“Woolworths (WOW), Coles (COL), Endeavour Group (EDV) and Wesfarmers (WES) are all down over 10% after their results,” Raymond said.

“As we know, the stocks were performing well before their results but their outlooks didn’t meet market expectations,” he added.

What about Woolworths (WOW)?

“WOW’s financial year 2022 results were fine but their outlook was more uncertain, given the strong COVID sales volume, which can’t be duplicated. The supermarket business is likely to be down materially in the first half of 2023, given supply chain disruption,” he said.

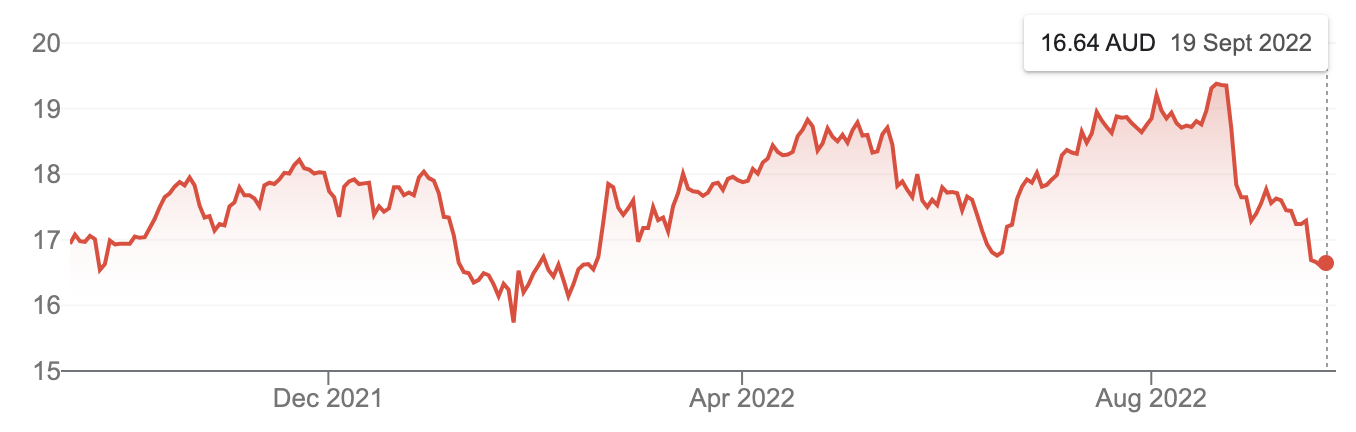

Woolworths Limited (WOW)

What about Coles (COL)?

“COL didn’t provide trading updates for the first seven weeks in financial year 2023.

“The market is concerned that COL’s CAPEX on its transformational projects is going to be higher than expected, which means a cost overrun,” he said.

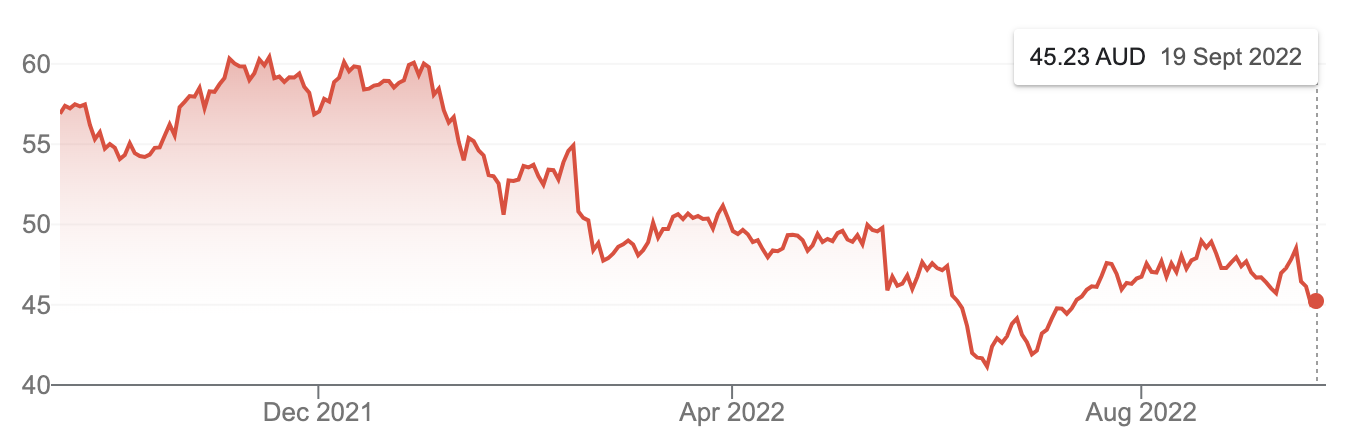

Coles Group Limited (COL)

What about Endeavour Group (EDV)?

“EDV’s financial year 2022 results were again fine,” Raymond said, “but the market is uncertain how the company can reproduce very strong financial year 2022 demand as customers are likely to spend more money elsewhere, for example travelling, etc.”.

Endeavour Group Limited (EDV)

What about Wesfarmers (WES)?

“While the WES stock price was also weak, we think it’s a standout from the reporting season,” Raymond said.

“The outlook is seen as positive.

“Retail trading conditions were robust for the first seven weeks for the company.

“K-Mart sales were strong. Bunnings’, performance was OK too.

“While WES is predominately a retail stock, it’s also developing Mt Holland – a lithium mine based in WA.

“WES confirms the development costs remain on track. First production is seen as second-half 2024. If we assume a long-term lithium price of US$30,000 (today’s US$50,000), this translates to forecast EBIT $550 million or 10% of WES EBIT today, on a total capex spend of $2 billion, which included the acquisition costs of Kidman.

“WES has a track record of making good money from resource investments, as in the case of its coal business, which was later sold to New Hope (NHC),” he said.

Wesfarmers Limited (WES)

What’s Raymond’s ranking for these consumer staples?

- WES (21.5x, yield 4%)

- COL (21x, yield 3.9%)

- WOW (25x, yield 2.9%)

- EDV (24x, yield 3%)

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.