Predicting stock winners and losers based on currency moves is a mug’s game.

For starters, currencies are notoriously hard to forecast. Who knew the Aussie dollar would tumble to US62 cents this year, from US76 cents at the start of 2021? Or that the Greenback would rally as hard as it has, amid interest-rate rises?

Also, buying a company because of its offshore revenue is tricky. Multinationals have revenue and costs in multiple currencies – and complicated hedging programs.

Over the years, I’ve seen recommendations on Australian companies that earn a chunk of revenue in US dollars, on currency grounds. But the company’s valuation had already factored in the effect of a depreciating Australian dollar on its earnings.

That said, a falling Australian dollar (relative to the Greenback) makes our assets more attractive to cashed-up offshore private-equity firms and pension funds.

Don’t get me wrong. I’m not suggesting a weakening Australian dollar will trigger a spate of takeovers. But offshore acquirers will surely be considering more ASX-listed companies after heavy falls in global equities and our weakening currency.

This is an interesting time for predators. The S&P/ASX 200 Industrials Index is down about 13% (to end-September 2022). The Australian dollar against the Greenback is down 10% over the same period. Interest rates have soared and talk of global recession is deafening. Predators could buy near the bottom of the cycle in the next 12 months.

My guess is that CEOs of companies with cashed-up balance sheets will be itching to make acquisitions and drive the next phase of growth.

That said, readers know I am resistant to buying companies solely on takeover talk. Picking targets is hard enough; getting the timing right is almost impossible. Stories about takeover targets attract headlines, but it’s not a great basis for investment. For every takeover target, many more disappoint investors.

More important is finding quality, undervalued companies that are good investments, with or without takeover, and being prepared to hold for the long term. A takeover should be a secondary consideration – and validation that you own an undervalued stock.

Caveats aside, I see a few possible takeover themes this year. The first is foreign predators revisiting ASX-listed companies where takeover talks collapsed. Think Brambles, Link Group or, more recently, Ramsay Health Care.

The second theme is beaten-up industrial and financial stocks. For example, the Star Entertainment Group and Insurance Australia Group. In small-cap beverage stocks, United Malt Group and Lark Distilling Co are worth watching.

The third theme is the best bet for takeovers: infrastructure-related companies. Offshore pension funds and private-capital firms have acquired and privatised key infrastructure assets over the past few years. Sydney Airport is a prime example.

Barely any infrastructure stocks remain on ASX. Those left must appeal to offshore predators that continue to gobble up listed infrastructure assets that can pass on higher costs to consumers due to their inflation-linked charges.

Here are three ideas to consider:

1. APA Group (APA)

It won’t surprise market watchers to include APA, the market’s premier gas-pipeline business, at the top of this list. The media has long speculated on APA being a target; reports in May suggested predators were starting to circle.

That might be hype. What is clear is APA has an excellent portfolio of gas-infrastructure assets and valuable economies of scale. The stumbling block for predators might be uncertainties around gas-market reform and how to price these assets as the world moves from fossil fuels and towards decarbonisation.

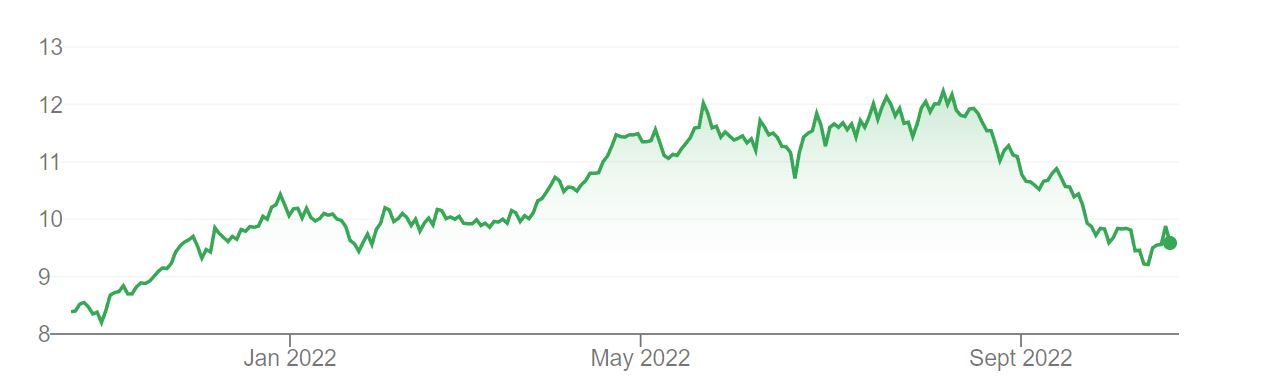

APA looks modestly undervalued at $9.50. Morningstar values it at $10 a share and the consensus price target, based on 11 brokers, is $10.54. An expected forward dividend yield of almost 6% from a defensive business is another attraction.

With or without takeover, APA appeals to long-term investors after a near 20% price fall in the past three months. If APA keeps falling, a predator will eventually emerge.

Chart 1: APA Group

Source: Google Finance

2. The Lottery Corporation (TLC)

TLC was only admitted to ASX in May after its demerger from Tabcorp Holdings. Almost from its debut, there has been speculation that TLC is a takeover target.

TLC is Australia’s leading lottery operator. Its brands include The Lott, NSW Lotteries, Gold Casket, Keno, Tatts and SA Lotteries. The company’s national network of thousands of distributors is hard for competitors to replicate.

TLC is more like a utility company than a gaming business. Exclusive licences in most States and Territories are a form of monopoly in the lotteries business. TLC’s steadily rising revenues also have infrastructure-like traits.

TLC is down about 11% over three months. A consensus price of $4.66, based on 11 analyst price targets, suggests TLC is undervalued at the current $3.96.

TLC is no screaming buy, but it would be a good asset for a global private-equity firm. The business has a lot of growth options through innovations and Australians love their weekly lotto ticket (which provides steady, recurring income for TLC).

The company’s former parent – Tabcorp Holdings – is another takeover possibility. But that’s a story for another column.

Chart 2: The Lottery Corporation

Source: Google Finance

3. Dalrymple Bay Infrastructure (DBI)

DBI is the biggest surprise on this list. The company ships thermal and coking coal through the Dalrymple Bay Coal Terminal at the Port of Hay Point, south of Mackay in north Queensland. DBI listed on ASX in December 2020, valued at $1.2 billion.

Much depends on Brookfield Asset Management, the global alternative assets manager that holds just over half of DBI. Brookfield sold a 51% stake in DBI for the IPO (and has since bought more shares).

Unlike coal producers, DBI hasn’t benefitted as much from rising coal prices. DBI relies on coal production and charges customers on a per-tonne basis. There hasn’t been a lot of growth in actual coal production, despite higher prices.

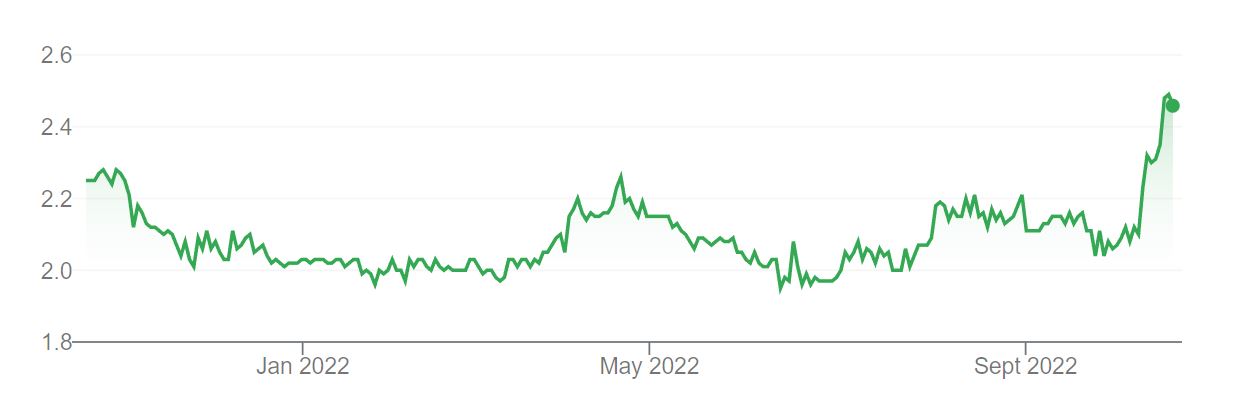

DBI this month announced significant increases in its Terminal Infrastructure Charge (TIC). Its TIC will rise annually for inflation over a 10-year agreement. The deal was a good outcome for DBI and its share price jumped on the news.

A consensus target of $2.68 (based on five brokers) suggests DBI is modestly undervalued at $2.33.

Like or loathe coal, Dalrymple Bay is the world’s largest metallurgical export coal facility. DBI describes the terminal as a “global gateway” from the Bowen Basin and a “critical” link in the global steelmaking chain.

Like other key infrastructure, DBI has an annuity-like risk profile and stable cash flows. An expected forward yield of almost 8% is testament to that.

Granted, selling a coal-related asset in this market is harder work as institutions shy away from fossil-fuel assets due to Environmental, Social and Governance (ESG) issues. But port infrastructure has plenty of appeal, particularly for foreign private capital (or sovereign wealth funds) that want to shore up future coal supply.

Chart 3: Dalrymple Bay Infrastructure

Source: Google Finance

Tony Featherstone is a former managing editor of BRW, Shares and Personal Investor The information in this article should not be considered personal advice. It has been prepared without considering your objectives, financial situation or needs. Before acting on information in this article consider its appropriateness and accuracy, regarding your objectives, financial situation and needs. Do further research of your own and/or seek personal financial advice from a licensed adviser before making any financial or investment decisions based on this article. All prices and analysis at October 18, 2022.