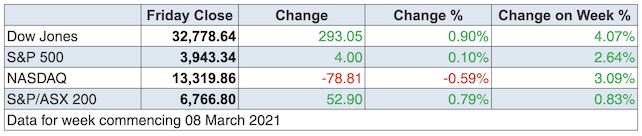

Wall Street can’t throw off bond market concerns, with another jump in yields hitting tech stocks again. The Nasdaq was down pretty heavily before the close, taking the S&P 500 into negative territory after travelling at record highs for most of the week. To that point, the less-tech-dependent Dow Jones was up and making new records.

To explain this in a nutshell, the huge stimulus plus the extensive vaccination programme says an economic boom is coming. And the bond market does what it does — it anticipates rising interest rates. It’s even believable that the 10-year bond rate will be higher than the 1.63% made overnight, which was the highest level in a year.

That’s right, before a year ago, the 10-year rate was a lot higher — over 2% in 2019 and 1.8% before the Coronavirus crash! All this might really be a process of the US economy approaching normalcy over 2021. And just as we saw this week, central banks will try and slow down the yield spike. And when that happens, stocks will rise. In fact, the EU’s central bank actually made that promise only this week.

As CommSec’s Ryan Felsman reported: “European share markets closed at the highest levels in a year on Thursday on an easing of concerns about rising bond yields. The European Central Bank said that bond purchases would be lifted: ‘The Governing Council expects purchases under the pandemic emergency purchase programme (PEPP) over the next quarter to be conducted at a significantly higher pace than during the first months of this year.’”

You should know that big stimulus ignites what’s called the reflation trade: financials, energy and industrials. The higher rates hurt tech stocks and China-related companies, with the latter not a trend I’ve noticed before.

This development is good for value stocks and those identified with the reopening of the economy. Those growth stocks, like tech, that did well in the lockdowns of 2020, are under pressure now.

Why do tech stocks cop it?

Well, this is the standard response: “Sharp increases in interest rates can put outsized pressure on high-growth tech stocks as they reduce the relative value of future profits.” (CNBC) While that’s true, there are a lot of non-tech businesses that would also be similarly affected. I prefer to just see it as some tech stocks were overbought and it’s time for profit-taking as the rotation into businesses that will do well as economies reopen more because of vaccinations and stimulus.

It is what it is until some big fund managers decide that it’s not! And then we’ll get a new explanation narrative out of the market. This tendency creates opportunities to buy good companies at better prices.

CBA at $64 six months ago was a case in point, when tech stocks were the irresistible love child of the stock market.

This is why tech stocks could remain under pressure while the bond market sends yields higher: “Ned Davis Research estimated that the Nasdaq 100, the tech heavy index, which tracks the 100 largest non-financial companies in the Nasdaq Composite, would drop another 20% if the 10-year yield hits 2%.”

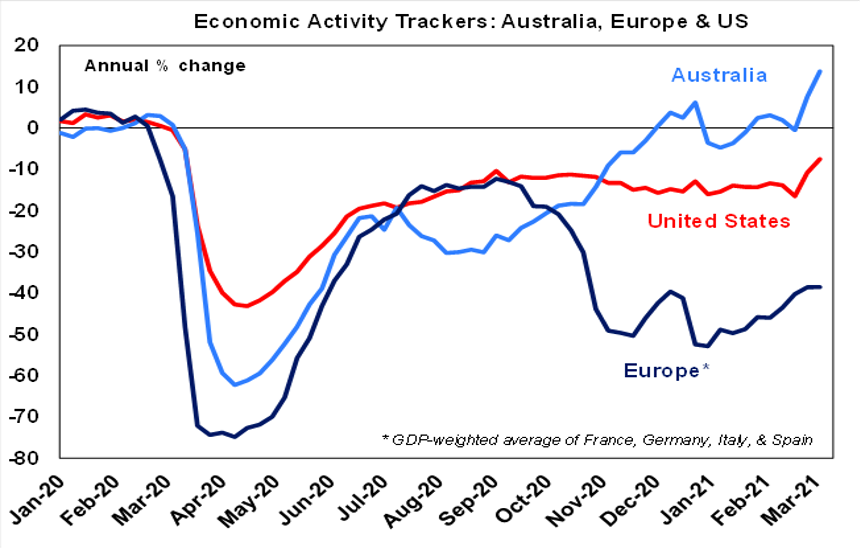

On the good news front, the chart below shows all three Economic Activity Tracker lines are now pointing up, with Australia miles out in front.

Source: AMP Capital

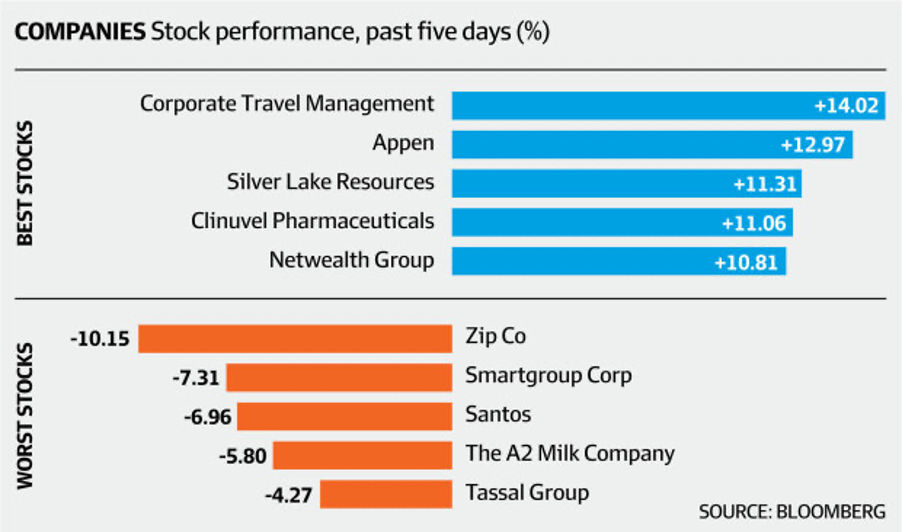

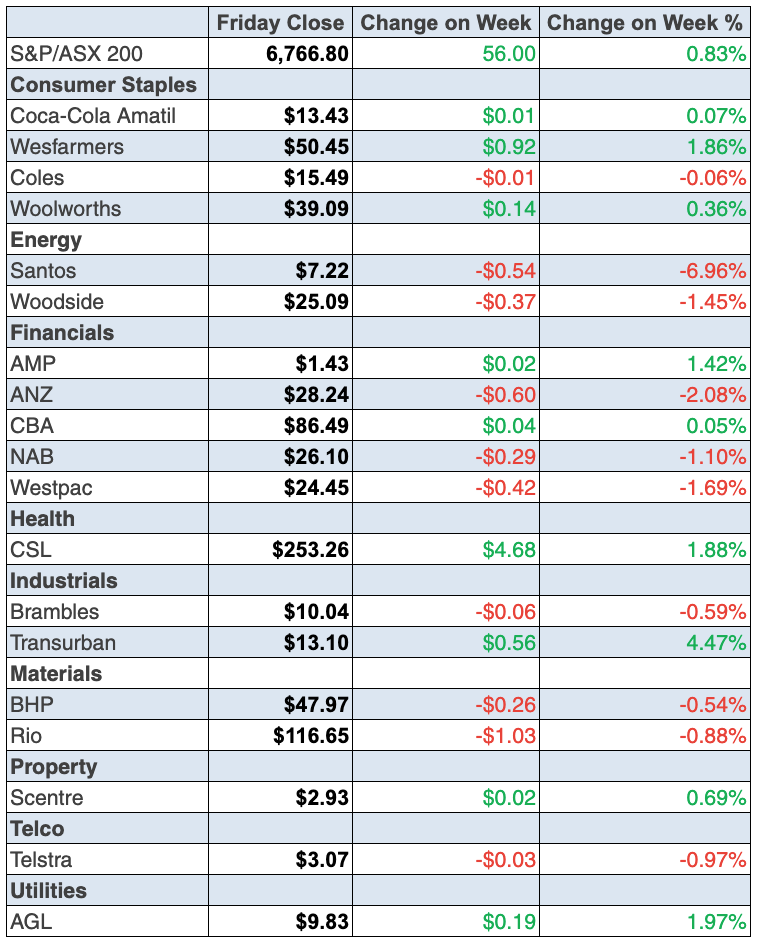

To a local story for the week, it was a tech stock revival and the Morrison Government’s $1.2 billion support for the travel and aviation sectors helped the local stock market close on a high this week. The 0.9% rise on Friday gave us a 0.8% jump for the week, with the S&P/ASX 200 ending at 6766.8. But we still aren’t in the record high territory that US indices are at right now.

Our time will come, with economic readings on consumer and business confidence at historically high levels. More on that below in What I Liked.

S&P/ASX 200

Travel stocks had a good week, with Flight Centre up 8.5% to $18.61 and Webjet flew 8.2% higher to $6.08. I’m glad I’ve been a believer in these businesses!

The tech stock rise was a little discriminatory, with two stocks I’ve liked heading in different directions.

First Appen has at long last got the nod of approval from the market with a 13.1% rise to $17.87, while after some nice rises recently, Zip Co lost ground and was down 10.4% for the week.

Profit-taking and the threat of PayPal hasn’t helped the company’s share price, but I remain a believer in both Afterpay and Zip.

Now at $8.77, A2Milk is testing my belief in Buffett’s advice to be greedy when others are fearful, but I liked Tony Featherstone’s assessment in Thursday’s Switzer Report.

What I liked

- The Westpac-Melbourne Institute Index of Consumer Sentiment rose by 2.6% in March to 111.8 – the second highest reading in seven years. A reading above 100 points denotes optimism.

- The weekly ANZ-Roy Morgan consumer confidence rating rose by 1.5% to 111.9 points (long-run average since 1990 is 112.6). Confidence is up by 71.4% since hitting record lows of 65.3 on 29 March 2020 (lowest since 1973). Consumer views on ‘current economic conditions’ rose 3.6% to a 19-month high of 5.3 points.

- The NAB business confidence index rose from 12 points in January to an 11-year high of 16.4 points in February (long-term average is 5.1 points).

- The NAB business conditions index lifted to a 30-month high of 15.4 points from 9.1 points (long-term average is 5.3 points).

- In seasonally adjusted terms, preliminary job vacancies increased by 7% (or 12,600 job advertisements) – the 10th successive increase – in February to stand at a 9-year high of 191,994 available positions. Job ads are up 24.8% (or 38,100 advertisements) over the year.

- The CBA says that credit and debit card spending in the week to March 5 lifted by 10.8% on a year ago (previously: 10.4%). Spending on services rose 11.9% from a year ago (previously: 4.3%). The annual growth rate of goods spending lifted 9.8% (previously: 17%).

What I didn’t like

- The bond market overreaction and its hit on all tech stocks, but it won’t go away any time soon. Eventually, the market will tell us that not all techs are the same — mark my words.

- On the coronavirus front, global new deaths are continuing to fall but the decline in new cases since January remains stalled, mainly due to rising trends in Europe (particularly Italy, but also France and Germany) and a renewed surge in Brazil.

One big like

I have to say my lack of “What I didn’t like” has to be one big like! It explains why stocks have good potential to go higher in 2021.

And don’t forget to catch up on some of our great stories of this week, including Paul Rickard’s objective look at AGL, Michael Wayne’s positive take on Credit Corp and Maureen Jordan’s recount of our tech discussion out of last week’s webinar (which I urge you to attend on the first Friday of each month!).

The week in review:

- Here’s a group of 10 quality companies I think look well-priced and are also in the top 100 ASX list: CSL (CSL), A2 Milk (A2M), Xero (XRO), Treasury Wine Estates (TWE), JB Hi-Fi (JBH), Harvey Norman (HVN), Altium (ALU), Ramsay Healthcare (RHC), Reliance Worldwide (RWC) and Resmed (RMD).

- Is there value in AGL (AGL)? Is it time to buy? Paul Rickard gives his candid view on this former blue-chip stock in his article this week.

- Tony Featherstone said he thinks A2 Milk (A2M) and Treasury Wines Estates (TWE), both quality China-focused agricultural stocks, offer value at their current prices.

- James Dunn put the spotlight on 6 Aussie iron ore stocks: Fortescue Metals Group (FMG), BHP (BHP), Rio Tinto (RIO), Mineral Resources (MIN), Mount Gibson Iron (MGX) and BCI Minerals (BCI).

- For our “HOT” stock this week, Michael Wayne selected Credit Corp (CCP).

- In Buy, Hold, Sell – What the Brokers Say this week, there were 7 upgrades and 6 downgrades in the first edition, and 7 upgrades and 3 downgrades in the second edition.

- In Questions of the Week, Paul Rickard answered your questions about fair value versus market share price, ETFs for exposure to Asia, Sydney Airport (SYD), and how the percentage chance of a rate rise is calculated.

- Finally, Maureen Jordan shared a key discussion on tech stocks from our webinar last week. If you haven’t already, you can access the full recording and transcript of this webinar here. Keep an eye on your inbox for future monthly webinar invitations as well as reminders for our weekly Boom! Doom! Zoom! sessions at 12pm on Thursdays.

Our videos of the week:

- Boom! Doom! Zoom! | March 11, 2021

- Beaten up quality stocks to buy: CSL, JBH, TWE, A2M, MND, TYR & Tesla? | Switzer TV: Investing

- How to successfully buy or sell in this ferocious property market | Switzer TV: Property

Top Stocks – how they fared:

The Week Ahead:

Australia

Monday March 15 – Reserve Bank Governor speech

Tuesday March 16 – Weekly consumer sentiment (March 14)

Tuesday March 16 – CBA Household Spending Intentions (Feb.)

Tuesday March 16 – Property price indexes (December quarter)

Tuesday March 16 – Weekly payroll jobs & wages (February 27)

Tuesday March 16 – Reserve Bank Board meeting minutes

Wednesday March 17 – Overseas travel statistics (February)

Wednesday March 17 – Household impacts of Covid-19 survey (Feb.)

Wednesday March 17 – Speech by Reserve Bank official

Thursday March 18 – Labour force (February)

Thursday March 18 – Population growth (September quarter)

Friday March 19 – Preliminary retail trade (February)

Overseas

Monday March 15 – China retail/production/investment (February)

Monday March 15 – US Empire State manufacturing index (March)

Tuesday March 16 – US Retail sales (February)

Tuesday March 16 – US Industrial production (February)

Tuesday March 16 – US NAHB housing market index (March)

Tuesday March 16 – US Export/import prices (February)

Tuesday March 16 – US Business inventories (January)

March 16-17 – US Federal Reserve (FOMC) meeting

Wednesday March 17 – US Housing starts (February)

Wednesday March 17 – US Building permits (February)

Thursday March 18 – US Philadelphia Fed factory index (Mar.)

Thursday March 18 – US Conference Board leading index (February)

Food for thought:

“I remember saying to my mentor, ‘If I had more money, I would have a better plan.’ He quickly responded, ‘I would suggest that if you had a better plan, you would have more money.’ You see, it’s not the amount that counts; it’s the plan that counts.” – Jim Rohn

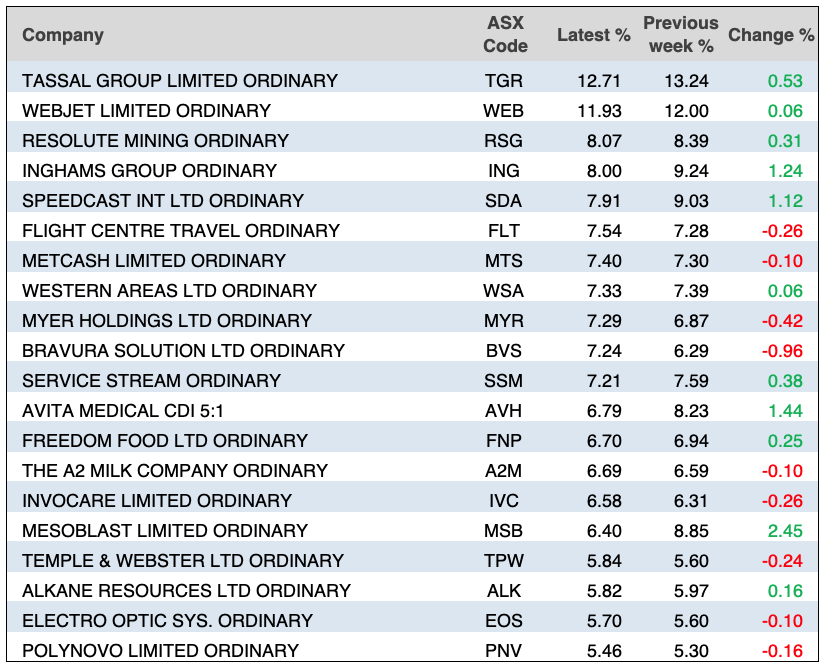

Stocks shorted:

ASIC releases data daily on the major short positions in the market. These are the stocks with the highest proportion of their ordinary shares that have been sold short, which could suggest investors are expecting the price to come down. The table shows how this has changed compared to the week before.

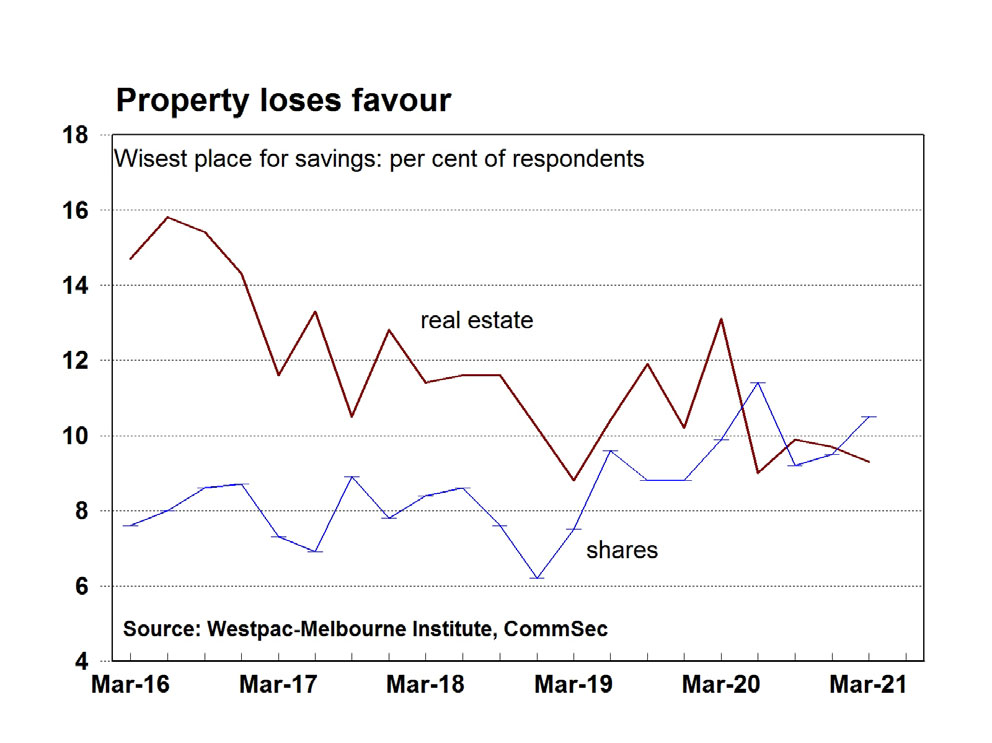

Chart of the week:

CommSec Chief Economist Craig James highlighted data from the latest Westpac-Melbourne Institute Index of Consumer Sentiment survey in the chart below. 10.5% of respondents said shares were the wisest place for extra savings, the second highest level in seven years and edging out the 9.3% of respondents who selected property:

Top 5 most clicked:

- Why I want more of these 10 stocks – Peter Switzer

- Should you top up on a2 Milk & Treasury Wines Estate? – Tony Featherstone

- If you buy AGL will you “catch a falling knife”? – Paul Rickard

- 6 Aussie iron ore stocks in the spotlight – James Dunn

- My “HOT” stock: CCP, again! – Maureen Jordan

Recent Switzer Reports:

- Monday 8 March: Why I want more of these 10 stocks

- Thursday 11 March: Should you buy a2 Milk & Treasury Wines?

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.