I have spoken previously about there being a lot of negativity around Chinese economic growth and iron ore prices,” Michael said.

“In early June, we sensed that this bearishness was overdone, and the market was in a similar position to November 2022, which saw a massive rebound in iron ore stocks.

“Recently we’ve seen the major analysts start to increase their price targets on FMG. “Although many rate FMG as a sell, for now, they’re likely to soon realise that they need to start buying because they’re surprised by the strength in iron ore.

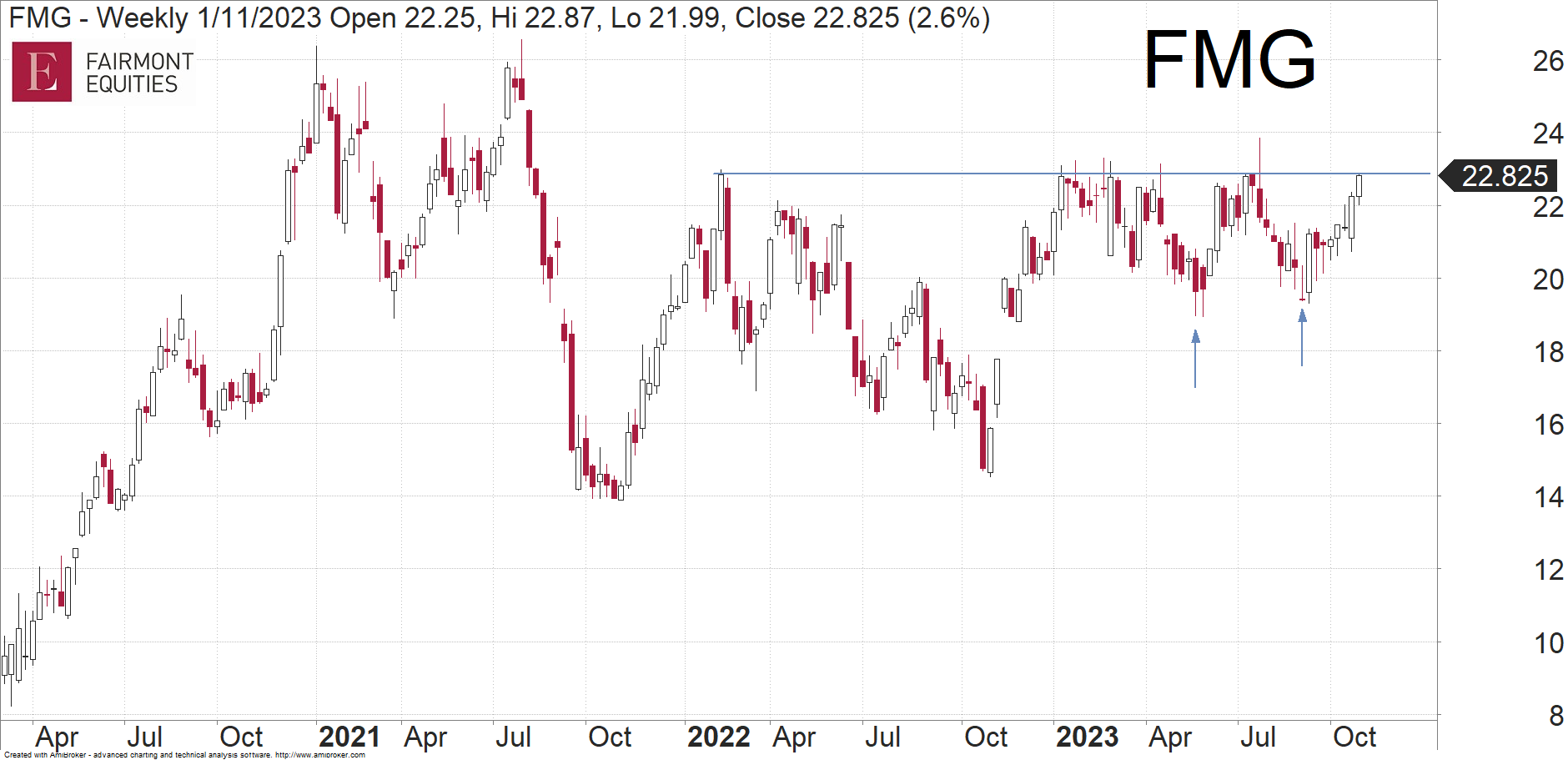

“Our analysis of FMG over the course of the year highlighted the very clear resistance level near $23.

“With FMG now putting in a double bottom (arrows) and pushing higher against a weaker market, the chart is looking more and more positive here and it is set to once again test that $23 area.

“A weekly close above $23 is the next buy signal as that breakout should lead to a rally to new highs. Traders, however, may wish to take profits up near $23 and then wait for a clear break before buying back in.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.