Macro and global sentiment continue to support equities, but the local reporting season keeps injecting lots of volatility into the Australian share market, as the calendar morphs into the final two weeks of what will yet become a deluge in corporate report releases.

Stockbroking analysts continue to issue more downgrades than upgrades in ratings for individual, ASX-listed entities. The week ending Friday 15 February 2019 was certainly no exception.

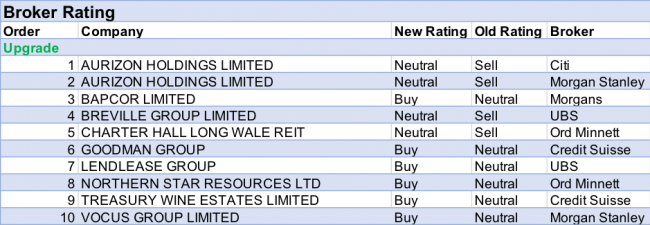

For the eight stockbrokers monitored daily, FNArena counted 36 downgrades for the week, only offset by 10 upgrades.

Among those 10, only six moved up to a Buy, including results reporters Aurizon Holdings (2x), Bapcor, Breville, Goodman Group, and Treasury Wine Estates.

There is a lot more to observe in terms of individual stocks and changes in ratings on the flipside of the week’s ledger; AMP received two more downgrades, Bendigo and Adelaide Bank accumulated three downgrades, Breville Group combined the one upgrade with two downgrades, Cleanaway Waste Management also received three downgrades, as did Magellan Financial Group, while beaten down Pact Group’s sixth profit warning since 2017 was good for yet another two downgrades. Treasury Wine Estates received two downgrades post financial report.

Downgrades reflected a mix of poor results and solid results prompting over-excited share price responses.

All in all, 13 of the 36 downgrades (50%) moved to Sell, including all three downgrades for Bendigo & Adelaide Bank as well as both downgrades for Pact Group, with Class, Challenger, Newcrest Mining, Stockland and Virgin Australia among those to receive fresh Sell ratings.

In terms of all eight stockbrokers combined, Sell ratings still only represent a little more than 14% of all ratings, while total Buy ratings (44.60%) continue to outnumber total Neutral/Hold ratings (41.17%). Traditionally, when Buy ratings are this far ahead of Neutral/Holds it signals a rather rough time for the share market.

This time around, the signal (if there is one) is more difficult to read as five months of relentless selling in late 2018 have been swiftly followed up by two months of swift recovery. Many a shorter-term focused expert is now calling for a “cooling off” period, at the least, but it remains to be seen whether equity markets are paying attention.

One observation stands, however, and that is this reporting season already is proving incredibly tough to read in terms of share price movements post results releases.

The table for positive revisions to earnings estimates equally reveals large adjustments, with AGL Energy on top for the week, followed by GBST Holdings, Beach Energy, Goodman Group, South32, and others.

On the flipside, we find Virgin Australia, Aveo Group, Coronado Global Resources, Superloop, Carsales, and others.

Local reporting season genuinely moves into a (much) higher gear this week. If the first two weeks are anything to go by, investors should expect more fireworks, and other types of explosions.

In the good books

- BAPCOR LIMITED (BAP) was upgraded to Add from Hold by MorgansB/H/S: 4/0/0

Bapcorp’s first-half result met the broker. A slowing in trading momentum in the second quarter was cushioned by divisional margin expansion.

Management has revised down guidance to the low end of previous guidance and the broker believes the stock can meet that comfortably, noting fundamentals are firm and expects trading challenges will be temporary.

Broker upgrades to Add from Hold but reduces the target price to $6.54 from $6.90.

- BREVILLE GROUP LIMITED (BRG) was upgraded to Neutral from Sell by UBSB/H/S: 1/2/1

First half results were ahead of expectations. UBS notes slower growth in North America was far from weak, still delivering 7.1%, and fears around Australian trading were not realised. While cash flow was soft, the broker notes working capital is being built up in the UK, the US and Europe. UBS upgrades to Neutral from Sell, believing there are years of growth ahead in Europe. Target is raised to $14.30 from $11.20.

See downgrade below.

- GOODMAN GROUP (GMG) was upgraded to Outperform from Neutral by Credit SuisseB/H/S: 3/2/1

First half results were in line with expectations while guidance has beaten Credit Suisse forecasts. The level of demand for industrial assets remains strong, supported by revaluations, investment and development activity. The company will reduce its pay-out ratio to the low 50% range in order to sustain higher development work-in-progress in the near term. The broker expects market conditions to remain positive and upgrades to Outperform from Neutral. Target is raised to $13.22 from $10.84.

- TREASURY WINE ESTATES LIMITED (TWE) was upgraded to Outperform from Neutral by Credit SuisseB/H/S: 4/3/1

The company missed the broker’s expectations and cash flow in the first half, although there was a 25% increase in receivables outstanding, much of which was paid down in January. The broker finds some signs of falling prices in the Penfolds luxury range, and there is a risk that the market may struggle to absorb the double-digit uplift in supply. However, the continued expansion of the range in China should allow for very strong growth. Credit Suisse upgrades to Outperform from Neutral and raises the target to $19.85 from $16.45. The company expects to grow operating earnings by 15-20% in FY20.

See downgrade below.

In the not so good books

- AMP LIMITED (AMP) was downgraded to Neutral from Buy by Citi and to Hold from Accumulate by Ord MinnettB/H/S: 0/7/0

In response to AMP’s result and guidance Citi has cut forecast earnings by -3% in FY19 and -13% in FY20, cut its target to $2.50 from $2.80, and downgraded to Neutral (High Risk). AMP does appear to offer some longer term value, the broker suggests, but an internal focus and rebasing of underlying earnings expectations mean investors will likely require significant patience before returns emerge. And the risk of regulatory action remains. 2018 underlying earnings were in line with guidance. Ord Minnett believes 2019 will be a year of re-building and poses significant challenges. The broker reduces the rating to Hold from Accumulate, noting the uncertainty in wealth management and the absence of immediate catalysts. Target is reduced to $2.35 from $2.60.

- ASX LIMITED (ASX) was downgraded to Sell from Hold by Deutsche BankB/H/S: 0/2/6

Deutsche Bank saw ASX delivering an interim performance in line with expectations. The analysts point out there is impact from the new accounting standard AASB15, but further out this should reduce the volatility of income recognition, on their assessment. It’s the valuation that is a problem, however, and on that basis the stock is receiving a downgrade to Sell from Hold. Target price falls to $57.60 (was $58.50).

- BREVILLE GROUP LIMITED (BRG) was downgraded to Accumulate from Buy by Ord Minnett and to Underperform from Neutral by Credit SuisseB/H/S: 1/2/1

First half net profit was ahead of Ord Minnett’s forecast. The broker acknowledges Breville is making genuine improvements and its ambitious plans appear to be working. This is supported by 9% constant currency growth even against tough comparables. Ord Minnett increases the target to $15.08 from $13.69. While envisaging potential upside for those willing to take a slightly longer view, the broker downgrades the rating to Accumulate from Buy on valuation grounds. First half results were solid, Credit Suisse notes, and stronger than expected. However, the broker suspects expectations of margin expansion in the medium term are likely to be optimistic. The broker increases FY19 forecasts by 4%, which implies 12.4% operating earnings (EBIT) growth. Rating is downgraded to Underperform from Neutral, a valuation-based view given the performance in the share price and considered an opportunity to take profit. Target is raised to $12.59 from $11.69.

See upgrade above.

- CITY CHIC COLLECTIVE LTD (CCX) was downgraded to Neutral from Buy by CitiB/H/S: 0/1/0

The company formerly known as Specialty Fashion (now in slimmed down survivor format) reported an interim financial performance some 3% above expectations at Citi. The two key items, according to the analysts, were strong sales growth and steady gross profit margins. Dividends are back on the agenda, and Citi welcomes the move, adding further capital management may release excess franking credits. Interim dividend of 2.5c was well ahead of Citi’s predicted 1.5c, plus shareholders also receive a special 2.5c on top. Taking it all in, Citi’s share price target has risen to $1.45 but the rating is lowered to Neutral from Buy, in reference to the share price rally.

- CLASS LIMITED (CL1) was downgraded to Reduce from Hold by MorgansB/H/S: 1/1/1

Class’s 2019 first-half result met the broker but Morgans downgrades to Reduce from Hold, believing free-cash conversion and rising costs point to challenges ahead. Previously, the broker set the target price on a discounted valuation basis but has shifted to a blended valuation to reflect political (federal election) and regulatory risk. Target price falls to $1.34 from $1.48.

- CLEANAWAY WASTE MANAGEMENT LIMITED (CWY) was downgraded to Hold from Buy by Deutsche Bank, to Neutral from Buy by UBS and to Neutral from Outperform by Credit SuisseB/H/S: 2/4/0

Deutsche Bank analysts describe the interim report as a “good beat across the board”. Both revenues and margins surprised to the upside. But it’s all in the share price already, which is why the Hold rating is now in place (downgrade from Buy). Target price jumps to $2.33. First half results beat expectations. The improvement in the business impressed UBS, as both organic growth and underlying operating leverage were stronger than expected. Momentum should continue into the second half. The broker continues to highlight the defensive characteristics of the business. Yet, at current levels, this is largely reflected in the share price and the rating is downgraded to Neutral from Buy. Target is raised to $2.30 from $2.15. First half results were below Credit Suisse estimates. Integration of Toxfree remains on track and the synergy timeline is unchanged. While the broker likes the business and the opportunities, the shares are considered fully valued for now. Credit Suisse downgrades to Neutral from Outperform and raises the target to $2.15 from $2.05.

- MAGELLAN FINANCIAL GROUP LIMITED (MFG) was downgraded to Neutral from Outperform by Macquarie, to Hold from Add by Morgans and to Neutral from Buy by UBSB/H/S: 3/4/0

Magellan’s result beat Macquarie by 3%, reflecting well managed costs. The fund manager continues to deliver strong results, the broker notes, and recent performance metrics should support ongoing funds flows. But the stock is trading at a 21% premium to ASX listed fund managers against a five-year average of 14%. Macquarie thus downgrades to Neutral on valuation grounds. Target rises to $31.75 from $29.00. Magellan Financial Group’s 2019 first-half result outpaced the broker by 4%, as management fee revenue rose 27% on the previous half and a strong performance from core funds. The broker notes growth potential, pointing to the stock’s balance sheet and new products. But the stock is trading within Morgan’s valuation so the stock is downgraded to Hold from Add, looking for a better entry point. Target price rises to $33.40 from $28.76. The company continues to experience a significantly stronger investment performance and fund flow trends versus its listed asset management peers. UBS believes this momentum is now adequately priced into the stock and downgrades to Neutral from Buy. First half net profit was ahead of estimates, driven largely by funds management profits. Target is raised to $32.30 from $28.90.

- NEWCREST MINING LIMITED (NCM) was downgraded to Sell from Neutral by UBSB/H/S: 1/4/3

First half results were in line with forecasts. Newcrest now appears expensive to UBS, trading around 10% above valuation. The broker believes the premium to the rest of the market is not justified, as production is likely to peak in the next two years. UBS downgrades to Sell from Neutral and reduces the target to $24.00 from $24.50.

- TRANSURBAN GROUP (TCL) was downgraded to Neutral from Outperform by MacquarieB/H/S: 3/4/1

While accounting influenced the first half result, the focus is on cash generation and Macquarie expects the reliance on refinancing as a supplement should diminish in the next two years. Management has emphasised current project developments and internal opportunities, such as the widening of the M7. Macquarie makes minor changes to its forecast to reflect weaker traffic at Citylink and marginally lowers the target to $11.89. Rating is downgraded to Neutral from Outperform. Macro influences are expected to be the major driver of the performance in the near term.

- TASSAL GROUP LIMITED (TGR) was downgraded to Neutral from Outperform by Credit SuisseB/H/S: 1/2/0

First half results beat Credit Suisse forecasts, confirming the view that the company will benefit from high harvest volumes and still enjoy strong pricing. The broker continues to believe the market dynamics for salmon are supportive and believes the targets for prawns, if achieved, will materially boost earnings. The broker downgrades to Neutral from Outperform as the valuation is back in line with the long-run average. Target is raised to $5.15 from $4.90.

- TREASURY WINE ESTATES LIMITED (TWE) was downgraded to Equal-weight from Overweight by Morgan Stanley and Downgrade to Hold from Accumulate by Ord MinnettB/H/S: 4/3/1

Morgan Stanley believes the brand is being stretched more and suspects the need to put away large volumes is likely to slow growth. While America represents a good story, the broker believes this is captured in expectations. Meanwhile, luxury inventory is rising. As the valuation now appears fair, the broker downgrades to Equal-weight from Overweight. Industry view: Cautious. Price target $17. First half underlying net profit was below Ord Minnett’s forecast. Despite strong execution and EBITS growth, the broker observes growth rates are becoming more dependent on vintage, which affects the multiple. Moreover, incremental EBITS growth generates less cash and this reduces valuation support. Ord Minnett downgrades to Hold from Accumulate and reduces the target to $17.50 from $20.00. See upgrade above.

- UNIBAIL-RODAMCO-WESTFIELD (URW) was downgraded to Underperform from Outperform by MacquarieB/H/S: 1/2/1

Following the release of 2018 financials, Macquarie has double-step downgraded to Underperform from Outperform. In an initial response to the release, the analysts note 2019 guidance is -8% below their own forecast, and -13% below market consensus. The underlying weakness can become a genuine problem, point out the analysts, given elevated gearing of the balance sheet. New target $10.88 (was $13.59).

- VIRGIN AUSTRALIA HOLDINGS LIMITED (VAH) was downgraded to Underperform from Neutral by Credit SuisseB/H/S: 0/1/2

Management has noted pricing for business travellers has been flat in the past month while the leisure market is down slightly. The company is guiding to at least 7% revenue growth in the third quarter, slowing from the 10% reported in the first half. While underlying pre-tax profit estimates are reduced by -67% for FY19 Credit Suisse improves forecasts for FY20 and FY21 on lower fuel cost assumptions. The broker downgrades to Underperform from Neutral and reduces the target to $0.18 from $0.20.

- WOODSIDE PETROLEUM LIMITED (WPL) was downgraded to Hold from Accumulate by Ord MinnettB/H/S: 4/4/0

2018 results were below expectations because of higher depreciation and finance costs. Yet, the full year dividend surprised Ord Minnett, implying a 94% pay-out ratio. Management indicated this was due to stronger cash generation over 2018. With the stock trading in line with valuation and consensus earnings forecasts appearing optimistic, Ord Minnett downgrades to Hold from Accumulate. Target is steady at $34.50.

Earnings forecast

Listed below are the companies that have had their forecast current year earnings raised or lowered by the brokers last week. The qualification is that the stock must be covered by at least two brokers. The table shows the previous forecast on an earnings per share basis, the new forecast, and the percentage change.

The above was compiled from reports on FNArena. The FNArena database tabulates the views of eight major Australian and international stock brokers: Citi, Credit Suisse, Deutsche Bank, Macquarie, Morgan Stanley, Morgans, Ord Minnett and UBS. Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.