This week has been a week of unusual developments – a case in point is the unravelling of Labor’s plans for our superannuation! That’s a watch this space! Meanwhile, Paul Rickard has been hopefully telling Mike Cannon-Brookes and the rest of the Tyro board not to screw small shareholders by selling out to discount shoppers, such as Potentia Capital, who want to pay $1.60 for a stock that will be $2 when the tech re-loving phase later this year happens, as interest rate rises conclude. Why would Potentia Capital want to pay $1.60? Maybe it’s because they know this business is worth a whole lot more! Go Paul! (Of course, we never talk about Tyro because he’s on the board.)

This Saturday Switzer Report will be different! You’ll get what excites or worries me right now.

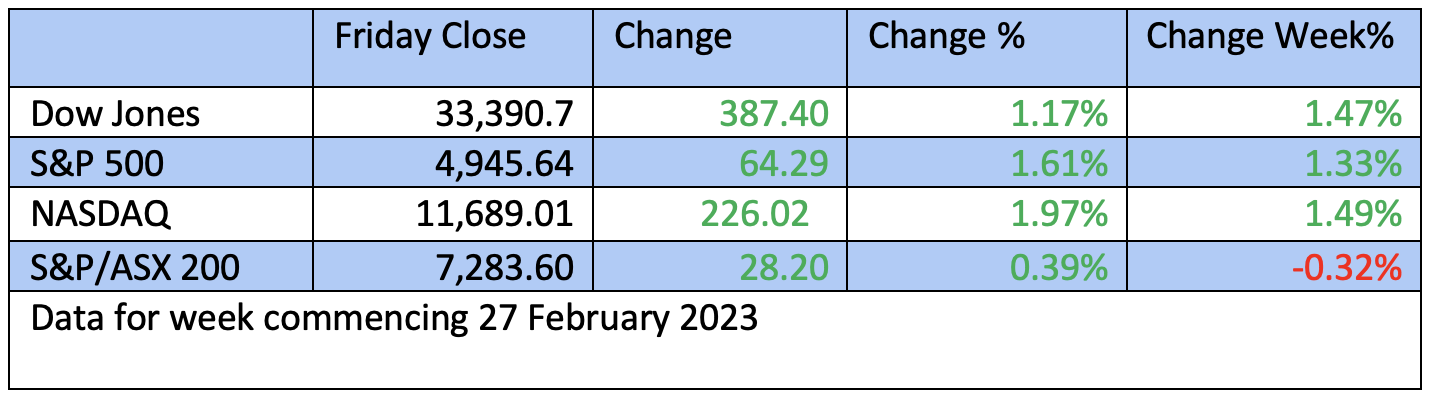

The battle between market optimists and pessimists continued this week, with the former looking like they got the upper hand, with Wall Street finishing up for the week. And it coincided with the important development of a falling yield on the important 10-year Treasury Note, which went under the 4% level.

The bulls are expecting economic data will soon vindicate their positivity, while the bears are saying “forget it!” Right now, these stock markets aren’t selling off, despite worrying inflation signs in the US, because there are optimists buying when pessimists are selling, which has contained the markets’ dips in February, after a great January.

“The stock market is very sensitive to bond yields at this point and looking for some respite to the recent upward moves in yields,” said Yung-Yu Ma, BMO Wealth Management chief investment strategist. “There’s a nervous anticipation to upcoming data releases for jobs and inflation after the difficult readings last month. The market is unlikely to have sustained traction until data points resume a cooling trend.”

Helping the bulls was Atlanta Fed President Raphael Bostic, who suggested that the US could be better off with 25 basis points rises, rather than big half-a-percent hikes. This puts enormous pressure on Friday’s jobs report. If it’s another hot big number for employment, bond yields will spike and stocks will slide.

One of the world’s great market optimists (who even makes me look pessimistic!) is Tom Lee, MD at Fundstrat Global Advisors in the Big Apple. Tom thinks markets will pick up in March and April. Why? “The softness in equities since mid-February has not yet reversed, but we believe the window is soon emerging where this softness will give way to an 8-week period where equities will rally strongly,” Lee said in a note to clients Thursday. His economic crystal ball is telling him that hot inflation and the too warm labour market will both be in for a cooling and Wall Street and the Nasdaq on Times Square will love that.

It makes this week’s data drop really pivotal to where stocks head.

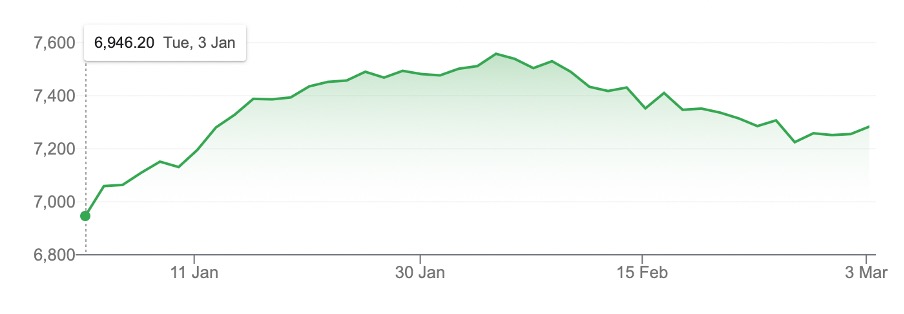

To the local story and the S&P/ASX 200 rose 28.2 points on Friday but for the week the Index was off 23.4 (or 0.32%) to finish at 7283.60. And China’s stronger-than-expected rebound has helped. That said, it’s been a tough month, with the market indicator down 255 points (or 3.39%). However, year-to-date the story remains promising.

S&P/ASX 200

On a six months basis, we’re up 6.3%. Despite a mainly problematic 2022, which saw the worst year for bonds since 1926 and the US S&P 500 was down close to 20% for the calendar year, it has paid to stay long stocks overall.

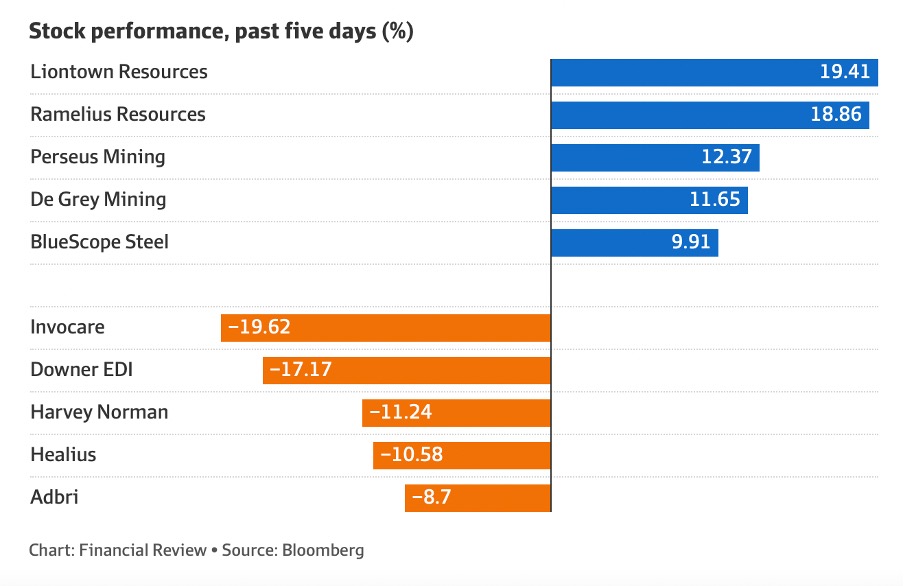

The China story helped the big miners, with BHP up 7.66% to $48.32 for the week, Rio gained 7.92% to $126.40 and Fortescue was up a whopping 10.38% to $22.76.

And at long last, the market started to agree with analysts that Santos looked cheap, with the share price up 4.36% for the week to $7.20, but it still lives in the shadow of Woodside, which rose 7.97% to $37.79 for the week.

EDI Downer’s fall was linked to mistakes in the group’s accounts, which saw the Chairman resign! And how damning is this from Morningstar’s head of equities, Peter Warnes, who told the AFR that Downer had potential but its management needed “a clean-out from top to bottom.” Cecily Lefort reports suggestions that “it could also become the target of a takeover.”

Qantas flew higher this week with the share price up 6.03% to $6.51, with the AFRreporting that “Qantas plans to hire as many as 8500, including pilots, cabin crew and engineers in the next 18 months as part of a recruitment and training initiative to replace thousands of roles slashed in the pandemic”.

Does that mean we will have to wait another year and a half before ticket prices become buyable without mortgaging the house?

Banks were up Friday but down for the week. CBA slid 3.31% to $97.75, NAB lost 2.48% to $29.15, Westpac dropped 4.36% to $21.73 and ANZ was 3.48% lower to finish at $23.85. The run of slower economic data for the Oz economy would have many thinking that if this means fewer rate rises, then banks won’t do as well.

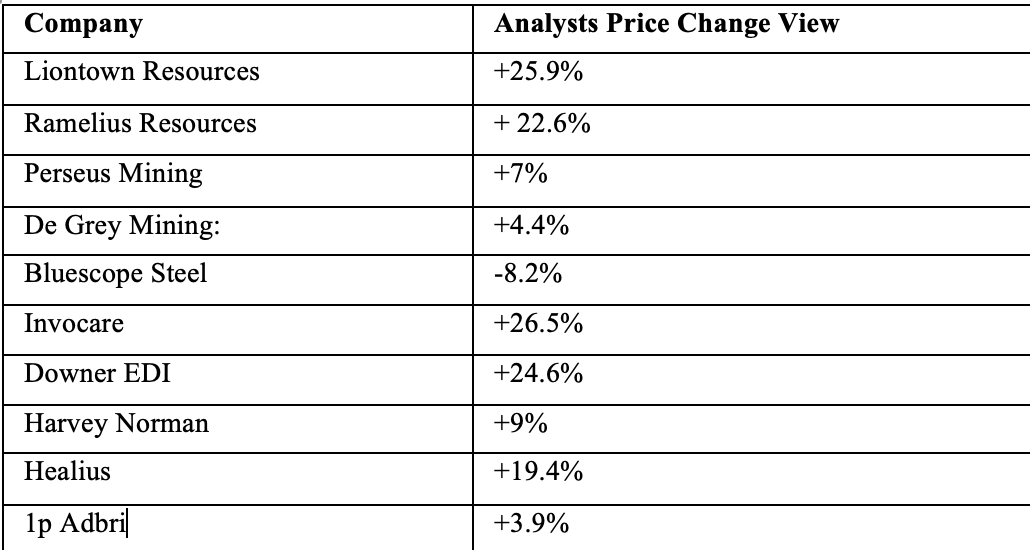

Winners and Losers this week but what do analysts say?

Let’s see what the analysts at FNArena think of these companies:

What I liked

- The monthly inflation reading was less than expected, with annual inflation falling one percentage point from the annual pace of 8.4% in December to 7.4% in January.

- New lending for housing fell by a larger‑than‑expected 5.3% in January — that’s 12 months in a row and shows the RBA’s rate rises are working and maybe we’re close to the top.

- Building approvals fell by 27.6% in January, which isn’t really good for the industry but it’s another sign that the RBA should think about ending its rate rise program.

- Real GDP rose by 0.5% in Q4 2022 to be up 2.7% on year ago levels. This was smaller than expected and is another reason for the RBA to think twice about too many more rate rises.

- Retail trade rose by 1.9% in January 2023, only partly reversing a 4% decline the previous month. I want retail to slowdown but not look like it’s a precursor to a recession, so this rise in retail sales is welcomed.

What I didn’t like

- This from CBA’s economics team: “Two further 25bp rate hikes, which we anticipate based on the RBA’s recent communication, makes the ‘soft landing’ increasingly hard without monetary policy easing later this year”.

- Business investment and dwelling construction contracted over the quarter, while inventories were also a drag on activity. This might be good for convincing the RBA to ease up on rate rises but this is not good for growth in 2023 and 2024.

Bottom line?

This year will be good for both stocks and bonds and all we have to wait for are signs that this excessive interest rate rise cycle here and overseas is close to an end.

One last observation

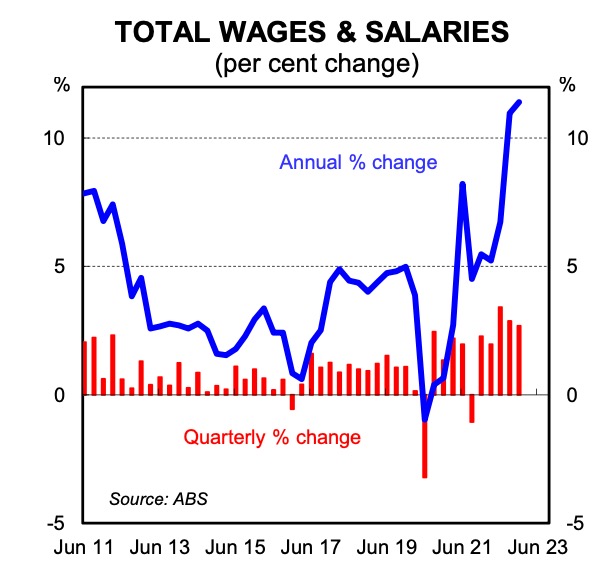

Company profits rebounded over the December quarter, rising by 10.6%, which adds to the case that inflation has been kicked along by profiteering rather than excessive wage demands. That said, wages and salaries rose by 2.6% in the December quarter and are up by 11.6% over the past year. It looks like a lot of Aussies have helped inflation’s surge in 2022. I suspect the run of recent data will have the RBA’s Dr Phil pondering whether he should keep up with his interest rate torture.

The Don’t Miss Videos/stories of the week

What Jun Bei Liu wants to buy:

Albo and Dr Jim’s Super Madness:

Why we are closer to the end of silly, excessive interest rate rises:

https://switzer.com.au/the-experts/peter-switzer/aussies-are-feeling-the-pinch/

- Chinese rescuers are on the way for the economy

- Boom Doom & Zoom fans go to:

https://switzerreport.com.au/video/boom-doom-zoom-2nd-march-2023

- Even Ross Gittins is warning Dr Phil!

This is the guts of Ross’s column:

As the Commonwealth Bank’s Gareth Aird has said, since the Reserve Bank board’s meeting early last month, when it suddenly signalled more rate rises to come, all the numbers we’ve seen – on economic growth, wages, employment, unemployment and the consumer price index – have all come in weaker than the money market was expecting.

What’s more, he says, only part of the Reserve’s 3.25 percentage-point rate increase so far had hit the cash flow of households with mortgages by the end of last year.

“There is a key risk now that the Reserve Bank will continue to tighten policy into an economy that is already showing sufficient signs of softening,” Aird said.

Bottom line? The RBA could be close to the top of its interest rate rising cycle and if you add a stronger, growing China, all we need is the US to show signs that the economy is slowing sufficiently to justify no more rate rises.

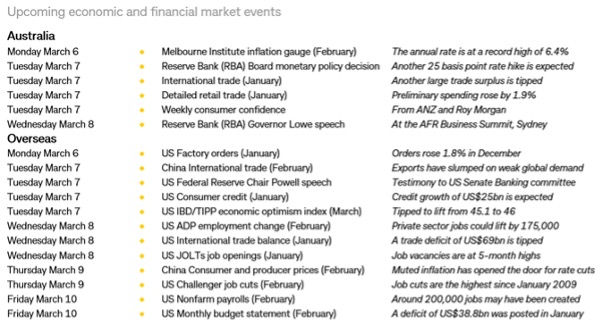

The big data drops next week

Tuesday’s rates decision from the RBA and the US Jobs Report on Friday are the biggies for the market.

Chart of the Week

That’s a big rise in wages!