Telstra’s (TLS) first half result was in line with expectation, Raymond said “and financial year 2023 guidance reaffirmed this.

“Telstra’s dividend is 8.5 cents.

“There are four key reasons why we like TLS now:

- Mobileis 60% of EBITDA. Telstra continues to add new subscribers. The industry looks rational and sustainable, as evidenced by a lift in mobile prices across the sector

- Cost control.This is the new CEO’s first result and the management remains committed to $500 million in cost-out over the next two years.

- Infrastructure Co (InfraCo) is 21% of EBITDA. Management provided increased disclosure on InfraCo to help better realise value. Management said they’re looking for every single option. Our analyst thinks there will be something happening soon.

- Return on investment capital (ROIC). Telstra finally generated an ROIC over the cost of capital (WACC) i.e., Telstra is back in the game of creating financial value.” Raymond said.

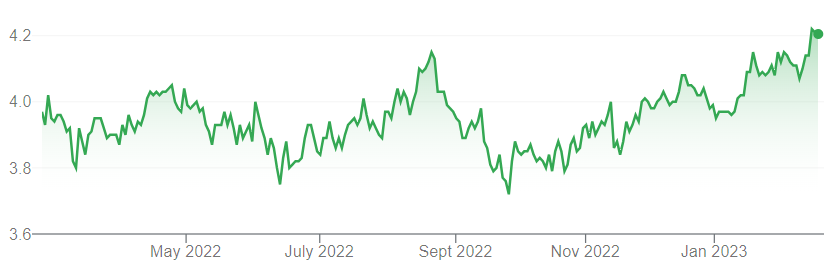

Telstra (TLS)

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.