The faster than anyone expected swift recovery in Aussie equities is triggering a deluge in recommendation downgrades from whiplash-affected stockbroking analysts while the February reporting season continues to gather substance in Australia. For the week ending February 8, 2019 FNArena counted six recommendation upgrades by the eight stockbrokers monitored daily and all went to Buy from Neutral. Three of the upgrades (50%) followed the release of financial results, with GUD Holdings the only one to see its share price punished at first, then recover steadily.

There was a lot more action on the downgrades side of the week’s ledger with 19 downgrades recorded, of which only three ratings moving to Sell. Those three unlucky ones are Sydney Airport, IDP Education, and Evolution Mining. Large cap stocks including CSL, AGL Energy, Fortescue Mining, Insurance Australia Group, Transurban, and banks National Australia Bank and Westpac all received one downgrade each.

In the good books

- IDP EDUCATION LIMITED (IEL) was upgraded to Accumulate from Hold by Ord MinnettB/H/S: 3/1/1

Ord Minnett was impressed with the first half result, which beat estimates by 13.4%. Strong revenue growth was demonstrated across-the-board and student placement was up 40%. The broker observes there are few companies listed on the ASX that provide the same kind of exposure to the Indian growth story and there are few reasons why the company cannot capitalise on the opportunities ahead.

The broker considers the valuation lofty but “irresistible” and upgrades to Accumulate from Hold. Target is raised to $14.16 from $8.41. See downgrade below.

In the not-so-good books

- AGL ENERGY LIMITED (AGL) was downgraded to Neutral from Buy by CitiB/H/S: 1/4/3

Citi analysts have been among the market optimists when it comes to AGL Energy, but they now see multiple reasons to become more cautious. One of the reasons includes the current share price. A second reason is that investors will find it hard to accurately value new growth projects, including grid scale batteries.

Equally noteworthy is Citi’s suggestion AGL Energy might be venturing onto the acquisition path, having plenty of balance sheet capabilities, including the option of expanding overseas or in new areas such as broadband. The removal of buybacks has triggered a -6%-10% cut to forecasts, also including lower electricity portfolio margins as well as lower cost-out projections. Price target drops to $22.48 from $23.79 and rating downgraded to Neutral from Buy.

- ALLIANCE AVIATION SERVICES LIMITED (AQZ) was downgraded to Neutral from Outperform by Credit SuisseB/H/S: 1/1/0

Credit Suisse observes the share price had risen 29% since the August 2018 result, on continued positive news flow, while the rest of the share market went through a difficult period. Qantas ((QAN)) entering the shareholders’ register, with the intention of building a majority stake, has fundamentally complicated matters.

Credit Suisse professes not to have any idea how the competition law sits in between Qantas and Virgin Australia ((VAH)) and Alliance Aviation. The analysts think it’s best to take a more cautious stance, hence the downgrade to Neutral from Outperform. Target price increases to $2.50 from $2.45. Earnings estimates have been reduced, but DPS forecasts have gone up, as the financial report itself seems to have missed expectations on several items, but never in a big way (the analysts talk about favourable operating conditions, but with an adverse mix)

- CALTEX AUSTRALIA LIMITED (CTX) was downgraded to Hold from Buy by Ord MinnettB/H/S: 5/1/1

Following a review of the investment thesis and the modest share price recovery, as well as a new alliance between Coles ((COL)) and Viva Energy ((VEA)), Ord Minnett downgrades to Hold from Buy and lowers the target to $27.50 from $30.00.

The broker believes the new alliance between the latter two makes gross margin expansion more difficult and market share losses are expected for Caltex customer Woolworths ((WOW)) and, to a lesser extent, Caltex itself.

- INSURANCE AUSTRALIA GROUP LIMITED (IAG) was downgraded to Neutral from Outperform by Credit SuisseB/H/S: 3/4/1

First half results beat Credit Suisse estimates. The broker is cautious about whether the business will still hit the upper end of its guidance range for the full year.

This requires an allowance for expense savings in the second half and steady assumptions of peril and investment income. The broker increases FY19 net profit estimates by 11% to incorporate the beat to forecasts. As the stock has outperformed the market in the last four months and there is some earnings risk emerging into the second half, the broker downgrades to Neutral from Outperform. Target is raised to $7.80 from $7.65.

- IDP EDUCATION LIMITED (IEL) was downgraded to Sell from Neutral by UBSB/H/S: 3/1/1

UBS observes almost every section of the company’s business is delivering growth and the digital strategy is progressing well. This presents a real opportunity to take market share. First half results were ahead of expectations. UBS believes valuation at current levels is stretched and downgrades to Sell from Neutral. Target is raised to $12.90 from $11.30.

- NATIONAL AUSTRALIA BANK LIMITED (NAB) was downgraded to Hold from Add by MorgansB/H/S: 3/4/1

Morgans considers the leadership changes a negative development, amid increased risk of a cut to dividends, disruption to the transformation strategy and more remediation charges. First quarter cash earnings were slightly lower than the broker expected with revenue the main area of softness.

Going forward, the run rate is expected to improve as increases to standard variable rates become effective. Morgans downgrades to Hold from Add and reduces the target to $25.00 from $31.50.

- PUSHPAY HOLDINGS LIMITED (PPH) was downgraded to Hold from Buy by Ord MinnettB/H/S: 0/1/0

The company’s third quarter update appeared solid to Ord Minnett at first glance, although management has indicated that revenue in FY19 will be at the lower end of guidance. With respect to FY20, 30% growth off the FY19 base is considered a reasonable target. Nevertheless, the broker’s confidence in stated targets is low, suspecting that increasing online penetration with existing customers is getting harder to obtain. Rating is downgraded to Hold from Buy. Target is reduced to $3.47 from $3.89.

- TECHNOLOGYONE LIMITED (TNE) was downgraded to Hold from Buy by Ord MinnettB/H/S: 0/4/0

The share price has increased over 65% since Ord Minnett initiated coverage in July 2018. The broker believes growth has now been captured in the valuation and downgrades to Hold from Buy. While there is potential for earnings upgrades over the medium term, the broker would like to have a more evidence of accelerating back book cloud adoption before upgrading forecasts. Target is raised to $6.10 from $6.00.

- WESTPAC BANKING CORPORATION (WBC) was downgraded to Hold from Accumulate by Ord MinnettB/H/S: 2/4/2

Ord Minnett downgrades to Hold from Accumulate, following the first half result from Commonwealth Bank (CBA) which provides further evidence of a very challenging retail banking environment. Retail banking accounts for 38% of Westpac’s revenue and Australian home loans are 62% of its group loans. The broker reduces the target to $28.90 from $30.90.

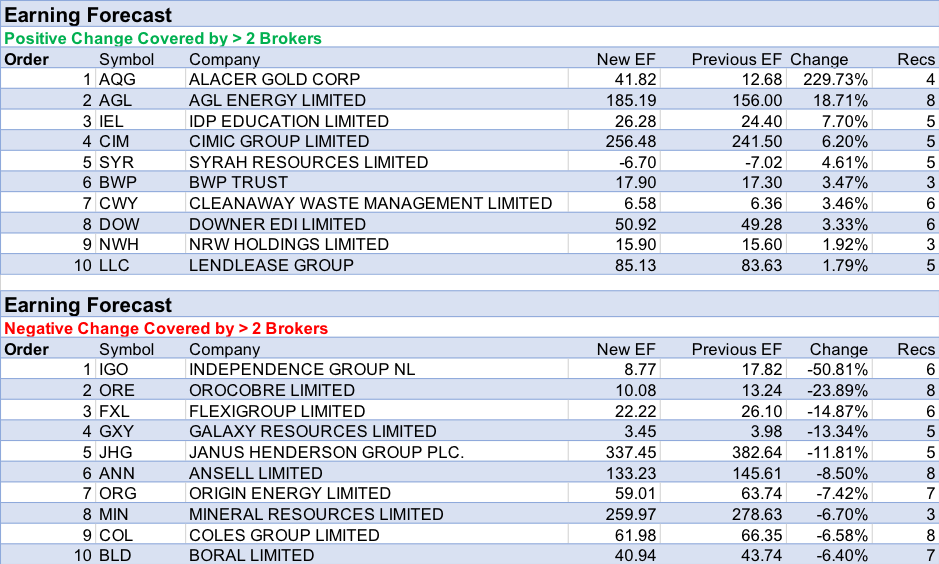

Earnings forecast

Listed below are the companies that have had their forecast current year earnings raised or lowered by the brokers last week. The qualification is that the stock must be covered by at least two brokers. The table shows the previous forecast on an earnings per share basis, the new forecast, and the percentage change.”

The above was compiled from reports on FN Arena. The FNArena database tabulates the views of eight major Australian and international stock brokers: Citi, Credit Suisse, Deutsche Bank, Macquarie, Morgan Stanley, Morgans, Ord Minnett and UBS.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.