With interest rates set to stop rising and, eventually, falling, it’s our job to identify those businesses struggling over the past couple of years because they were tech/growth companies, with debt and/or were interest rate sensitive businesses.

Also, we have to factor in that because the share prices of these businesses have been smashed since 2022, they’re also potential takeover targets.

This week we saw a classic case in point with BNPL (buy now pay later) company Zip Co., up 32.85% to finish the week at 91 cents. I’ve been talking about its US rival — Affirm — which reported better than expected earlier in the year.

And while there’s nothing firm about Affirm’s interest in Zip, The Australian newspaper effectively referred to some ‘smoke’ that could be coming from a new fire of interest in this price-smashed business. This chart very visually proves the case.

Zip Co.

This fall from grace wasn’t simply rising interest rates as this sector has been invaded by the biggies, such as Apple, PayPal, and others, which saw the lunches of Afterpay and Zip well and truly eaten.

That said, given Zip’s customers in the US and here, it obviously looks cheap to a company such as Affirm. Also, if overseas marauders wait too long, they might find the expected rising Aussie dollar will make a takeover of a local business more expensive.

So, let’s look for seemingly under-priced stocks (according to the analysts). Some of these could also be takeover targets.

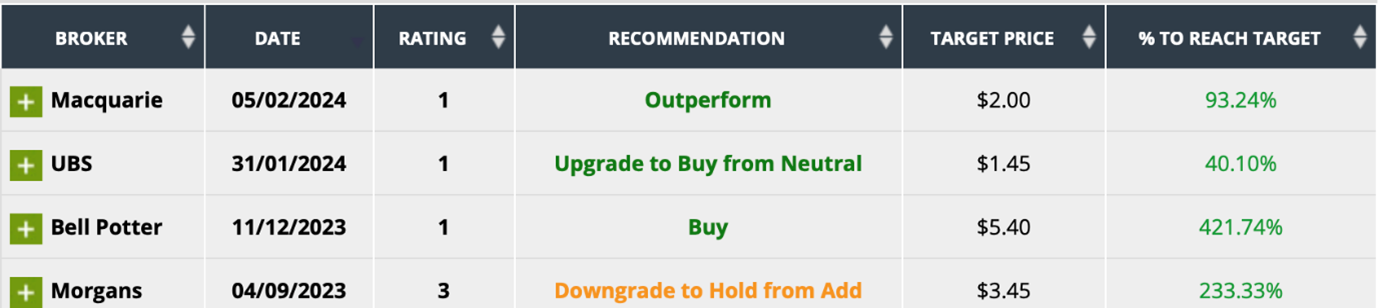

An interesting case in point is Arcadium Lithium (LTM), which is the ‘baby’ born of the merger of Allkem and Livent, which the analysts seem totally in love with, as the table below shows.

Arcadium Lithium

The consensus rise for LTM is 69.6%. As you can see, four out of four experts are on board with the company’s possible future.

One company I’ve always thought was a takeover target is Tyro (TYR). Last year, it had two potential suitors in Potential Capital Management (PCM), which had offered $1.60 for a stock that’s now $1.15. And as PCM dropped out after the Tyro board rejected the low-ball price, along came Westpac, which didn’t make a serious offer, though it saw value in the company that’s the fifth-largest provider of eftpos services in Australia.

Right now, the consensus rise is 46.5%, which would take Tyro’s share price to $1.68, which would still be down on the company’s listing price of $2.75, which popped to $3.30 on day one as a listed vehicle!

TYRO

All this has made it very hard for me to cut my losses on a company that will benefit from lower interest rates in the future.

While on the subject of stocks deeply loved by analysts, one stock that owes me money and I can’t sell is Chalice Mining (CHN). The table below tells the story why in simple numbers. CHN has a predicted consensus rise of, wait for it, 197%

CHALICE MINING

It’s no point me labouring why the analysts like this company, as they clearly do. However, short sellers think they can make money not buying the stocks with about 9% of share sold short! When you go long CHN, you’re betting the analysts will be right and the short sellers will be caught in a squeeze play and CHN’s share price will spike. However, you will have to be patient.

It can be a big mistake following big name directors or investors, but I can’t get out of my head this from The Western Australian in September last year: “Mining billionaire Tim Goyder is making the most of a slump in the share price of Chalice Mining, spending more than $30 million over the past week to grow his stake in the nickel explorer. Mr Goyder, who was chairman of Chalice until October 2021, has increased his stake from 8.8 per cent to 10.43 per cent, according to a fresh disclosure lodged on the ASX.”

When Goyder went longer CHN, it was around $2.79, but today it’s $1.04! Ouch! If you want a leg up, US stock-watching operation TipRanks recently reported the following: “Based on 3 Wall Street analysts offering 12 month price targets for Chalice Mining Limited in the last 3 months — the average price target is AU$2.22 with a high forecast of AU$3.00 and a low forecast of AU$1.45. The average price target represents a 134.95% change from the last price of AU$0.95.”

Tim Goyder and I hope these guys are right about this nickel miner!

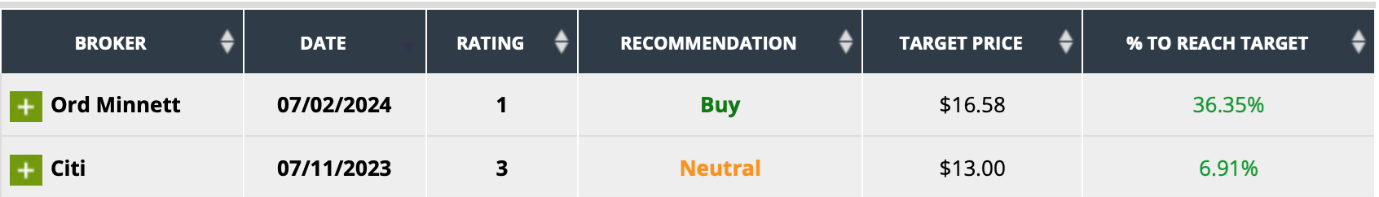

For those looking for a safer kind of investment, with a 3% plus dividend and has a pretty good track record, then EVT (formerly Event Hospitality & Entertainment) is an Australian entertainment and leisure company that analysts quite like. It operates cinemas and theatres in Australia and NZ and its hotel brands include Rydges and Thredbo Alpine resort.

The consensus rise is 21.6% but there are only two analysts surveyed. Ord Minnett’s belief in the company has led to a 36.35% predicted rise, which has spiked the average expected share price going forward. For dividend players, this is a company that should probably be on your radar screen.

On a one-year basis, the company is down 11.82% but since December 5 the stock price has surged 24%, which indicates that the views that led to the company’s share price falling from $16.62 in November 2021 to a low of $10.16 in October of last year (a 39% fall) have started to be reassessed more to the positive. I suspect gains ahead but I’m not predicting big ones unless out treks back to cinemas start to pick up significantly.

The hunt for good value stocks will continue and as I always say: “Watch this space.”

Important information: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. For this reason, any individual should, before acting, consider the appropriateness of the information, having regard to the individual’s objectives, financial situation and needs and, if necessary, seek appropriate professional advice.