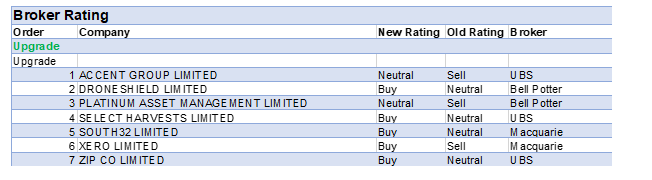

In the week ending Friday March 8, 2024, there were seven rating upgrades and no downgrades for ASX-listed companies by brokers monitored daily by FNArena. It was a quieter period by comparison to recent weeks, and over the next three weeks there will be only sporadic earnings releases by a relatively tiny number of companies.

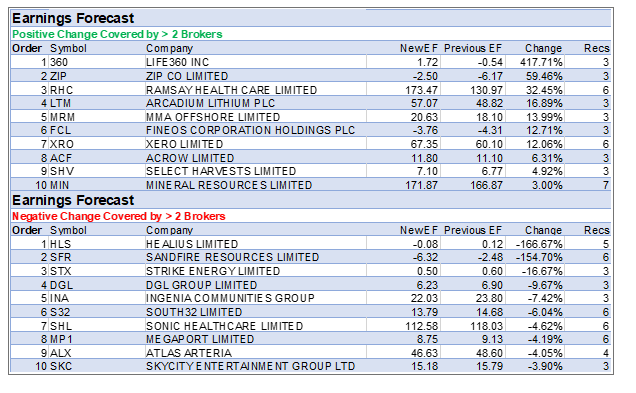

The tables below show percentage downgrades by brokers to average earnings forecasts and negative adjustments to average target prices were broadly similar to upgrades and positive adjustments, apart from a few outliers.

Two of those outliers were Zip Co and Life360, which, along with Xero, received material upgrades by brokers to average earnings forecasts and target prices.

At the beginning of the week, brokers began upgrading forecasts for Life360, following the release of FY23 results on the Friday prior.

The results delivered on Morgan Stanley’s sales forecast, beat the broker’s earnings forecast, while FY24 guidance by management also exceeded the consensus forecast.

The highlight, according to Ord Minnett, was the announced move into advertising which will add a new, high-margin (around 70%), low-investment revenue stream. The introduction of advertising to non-paying monthly active users (MAU) is capital light, agreed Morgan Stanley, and even at very modest monetisation rates, implies revenue upgrades by consensus.

FNArena’s daily monitoring of Life 360 consists of three brokers. Morgan Stanley has an Overweight rating, while Ord Minnett and Bell Potter both have Buy recommendations. The average target price of these three brokers last week rose to $13.63 from $10.45, suggesting a further 10.4% upside to the latest share price.

For Zip Co, UBS upgraded its rating to Buy from Neutral and raised its target materially to $1.43 from 36c. First half results in the prior week revealed stronger-than-expected cash earnings. The analyst was surprised by the addition of 100,000 net new active customers in the US for the half, reversing declining customer trends in the previous two years.

This broker noted US BNPL penetration is less than 2% of total payments, compared to 13-15% in Australia, suggesting significant room for further growth.

Last week, stockbroking analysts reacted to Xero’s presentations in the prior week of management’s FY25-27 strategy and aspirations for future growth.

Macquarie increased its target to $152.60 from $87 and upgraded by two rating notches to Outperform from Underperform. These changes reflect the broker’s increased confidence in new management’s strategy for better product development and an improved customer value proposition. A demonstration of the generative AI assistant (Just Ask Xero) reflected an advanced data and AI strategy that will potentially improve efficiency, in the analyst’s view.

Anticipating the new strategy will increase annual revenue per user and subscription growth, Buy-rated Citi increased its target to $159 from $129.40. On the other hand, Ord Minnett maintained its Sell rating and $78 target in the ongoing belief Xero’s international expansion is doomed to failure, despite the updated strategy.

Healius received the largest percentage downgrade to average earnings forecast by brokers in the FNArena database. Last week, the focus was on the announcement by Healius of a strategic review of assets and structure, and the resignation of CEO and Managing Director Maxine Jaquet. Taking over these dual roles will be the company’s current CFO, Paul Anderson.

The most likely outcome of the strategic review, suggested Citi (Sell), is a sale of the Imaging division, while a partial sale of the Pathology department may also be on the cards. The sale of Imaging would solve near-term gearing issues, yet the analyst cautioned it would not be sufficient to solve the profitability and structural challenges facing the Pathology department.

Both Citi and Buy-rated Ord Minnett left their 12-month target prices for Healius unchanged at $1.10 and $3.00 respectively.

Sandfire Resources was next on the earnings downgrade table, but both UBS (Buy) and Morgan Stanley (Equal weight) remained upbeat about the outlook.

Turning to the earnings upgrade table, the average earnings forecast for MMA Offshore, a provider of marine and subsea services globally, rose by 14% last week after Citi initiated research coverage with a Buy rating and $2.60 target. The company is benefiting from a robust cyclical upswing in offshore capex coinciding with no new vessel supply, explained the analysts.

MMA’s revenue is generated from both time charter of vessels as well as from integrated projects which encompass vessel-hire as well as a suite of various technical services.

Management is optimistic about the benefits of diversification for the business, and the extent to which the growth in offshore wind and decommissioning reduces dependency on the Oil & Gas capex cycle. While an earnings trough in a downturn for the energy sector is likely to be less than for prior cycles, Citi cautioned the risk/reward for MMA is arguably less compelling than 12 months ago.

In the good books: upgrades

ACCENT GROUP LIMITED ((AX1)) was upgraded to Neutral from Sell by UBS. B/H/S: 4/2/0

Following a review of the outlook for Accent Group, UBS has become more upbeat around both revenue growth and earnings (EBIT) margins.

The broker’s rating is upgraded to Neutral from Sell and the target increased to $2.05 from $1.95.

Stronger revenue growth should arise from more stores, higher like-for-like sales growth, while earnings margins should lift due to a lower ratio for cost-of-doing-business (CODB)/sales, explains the analyst.

DRONESHIELD LIMITED ((DRO)) was upgraded to Buy from Hold by Bell Potter. B/H/S: 1/0/0

Bell Potter seizes upon the opportunity afforded by a recent share price fall to reinstate its rating for DroneShield to Buy from Hold.

The broker is confident the company’s earnings will continue to grow in 2024, especially after the recent management presentation illustrating an ever-growing pipeline which currently stands at $388m for FY24, and $510m in total.

DroneShield had its first profitable year in 2023 and the broker notes the increasing risk of drones and the relevance of the company’s AI/machine learning technology to counter the risk.

The 90c target is unchanged.

PLATINUM ASSET MANAGEMENT LIMITED ((PTM)) was upgraded to Hold from Sell by Bell Potter. B/H/S: 0/3/2

Platinum Asset Management’s 1H results on February 29 were a minor beat on Bell Potter’s forecasts aided by slightly better revenue and slightly lower costs. A fully franked 6cps interim dividend was declared.

The broker was impressed by new CEO Jeff peter’s first presentation of results, which included a two-point turnaround plan. It’s noted the strategies will have a cost to implement, and there will be a lag between implementation and delivery.

Based on the results, the analysts increase earnings (EBITDA) forecasts by 7.1% for FY24, 14.7% for FY25 and 10.8% for FY26.

The target rises to $1.13 from 84c and the rating is upgraded to Hold from Sell.

SOUTH32 LIMITED ((S32)) was upgraded to Outperform from Neutral by Macquarie. B/H/S: 6/0/0

Macquarie upgrades its rating for South32 to Outperform from Neutral due to an improved operating performance, potential capital management and after applying a higher multiple for the aluminium operations.

Should the Illawarra metallurgical coal sale proceed, the broker anticipates the company’s concentrated aluminium and base metals exposure will provide upside into next year as prices strengthen.

The analyst forecasts an additional US$1.3bn of discretionary cash will be available in FY25 under the company’s capital allocation framework.

The target rises to $3.40 from $3.10.

SELECT HARVESTS LIMITED ((SHV)) was upgraded to Buy from Neutral by UBS. B/H/S: 3/0/0

UBS upgrades its rating for Select Harvests to Buy from Neutral as the new CEO is delivering ahead of initial targets for cost and cash flows. Additionally, the almond price has improved in recent months with a positive impact on the company’s balance sheet.

Regarding strategic initiatives, management has increased profit benefits to $40m from $15-25m due to lower people costs, along with lower water and power costs, explains the analyst.

UBS reduces its FY25 cost forecast for Select Harvests to $6.38/kg from $6.66/kg.

The broker’s target rises to $5.10 from $4.20 on higher earnings forecasts and a higher assumed multiple.

XERO LIMITED ((XRO)) was upgraded to Outperform from Underperform by Macquarie. B/H/S: 4/1/1

Macquarie increases its target for Xero to $152.60 from $87 and upgrades by two rating notches to Outperform from Underperform.

These changes reflect the broker’s increased confidence in the company’s strategy as expressed by new key management personnel. Better product development and an improved customer value proposition are anticipated.

A demonstration of the generative AI assistant (Just Ask Xero) reflects an advanced data and AI strategy that will potentially improve efficiency, in the analyst’s view.

Management will continue to focus on the US opportunity in the direct channel, notes Macquarie.

ZIP CO LIMITED ((ZIP)) was upgraded to Buy from Neutral by UBS. B/H/S: 2/1/0

UBS upgrades its rating for Zip Co to Buy from Neutral and raises its target materially to $1.43 from 36c. First half results last week revealed stronger-than-expected cash earnings (EBTDA), driven by improving gross profit margins, explains the analyst.

The results also illustrated to the broker the benefits from recent cost-out and strong momentum in the US. It’s noted US BNPL penetration is less than 2% of total payments, compared to 13-15% in Australia, suggesting significant room for growth.

In a surprise for UBS, the company added 100,000 net new active customers in the US (in H1), reversing declining customer trends in the previous two years.

Earnings forecast

Listed below are the companies that have had their forecast current year earnings raised or lowered by the brokers last week. The qualification is that the stock must be covered by at least two brokers. The table shows the previous forecast on an earnings per share basis, the new forecast, and the percentage change.

The above was compiled from reports on FNArena. The FNArena database tabulates the views of seven major Australian and international stockbrokers: Citi, Credit Suisse, Macquarie, Morgan Stanley, Morgans, Ord Minnett and UBS. Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.