Last week’s Boom, Doom, Zoom webinar was made tricky as I had an offsite meeting and wasn’t able to access FNArena for the experts’ view on a number of stocks that look interesting right now. Their share prices have fallen, and the question is: Are they in the buy zone?

The companies in question are Worley (WOR), Qube Holdings (QUB), Sonic Healthcare, Ampol, Magnis Energy Technologies, Helloworld Travel, Calix, and Iluka Resources.

Let’s go through each one of these.

- Worley (WOR)

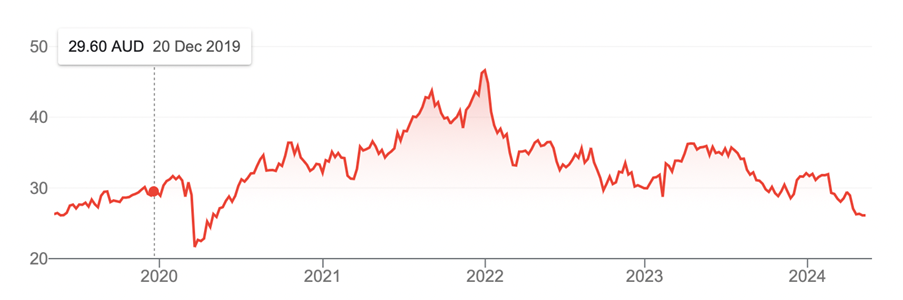

Worley (WOR) has been a tricky company to catch over the years. However, when it gets on a share price uptrend, it has often delivered, as the chart below shows.

Worley (WOR)

However, it can disappoint and ends up burning investors. My preference is to pick up Worley at a low, which we saw in 2009, 2016 and 2020.

That said, its share price has been doing nothing year-to-date but there is a discernible uptrend. The consensus view has a target price of $18.33 against the current price of $15.37, so that’s a 19.3% upside, if the experts are right.

Three out of four analysts like the company and the range of a price rise is 17.76% to 43.14%, which was a call by UBS.

- Qube Holdings (QUB)

Logistics business, Qube Holdings (QUB), is often a forgotten company but it has been a consistent performer, as the chart below shows.

Qube Holdings (QUB)

It’s up 8% year-to-date and 11.43% over the year, and 228% since 2007, when it listed. Did I say it was a consistent performer?

It’s now $3.51, but you could have bought it for $1.85 when the Coronavirus crashed the market! Right now, the consensus rise is tipped at 3.6%. Three out of four analysts like the stocks, with Citi seeing a 12.54% rise, while Morgan Stanley expects a 0.85% fall.

This looks like a core portfolio stock that should be bought when the market goes ‘stir crazy’ and madly negative.

- Sonic Healthcare (SHL)

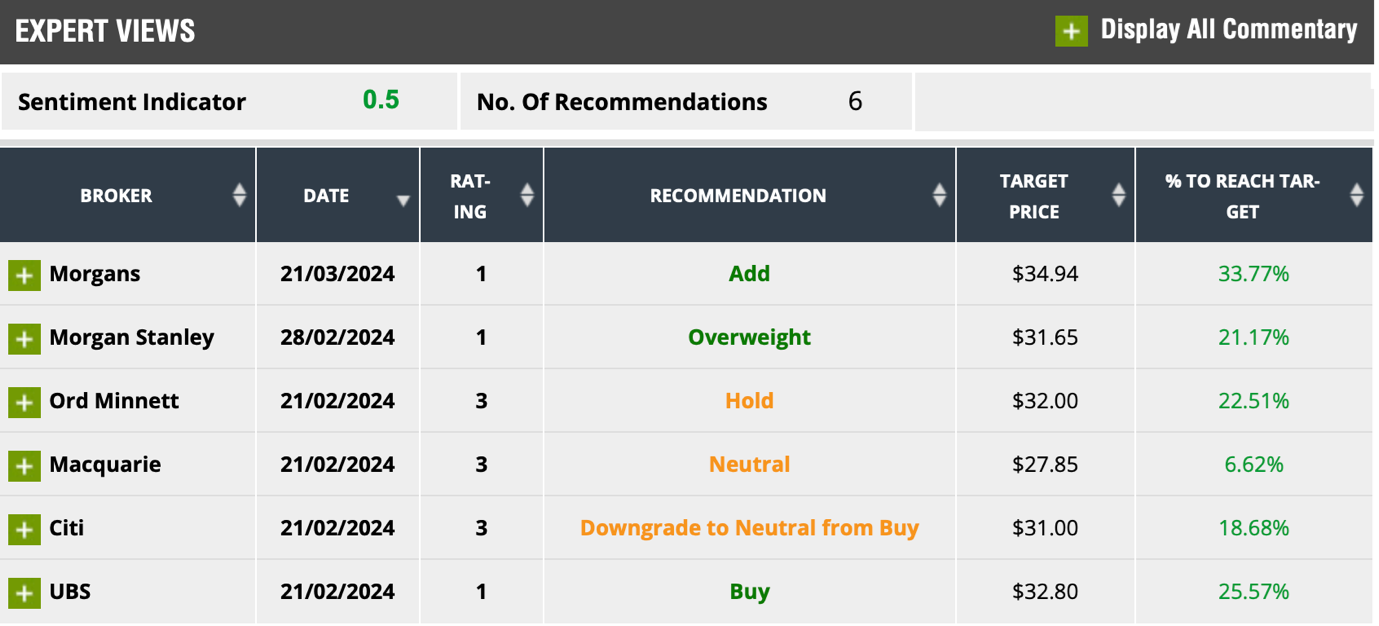

Sonic Healthcare (SHL) has been on the outer after doing well during the pandemic, when pathology and GP services were hugely important. This chart captures the company’s unpopularity since 2022.

Sonic Healthcare

However, the analysts are telling us that SHL’s dumping might have been excessive, with six out of six experts liking the company. Morgans sees a 33.77% gain ahead. This table suggests SHL is in the buy zone, though some analysts are losing some enthusiasm based on the recommendations below.

That said, SHL looks like a decent speculative play.

- Ampol (ALD)

Dividend stock Ampol (ALD) looks like a 50:50 job, with two out of four analysts seeing a 13-14% rise, while the other two only tip a 1-2.5% fall for the stock. I’d only buy ALD if I wanted a 6%+ dividend, which it tends to deliver, along with the chance of a moderate gain in share price in a year when I expect our S&P/ASX 200 index to easily rise 10%.

- Magnis Energy Technologies (MNS)

According to the company’s website, Magnis Energy Technologies (MNS) is a vertically integrated lithium-ion battery company, with strategic investments in several aspects of the electrification supply chain, including manufacturing of green credentialed lithium-ion battery cells, leading edge lithium-ion battery technology and high-quality, high-performance anode materials.

But what do the analysts think of the business?

It’s too small for FNArena to cover but the limited coverage of the company isn’t good. This 42 cents company had the following news story in late 2023: “MNS shares are falling because it looks like the company might actually lose its American battery factory. Obviously, it’s a bit premature to say that it will. But that subsidiary, Imperium3 New York, looks like it’s in breach of a loan agreement”.

But it gets worse, with this from ASIC five days ago: “ASIC has launched civil penalty proceedings in the Federal Court against Magnis Energy Technologies Limited, alleging the company failed to disclose material information about its self-described “flagship” lithium-ion battery manufacturing facility.

“ASIC is also suing Magnis executive chairman Frank Poullas for his involvement in Magnis’ alleged disclosure failures and for alleged breaches of his director’s duties, arguing that he failed to ensure Magnis met its disclosure obligations”. Conclusion? Forget MNS.

- Helloworld (HLO)

Helloworld (HLO) has had a bad month losing 12.94% but the market action seems to defy the company’s view on its future. This is the official view of HLO’s management: “HLO reaffirms its guidance to achieve an underlying EBITDA of $64-$72m for the FY24 year, subject to no material adverse change in operating conditions over the remainder of the financial year”.

Okay, that’s the company story, so what are the analysts saying? These assessors like the business, with a 49.4% rise tipped! And three out of three analysts have big target price rises ranging from 24.5% to 71.08%, with this latter big call coming from Morgans. It looks like HLO is in the buy zone.

- Calix (CXL)

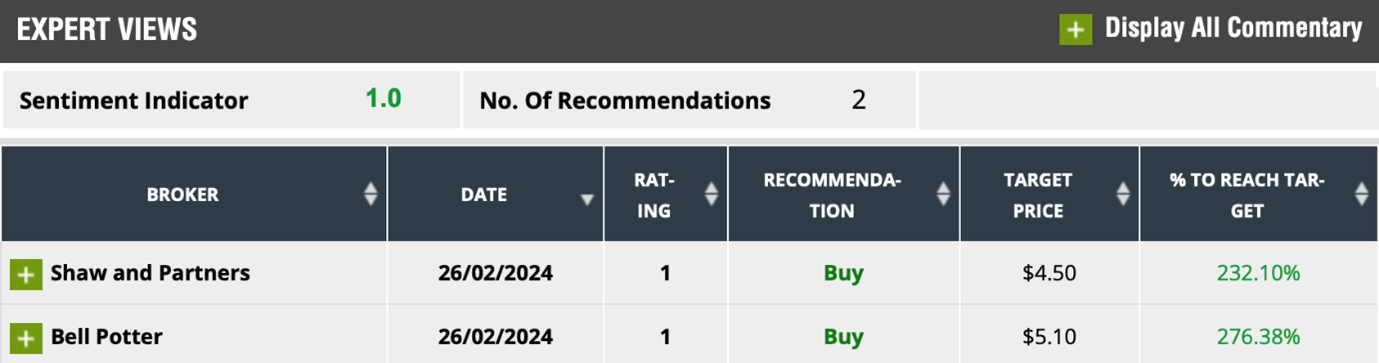

Calix (CXL) is an interesting company that often gets asked about in our Boom, Doom, Zoom webinar. It’s an environmental technology company, which it says is “solving global challenges in industrial decarbonisation and sustainability, including CO2 mitigation, sustainable processing, batteries, biotechnology and water treatment”.

It looks like a company homed in on the future, and the two analysts who cover the company really like this operation big time, with the consensus forecast is, wait for it, 254.2%! While I personally want to do more work to understand the company, it really does look to be in the buy zone.

- Iluka Resources (ILU)

Finally, Iluka Resources (ILU) is the largest producer of zircon and titanium dioxide, which is derived rutile and synthetic rutile globally. Iluka mines heavy mineral sands and separates the concentrate into its individual mineral constituents: rutile, ilmenite, and zircon.

The consensus view is that the share price is tipped to rise 1.3% but the analysts are split, with three out of six giving ILU the thumbs down. However, against that, Ord Minnett likes the potential of the producer, with the broker’s analysts seeing a 22.74% rise ahead.

That’s the local view. The overseas view is more positive, based on nine Wall Street analysts offering 12-month price targets for Iluka Resources in the last three months. The average price target is $7.76, with the highest call $9.50, but the average rise expected is more like 0.11% and it makes me think ILU isn’t in the buy zone.

On the other hand, the one-year chart shows that there has been a 29.8% drop over the past 12 months and it looks like a base is building. In February, the AFR’s Brad Thompson reported the following: “Iluka Resources is in talks with the Albanese government about the future of Australia’s first rare earths refinery after revealing a building cost blowout is at the top end of what it feared two months ago”. Thompson added: “It appears more taxpayer funds could be tipped into the project depending on the outcome of talks between Iluka and the government, which is currently weighing up relief measures for the collapsing nickel industry and the flagging lithium sector. Like nickel and lithium, the rare earths industry has been hit by weaker pricing. Iluka boss Tom O’Leary called out China’s capacity to use market dominance in rare earths to dictate premiums and influence the Asian Metal index”.

Iluka could be a surprise package. I intend to do more research into the company, so watch this space!

Important information: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. For this reason, any individual should, before acting, consider the appropriateness of the information, having regard to the individual’s objectives, financial situation and needs and, if necessary, seek appropriate professional advice.