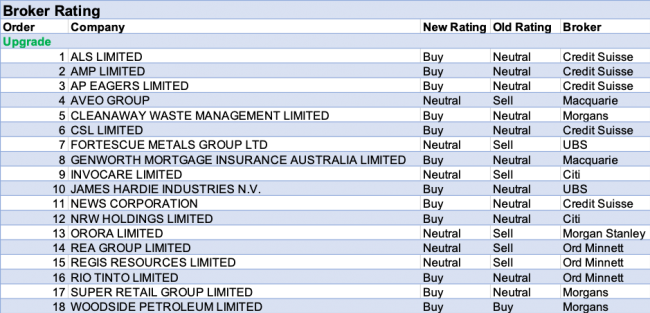

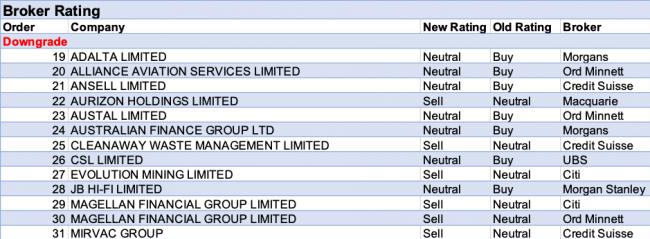

The combination of the local share market seemingly hitting a speed bump and an acceleration in corporate results releases has swung around the dynamic in stockbroker ratings during the week ending on Friday, 16th August 2019.

For the week, FNArena registered 24 upgrades being issued for individual ASX-listed stocks against 13 downgrades. Previously, the pendulum had been firmly in favour of more downgrades.

Somewhat tempering the at face value positive turnaround is the observation only 12 out of the 24 upgrades moved to Buy; the other half got stuck in the Neutral/Hold section. In similar fashion, six of the 13 downgrades moved to Sell. This remains a hugely divided market.

Magellan Financial was the sole receiver of two downgrades to Sell. Star performer CSL is represented on both sides, as is Cleanaway Waste Management.

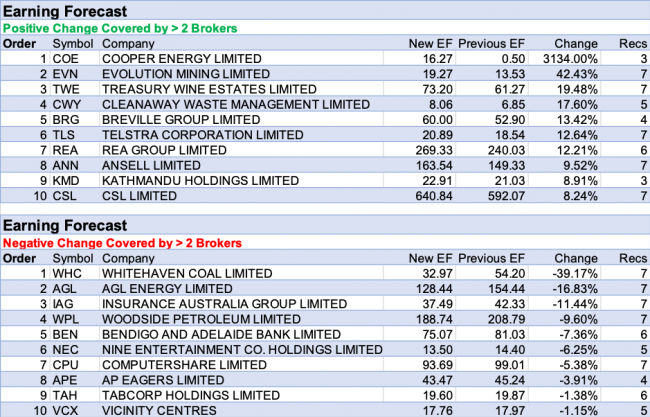

The week’s table for positive revisions to earnings estimates is filled with large increases with Cooper Energy (result) on top, handsomely beating the likes of Evolution Mining (result), Treasury Wine Estates (result), Cleanaway Waste Management (result) and Breville Group (result).

On the negative side, and as should be expected, we find some of the early disappointers this August reporting season with Whitehaven Coal, AGL Energy, Insurance Australia Group and Woodside Petroleum receiving the largest cuts to forecasts.

The August reporting season speeds up a few notches this week, while the macro background remains closely watched by less than comfortable local investors.

In the good books

1. AVEO GROUP (AOG) was upgraded to Neutral from Underperform by Macquarie B/H/S: 1/2/0

The company has entered into a scheme agreement with entities controlled by Brookfield Property for the acquisition of securities for $2.195, inclusive of the annual distribution of 4.5c. Macquarie calculates the cash consideration represents an acquisition multiple of around 29x enterprise value/EBITDA. The broker upgrades to Neutral from Underperform and raises the target to $2.15 from $1.61.

2. AP EAGERS LIMITED (APE) was upgraded to Outperform from Neutral by Credit Suisse B/H/S: 4/0/0

The merger with Automotive Holdings (AHG) is likely to drive material accretion and a consequent re-rating, Credit Suisse believes. Since the merger announcement the stock has appreciated 51%, which mostly reflects merger dynamics. Credit Suisse upgrades to Outperform from Neutral. 2019 estimates allow for a -7% decline in first half earnings from both automotive and truck divisions, and a recovery is expected in automotive earnings in 2020. Target is raised to $12 from $7.

3. CSL LIMITED (CSL) was upgraded to Outperform from Neutral by Credit Suisse B/H/S: 3/4/0

Net profit in FY19 was in line with Credit Suisse estimates. There was robust sales growth in key products although specialty sales declined in the second half. Credit Suisse upgrades to Outperform from Neutral as earnings estimates are upgraded and the model is rolled forward. The broker remains cautious on the outlook for specialty products. Target is raised to $249 from $199. As the stock is trading at a discount to key Australian healthcare peer Cochlear (COH) and in line with ResMed (RMD) upside is envisaged at current levels.

See downgrade below.

4. CLEANAWAY WASTE MANAGEMENT LIMITED (CWY) was upgraded to Accumulate from Hold by Ord Minnett and to Add from Hold by Morgans B/H/S: 3/1/1

FY19 earnings were below Ord Minnett’s forecasts. The broker suspects any general economic softness is likely to be a near-term headwind. The Australian waste management industry is poised for structural change, with Cleanaway Waste ideally positioned to take advantage of any changes, in the broker’s view. Rating is upgraded to Accumulate from Hold and the target raised to $2.30 from $2.10.

Morgans believes the share price has overshot on the downside and upgrades to Add from Hold. The company expects underlying operating earnings growth in FY20 to moderate slightly. The broker notes the balance sheet is strong but, in a period where capital return initiatives are becoming increasingly common, the company prefers to retain its firepower to fund growth. Target is reduced to $2.31 from $2.56.

See downgrade below.

5. FORTESCUE METALS GROUP LTD (FMG) was upgraded to Neutral from Sell by UBS B/H/S: 2/4/1

UBS upgrades to Neutral from Sell after the trade tensions and local growth weighed on the sector and the Fortescue Metal share price fell -16%. The target is reduced to $6.60 from $7.20.

6. GENWORTH MORTGAGE INSURANCE AUSTRALIA LIMITED (GMA) was upgraded to Outperform from Neutral by Macquarie B/H/S: 1/1/0

Brookfield Business Partners has entered into a share purchase agreement for all the shares in Genworth Canada. Macquarie observes the transaction would be removing one of the barriers in completing the acquisition of Genworth Financial by China Oceanwide, which still needs to receive clearance for currency conversion and funds transfer from Chinese authorities. Macquarie upgrades Genworth Australia to Outperform from Neutral, given the recent decline in the share price and the increase in Genworth Financial’s capital flexibility. Target is $3.25.

7. INVOCARE LIMITED (IVC) was upgraded to Neutral from Sell by Citi B/H/S: 0/6/0

InvoCare’s interim report came out below expectations and has triggered reductions for future estimates. Citi has decided to upgrade to Neutral from Sell, inspired by the share price fall, while leaving its price target unchanged at $13.75. All in all, the analysts continue to expect a normalisation of the death rate, which should make management’s task a lot easier in the years ahead. They note the company did not provide any guidance, but also there is a significant amount of operational leverage that will kick in with better numbers.

8. ORORA LIMITED (ORA) was upgraded to Equal-weight from Underweight by Morgan Stanley and to Accumulate from Hold by Ord Minnett B/H/S: 4/3/0

FY19 earnings were below Morgan Stanley’s estimates. Australasia was modestly ahead but North America was soft. No guidance was provided. Further challenging conditions are expected in FY20, amid cost pressures. Morgan Stanley assesses the difficult outlook is now encapsulated in the share price and upgrades to Equal-weight from Underweight. Price target is reduced to $3.00 from $3.20. Sector view is Cautious.

FY19 net profit was below estimates. Cash conversion was also lower than expected. Ord Minnett was disappointed with the performance in North America, where the earnings (EBIT) margin fell to 4.5% from 5.6%. Australasian earnings were ahead of forecasts. Nevertheless, after the sell-off in the share price, the broker envisages value at current levels and upgrades to Accumulate from Hold. Target is reduced to $3.00 from $3.40.

9. REGIS RESOURCES LIMITED (RRL) was upgraded to Hold from Lighten by Ord Minnett B/H/S: 0/2/5

Ord Minnett updates gold price forecasts, which are now 3-7% higher across the forecast period. The broker upgrades Regis Resources to Hold from Lighten following the change. Target is raised to $5.30 from $4.50.

10. SUPER RETAIL GROUP LIMITED (SUL) was upgraded to Add from Hold by Morgans, to Accumulate from Hold by Ord Minnett and to Buy from Neutral by UBS B/H/S: 5/2/0

FY19 results were in line with Morgans. The broker expects benign growth in FY20, with management noting there are some positive signs in consumer behaviour at the start of the new financial year. Morgans envisages upside to the current multiples and upgrades to Add from Hold. Target is raised to $9.87 from $9.01.

While FY19 results were below forecasts, Ord Minnett notes the external environment is improving. The broker believes the company has an attractive business mix, anchored by a resilient automotive business and sports segments that are benefiting from cost savings. While outdoor has been disappointing, BCF is showing signs of stabilising and Macpac has been a strong performer despite tough comparables. Rating is upgraded to Accumulate from Hold and the target raised to $10.00 from $9.50.

Underlying earnings (EBIT) were below estimates in FY19 but FY20 trading in the early stages is encouraging and UBS upgrades to Buy from Neutral. The upgrade reflects accelerating momentum in July sales, with no material shift in discounting as well as upside from tax reductions. The broker raises the target to $9.90 from $9.00.

11. TELSTRA CORPORATION LIMITED (TLS) was upgraded to Accumulate from Hold by Ord Minnett B/H/S: 2/3/2

FY19 results and FY20 guidance, at first glance, are better than Ord Minnett expected. However, once the impact of new lease accounting standards are incorporated, guidance is slightly below expectations. Management has targeted lower capital intensity in the outer years post the NBN migration. This leads Ord Minnett to raise the target to $4.25 from $3.55. Rating is upgraded to Accumulate from Hold.

12. WOODSIDE PETROLEUM LIMITED (WPL) was upgraded to Add from Hold by Morgans and to Hold from Lighten by Ord Minnett B/H/S: 2/4/1

First half results were weaker than Morgans expected. The result was driven by extra costs attributed to Pluto. The broker has gained some confidence in the prospect of the Browse JV signing a gas processing agreement with the North West Shelf. While finding fears around longer-term LNG supply risks justified, Morgans also envisages upside for global LNG demand. The broker upgrades to Add from Hold and reduces the target to $34.97 from $35.24.

First half financials were weaker than expected. Moreover, management commentary did little to ease Ord Minnett’s concerns about the viability of development projects. Still, the stock is trading below the broker’s risk-weighted valuation, leading to an upgrade to Hold from Lighten. Target is reduced to $32.50 from $33.70.

In the not-so-good books

1. CSL LIMITED (CSL) was downgraded to Neutral from Buy by UBS B/H/S: 3/4/0

FY19 results were in line with UBS estimates. In updating key operating assumptions the broker increases estimates for earnings per share in FY20 by 4%. Seqirus EBIT in FY19 was US$154m, on track to hit guidance. Behring revenue growth of 10% was underpinned by immunoglobulin. Based on the recent performance in the share price UBS downgrades to Neutral from Buy. Target is raised to $245 from $223.

See upgrade above.

2. CLEANAWAY WASTE MANAGEMENT LIMITED (CWY) was downgraded to Underperform from Neutral by Credit Suisse B/H/S: 3/1/1

Cleanaway’s FY19 result was largely in line with forecasts but FY20 guidance has been impacted by China’s new policies on exported waste. These have led to volatile recycled material prices and increased waste sorting costs, Credit Suisse notes. Management has refrained from reaffirming margin assumptions. The broker downgrades to Underperform from Neutral, cutting its target to $1.85 from $2.15.

See upgrade above.

3. EVOLUTION MINING LIMITED (EVN) was downgraded to Sell from Neutral by Citi B/H/S: 0/3/4

It appears FY19 revealed itself as a small “miss” by circa -3%%, but Citi’s downgrade to Sell from Neutral has been inspired by the elevated share price. The company released full FY19 production numbers only last month, point out the analysts. Citi analysts point out the share price has enjoyed a jolly good ride on the back of the balance sheet deleveraging over years past, but that story is nearing its end. Higher wage costs are reducing future estimates. Target drops by -10c to $4.20.

Earnings forecast

Listed below are the companies that have had their forecast current year earnings raised or lowered by the brokers last week. The qualification is that the stock must be covered by at least two brokers. The table shows the previous forecast on an earnings per share basis, the new forecast, and the percentage change.

The above was compiled from reports on FNArena. The FNArena database tabulates the views of seven major Australian and international stock brokers: Citi, Credit Suisse, Macquarie, Morgan Stanley, Morgans, Ord Minnett and UBS. Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.