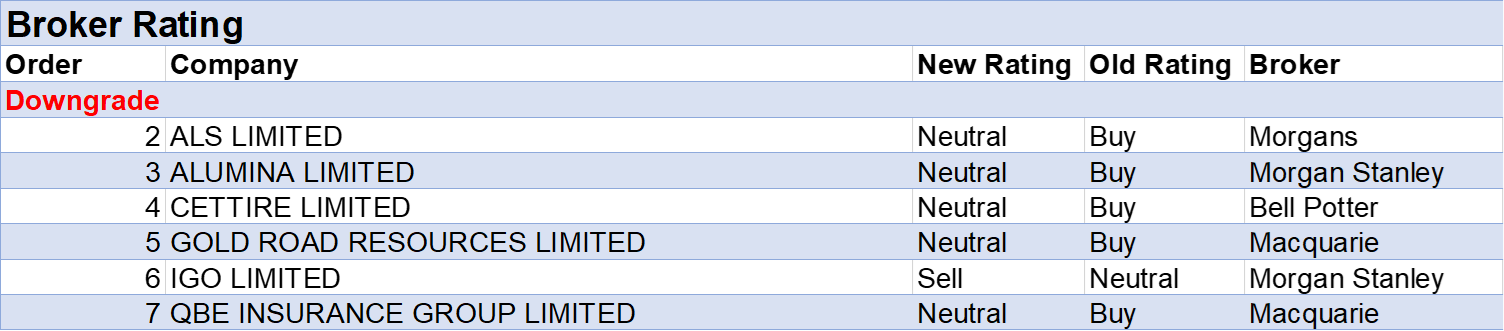

For the week ending Friday April 5, 2024, FNArena recorded one rating upgrade and six downgrades for ASX-listed companies by brokers monitored daily.

Victorian gas producer Cooper Energy’s average target price rose by around 10% following a research update by Macquarie, after management updated the market on decommissioning at the Basker Manta Gummy (BMG) subsea oil facilities, as well as initiatives through the Orbost Improvement Project.

The company has two gas plants: the Orbost plant which processes gas from the Sole field; and the Athena plant which is processing gas from various Otway fields. The BMG facilities in the Gippsland basin were acquired by Cooper from the previous joint venture partner back in 2014.

Cooper Energy has turned the corner, in Macquarie’s opinion, with the decommissioning at BMG nearing completion and because of improving production at the Orbost gas plant.

Orbost is delivering structurally rising production rates and management has reduced by -$10m the anticipated cost of a third absorber, the installation of which is expected to increase the overall production rate, explained the analyst.

The broker also highlighted the company’s Athena plant is one of few options for locally sourced gas in Victoria as it is cheaper, more certain and generates lower emissions compared to LNG imports. The Outperform rating was retained and the target price increased by 35% to 27c largely because of the broker’s increased valuation for the Otway operations.

On the flipside, the average target price for Orora fell by nearly -10% after five covering brokers in the FNArena database reacted to downgraded second half earnings guidance by management for the base business and the recently acquired French glass bottle maker, Saverglass.

Orora designs, manufactures, and supplies packaging products and services to the grocery, fast moving consumer goods, and industrial markets in A&NZ, the US, and internationally.

The trading update implied to Morgan Stanley consensus will need to make mid-to high-single-digit forecast earnings downgrades due largely to softness in North America and the Saverglass business. Weaker volumes were ongoing through the March quarter driven by Distribution and price deflation, explained the broker, along with ongoing de-stocking by customers of Saverglass.

The performance of Saverglass since acquisition has been underwhelming, in Morgans view, and the overall operating outlook remains weak.

More positively, Macquarie noted signs of cyclical improvement in the North American box market while spirits volumes are bottoming out, though timing for the end of destocking is uncertain. Citi concurred, cautiously suggesting this should be the last downgrade by management due to an increasing amount of industry data showing sequential improvement/stabilisation in conditions for both paper and glass.

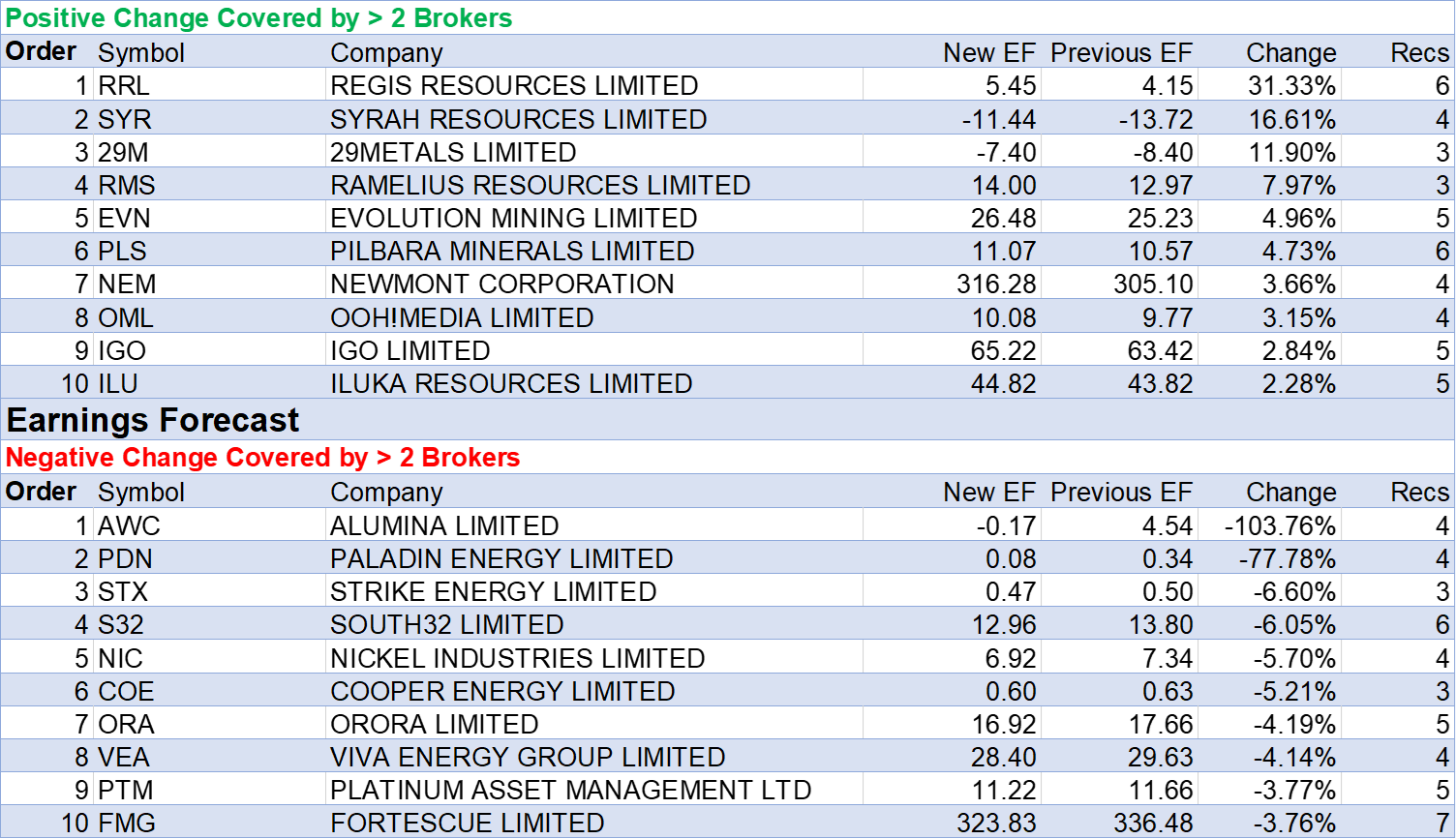

The two top ten earnings change tables below show 17 of the 20 positions were filled by resources companies. This domination was largely due to a report out by the Morgan Stanley commodities team containing new price forecasts. This report also suggested investors focus on stocks with exposure to commodities that will benefit from lower interest rates and either supply discipline or supply disruptions.

In terms of material changes to average earnings forecasts last week, the Morgan Stanley report was responsible for the appearance in the tables below of Regis Resources, Syrah Resources and 29Metals for positive earnings changes, and Alumina Ltd, which received the largest percentage downgrade to average earnings forecast last week.

Tailwinds are in place to support gold prices, according to the broker, with Evolution Mining, Regis Resources and Northern Star Resources the preferred exposures. The target for Regis Resources was increased $2.45 from $2.40 and the Overweight rating remained unchanged.

Later in the week, brokers also reacted to management’s claim of substantial progress towards completion of the definitive feasibility study (DFS) for the McPhillamys gold project.

Morgan Stanley raised its target for vertically integrated natural graphite and battery anode company Syrah Resources, to 45c from 39c and retained an Equal-weight rating. On the same day, Shaw and Partners (Buy, High Risk) lowered its target to $1.10 from $1.30.

This broker was updating research for Syrah’s March 25 FY23 results and equity placement (on March 13) to raise $98m to preserve operating mode optionality at Balama and fund operating costs for the Vidalia downstream active anode material facility in the United States. Proceeds are also to support Vidalia’s ramp-up and progress.

With no production at the Balama graphite operation in Mozambique since April 2023, Syrah reported a FY23 total loss after tax of -$84m compared with a -$26.8m loss in the previous corresponding period. Shaw’s lower target was due to the equity dilution and a six-month delay in first revenue from the Vidalia plant.

The increase in average earnings forecast for 29Metals was solely due to Morgan Stanley’s new commodities forecasts. For base metals, the broker preferred copper and nickel on supply tightness and revealed an order of preference for Evolution Mining (copper/gold), Nickel Industries, 29Metals and South32. The broker’s target for 29metals was increased to 55c from 50c.

For Alumina Ltd, Citi noted the share price was trading at a 45% premium to the broker’s discounted cash flow valuation thanks to a share price surge for Alcoa in the US. In the analyst’s view, a positive for Alumina Ltd is the share price disconnection from alumina pricing, and linkage to Alcoa’s current scrip offer price.

Morgan Stanley downgraded its rating for Alumina Ltd to Equal weight on valuation, while increasing its target to $1.30 from $1.10.

In the good books: one upgrade

ELDERS LIMITED ((ELD)) was upgraded to Outperform from Neutral by Macquarie. B/H/S: 3/2/1

Macquarie raises its target for Elders to $10.45 from $7.12 and upgrades its rating to Outperform from Neutral after adopting profit forecasts around 10% ahead of consensus over FY24 and FY25.

These higher forecasts are based on a more positive view on both the seasonal outlook and livestock prices. Above average rainfall at the end of 2023 on the east coast of Australia is expected to result in a strong winter plant over April to June.

Also, the National Oceanic and Atmospheric Administration (NOAA) in the US is suggesting a 62% probability of La Nina conditions emerging later in the year, providing the analyst with confidence for the 2024/25 season.

Livestock prices have rebounded from depressed levels, and Macquarie expects strong demand for Australian beef (particularly out of the US as slaughter rates decline) will underpin prices over FY24/25.

The broker’s target price is also boosted by a multiple re-rate and lower discount applied to earnings thanks to a dissipation of El Nino/weather risk.

In the not-so-good books: six downgrades

ALS LIMITED ((ALQ)) was downgraded to Hold from Add by Morgans. B/H/S: 1/2/1

Morgans raises its target for ALS Ltd to $13.70 from $13.35 after allowing for a slightly softer-than-expected trading update, an increase in Nuvisan ownership to 100% (at nil cost) and two acquisitions costing $225m.

The two acquisitions Life Sciences businesses in north-west US and Western Europe make strategic sense to the analyst though earnings/value accretion may require patience.

The broker rates ALS Ltd very highly but downgrades its rating to Hold from Add on valuation.

ALUMINA LIMITED ((AWC)) was downgraded to Equal weight from Overweight by Morgan Stanley. B/H/S: 0/4/0

Morgan Stanley’s commodities team updates forecasts and suggests investors focus on stocks with exposure to commodities that will benefit from lower interest rates and either supply discipline or supply disruptions.

The analysts see room for a bounce in iron ore prices and believe lithium share price valuations have potential to correct further.

For base metals, the broker prefers copper and nickel on supply tightness and likes (in order of preference) Evolution Mining (copper exposure), Nickel Industries, 29Metals and South32.

Morgan Stanley’s rating for Alumina Ltd is downgraded to Equal weight from Overweight on valuation with a target of $1.30, up from $1.10. Industry View: Attractive.

CETTIRE LIMITED ((CTT)) was downgraded to Hold from Buy by Bell Potter. B/H/S: 0/1/0

Cettire’s last update in February reported sales revenue up 80% year on year for the month of January. Bell Potter’s March Q forecasts factor in the strong comparable period and sales revenue growth of 66% year on year.

The broker eagerly looks for updates on the China launch with market entry imminent.

Bell Potter has reduced the target multiple in its relative enterprise valuation, which results in a target price cut to $4.50 from $4.80. The broker considers the share price to now be fair, and downgrades to Hold from Buy.

GOLD ROAD RESOURCES LIMITED ((GOR)) was downgraded to Neutral from Outperform by Macquarie. B/H/S: 3/1/0

A timely restart of the Gruyere gold mine in WA is now critical to meet management’s 2024 guidance, suggests Macquarie. This comment follows news further rain has caused supply road closures leading to a cessation of processing activities at the mine.

As a result of rain impacts, management expects production and costs (AISC) towards the lower and higher end of the prior respective guidance ranges.

The broker downgrades Gold Road Resources to Neutral from Outperform following a recent share price rally. The $1.70 target is unchanged.

IGO LIMITED ((IGO)) was Downgraded to Underweight from Equal weight by Morgan Stanley. B/H/S: 2/2/1

Morgan Stanley’s commodities team updates forecasts and suggests investors focus on stocks with exposure to commodities that will benefit from lower interest rates and either supply discipline or supply disruptions.

The analysts see room for a bounce in iron ore prices and believe lithium share price valuations have potential to correct further.

The analysts believe valuations for the lithium pure-plays on the ASX remain elevated and are cautious around battery supply chain inventories and offline supply which can be restarted. Nonetheless, it’s thought a floor for lithium prices may be near.

Mineral Resources is the suggested way to play lithium followed by Pilbara Minerals and IGO.

As the current mine plan for IGO’s Greenbushes mine continues to be reworked, the analysts see risk around future expansions.

The rating for IGO is downgraded to Underweight from Equal-weight and the target falls to $5.95 from $7.20 Industry view is Attractive.

QBE INSURANCE GROUP LIMITED ((QBE)) was downgraded to Neutral from Outperform by Macquarie. B/H/S: 4/1/0

Following the recent share price rally, Macquarie downgrades its rating for QBE Insurance to Neutral from Outperform but raises the target to $18 from $17.10 largely due to updated currency forecasts.

The company is currently trading at a 10.4% premium to weighted international peers on a two-year forward PE multiple compared with the three-year historical average premium of circa 0.5%, explains the analyst.

The broker anticipates the FY24 combined operating ratio (COR) will be 93.8% which compares with management’s guidance for 93.5%.

Earnings forecast

Listed below are the companies that have had their forecast current year earnings raised or lowered by the brokers last week. The qualification is that the stock must be covered by at least two brokers. The table shows the previous forecast on an earnings per share basis, the new forecast, and the percentage change.

The above was compiled from reports on FNArena. The FNArena database tabulates the views of seven major Australian and international stockbrokers: Citi, Credit Suisse, Macquarie, Morgan Stanley, Morgans, Ord Minnett and UBS. Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.