Two trends have strengthened this month. First, more central banks are getting on top of inflation. US inflation in October was 3.2% higher than a year earlier and Eurozone inflation that month was 2.9%.

That explains why I argued in this Report earlier this month that we are very close to a turning point’ for US interest rates. Data since then supports that view and confirms rate hikes overseas are working to abate price pressures.

The second trend is Australia’s lagging position in the inflation battle. As inflation falls faster than expected in the US, Eurozone and even Britain, it remains stubbornly high in Australia. That’s partly due to record migration and its effect on housing demand, as well as infrastructure spending and wage growth.

Consumer demand in Australia continues to surprise. Many people built up significant savings buffers during the COVID-19 pandemic as the Australian government overstimulated the economy. As people draw on those savings and drove demand, it’s harder for the Reserve Bank to quell inflation.

So, what does this look like for Australian investors in 2024? For starters, I can’t see the RBA cutting local interest rates anytime soon. If anything, the RBA is likelier to raise rates again in the first quarter of 2024, given persistent price pressures.

As the US and other developed economies cut their interest rates next year – possibly faster than markets expect due to fears of deflation – Australia could look like an outlier with its inflation rate and interest-rate cycle.

Given that backdrop, it’s likely that global equities will outperform Australian equities in 2024, as investors respond to interest-rate cuts in the US, Europe and Britain.

A modestly higher Australian dollar against the Greenback is likely as our rates stay higher for longer and as US rates fall. A weaker US dollar should be good for emerging-market equities that look historically undervalued.

International Monetary Fund (IMF) research has found negative spill overs from an appreciating US dollar fall disproportionately on companies in emerging economies to those in developed economies, which are less vulnerable to a rising Greenback.

A strengthening US dollar hurts emerging economies through their trade and finance channels. Trade volumes in emerging economies decline given most commodities are priced in US dollars. On finance, interest costs for US-dollar-denominated debt rise, credit availability deteriorates and capital inflows slow.

The reverse is also true. A declining Greenback should support emerging-market equities and bonds in 2024. With the US dollar index just off a 20-year high, the outlook for emerging markets should improve next year.

To be clear, I’m not suggesting a big fall in the Greenback or a large rally in emerging equities. Also, for most investors, emerging-market equities should only be a fraction of their overall asset allocation, given the risks.

As history repeatedly shows, emerging-market equities have higher volatility and do not suit risk-averse or short-term investors. It is a long-term idea to add emerging-market exposure to portfolios when the asset class is badly out of favour – at the peak of the US interest-rate cycle.

Caveats aside, the main reason to invest in emerging-market equities is exposure to faster-growing economies. One of the great megatrends – the middle-class boom in emerging economies – is alive and well. Hundreds of millions of people joining the middle-class this decade and beyond is a big tailwind.

Valuation is the other reason to invest in emerging markets. The MSCI Emerging Markets Index this year has traded at one of its largest discounts in history to the MSCI World Index. Whether it is Price Earnings (PE) or Price-to-Book multiples, emerging-market equities have been vastly out of favour.

In some ways, emerging-market equities remind me of small-cap equities in Australia. Both asset classes are horribly out of favour and look cheap on key valuation metrics. But proponents of emerging-market and small-cap equities have been saying that all year – only to watch these assets get cheaper!

For me, it’s not a question of whether emerging-market equities (or small-cap equities) are undervalued: it’s more about timing. Few investors ever pick the absolute turning point, but we are close enough for a modest increase to emerging-market allocations in portfolios, given the outlook for US inflation, interest rates and the Greenback in 2024.

Here are three ways to gain exposure to emerging-market equities and bonds through Exchange Traded Funds (ETFs) on ASX. I’ve outlined an index strategy (IEM), a smart-beta strategy (VanEck) and an active strategy (Fidelity) below.

- iShares MSCI Emerging Markets ETF (ASX: IEM)

IEM is the largest emerging-market ETF on ASX by assets under management ($845 million at end-October 2023).

IEM provides exposure to more than 800 large and mid-sized companies through a single fund. By country, about 29% of IEM is allocated to China, 15% to India and 15% to Taiwan. By sector, financials and tech stocks account for a combined 43% of IEM. The index is skewed towards large companies in more advanced emerging economies (there are only small allocations to Southeast Asia, for example).

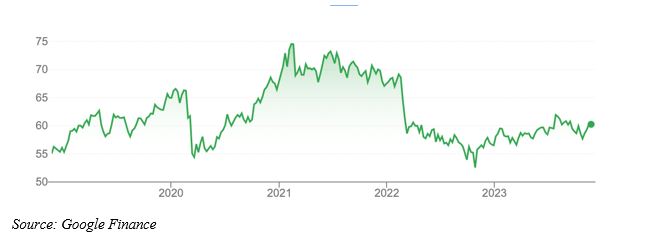

IEM has an annualised return over five years of 2.83% to end-October 2023. Over 10 years, the annualised return is a paltry 4.46%. That’s terrible for long-suffering investors but an opportunity for prospective investors to put money to work in an asset class (via IEM) that has been out of favour.

IEM is unhedged for currency movements and has an annual management fee of 0.68%.

Chart 1: iShares MSCI Emerging Markets ETF (ASX: IEM)

- VanEck MSCI Multifactor Emerging Markets Equity ETF (ASX: EMKT)

Smart-beta ETFs use investment rules to maximise exposure to factors such as growth, value or momentum. Done well, smart-beta ETFs can provide an automated form of active management, without the fees of active funds.

EMKT provides smart-beta exposure to EM equities on four factors: Value, Momentum, Low Size and Quality. The ETF holds 244 securities, almost half of which are in China and Taiwan.

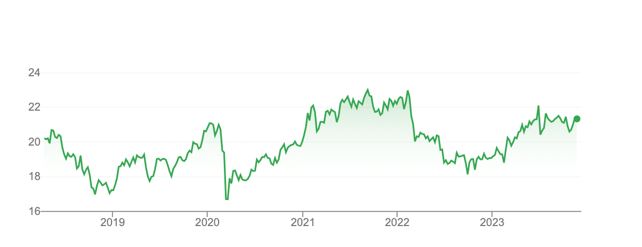

EMKT has had better relative performance than EM index ETFs over one year to end-October 2023, Its total return over one year is almost 17%. Over five years, EMKT’s annualised return is a bit below 8%.

At end-October 2023, EMKT traded on a PE of 7.6 times and a price-to-book ratio of 1.12 times. That shows how low valuations have become in emerging-market equities.

Chart 2: VanEck MSCI Multifactor Emerging Markets Equity ETF

- Fidelity Global Emerging Markets Fund (ASX: FEMX)

FEMX suits investors who want full active management in emerging-market equities to identify opportunities and protect capital during market downturns.

Active managers could argue, with some justification, that volatile asset classes, such as emerging markets, require having fund managers that specialise in the region and decide what and when to buy and sell. Fidelity has a good reputation in emerging-market equities.

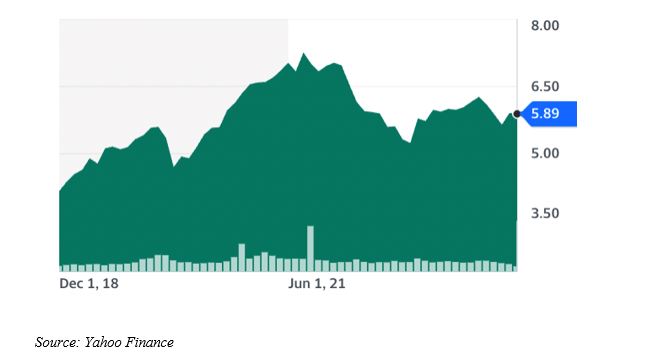

FEMX has a concentrated portfolio of 30-50 stocks. An annual fee of 0.99% is higher than index funds and reflects FEMX’s active management.

FEMX returned 8.08% over one year to end-October 2023, underperforming its benchmark index (11.9%). FEMX has done better over five years, comfortably outperforming its benchmark.

Chart 3: Fidelity Global Emerging Markets Fund

Tony Featherstone is a former managing editor of BRW, Shares and Personal Investor magazines. The information in this article should not be considered personal advice. It has been prepared without considering your objectives, financial situation or needs. Before acting on information in this article consider its appropriateness and accuracy, regarding your objectives, financial situation and needs. Do further research of your own and/or seek personal financial advice from a licensed adviser before making any financial or investment decisions based on this article. All prices and analysis at 23 November 2023.