As I mentioned last week in my column, the New Zealand cohort of stocks on the Australian Securities Exchange (ASX) is large, boasting 59 members, ranging across the Kiwi economy from large renewable energy generators and agribusinesses to retailers and service companies. There is absolutely no shortage of world-class innovation coming out of our near neighbour: here are three Kiwi stocks that I think are global standouts in their fields — and each of these, for various reasons, looks to be alluringly cheap right now.

1. Volpara Health Technologies (VHT, 83 cents)

Market capitalisation: $209 million

12-month total performance: –6.7%

Three-year total performance: –22.5% a year

Analysts’ consensus target price: $1.109 (Stock Doctor/Thomson Reuters, three analysts); $1.21 (FN Arena, one analyst)

Listed in April 2016, the Wellington-based Volpara has a suite of breast imaging analytics software that is changing the game in breast X-rays. Volpara’s software measures breast density, which is both a key indicator in early breast cancer detection, and a flaw in the current standard procedure of a mammogram X-ray, because breast density can hide cancer in a mammogram. Studies suggest that mammograms detect only 65% of cancers in women with dense breasts: Volpara’s software analyses breast density and also the probability of missing potential tumours, helping to determine whether further scans are required.

The platform uses artificial intelligence (AI) to analyse the mammogram images, and allows radiologists to quantify breast tissue with precision and helps technologists produce mammograms with optimal image quality, positioning, compression, and dose. This enables personalised, high-quality screening that can give a better chance of early detection of breast cancer.

In 2019, the US Food & Drug Administration (FDA) gave the Volpara technology a huge boost, with its decision to introduce mandatory reporting of breast density in mammograms in the USA. The FDA requires all US screening facilities to provide information on breast density to women and their healthcare providers after a mammogram, on the basis that breast density data can help doctors and patients make more informed decisions about breast cancer risk.

Early this year, Volpara expects the FDA to roll-out its new breast density notification rule, which would require providers to notify women if they have dense breasts, what this means for their risk of breast cancer, the importance of speaking with a health care provider about breast density, and the need for additional screenings to find breast cancer. 40% of women over 40 have dense breasts, and their risk of breast cancer is much higher. Not only does the FDA ruling validate the importance of breast density, Volpara says it “sets the example for the rest of the world.”

Breast cancer is now the most commonly diagnosed cancer in the world with about 2.3 million people affected globally each year. It is also the fifth-leading cause of death in women, with an estimated 685,000 women dying from it in 2020. In Australia and New Zealand, it is the cancer that’s most commonly diagnosed in women, and the second-most in the US, behind heart disease.

More than 2,000 facilities use Volpara’s software, including top US cancer screening centres. The company says that more than 6.5 million women across 40 countries have had their breast density assessed by Volpara’s platform.

Volpara recently achieved the “40% mark” in the US, meaning that 40% of all the mammograms done in the US are touched by at least one of its products. The company has a lot of potential there as many of our customers do not have all its software.

For the most recent quarter, the three months ended 31 December 2022, quarterly cash receipts jumped 60%, or 42% in constant currency, to NZ$11.2 million. This enabled the company to achieve its first positive net cash flow quarter on record, with cashflow of NZ$1.3 million, more than double the figure from a year ago. Volpara has set the goal of operating cash flow break-even by the fourth quarter of FY24.

Volpara is also extending its technology into other areas, such as a lung-screening program and a breast arterial calcification (BAC) patent to create a tissue composition map that identifies and quantifies BAC from a mammogram, helping radiologists identify the need to take steps toward the prevention of heart disease. BACs are clusters and patterns of calcification that appear on the mammogram image and may indicate heart disease or high risk of disease. The company has an agreement with Microsoft to research and develop software that uses mammograms to identify potential cardiovascular issues. The partnership aims to expand the ability of breast cancer screening programs to make cardiovascular assessments from routine mammograms.

All up, Volpara looks to have plenty of scope for share price growth from this point, solving a major global medical need.

2. Serko (SKO, $2.45)

Market capitalisation: $295 million

12-month total performance: –45.6%

Three-year total performance: –19.9% a year

Analysts’ consensus target price: $4.59 (FN Arena, two analysts)

Serko, which listed on the ASX in June 2018, is a software-as-a-service (SaaS) company whose technology handles corporate travel and expenses management. More than 6,000 corporate customers in 35 countries spread across Asia-Pacific, North America, the UK and Europe rely on Serko to help them manage their corporate travel programs and make sense of their corporate expenses. More than two million people have access to Serko’s technology and prior to the COVID pandemic, more than US$4.5 billion of travel spending was transacted on Serko’s platform every year, through more than four million bookings.

In 2018, Serko launched Zeno, its online travel and expenses management platform, powered by AI, that brings personalised itineraries, chatbot bookings and intelligent travel management to the industry for the first time. Serko bills Zeno as a next-generation travel management app, using AI tools such predictive workflows to enhance the user experience. Zeno has been built to handle the “connected trip” concept, which is aimed at enabling company finance staff to manager all the components of someone’s business trip such as flights, rail, accommodation, food, drink, and entertainment in a single booking.

In November 2019, Serko signed a deal with US-based travel technology giant Booking.com to power its new business-to-business corporate travel platform. As part of that landmark deal, Booking Holdings (the Nasdaq-listed parent of Booking.com) invested $11.2 million in Serko, taking a 4.7% “cornerstone stake.”

Clearly, as a company built around business travel, COVID was not great news for Serko, with its share price plunging from over $5 to under $1 in the March 2020 quarter. But as corporate travel recovers — driven by smaller businesses — Serko is in a good place, projecting revenue to more than double this financial year.

Zeno was built primarily to target small and medium-sized businesses, and the Booking.com partnership has exposed its technology to a global SME (small and medium-sized enterprises) market that it did not have access to before. The company is also a Microsoft SaaS partner and is using that status to tap into new markets.

The benefits of the strategic partnership with Booking Holdings are starting to flow through, and were crucial in Serko’s recent lift to its revenue guidance for FY23, which ends March 31, 2023. Stronger-than-expected trading over December and January allowed Serko to upgraded its full-year revenue guidance to a range of NZ$42 million to NZ$47 million, which if borne out would represent an increase of 123% to 149% on the previous year’s total income of NZ$18.9 million.

Serko resembles Volpara, in that it is evolving its business toward cashflow breakeven and profitability, while balancing that intention with the investment it needs to make to build its business. The company has told the stock exchange that it expects to return to a cashflow positive position during the FY25 financial year. As its business grows back to pre-COVID activity levels, Serko could be a rewarding journey for buyers at these levels.

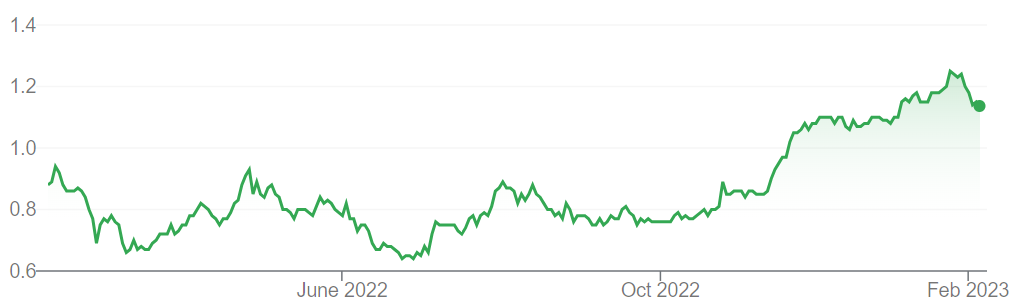

3. Aroa Biosurgery Limited (ARX, $1.15)

Market capitalisation: $395 million

12-month total performance: 30.9%

Three-year total performance: n/a

Analysts’ consensus target price: $1.45 (Stock Doctor/Thomson Reuters, four analysts),

Listed in Australia in July 2020, Auckland-based Aroa Biosurgery is a soft-tissue regeneration company that develops, manufactures and distributes medical and surgical products to improve healing in complex wounds and soft tissue reconstruction. The company’s flagship technology is its AROA ECM (extra-cellular matrix) platform, which is a patented biomaterial containing a rich and complex mix of biological molecules — containing more than 150 ECM proteins known to be important in the healing process — that is the building block for its range of soft-tissue repair products. AROA ECM is made from ovine (sheep) forestomach tissue, sourced exclusively from New Zealand pasture-raised animals.

The technology is built around a process called “dynamic reciprocity,” in which cells and the surrounding soft tissue ECM constantly interact to modulate tissue physiology. The components of AROA ECM play an important role in regulating tissue growth and maintenance, and orchestrating the process of tissue regeneration. AROA ECM retains the authentic structure, signalling and substrates of tissue ECM to help guide tissue repair; the matrix retains the delicate micro-architecture of tissue ECM to influence the way cells attach, migrate, grow and differentiate. Importantly for its potential range of uses, components in the AROA ECM also attract stem cells.

Aroa Biosurgery has successfully cracked the crucial US market, targeting chronic wounds and soft tissue reconstruction including, hernia, breast reconstruction and trauma/limb salvage/ tumour surgery. It sells four main products in the US, namely:

- Endoform Natural and Endoform Anti-microbia: these products support all phases of wound healing and are appropriate for use early in wound management;

- Myriad Matrix: helps to maximise tissue repair across a wide range of surgical applications;

- OviTex: a reinforced biological scaffold for abdominal wall reconstruction; and

- OviTex PRS: a specialised reinforced biological scaffold for plastic and reconstructive surgery.

The major growth driver is Myriad, which is about to be extended with a new product, Myriad Morcells, a powdered format that can be taken orally to help kick-start the healing process. Another new product that will shortly join the range is Symphony, which is similar to Myriad, but combines AROA ECM and hyaluronic acid in a format designed specifically for use in the outpatient setting for complex wounds diabetic and venous ulcers. Symphony, which the company sees as a high-value product, will be launched in April.

Enivo, Aroa’s platform technology for a family of new products – including partially removable and resorbable implants, and a variety of formats for different anatomical sites/procedures – will enter a pilot clinical trial later this year.

The product range has regulatory approval in more than 50 countries: Aroa has a key relationship with the Nasdaq-listed TELA Bio, which is its sales and distribution partner licensed for abdominal wall reconstruction/hernia and breast reconstruction sales. Five million AROA devices have been applied in treating patients, and the company says its existing product range has a US$2.5 billion ($3.6 billion) total potential addressable market in the US alone. To that can be added the US$1 billion ($1.44 billion) total potential addressable market in the US that Aroa estimates is available to Enivo.

As the healthcare market recovers from the COVID pandemic, Aroa Biosurgery is forecasting strong growth in FY23, with product revenue guidance of NZ$51 million–NZ$55 million, which would be a 30%–40% increase on FY22, which itself was a 78% increase on FY21. In FY23, Aroa is forecasting that its normalised EBITDA (earnings before interest, tax, depreciation and amortisation) will break even.

Aroa Biosurgery is doing all the right things, and looks an excellent prospect at current prices.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.