Readers of this column know I pay extra attention to Initial Public Offerings (IPOs) a few years after they list, when the hype fades and valuations improve.

The same logic applies to thematic Exchange Traded Funds (ETFs) that invest in hot sectors or themes – and are often launched with great fanfare.

More than 40 thematic ETFs are now quoted on the ASX. Like other markets, ASX has had more interest in ETFs providing cybersecurity, artificial intelligence, cloud computing, clean energy, e-commerce, and other megatrends.

Chosen well, thematic ETFs are a useful portfolio tool. It’s impossible to get exposure to large-cap clean-energy companies in Australia, for example. The action is overseas and thematic ETFs are an easy way to access it.

The main attraction of thematic ETFs is simplicity and cost. Bought and sold like a share on ASX, thematic ETFs can provide exposure to diversified portfolios of the world’s largest cybersecurity or AI stocks in a single trade.

Investors who favour megatrend investing like the convenience of thematic ETFs. Rather than pick stocks, they can bet on emerging and established megatrends, some of which have years and decades of growth ahead.

The main risk is hype. Like other product manufacturers, ETF issuers have a knack of launching products when sectors or themes are in vogue. Inevitably, investors buy into a trend after valuations have rallied, then watch their thematic ETF underperform.

Not all thematic ETFs underperform after launch. However, a 2021 US academic study found that specialised (thematic) ETFs lose, on average, about 30% in risk-adjusted terms over their first five years after launch.

Investors need extra caution buying into themes that are well known and priced into markets – or relying on back-testing from product issuers. The performance of thematic ETFs often appeals, depending on the back-testing timeframe chosen.

Concentration risk is another consideration. Some thematic ETFs have a low number of holdings by ETF standards, principally because there are fewer investable stocks with sufficient liquidity for some themes. Thematic ETFs also have higher annual fees, on average, than broad-based ETFs and currency risk.

The key for investors is deciding whether the thematic ETF provides exposure to a long-term structural trend – or a fad designed to attract quick money.

I believe most thematic ETFs in Australia provide exposure to genuine long-term megatrends. We haven’t had the crazy thematic ETFs over whiskey, religion, or work-for-home companies, as seen in other markets.

Investors can use thematic ETFs as ‘satellite’ exposures to generate portfolio ‘alpha’ – a return greater than the market return. An investor who believes in the long-term potential of cybersecurity could allocate a small part of their portfolio to a thematic ETF that invests in the world’s best cybersecurity stocks.

Video games and esports

This brings me to video and esports – a megatrend that captured much attention a few years ago, but underperformed in 2021 and 2022, judging by the results of a couple of thematic ETFs on ASX.

As often happens, the thematic ETFs in video and esports were launched after many stocks exposed to these themes had rallied. Investors suffered hefty falls before video and esports ETFs started to recover in 2023 and this year.

Video games and esports ETFs reflect another truism in megatrend investing. Too many investors buy too late into the initial stages of the trend, then give up when valuations fall and the megatrend becomes more established.

Video games and esports have terrific long-term prospects. One industry study after another has predicted long-term growth in this technology category. PwC estimates global revenue from video games will be US$312 billion in 2027, from US$227 billion in 2023, as young adults flock to this form of entertainment.

Remarkably, video games and esports now generate more revenue than the global movie business and US sports industry combined, notes Betashares. The ETF issuer says the industry revenue and profitability in video games and esports are forecast to rise in coming years.

On the cost front, the market could underestimate the effect of artificial intelligence (AI) on development costs for video games and esports software. As programmers use AI to write code, and as games become faster to create, the profitability of some games developers should rise over time.

Here are two video and esports thematic ETFs on ASX to consider.

1. VanEck Video Gaming and Esports ETF (ASX: ESPO)

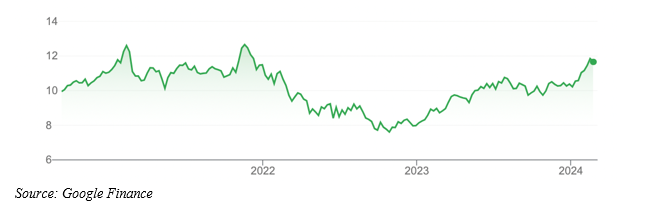

Launched in September 2020, ESPO performed okay for the first few years before tumbling in 2022 as interest rates rose and growth stocks lost favour.

From a peak of around $12.66 in late 2021, ESPO tumbled to below $8 in late 2023. The ETF now trades at $11.43 after solid gains in the past 18 months.

ESPO holds 25 of the world’s largest video and esports-related companies. Nvidia Corp, Advanced Micro Devices and Nintendo are ESPO’s three largest holdings. By country, about two-thirds of ESPO is invested in the US and Japan.

ESPO has returned 27% over one year to end-January 2024. However, over three years, ESPO’s annualised return is about -1.%. The ETF has a lot of ground to make up after disappointing investors since inception, notwithstanding last year’s rally.

With 25 holdings, ESPO is a concentrated bet on long-term growth in video and esports. I like the composition of its portfolio and a trailing Price Earnings (PE) ratio of 27 times is reasonable for higher growth tech stocks.

After the recent rally, investors might watch and watch for price consolidation or a pullback in ESPO. But it’s a useful tool for exposure to the video/esports trend.

Chart 1: VanEck Video Gaming and Esports ETF

2. Betashares Video Games and Esports ETF (ASX: GAME)

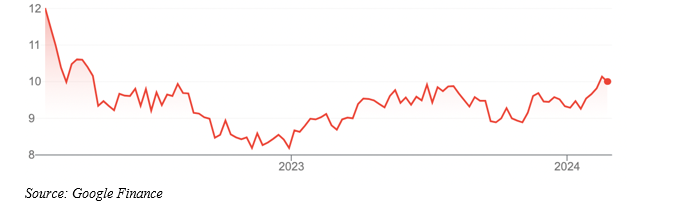

Launched in February 2022, GAME has been another underperforming thematic ETF. It returned 6.23% over one year to end-January 2024.

GAME holds 44 stocks, providing diversified exposure to an under-represented theme on ASX. Unlike ESPO, GAME does not hold Nvidia (in its top 10 holdings). Nvidia is the US tech giant that makes graphics cards for video games and chip systems. Nvidia has soared sixfold since October 2022, making it one of the ‘magnificent seven’ tech stocks.

GAME has an average forward PE ratio of 23 times and a price-to-book ratio of 2.7 times, Betashares data shows. After lagging the rally in tech stocks, GAME could be a thematic ETF to watch for investors who want long-term exposure to one of the more interesting technology megatrends.

GAME’s annual management fee of 0.57% compares to 0.55% for ESPO. In sports parlance, GAME has been lapped by ESPO in the past 12 months, judging by performance. But it has a slightly more attractive valuation at the current price and less concentration risk.

Chart 2: Betashares Video Games and Esports ETF

Tony Featherstone is a former managing editor of BRW, Shares and Personal Investor magazines. The information in this article should not be considered personal advice. It has been prepared without considering your objectives, financial situation or needs. Before acting on information in this article consider its appropriateness and accuracy, regarding your objectives, financial situation, and needs. Do further research of your own and/or seek personal financial advice from a licensed adviser before making any financial or investment decisions based on this article. All prices and analysis at 21 February 2024.