I received an email this week from a subscriber that said: “about 50% of my portfolio is in the major banks and my financial planner has advised me to sell all my bank shares. What do you think?”

To put it mildly, I think this is plain crazy. While I could understand if the advice was to reduce the exposure (the 50% holding is roughly double the 4 major banks combined market weighting of 22%), to go to a zero weighting in a sector that remains fundamentally cheap and is paying fantastic income is irrational.

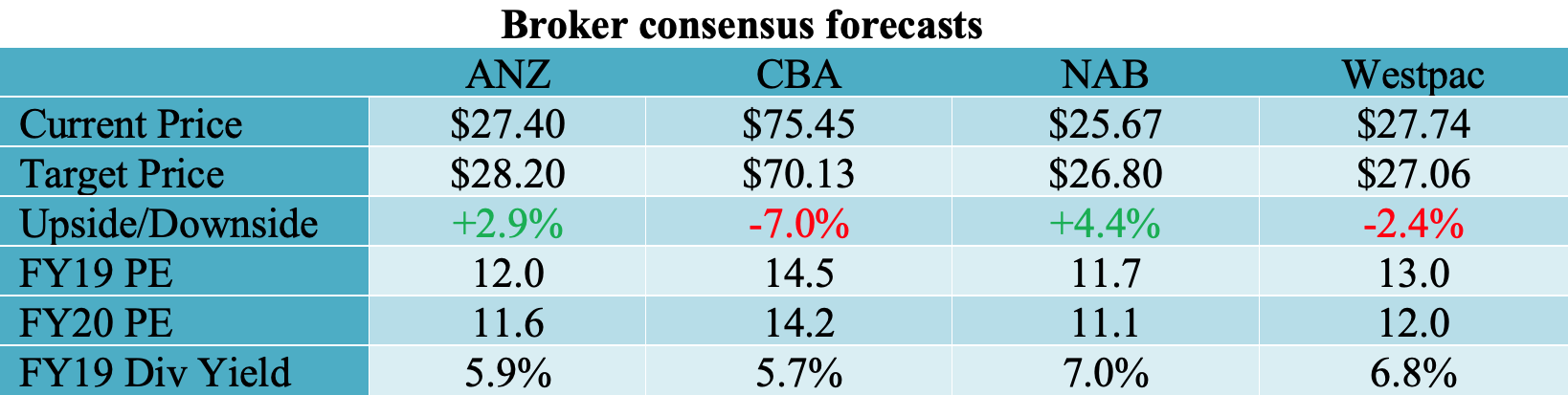

Interestingly, the major banks have rallied strongly over the last fortnight. Rises of around 6% are the norm, with leader Commonwealth Bank closing on Friday at $75.45, up 7.4% on its close on 11 April. The rally comes ahead of bank reporting season (which kicks off on Wednesday with the ANZ) and as disruption pressures in the iron ore supply chain (that has benefitted our major resource companies) start to ease.

Despite this rally, the “bears” are still in the ascendency when it comes to the outlook for the banks. Negative commentary seems to be pervasive – in the media, with market commentators, analysts and financial advisers. Let’s examine the case for the bearishness, and following the rally, ask not whether the banks are a “buy or a hold”, but rather, whether the banks are a ‘hold or a sell”?

The case for the bears

The case for the bears goes like this:

- The major banks are very exposed to the residential housing market. A material downturn in housing will increase mortgage stress, leading to loan delinquencies. Bad debts will spike.

- The major banks are growthless. Credit growth, both business and consumer, is anaemic. If the housing market turns sour, it could go negative. In this environment, revenue growth will at best be flat and most likely negative, particularly if funding margins remain tight.

- A legacy of the Royal Commission will be increased compliance and regulatory costs. While each of the major banks has set outside an amount to cover customer remediation, these have already been revised higher and the likelihood is that they will be revised higher again. Ongoing compliance costs will be higher than the banks are forecasting.

- The major banks are “on the nose” with their customers. Government supported initiatives such as “open banking” and investment by the market in “fintech” style businesses will over the medium term disrupt the major banks, leading to an erosion in market share and pricing pressures particularly on their profitable back books.

- Bill Shorten’s retiree tax (a ban on the refunding in cash of excess franking credits) will cause many self-funded retirees to sell their bank shares.

- The Reserve Bank of New Zealand’s capital review may require the Australian banks to raise further capital, or at least set aside capital management initiatives.

- Australian banks are “expensive” compared to their international bank peers, particularly on measures such as book value multiples.

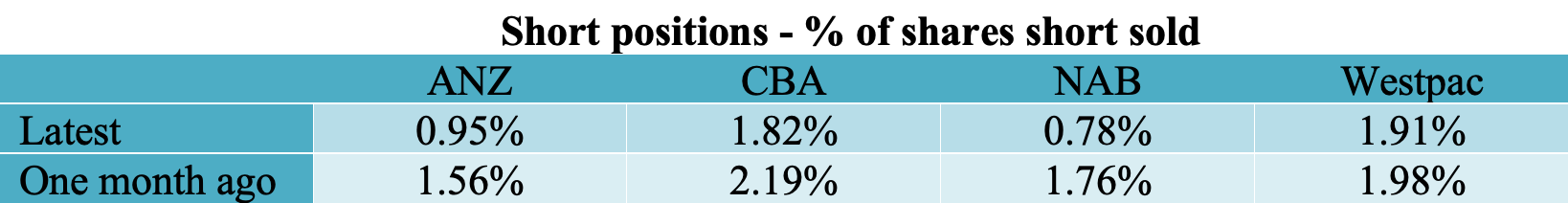

- Professional investors are “short” the major banks, having built up short positions in the expectation that bank share prices will fall.

In fact, short positions are being closed, not opened. According to the latest data on Friday from ASIC, short positions in NAB shares are less than one-half of what they were a month ago. As the following table shows, open short positions in each of the 4 major banks have reduced over the last month. There is nothing unusual in these positions – 1% to 2% of ordinary shares short sold is the norm.

In regard to the concern about the housing market, there is no argument that if the market “crashes”, banks are going to get hit hard and their share prices will tumble. I don’t believe the “crash story” because the two things that could cause it – higher interest rates or a big jump in unemployment – aren’t in play. I am of the view that the housing market will stabilize in 2019, as first home buyers and investors look for bargains.

Banks are largely growthless and this is why their shares have struggled to make much headway. The Royal Commission has also taken its toll, making banks very inward looking and quite risk averse when it comes to new revenue initiatives. To address the lack of revenue growth, each of the majors is focussed on their cost base. I expect that this will be the new game in town, with the winning bank the one that is best able to apply technology to digitise, improve productivity, enhance the customer experience and slash costs.

While the capital proposal from the NZ Reserve Bank is concerning, it is still only a proposal and has some years to play out. Further, as each of the major banks is on track to meet APRA’s “unquestionably strong” benchmark, some form of offset from APRA must be a possibility.

I have never bought the argument about book value multiples, and while the loss of franking credit refunds is a concern for many retirees, if Shorten is elected, it is by no means a certainty that the legislation will be enacted the way it is proposed. Further, any potential impact may already be priced into the market – a classic case of “sell the rumour, buy the fact”.

While industry disruption by fintechs and customer disquiet are legitimate concerns, they are longer term risks that won’t translate to a short-term hit to bank earnings. For me, the bear case boils down to a view on the housing market.

Reporting season and a dividend cut for NAB?

ANZ reports its first half profit on Wednesday, NAB on Thursday, and Westpac next Monday (6 May). Expectations are fairly low, with compliance and customer remediation costs, which will be booked above the line, eating into the cash profits. The main area of interest will be to see what progress has been made in reducing ongoing operating expenses.

If the press is to be believed, the NAB may also announce the appointment of its next CEO and perhaps more importantly, a dividend cut. NAB’s dividend payout ratio last year of 92% is viewed by most as unsustainable. Analysts are forecasting a full year dividend of 180 cents per share, down from 198 cents last year. The first half is forecast to be cut to 90 cents. Akin to the experience that both ANZ and BHP enjoyed when they cut their dividend, a bigger cut would most likely be viewed as a “positive” by institutional investors and analysts.

What do the brokers say about the banks?

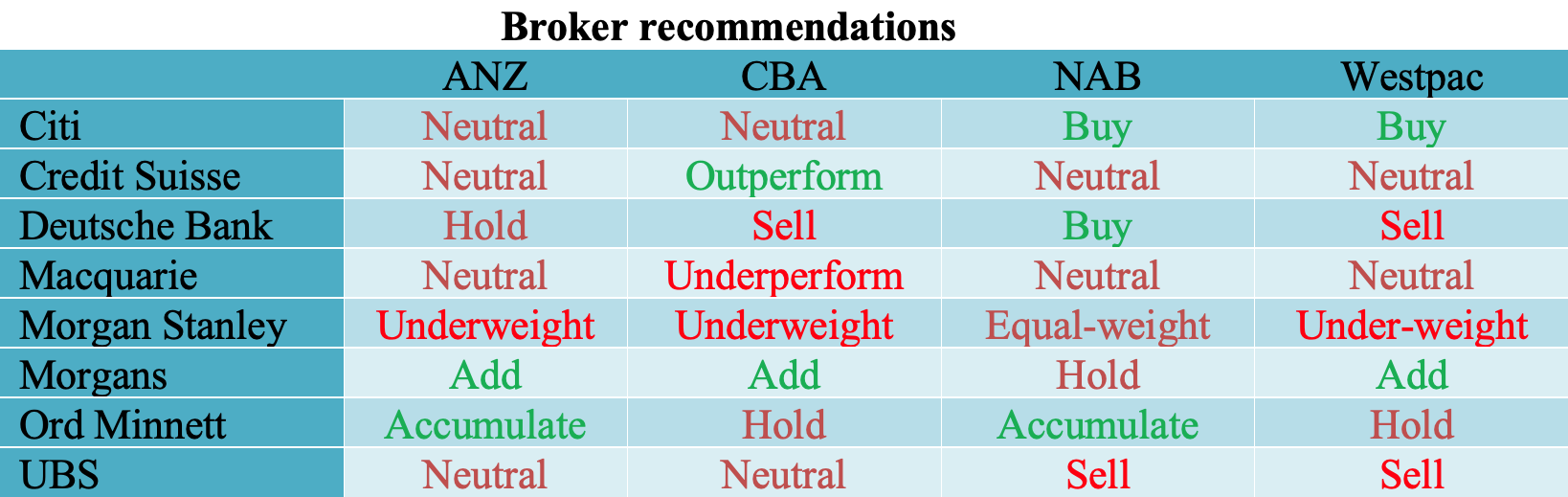

As a group, the major broker analysts are neutral to marginally negative on the sector. They see the lack of revenue growth as the major issue, and while there is no sign of any uptick in bad debts (which are at historically low levels), they note that this risk is rising.

The following table shows their individual bank recommendations (source FN Arena). There is no standout, and very little difference overall with each bank having a mix of “buy” (green) “sell” (red) and “neutral” (brown) recommendations.

On the numbers, the brokers see slightly more potential upside for NAB of 4.4% (its share price on Friday was 4.4% lower than the consensus target price), and 7% downside for the Commonwealth Bank. The latter continues to trade at a PE premium to its peers.

What’s the bottom line?

I don’t buy the bear case. A hold.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.