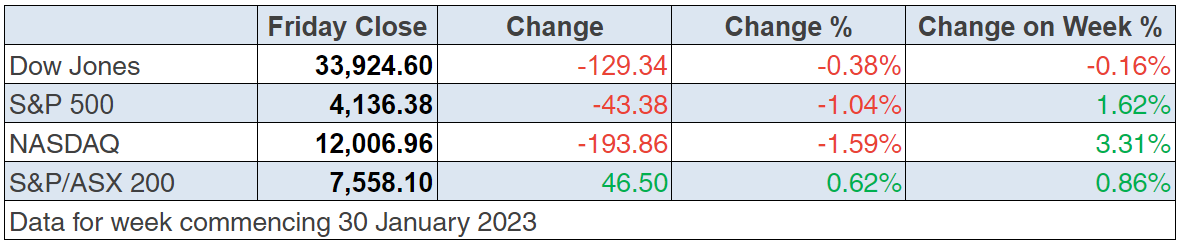

Just when it looked like it was time to crow about the tech sector being ready to be re-loved even earlier than I expected, along came a few disappointing reporting results from big US tech companies and a better-than-expected jobs report!

In January, the Yanks created 517,000 jobs rather than the predicted 187,000 that the Dow Jones survey of economists predicted. As Homer Simpson might lament: “Stupid dumb economists!!!”

Of course, this sent bond yields higher and says the Fed is now likely to be keen to keep raising interest rates longer than was thought for most of this week, following the 0.25% official rate rise announced by the US central bank.

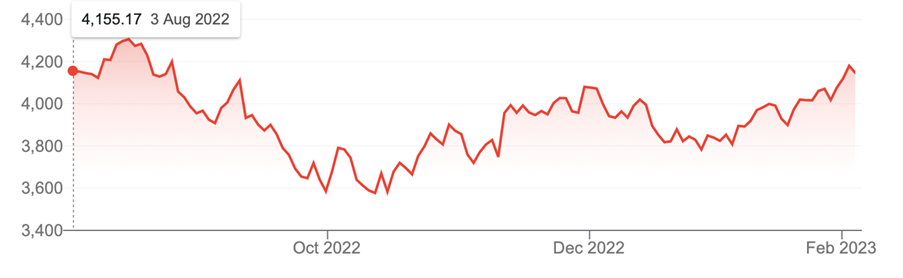

Add this to the weaker-than-expected reports from Apple, Alphabet and Amazon, you can see why the Nasdaq was down over 1% before the close and contrasts with the 5% plus rise before Friday’s trading. This chart shows how the news earlier in the week was greeted by buyers/believers in tech companies.

Nasdaq Composite

This chart shows what will happen in the future, when fears about inflation and rising interest rates are really behind the US economy. And like most debateable issues on Wall Street, there are those who think one month’s labour market numbers and weaker company reporting (that many expected anyway) doesn’t change belief in the trend for lower inflation without a serious recession. “I think the market’s coming closer to our view that inflation is declining rapidly,” said Jay Hatfield, CEO at Infrastructure Capital Management. “[The Fed’s] models have proven to be terrible. They missed this inflation on the upside, and now they’re missing the deflation.”

Our week finished with a three-day winning streak and we can thank Jerome Powell and the Federal Reserve for not spooking the life out of US and then global stock markets. Our week wasn’t helped by concerns about inflation and alarmist economists tipping four more rate rises before the RBA calls it quits.

The irony is before the ‘four more rises’ story broke, a hotshot from Morningstar was telling us that we might be the first country to embrace rate cuts, starting from this year!

There is a mortgage cliff for 800,000 borrowers come July this year and rolling into year’s end. This is bound to hurt spending and, inevitably, bring inflation down. And it could take us close to (or even create) a recession. And that’s why rate cuts could happen.

But that’s the possible bad news out there that COULD happen. Right now, stock markets liked the idea that US interest rate rises are getting close to the top and that’s why tech stocks had a great run this week, until that jobs report kerbed the enthusiasm. I’ve been talking about the great re-loving of tech and it sped up with a bang this week, but as I’ve often written: “You have to expect selloffs from profit-takers, which will take stock prices down occasionally until it’s really certain that rate rises are close to ending.”

That said, it’s going to take a lot of bad inflation and recession indicators to reverse this 15.5% rebound in the S&P 500 Index. I’ll be using any sell offs to lower my overall cost of holding stocks with a good outlook for when inflation is conquered.

S&P 500

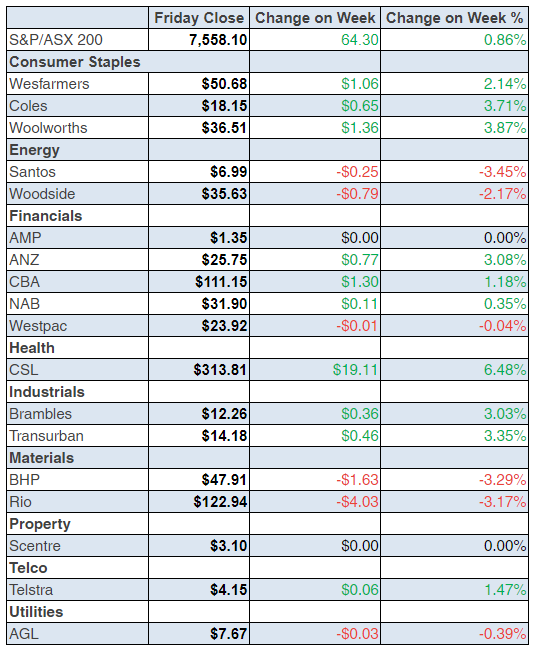

The S&P/ASX 200 Index ended up 0.86% (or 64.3 points) for the week to finish at 7558.10 — that’s about 1% our record high of 7632.8, which happened in August of 2021, before the interest rate rise cycle started.

Banks did well with reports earlier this week that the recent bigger-than-expected inflation reading meant those possible four more interest rate rises would be good for the bottom lines of banks. CBA hit an intraday all-time high of $111.43 but ended Friday at $111.15.

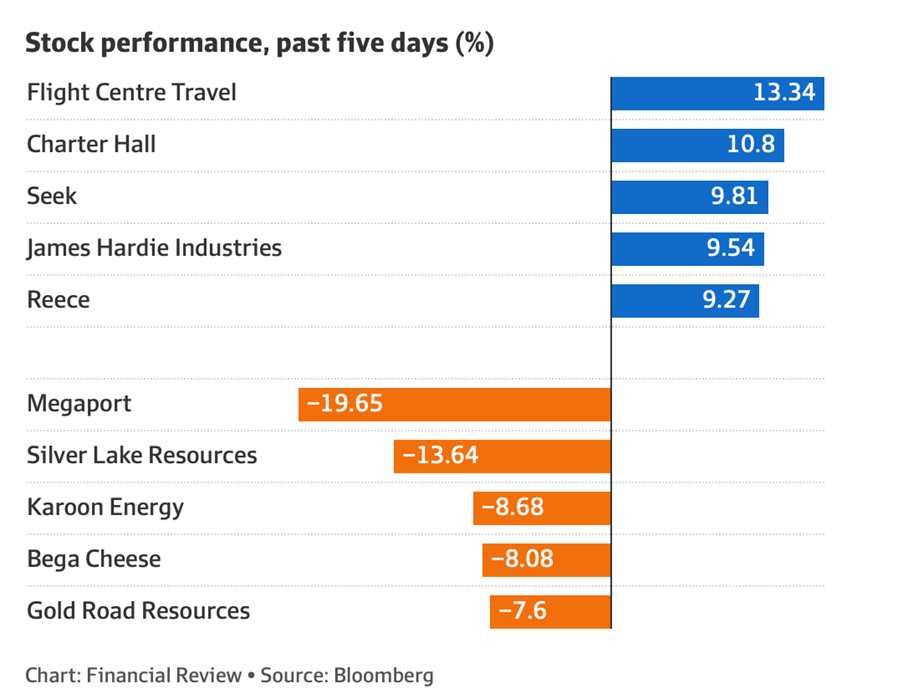

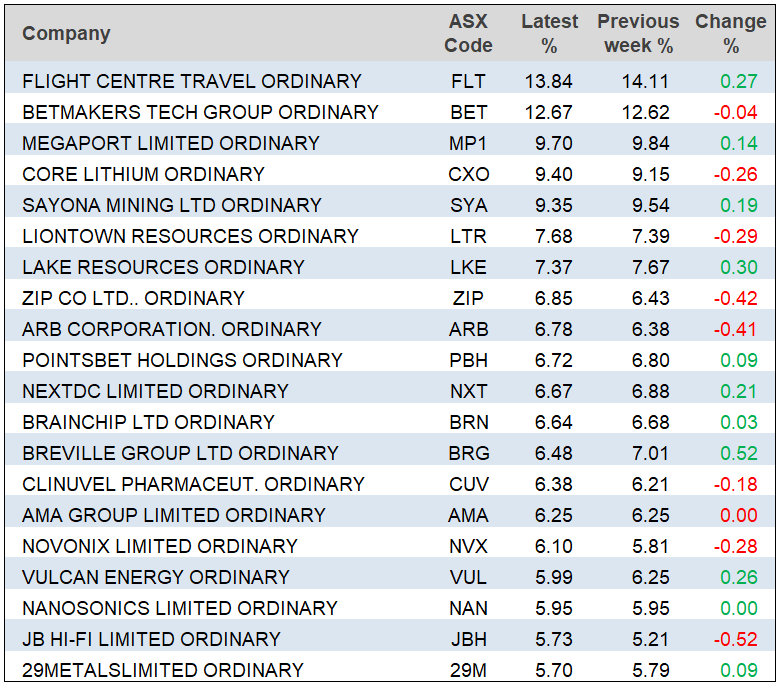

Here were the big winners and losers for the week:

Megaport again disappointed the market with its quarterly update and I intend to survey the views on this once star tech-performer to see if it’s worth persevering with it.

On better news, the good week for growth and tech stocks helped the likes of CSL, which was up 6.54% to $313.81, Xero up 6.19% to $81.99, Wisetech up 5.53% to $62 and even Appen gained 5.84% to $2.72. I think we’re seeing a preview of when the tide rises for tech stocks, all tech boats will lift with their individual quality/potential explaining any difference in the gains.

I also think Tyro was both helped by rekindled takeover talk and the rise in tech stock enthusiasm this week out of the States, which has been a point that I’ve made in the past. And it’s something that Potentia Capital’s owners, who want Tyro at a bargain price now, would believe as well.

When tech is well and truly in the re-loved phase with no more threatening inflation and interest rate rises, Tyro will get a lift. Its share price was up 5.19% to $1.62 this week.

What I liked

- The IMF forecasted better-than-expected global growth.

- The money market thinks our cash rate peaks now at 3.6% rather than 4%. It’s now 3.35%.

- Australia’s underlying budget deficit for 2022/23 was running at A$14.7 billion for the six months to December 2022, an A$11.5 billion improvement on the deficit profile from the October 2022 Budget. The Headline budget deficit was running at A$19.8 billion for the first half of 2022/23, an improvement of A$12.6 billion on the Budget profile.

- US Federal Reserve Chair Jerome Powell said the“disinflation process has started”in his press conference

- The US Federal Reservelifted the federal funds rate by 25 basis points, the smallest hike since March 2022, to a range of 4.5%-4.75%, the highest level since October 2007.

- The sneak preview of tech stocks being popular again and what it did to stock market indexes.

- This run of US economic data on Wednesday all said the US economy is slowing but not collapsing and the numbers were at odds with that jobs report out overnight: “The employment cost index rose 1% in the December quarter (survey: 1.1%). The FHFA house price index fell 0.1% in November (survey: minus 0.5%). S&P Case-Shiller home prices fell 0.8% in November (survey: minus 1%). The Conference Board consumer confidence index fell from 109 to 107.1 in January (survey: 109). The Chicago purchasing managers’ index (PMI) eased from 44.9 to 44.3 in January (survey: 43). The Dallas Federal Reserve services index rose from -20.5 to -15 in January (survey: minus 12).” (CommSec)

- Chinese economic data came in much better than expected this week.

What I didn’t like

- Average capital city prices fell another 1.1% and are now down by 9.6% from their April high – this is their fastest fall on record (back to 1980) and is approaching their 10.2% top to bottom fall seen in 2017-19.

- The US jobs number and I hope it proves to a rogue, against-the-trend stat.

- Germany’s gross domestic product (GDP), which unexpectedly fell 0.2% in the December quarter (survey: flat), heightening concerns about a recession.

- The Bank of England raised rates by 0.5%

I want measured bad news

Yep, that jobs report has ruined the rebound in market optimism but I insist that we are closer to that time when we can put the bear market of 2022 behind us. And in many ways, we really don’t want a mad take-off of stocks as this could spook the Fed and the likes of the RBA to go too hard on rates and end up putting us into a recession. However, I do hope that the next US jobs number isn’t anything like the one we saw overnight or else we’ll see more rate rises and lower stock markets.

The week in review:

- In this week’s Switzer Report, I look into 5 healthcare and 4 tech stocks the experts like for 2023!

- Paul Rickard shows us a risky stock he has found for income seekers, investing in a royalty company may have appeal, when the yield is over 6%.

- Tony Featherstone in his first article shows us two education microcap stocks that he found that he thinks will be good to watch for 2023 and in his second article Tony goes into two resource services stocks that he thinks are worth watching.

- James Dunn tells us about his 3 best ASX-listed overseas stocks, Here are three of the best (non-Kiwi) foreign listings: Block (Afterpay), Resmed and Zimplats.

- 4 targets he predicts will be great take overs for 2023, Takeovers aren’t easy to predict, but here are four situations where I think an acquisitive move wouldn’t be at all surprising.

- In our “HOT” stock column, Michael Gable, Managing Director of Fairmont Equities, says Karoon Energy (KAR) Plus Michael Gable, managing director of Fairmont Equities, gives his reasons for liking Iluka Resources (ILU).

- In Buy, Hold, Sell – Brokers Say, there were 7 upgrades and 12 downgrades in the first edition and 9 upgrades and 25 downgrades in the second edition.

- And finally, In Paul’s (Rickard) Questions of the Week, What is the cost base for the PEXA shares that Link has distributed? What is “tax deferred” income? Can ZIP get back to $3.00? Is an investment strategy using DRPs a good way to invest?

Our videos of the week:

- Chinese students banned good for our economy and will the Fed help or hurt stocks this week? | Switzer Daily

- 4 More rate rises?! Really? | Switzer Daily

- SWITZER TV is back! 3 potential big gaining stocks you should have! | Switzer Investing

- Huge drop in retail spending and two more reasons to buy stocks for 2023! | Switzer Daily

- Boom! Doom! Zoom! | 2nd February 2023

- Fed has made it safe to buy stocks for 2023 but what about the RBA? | Switzer Daily

- China coal ban dropped and tech stocks soar! Yahoo for our super! | Switzer Daily

Top Stocks – how they fared:

The Week Ahead:

Food for thought: “The key to making money in stocks is not to get scared out of them.” – Peter Lynch

Stocks shorted:

ASIC releases data daily on the major short positions in the market. These are the stocks with the highest proportion of their ordinary shares that have been sold short, which could suggest investors are expecting the price to come down. The table shows how this has changed compared to the week before.

Chart of the week

For the 12 months to 30 June, the company earned $265.2m in royalties. This was up 83% on FY21, and included a final quarter capacity payment of $46m.

In terms of growth, the company has a targeted strategy focussing on “value accretive investment”. It is seeking to create new royalties by providing project capital and balance sheet repair to bulk, base and battery metal miners at or nearing production (target $100m to $300m), and to acquire existing royalties. But these activities are still in the early stages as MAC accounts for more than 98% of the revenue.

Since listing in November 2020, Deterra’s share price has traded in a relatively narrow band, with movements in the iron ore price being the major drivers of change. On Friday, the shares closed at $4.91.

Deterra Royalties (DRR) – 11/20 to 1/23

– Paul Rickard, Switzer Report

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances