“Coles Group COL’s third quarter 2023 sales trading update overall was above our expectations,” Raymond said.

“Management said supermarkets sales growth has continued into the fourth quarter 2023, with volumes remaining modestly positive, while supplier input cost inflation is expected to continue to be moderate.

“We have adjusted financial years 2023/24/25 underlying EBIT by +1%/+1%/+1%.

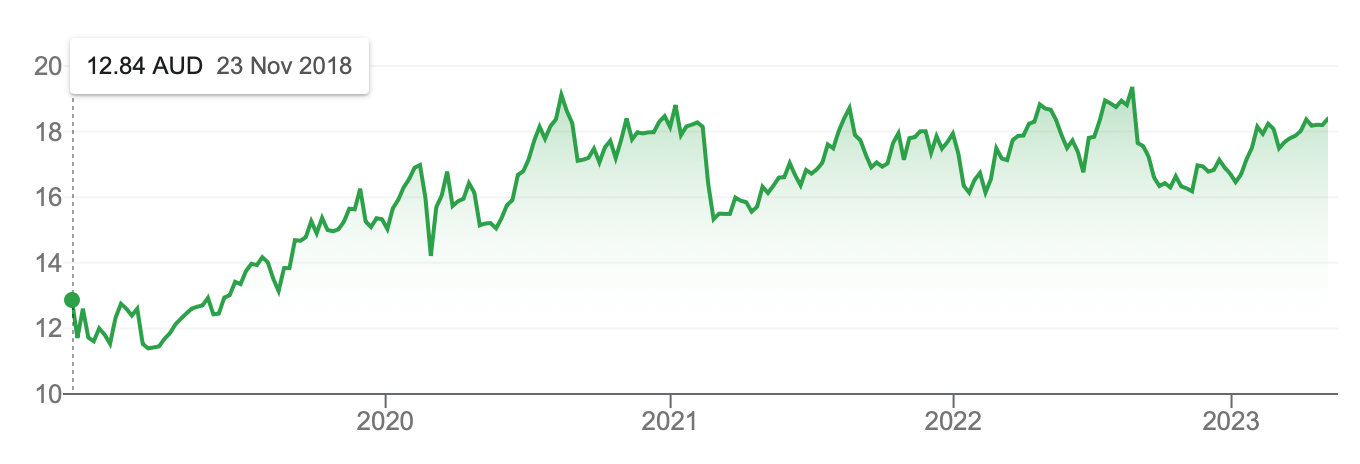

“Our target price rises to $19.85 (from $19.60) and we maintain our ADD rating,” Raymond added.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.