARK INFRASTRUCTURE GROUP (SKI) was upgraded to Equal-weight from Underweight by Morgan Stanley B/H/S: 0/5/1

Morgan Stanley assesses the share price has now incorporated the FY21 re-basing of the distribution. The stock is down -9% over the year to date so valuation has become undemanding and the risk/reward is more balanced. The broker upgrades to Equal-weight from Underweight. Target is reduced to $2.15 from $2.24. Industry view is Cautious.

In the not-so-good books

1. AP EAGERS LIMITED (APE) was downgraded to Hold from Accumulate by Ord Minnett B/H/S: 4/1/0

Ord Minnett was underwhelmed by the trading update, which indicated pre-tax profit for the first 10 months of 2019 declined -6%. The broker likes the business model over the medium term but is not over confident about 2020. This leads to a downgrade to the rating to Hold from Accumulate. The broker points out the economics of dealerships have changed and are likely to continue to evolve and AP Eagers is ideally positioned to participate in consolidation and leverage its market leadership. Yet, Ord Minnett is cautious about consensus expectations, which imply a market recovery and/or meaningful merger benefits in 2020. Target is reduced to $11.50 from $12.50.

2. AUSNET SERVICES (AST) was downgraded to Reduce from Hold by Morgans B/H/S: 0/4/2

AusNet Services’ first half result was weaker than Morgans expected, even after including a one-off boost from a sale of inventory. The broker has materially downgraded forecasts, re-basing to the weak first half performance, and including assumptions of lower-for-longer interest rates and inflation. Target falls to $1.58 from $1.74. Morgans now calculates a forecast total shareholder return of -10%, hence a downgrade to Reduce from Hold.

3. CROMWELL PROPERTY GROUP (CMW) was downgraded to Lighten from Hold by Ord Minnett B/H/S: 0/1/1

Cromwell Property will acquire a portfolio of seven Polish retail properties for around $1bn on an estimated capitalisation rate of 5-5.25%. The transaction will settle in November and the company intends to reduce its interest to 20-30% over the next 18-24 months. Cromwell Property already manages the assets on behalf of third-party investors. The company has not disclosed its gearing post the transaction, nor its covenants. Given real estate investment trusts have a chequered history when it comes to leverage during the global financial crisis, Ord Minnett suspects the buffer to covenants will be too tight for some equity investors. Rating is downgraded to Lighten from Hold. Target is $1.10.

Earnings forecast

Listed below are the companies that have had their forecast current year earnings raised or lowered by the brokers last week. The qualification is that the stock must be covered by at least two brokers. The table shows the previous forecast on an earnings per share basis, the new forecast, and the percentage change.

The above was compiled from reports on FNArena. The FNArena database tabulates the views of seven major Australian and international stock brokers: Citi, Credit Suisse, Macquarie, Morgan Stanley, Morgans, Ord Minnett and UBS. Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.