Headquartered in Fort Lauderdale, Florida and with global operations that include New York, Seattle, London and Sydney, GQG is aninvestment management firm focused on global and emerging markets equities.

“GQG’s funds under management (FUM) is down ~0.7% for the month to US$107.4 billion, with strong net inflows (+US$1.3 billion) offsetting a weak market performance month,” Raymond said.

“FUM movements at the strategy level ranged from down 2.4% to up 3.5%.

“Net flows were positive for the month (US$1.3 billion is strong), which looks largely driven by consistent retail flows (and likely stable institutional flows for the month).

“Year-to-date net inflows are US$7.3 billion.

“Overall, another solid FUM outcome for Aug-23 with GQG managing to offset weaker markets with flows.

“We continue to expect some volatility in monthly Institutional flows (potential for some monthly net outflow outcomes), which are more macro/asset allocation driven vs investment performance led.

“There has been mo update on the potential bid for Pacific Current (PAC), with PAC stating they will assess potential offers in September.

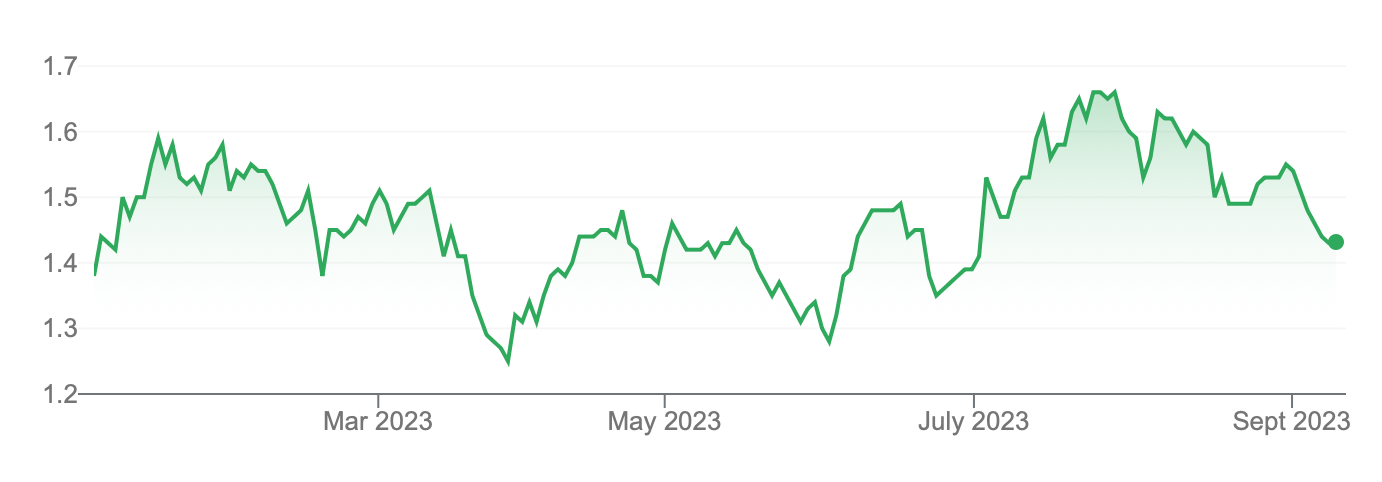

“GQG is trading back at ~10-10.5x financial year 2024 PE; >9% yield.

“We maintain an Add,” Raymond said.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.