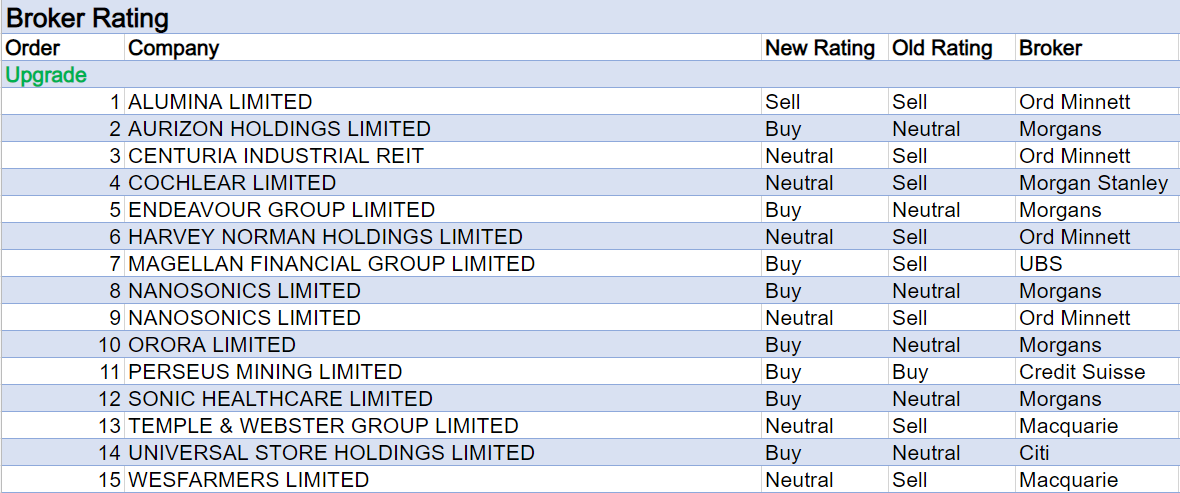

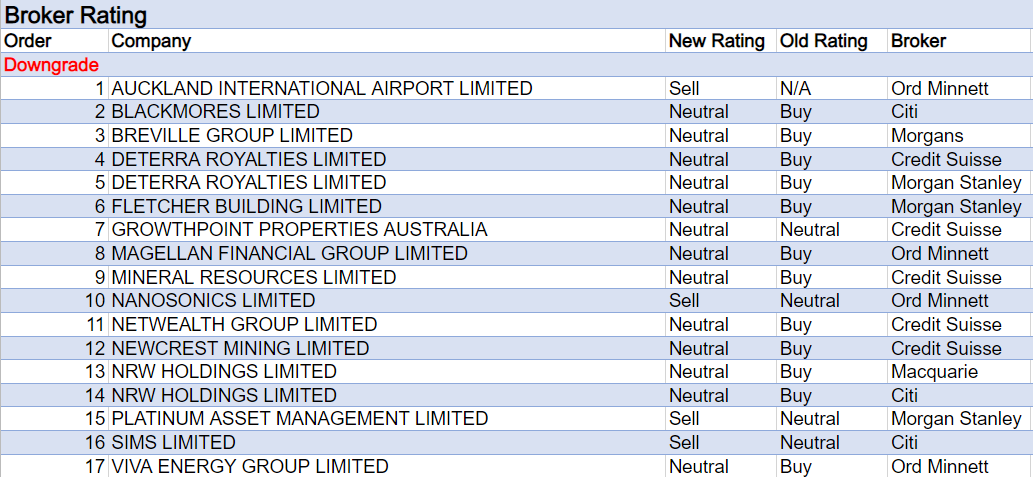

For the week ending Friday February 17 there were fifteen upgrades and seventeen downgrades for ASX-listed companies covered by brokers in the FNArena database.

Most of the valuation and ratings changes stemmed from an increased pace of announced results during the February reporting season.

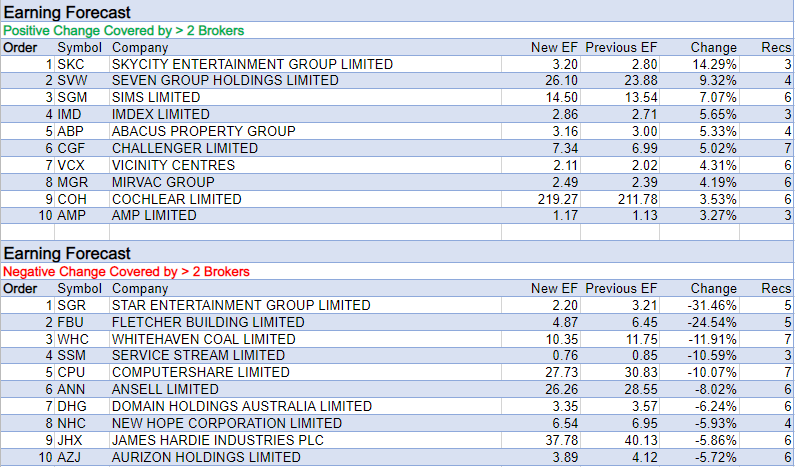

The largest percentage adjustments in target prices occurred in the Gaming sector, with a 14% increase for SkyCity Entertainment and -31% fall for Star Entertainment.

In the wake of first half results and upgraded FY23 guidance, Outperform-rated Credit Suisse raised its target for SkyCity to $2.90 from $2.80. However, the largest impact on the average target price in the FNArena database came via first time inclusion of research by Ord Minnett (target $3.50).

This broker, which now sources its research from Morningstar instead of JP Morgan, observed the casino operator is back operating at pre-covid levels.

Macquarie also pointed out SkyCity is more protected than listed peers from regulatory reform and tax changes, with more than 85% of earnings coming from New Zealand.

For Star Entertainment, Macquarie lowered its target to $1.55 from $3.05 last week after the company provided a disappointing earnings update and downgraded earnings guidance for FY23, which fell -24% short of the consensus expectation.

Regulation, competition and potentially higher casino taxes in FY24 remain wildcards, all of which would be exacerbated by a tight balance sheet, cautioned the broker. It’s thought an equity raising may be required.

Buy-rated UBS also slashed its target to $1.95 from $3.75 for Star after a new analyst reviewed forecasts across the sector. The good news for current investors, according to the analyst, is that potential upside is relatively strong, with the group now undervalued following regulatory and compliance issues.

The average target price in the FNArena database for Fletcher Building also fell heavily last week to $4.87 from $6.45.

Morgan Stanley downgraded its rating to Equal-weight from Overweight as Residential and Development earnings came in at less than half of the analysts prior forecast, when management pre-released first half results at the beginning of the week.

FY23 guidance was also reduced to NZ$800-855m from over NZ$855m due to wet weather in New Zealand over January and February.

After actual first half results later in the week, Credit Suisse significantly lowered its earnings forecasts and reduced its target to $4.10 from $4.80, though pointed to valuation support from an attractive FY24 dividend yield.

Whitehaven Coal was third on the table for percentage fall in broker targets last week and New Hope Corp also appeared in the top ten, after the release of first half and second quarter results, respectively.

The week began with a prescient call from Morgans for Coal sector companies in the February reporting season. While solid dividends were expected, the broker thought they would be lower than what the market was anticipating in light of large cash balances.

On cue, Whitehaven declared a 32cps dividend later in the week when market consensus was for 44cps, despite delivering results generally in line with broker forecasts. Credit Suisse felt the lower dividend was prudent, given a near-term pricing headwind with a mild northern winter and depressed industrial activity weighing on demand.

Citi noted uncertainty from a sharply declining thermal coal price and the domestic thermal coal reservation policy implemented by the NSW government. Six of the seven brokers in the FNArena database retained Buy (or equivalent) ratings.

Despite a -20% miss against consensus forecasts for production and sales in the second quarter, four covering brokers retained Buy (or equivalent) ratings for New Hope. Credit Suisse attributed the weaker quarter to dragline maintenance and mine sequencing to prioritise waste movement, but these issues are expected to materially improve second half performance.

The average target price in the database for Service Stream also fell last week after management identified a further $20m provision was required to complete a challenging utility project in Queensland, having previously announced a $5m contract provision in the last financial year.

Service Stream, Star Entertainment and New Hope also appeared in the top four positions in the earnings downgrade table below.

29Metals came fifth on that table after providing a negative production and cost update for the December quarter. Morgan Stanley still sees downside risks to the Golden Grove mine plan and expected grades, and is more dubious than consensus on the prospect for improving costs. The broker’s target was cut to $1.55 from $2.00.

SkyCity Entertainment sat atop the list for the largest percentage increase in forecast earnings by brokers in the FNArena database last week.

Total Buy recommendations comprise 52.02% of the total, versus 37.51% on Neutral/Hold, while Sell ratings account for the remaining 10.47%.

In the good books

COCHLEAR LIMITED (COH) was upgraded to Equal-weight from Underweight by Morgan Stanley, B/H/S: 1/3/1

Cochlear’s December-half result outpaced Morgan Stanley by 7%, thanks to a 9.5% beat in revenue. Margins proved a miss as higher operational expenses outpaced a lower tax and interest bill. Management announced an on-market share buyback over several years, starting with $75m for the first year. Of particular note was a sharp beat in the company’s CI revenue, leading the broker to suspect the company may be stemming market share losses and be back on the market-share growth path. Rating upgraded to Equal Weight from Underweight, the broker expecting the CI unit growth, and the N8 launch will drive stronger June-half earnings. Target price rises to $214, which compares with the last entry in the FNArena data base on February 7 of $190. Industry view: In-line.

ORORA LIMITED (ORA) was upgraded to Add from Hold by Morgans, B/H/S: 3/4/0

Pricing discipline and ongoing business optimisation were behind an improving North American margin and return on funds employed (ROFE) metric in the 1H, according to Morgans. Orora’s result beat prior forecasts made by the analyst and consensus, with North American earnings (EBIT) rising by 20% (5% expected by Morgans), while Australasia’s earnings fell by -3%. Management retained FY23 guidance. The broker raises its target to $3.75 from $3.70 and upgrades its rating to Add from Hold.

SONIC HEALTHCARE LIMITED (SHL) was upgraded to Add from Hold by Morgans, B/H/S: 3/2/1

After being weighed down by the pandemic, Morgans feels Sonic Healthcare has now turned the corner with solid base business growth and effective cost-outs revealed in 1H results. The company’s rating is upgraded to Add from Hold. The analyst also notes some ongoing benefits from covid testing, as well as ample liquidity for capital management/M&A. Underlying results for the 1H were broadly in line as slowing covid testing weighed upon sales and cash flow, explains the broker, while margins for the base business are back to pre-covid levels and Imaging is also on the improve. The target rises to $37.04 from $34.77.

UNIVERSAL STORE HOLDINGS LIMITED (UNI) was upgraded to Buy from Neutral by Citi, B/H/S: 3/1/0

Citi finds current consensus expectations for Universal Store to be bearish, highlighting trading momentum for the key Black Friday and Christmas trading periods was strong. The broker adds the company will be cycling undemanding comparables moving forward and there is potential for consumer spend to hold up better than expected over the second half. The broker also expects growth initiatives including store rollout and the acquisition of Thrills to drive short to medium term earnings growth. The rating is upgraded to Buy from Neutral and the target price increases to $6.00 from $5.29.

WESFARMERS LIMITED (WES) was upgraded to Neutral from Underperform by Macquarie, B/H/S: 2/2/1

Macquarie does not qualify Wesfarmers’ result, other than to note Bunnings surprised with resilient consumer demand and a continued pipeline of work for commercial customers, and Kmart did well as sales normalised. The broker is more focused on the conglomerate’s lithium assets, and now incorporates them into its valuation. Initial production at Mount Holland has been pushed back six months and costs for the project expected to increase 10-20%. But this is considered immaterial compared to the cashflow that the asset is expected to generate at current prices. The cash generation of the lithium assets at current prices significantly change the cashflow of the group, Macquarie notes. Wesfarmers becomes one of the few defensive consumer stocks with significant earnings and dividend upside over the next few years. Upgrade to Neutral from Underperform. Target rises to $56.70 from $46.20.

In the not-so-good books

AUCKLAND INTERNATIONAL AIRPORT LIMITED (AIA) was downgraded to Lighten from Hold by Ord Minnett, B/H/S: 3/0/2

Ord Minnett now whitelabels Morningstar instead of JPMorgan and Auckland International Airport is included in the coverage, with a recent downgrade to Lighten as the share price has moved through the valuation trigger point. Target is $7. Auckland International Airport has substantial development opportunity which could bring its capacity up to nearly 26m passenger movements per year by 2026, the broker highlights.

GROWTHPOINT PROPERTIES AUSTRALIA (GOZ) was downgraded to Neutral from Outperform by Credit Suisse, B/H/S: 1/2/0

Growthpoint Properties Australia’s 12.5% year on year growth in funds from operations beat Credit Suisse. Finance costs were higher, consistent with an increase in the REIT’s cost of debt and higher average debt balances. Portfolio occupancy is lower at 94% with a WALE of 6.3 years due to well flagged tenant departures in the Office portfolio, the broker notes. Leasing success at Skyring should help improve occupancy in the near term, with Murray Rose remaining a swing factor over the shorter term. Growthpoint continues to trade on a discount to net tangible asset valuation while offering a 6.2% yield, but has recently run harder than peers, the broker notes. Downgrade to Neutral from Outperform, target rises to $3.60 from $3.56.

MAGELLAN FINANCIAL GROUP LIMITED (MFG) was downgraded to Hold from Accumulate by Ord Minnett, B/H/S: 1/4/1

Ord Minnett believes the downside risks for Magellan Financial are more than priced into the stock. The -60% drop in interim underlying net profit was largely expected and net losses from Barrenjoey and FinClear appear more cyclical than structural. The broker also notes good progress has been made on several fronts that should comfort investors. That said, Ord Minnett assesses it will be difficult to restore the company’s competitive strengths and downgrades to Hold from Accumulate. Target is $11.50. See also MFG upgrade.

NANOSONICS LIMITED (NAN) was downgraded to Lighten from Hold by Ord Minnett, B/H/S: 1/0/1

After a recent share price rally for Nanosonics, the valuation trigger at Ord Minnett has been reached and the broker’s rating falls to Lighten from Hold. No changes are made to the analyst’s forecasts and the $4.00 target is unchanged. See also NAN upgrade.

NEWCREST MINING LIMITED (NCM) was downgraded to Neutral from Outperform by Credit Suisse, B/H/S: 3/4/0

Credit Suisse suggests Newcrest Mining posted a “soft” beat on fair value adjustments. A record dividend of US15c ordinary and US20c special surprised against the broker’s US8c forecast. Credit Suisse feels a buyback would provide better value creation for shareholders. Newcrest has for sometime been significantly undervalued versus peers and the broker doesn’t believe shareholders own the stock for a 3% yield. Given few near-term catalysts for re-rating, Credit Suisse is surprised the board rejected Newmont’s offer. Downgrade to Neutral from Outperform. Target falls to $24.00 from $24.50.

NRW HOLDINGS LIMITED (NWH) was downgraded to Neutral from Outperform by Macquarie and to Neutral from Buy by Citi, B/H/S: 1/2/0

Macquarie assesses NRW Holdings met expectations for 1H23 earnings, although the report reflected mixed results; revenue was better than expected and EBIT lower than anticipated. The dividend came in 42% better than the broker’s forecast at 8c per share. Management guidance was unchanged and suggested an improvement in margins is expected in the 2H23. Macquarie adjusts EPS forecasts by -1% for FY23 and FY24 earnings estimates are unchanged. Target unchanged at $2.50 and the rating is downgraded to Neutral from Overweight, due to potential macro headwinds from higher inflation, wage growth and margin impacts.

Following 1H results, Citi downgrades its rating for NRW Holdings to Neutral from Buy, in the expectation of near-term headwinds from competitors preferencing revenue over returns. The result was also weaker than the analyst expected largely due to the Civil division where competitors have been aggressively bidding on contracts. In the markets that the company can actively pursue, the broker notes ongoing clear visibility for near-term revenue and no shortage of work. Management reaffirmed FY23 revenue guidance. The target falls to $2.80 from $2.90.

NETWEALTH GROUP LIMITED (NWL) was downgraded to Neutral from Outperform by Credit Suisse, B/H/S: 3/3/0

After a 1H result beat versus Credit Suisse and consensus forecasts of 7% and 1%, respectively, the broker downgrades its rating for Netwealth Group to Neutral from Outperform. After the share price has rallied around 15% so far this year, the analyst feels strong growth is already incorporated into the current share price, while there are downside risks for costs and near-term flows are unlikely to exceed expectations. The 1H beats were largely due to a higher figure for funds under administration (FUA), which is transitory and won’t benefit future periods, points out the broker. The target remains at $13.70.

VIVA ENERGY GROUP LIMITED (VEA) was downgraded to Hold from Accumulate by Ord Minnett, B/H/S: 3/3/0

While remaining positive on the company, Ord Minnett downgrades Viva Energy’s rating to Hold from Accumulate on grounds of valuation given recent share price strength.

Earnings forecast

Listed below are the companies that have had their forecast current year earnings raised or lowered by the brokers last week. The qualification is that the stock must be covered by at least two brokers. The table shows the previous forecast on an earnings per share basis, the new forecast, and the percentage change.

The above was compiled from reports on FNArena. The FNArena database tabulates the views of seven major Australian and international stockbrokers: Citi, Credit Suisse, Macquarie, Morgan Stanley, Morgans, Ord Minnett and UBS. Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.