Ahead of the close on Wall Street, the Dow was just positive and the other market indices were only just negative. But it’s the final hour that often determines the vibe that will prevail for our market on Monday. To be precise, the market doesn’t know where to go because the inflation-related data is improving, but it could be better. Meanwhile, Fed officials are playing ducks and drakes with Wall Street to ensure the stock market doesn’t go too optimistic, which could undermine the progress on bringing consumer prices down.

In contrast, European stock markets were strong and positive overnight, with global markets liking the lower-than-expected consumer and wholesale inflation numbers out over the past week or so, which has led to the cautious belief that the US Fed will ease up on big rate rises. That’s despite Fed officials telling the market that it was getting too enthusiastic and positive about future rate rises and that the stock market reaction was getting ahead of itself.

One renowned hard man, St Louis Federal Reserve president James Bullard, didn’t muck around by indicating that rates would need to go higher by at least 1 percentage point before the Fed’s work is done.

Of course, this could be appropriate Fed jawboning to keep a lid on the irrepressible nature of Americans with money. The Fed wants to keep the frighteners on investors, consumers and borrowing businesses to ensure inflation gets nailed ASAP.

That said, the ‘inflation is falling’ signs have been good following last week’s better-than-expected drop in the CPI in the States, with the annual reading coming in at 7.7% for the year ending in October, which was a much slower increase than the 8% economists had expected. This was the lowest annual inflation reading since January.

And then US share markets rose on Tuesday in response to another better-than-tipped reading on business inflation, which saw federal funds futures traders pricing in a 91% probability that the US central bank will hike rates by 50 basis points when it meets on December 13-14, rather than 0.75%. The latter was only seen as a 9% chance on December 12-13 when the Fed’s interest rate committee meets.

Interestingly, Fed officials have been playing good cop/bad cop with the very influential US Federal Reserve Vice Chair Lael Brainard actually saying that it would be “appropriate soon” for the US central bank to reduce the pace of its aggressive monetary policy tightening.

Another plus for the week were the noises coming from China. The path of the US-China relations has soured in recent years, with the Trump approach to diplomacy meeting a China hellbent on taking Taiwan, supporting Russia, the crackdown on Hong Kong and trade restrictions for US and its allies’ goods, which we know all about.

As the website ft.com put it, on the meeting between Joe Biden and Xi Jinping: “After three hours, the two leaders signalled a mutual desire to arrest that negative territory.” This G20 meeting could prove to be another tailwind, which will add to others such as falling inflation and a gradual reopening of China from COVID lockdowns that should make 2023 a good year for stocks.

Only excessive interest rate rises that could cause a US recession could hurt 2023’s stock price rise, however, it would only delay a stock market rally. If a worrying recession develops, the Fed would cut rates and stocks would take off.

Against the growing optimism that inflation will fall and a bad recession will result, there are other market players who aren’t as positive. Stephanie Lang, the chief investment officer at Homrich Berg, is a case in point. “Following the big rally coming off the better-than-expected CPI print, the market’s digesting the current data, which is bringing things back to reality,” she said. “The rally that followed the CPI print we don’t feel was justified by fundamentals… The market’s also pricing in a soft landing here, which we don’t think is likely to occur. So when you hear the Fed officials coming out and reiterating their stance, you’re starting to see the market readjust to that.” (CNBC)

But the bears have equally positive bulls out there and some of these have good reputations as data experts. Thomas Bruce of Ned Davis Research is one such expert and this is what CNBC reported this week: “We believe inflation has peaked and our base case is for the Fed to reduce their pace of rate hikes to 50 basis points in December…with favourable seasonality, technicals, and market sentiment, there’s just cause for optimism, despite an investment landscape still rife with macroeconomic concerns.”

Ultimately, the data will determine what the Fed does, what Fed officials say and how stock prices respond.

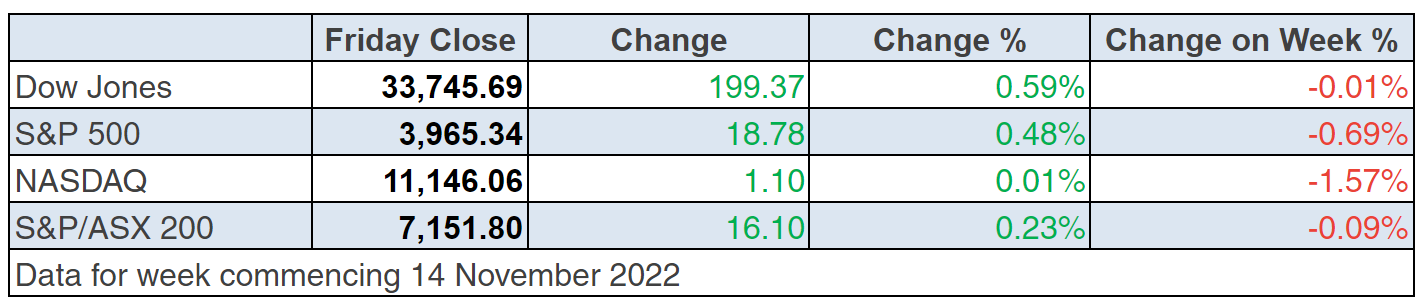

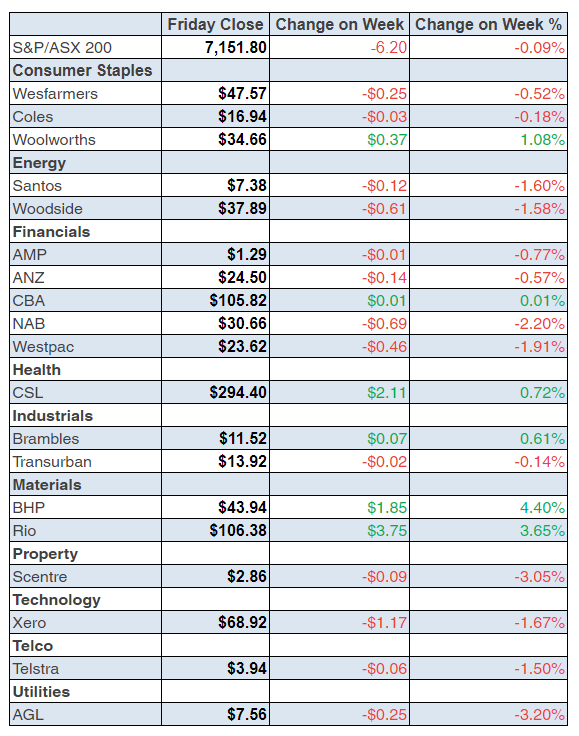

To the local story and in a wait-and-see week, the overall S&P/ASX 200 Index rose 16 for the week but lost 6 over the five days trading to finish at 7151.8. After being down 16% earlier this year, the index is now down only 5.77% year-to-date and 3.31% for the year.

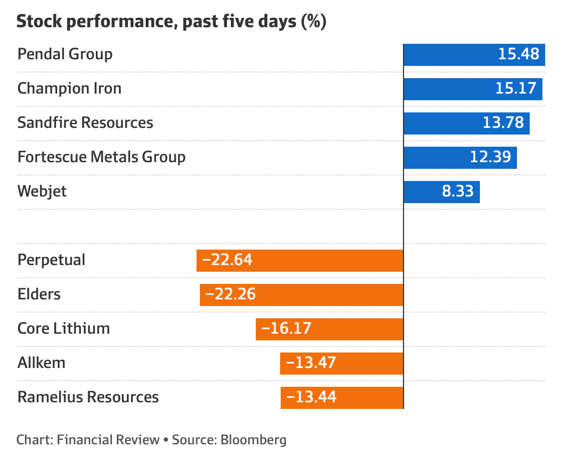

Here are the big winners and losers:

Shock positive performer was Nuix, which gained 21.9% on Friday and 13.93% for the week after a contract gain impressed the market. But it’s still down 75% for the year! Nanosonics had some support, up 2% for the week.

Copper was in favour and Oz Minerals was up 3.17% for the week to $27.34. Here’s the AFR’s take on the subject: “Copper miner OZ Minerals was the top performer, up 4 per cent to $27.34 after its board agreed to a sweetened takeover bid from BHP Group at $28.25 per share.

“BHP will now undertake four weeks of exclusive due diligence inside OZ, with the blessing of the OZ board, as it seeks to finalise a deal to give it increased exposure to copper. The industrial metal is in huge demand as the world transitions to electric vehicles and more renewable energy.”

What I liked

- Another good US inflation reading with the Producer Price Index (PPI) rising by 0.2% in October (survey: 0.4%). The annual growth rate fell from 8.4% to 8%. The core PPI (excludes food and energy) was flat (survey: 0.3%). Annual growth of the core PPI was 6.7% (survey: 7.2%).

- Employment rose by 32,200 people in October (consensus: 15,000) with full-time jobs up by 47,100, butpart-time jobs fell by 14,900. These job numbers are bad for inflation and interest rates but good for saying Australia dodges a recession.

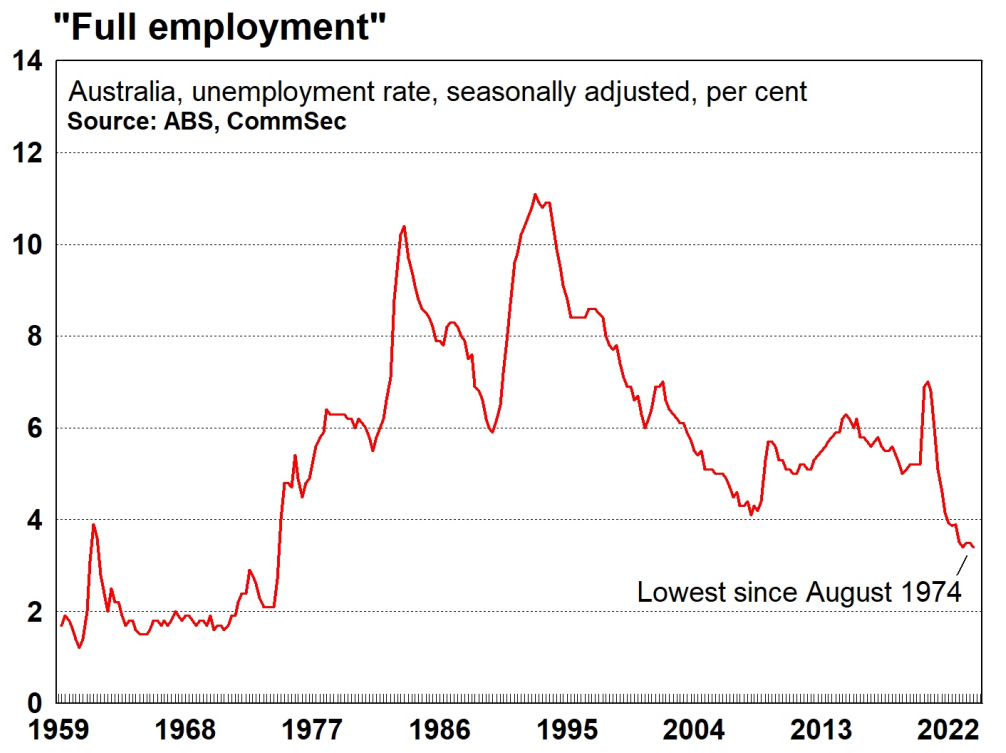

- The unemployment rate eased from 3.5% in September to a fresh 48-year low of 3.4% in October (the lowest since August 1974).

- Seven consecutive rate hikes totalling 275 basis points have seemingly not dented the job market.

- The weekly ANZ-Roy Morgan consumer confidence index rose by 2.7% in the past week after falling 10.4% over the previous six weeks.

- The Australian Construction Industry Forum (ACIF) predicts a lift in commercial and infrastructure building to offset a fall in residential building over the next three years.

- The CBA Household Spending Intentions (HSI) Index rose by 0.9% in October but annual growth fell from 14.1% to 7.4%. That’s a decent fall, which helps slow down inflation.

- The S&P Global Australia Services Purchasing Managers’ Index fell from 50.6 to 49.3 points in October. It’s the first reading below 50 in nine months and this is good for inflation. As it’s a small fall, it’s good for believing we’ll only get an economic slowdown and not a recession.

- US housing starts fell from a 1.488 million annual rate to 1.425 million in October (survey: 1.41 million). The Philadelphia Federal Reserve manufacturing index eased from -8.7 points to -19.4 points in November (survey: -6.2 points). The Kansas Fed manufacturing index rose from -22 points to -10 points in November (survey: -15 points).

What I didn’t like

- Wage growth, as represented by the Wage Price Index (WPI), grew by 1% in the September quarter — the fastest quarterly growth rate in 10½ years! This is bad for inflation and interest rates.

- US retail sales rose by 1.3% in October (survey: 1%), which might keep the Fed believing it has to keep handing out big interest rate rises to beat inflation.

- US consumer inflation expectations rose from 5.4% to 5.9% in October (survey: 5.3%) according to a survey by the Federal Reserve Bank of New York.

- Reports of a Russian missile landing in Poland added to share market volatility.

We’re sleeping in!

Because Wall Street now closes at 8am our time, we’ve decided that as of next week, we’ll send out our Saturday Report just after 8am rather than the usual 7am. The last hour of trade is too important for me playing a guessing game, so I’ve bitten the bullet and made the decision. It will still be in your inbox before 9am and I’ll probably get rid of the black rings under my eyes!

The week in review:

- In this week’s Switzer Report, I talk about whether this rally is trustworthy or not and is going for long stocks a good play for 2023: can this bounce back last and become a new bull market rally?

- Paul Rickard discusses Xero’s bet on the UK and USA and whether it can it deliver? Like many tech investors, Paul says he has been wrong about cloud accounting software provider Xero (XRO) and how it could be a good investment.

- Tony Featherstone talks about two stand out stocks that he thinks could benefit from climate-change. The list of companies working on climate-change mitigation is long and growing. Here are two infrastructure-services companies that suit long-term investors

- James Dunn is back with his series on little-know champions of the micro-cap world. Today James goes inside two companies very few investors know but they’re companies with growth prospects.

- In our Hot Stock column this week, Raymond Chan, Head of Asian Desk at Morgans, shares his views on REA Group (REA). Plus Michael Gable, Managing Director of Fairmont Equities, tells us why he likes Iluka Resources (ILU).

- In Buy, Hold, Sell – Brokers Say, there were 14 upgrades and 12 downgrades in the first edition and 3 upgrades and 7 downgrades in the second edition.

- And finally, In Paul’s (Rickard) Questions of the Week, Paul answers your queries on If it’s still good to hedge my currency exposure on US stocks. Or have you missed the boat? Which is best for growth – QBE or Suncorp? Do the brokers prefer Rio or BHP, and which pays the highest dividend yield? Why not make the age pension universal, and tax super pensions. Would this be revenue positive or negative for the Government?

Our videos of the week:

- Jun Bei Lu’s favourite stock right now, plus is it time to buy XERO or Dump it | Switzer Investing (Monday)

- A tough day for Lithium Stocks – is supply finally catching up with demand might this spike lithium? | Mad about Money

- Boom! Doom! Zoom! | 17 November 2022

- CSL, Resmed, Ramsay and Sonic Healthcare, are they in the buy zone? | Switzer Investing (Thursday)

Top Stocks – how they fared:

The Week Ahead:

Food for thought: “Behind every stock is a company. Find out what it’s doing.” —Peter Lynch

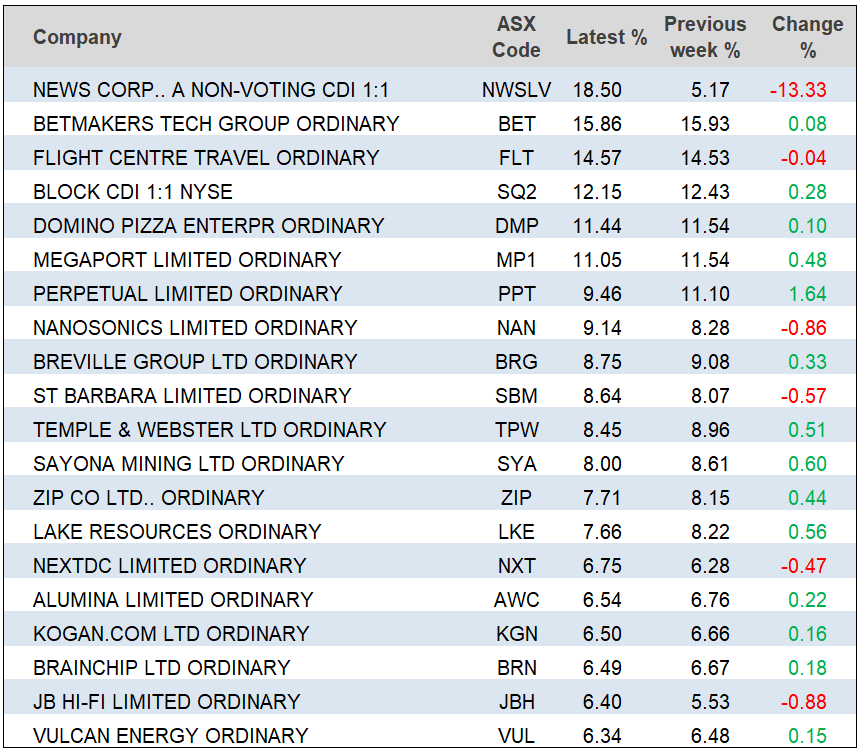

Stocks shorted:

ASIC releases data daily on the major short positions in the market. These are the stocks with the highest proportion of their ordinary shares that have been sold short, which could suggest investors are expecting the price to come down. The table shows how this has changed compared to the week before.

Chart of the week:

Seven consecutive rate hikes totalling 275 basis points have seemingly not dented the job market. The jobless rate is back at 48-year lows, another 30,000 plus jobs were created in the past month while hours worked lifted 2.3 per cent.

The number of people without a job is the lowest in 14 years. Since 2008, employment has grown a phenomenal 53 per cent to record highs with the overall labour force up 49 per cent and the jobless total hasn’t budged. Amazing.

Still, looking ahead, the federal government is looking to boost migrant numbers, with a forecast for net overseas migration of 235,000 people contained in the October budget. A targeted influx of skilled labour will ease job market ‘hot spots’, ensuring wage growth is sustainable and adding to consumer numbers and spending levels.

As always, there are complications with the data such as the number of people on annual leave in October down 10 per cent from normal. And the number sick in October was a third higher in October than normal.

One other point. The number of people not in the labour force stands at 7.15 million. There are potentially untapped resources, especially from the 60-70 age group. Tax and pension complications may be holding back potential workers.

Lifting rates from lows to more ‘normal’ levels was the easy part. The current tricky challenge is to grow the economy at a slower pace while keeping the jobless rate relatively low and pushing inflation toward the 2-3 per cent target band. Much also depends on what happens abroad with supply-chain issues – Craig James, Chief Economist – Commsec

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances