Like it or not, we’re now in the ‘waiting room’, like the old world when expectant fathers sat outside the operating room hoping their wife and child would come through the birth process without a problem. Unfortunately, this is a long wait, where we won’t know if our ‘baby’ will be a bull or a bear!

The rebound rally looks very bullish but expert doomsday merchants say it could be a bear market rally. In reality, it will be determined by the upcoming data drop in the US over the next couple of months and then what the Fed does.

This is the main game and this week showed that Wall Street is now not sure how to see the future of the US economy, company profits and therefore share prices.

Let me show you the conflicting developments this week from the numerous CommSec notes I received that showed how the stock and bond markets reacted to various news items:

- US share markets were firmer on Monday with investors digesting weak economic data in the US and China. Some investors believe that the soft data will temper the Federal Reserve rate hike expectations.

- US treasuries (bonds) were firmer on Monday (yields lower) in response to weak US and Chinese economic data. The Chinese central bank cut key lending rates in an attempt to boost economic activity. US 10-year yields fell by 5 points to nearly 2.8%. And US 2-year yields fell by about 6 points to nearly 3.2%.

- Global oil prices fell by nearly 3% on Monday to 6-month lows, after Chinese economic data fell short of analyst forecasts. Investors fear that the global economy will continue to slow, reducing oil demand and driving prices lower.

- US treasuries fell on Wednesday (yields higher). US 10-year yields rose by about 8 points to nearly 2.9%. And US 2-year yields lifted by about 3 points to nearly 3.28%.

- Global oil prices rose by about 1.5% on Wednesday. Reuters notes “a steeper-than-expected drawdown in US crude stocks outweighed concerns over rising Russian output and exports as well as recession fears”. The Brent crude price rose by US$1.31 (or 1.4%) to US$93.65 a barrel.

- Last trading week (ending August 12) all key US inflation measures recorded slower-than-expected growth. In response, expectations of future rate hikes were wound back, the US dollar fell and US share market indexes rose.

- Shares of Walmart climbed 5.1% after the retailer forecast a smaller drop in full-year profit than previously projected. But rising US government bond yields weighed on high-growth technology shares.

- US treasuries fell on Tuesday (yields higher) as encouraging results from American retail giants suggested the US Federal Reserve has room to further tighten financial conditions as it battles four-decade high inflation. US 10-year yields rose by about 2 points to nearly 2.81%. And US 2-year yields lifted by about 7 points to nearly 3.27%.

You can see the bond market yields going up and down day after day. Shares have primarily been rising but any news that implies the Fed will continue going hard on interest rate rises is turning sentiment negative.

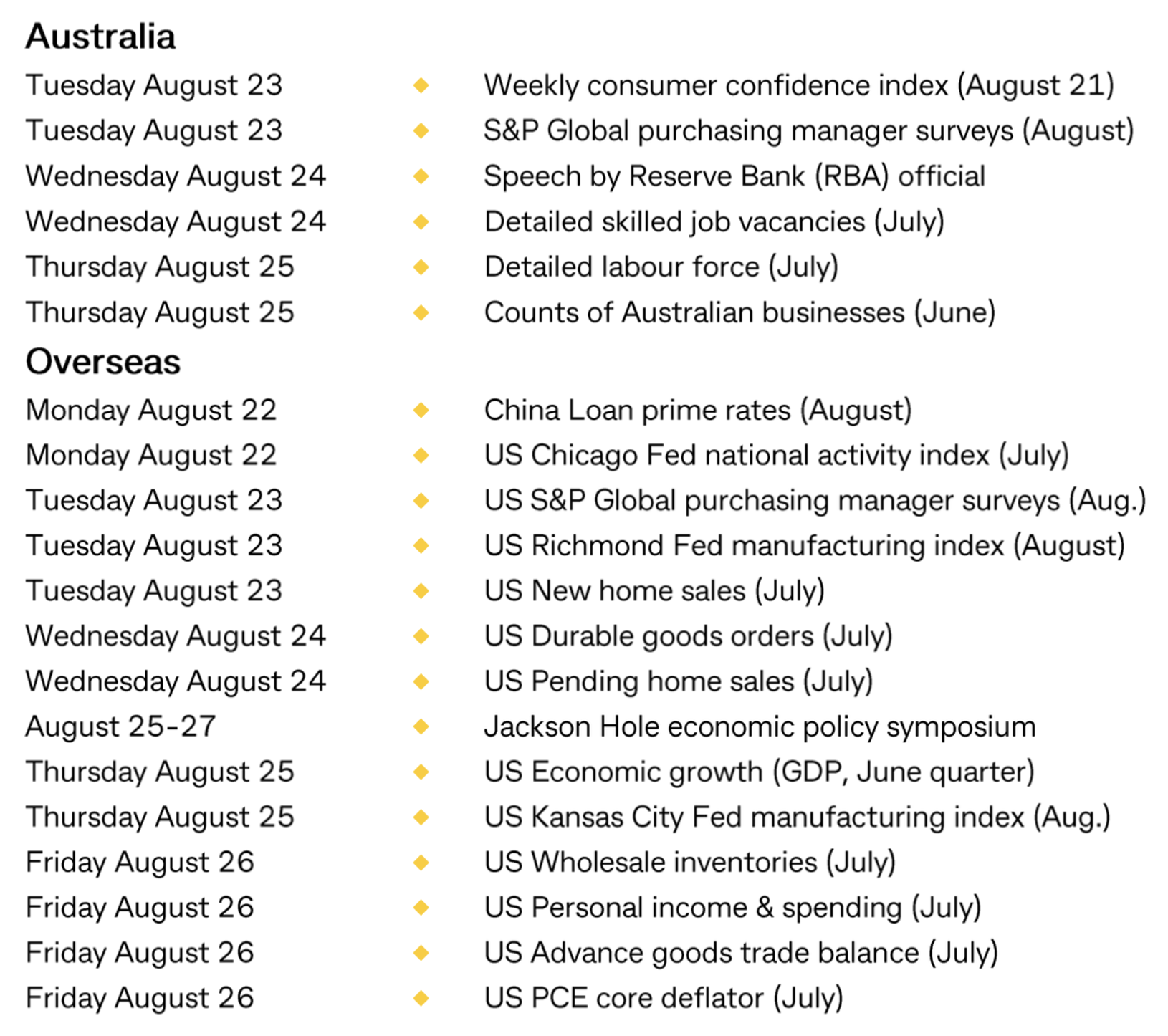

So when might the wait tell us that the worst of inflation and US interest rates is behind us? That will be September 13. Then later in September, the Fed decides on the next interest rate rise.

Until then I expect the stock market will find it hard to remain strongly positive and we’ll see profit-takers increase volatility. However, it would take a crazy curve ball from Russia, China, a key central bank or a statistician to make stock markets retest the June lows.

The current run of economic data makes me think that the ‘bub’ due in late September will be a bull. If I’m wrong and the ‘labour’ isn’t over, we’ll have another long wait into October before we can pull out the cigars. (Do young people still do that?)

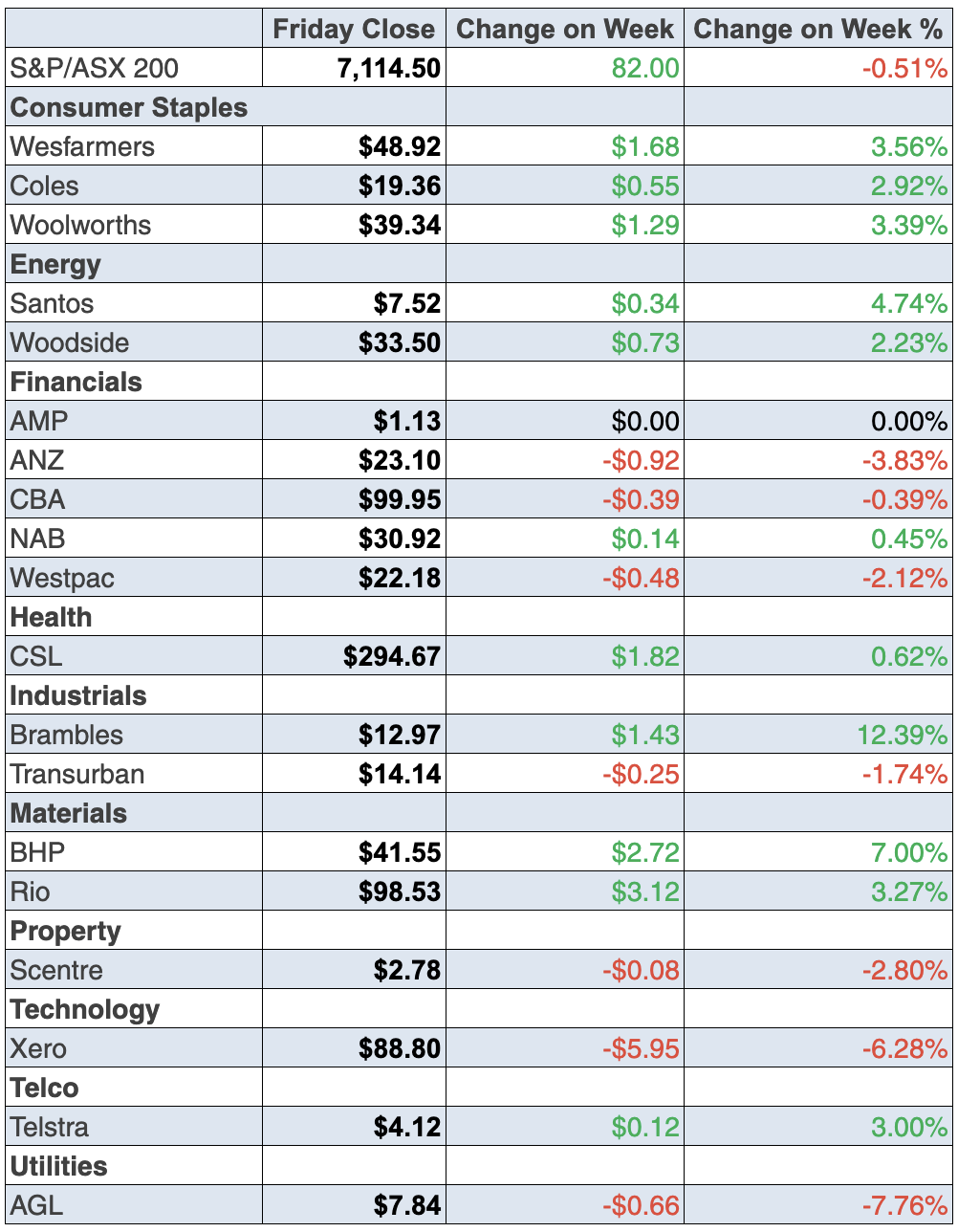

To the local story and the S&P/ASX 200 rose 1.17% (or 82 points) for the week. The AFR singled out energy stocks as the star performers. On Friday, Santos added 6.4% to $7.52 in its best day since March, as Whitehaven Coal jumped 6.2% to $7.36 and New Hope rose 4% to $4.93, Emma Rapaport reported. “Largest in the energy sub-index, Woodside Energy firmed 4.1 per cent to $33.5, as oil prices extended a 24-hour rebound.”

TPG copped it after reporting badly. Its shares fell 12.4% to $5.80!

Gold is back in favour for some, with Newcrest up 3.64% on Friday but Evolution Mining lost 8.66% for the week to close at $2.53.

Meanwhile, AGL is on a slide, losing 8.09% for the week to close at $7.84.

For a big picture look at reporting season, here’s Shane Oliver’s take: “The Australian June half earnings reporting season has now seen around 65% of company profits by market capitalisation report. Overall results are a bit soft, and they have slowed down since the initial recovery from the pandemic lockdowns. So far only 33% of results have surprised on the upside, 58% have seen earnings up on a year ago and 52% have increased dividends all of which are below average reflecting the cost pressures some businesses are facing. Reflecting this only 45% of companies saw their share prices outperform the market on the day results were released which is well below the norm of 54%. A significant proportion of companies have flagged earnings growth this year below inflation.”

What I liked

- The weekly ANZ-Roy Morgan consumer confidence index rose by 4.9% (the biggest increase in 16 months) to 84.2 points (the long-run average since 1990 is 112.2). Plus CBA economists reported the CBA Household Spending Intentions index rose by 1.1% in July to 114.8 points. (These are good signs for the health of the economy but the RBA could be pondering if their rate rises are working to scare the consumer into lower spending to bring down inflation.)

- Including bonuses (total hourly rates of pay), wages rose by 0.78% in the June quarter to be up by 3.13% on a year ago, the strongest annual growth rate in 9½ years (since December 2012). Private sector wages rose by 0.72% in the June quarter to be 2.65% higher when compared to a year ago — the strongest annual pace in 8½ years (since September 2013). Including bonuses, private sector wages grew by 0.86% in the quarter to be up 3.29% over the year – the strongest annual growth rate in a decade (since June 2012). However, this was weaker than expected and might mean the wage hit onto inflation might prove to be less than has been expected. This would be good for bringing down the RBA’s aggression toward interest rate rises.

- The jobs report probably showed that the RBA’s interest rate policy is working despite unemployment actually falling from 3.5% to 3.4%. Against that, full-time jobs were down 86,900 and the participation rate dropped from a record high of 66.8 to 66.4. Hours worked also fell. This is only one month so it’s early days for assessing how the rate rises are actually impacting the economy. Remember, we need a slowing economy to bring down inflation but we don’t want a recession so the 46,000 rise in part-time jobs is an OK development.

- Economists expected jobs to rise by 25,000 so the net fall of 40,900 (minus 86,900 + 46,000 = 40,900) was something the RBA would’ve liked to see.

- Following these numbers, CommSec’s Craig James said the CBA economics team thinks the September interest rate rise could be peeled back from an expected 0.5% to 0.25%, which might be one month early, but I hope they’re right.

- US industrial production rose by 0.6% in July (survey 0.3%), which might be a good sign that the US can avoid a real recession.

What I didn’t like

- The Australian Bureau of Statistics (ABS) has introduced a monthly Consumer Price Indicator (CPI). In June 2022, the monthly CPI was up 0.7% to stand 6.8% higher than a year ago. I like having a monthly inflation reading but I would’ve liked it to be lower.

- The CommSec take on the US Fed minutes that said: “Participants, [on the Fed Committee] agreed that there was little evidence to date that inflation pressures were subsiding. But many participants also noted a risk that the Fed could tighten the stance of policy by more than necessary to restore price stability”.

- UK inflation hit 10.1% in July, the highest in 40 years.

- In US economic data, the Empire State manufacturing index fell from 11.1 points to minus 31.3 points in August (5 points) and the NAHB Housing Market index fell from 55 to 49 in August (survey: 55). The Fed has to be careful about going too hard with its 0.75% rate rises.

- In Chinese economic data, retail sales rose 2.7% in the year to July (survey: 5%). Industrial production rose by 3.8% (survey: +4.6%). The excessive lockdown hangover is still holding back the Chinese economy.

- Germany’s ZEW economic sentiment index declined from minus 53.8 to minus 55.3 in August (survey: minus 52.7).

No Wall Street from me

Right now, I’m writing this over the Bay of Bengal as our plane heads toward Dubai. Then we’re off to London for Harper’s Bazaar business (our media operation publishes this wonderful masthead) but it means I’ll miss all the Wall Street action on Friday night our time.

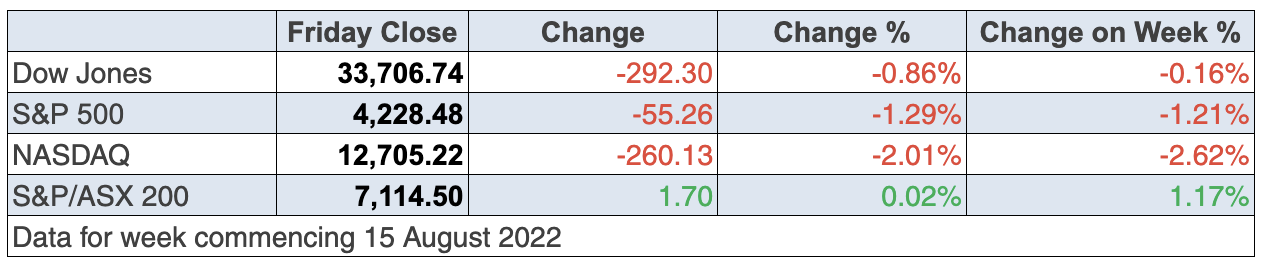

Given the ups and downs of the US market this week, I don’t have the courage to confidently tip what has happened to stocks, but my colleague Luke Stacey has provided the table of how markets have performed.

I’ll play catch up with Monday’s story. Have a great weekend!

The week in review:

- My message has always been that tech eventually will be re-loved. That love will start firstly with quality businesses that make profits but will extend to others with potential, as time goes by and interest rate rise fears dissipate. Buying quality and waiting has always been a great strategy. Here are 10 good companies (plus a few more for good measure!) that the analysts love.

- Paul (Rickard) takes a deep dive into Telstra today. Paul says while you’re never going to get rich by owning Telstra, with earnings now growing and dividend certainty, it’s increasingly looking like a low-risk investment asset.

- This week, Tony Featherstone’s focus is on Asian tech. Tony says prospective retail investors in Asian tech should use ETFs that provide diversified exposure rather than invest directly in a few stocks. They should use ASX-quoted ETFs for Asian tech exposure rather than buy ETFs on overseas exchanges. As such, he examines two Asian tech ETFs on the ASX that stand out.

- Back in July 2021, James Dunn took a look at the rare earths sector. And this week, James gives us an update on what he thinks are the best exposures to rare earths.

- In an article for this Report in July, Raymond Chan, Head of Asian Desk at Morgans, talked about upgrading Oz Minerals Limited (OZL) to ADD. As part of this edition’s “HOT” stock column, he adds a further comment to that view. In addition, Michael Gable, Managing Director of Fairmont Equities, says he sees bullish signs for Aristocrat (ALL).

- In Buy, Hold, Sell, What the Brokers Say, there were 8 upgrades and 15 downgrades in the first edition and 4 upgrades and 15 downgrades in the second edition.

- And finally, in Questions of the Week, Paul answers your queries about how sustainable BHP’s dividend yield of over 10% is; BlueScope says that it will frank its dividends next year. Why isn’t the current dividend franked?; Where can I find a list of the most shorted stocks? Is it time to bail on LiveHire (LVH)?

Our videos of the week:

- What is the immune system and what exactly does it do? | The Check Up

- The star stocks from reporting season: Telstra, BlueScope, Lovisa + 10 tech stocks analysts love! | Switzer Investing (Monday)

- Can we trust this stock market rally? Is BHP’s 11% dividend sustainable? How good was CSL’s report? | Mad about Money

- TOP STOCKS from reporting season! + Why these areas for property are looking attractive! | Switzer Investing (Thursday)

- Boom! Doom! Zoom! | 18 August 2022

Top Stocks – how they fared:

The Week Ahead: Food for thought: “Far more money has been lost by investors trying to anticipate corrections than lost in the corrections themselves.” – Peter Lynch

Food for thought: “Far more money has been lost by investors trying to anticipate corrections than lost in the corrections themselves.” – Peter Lynch

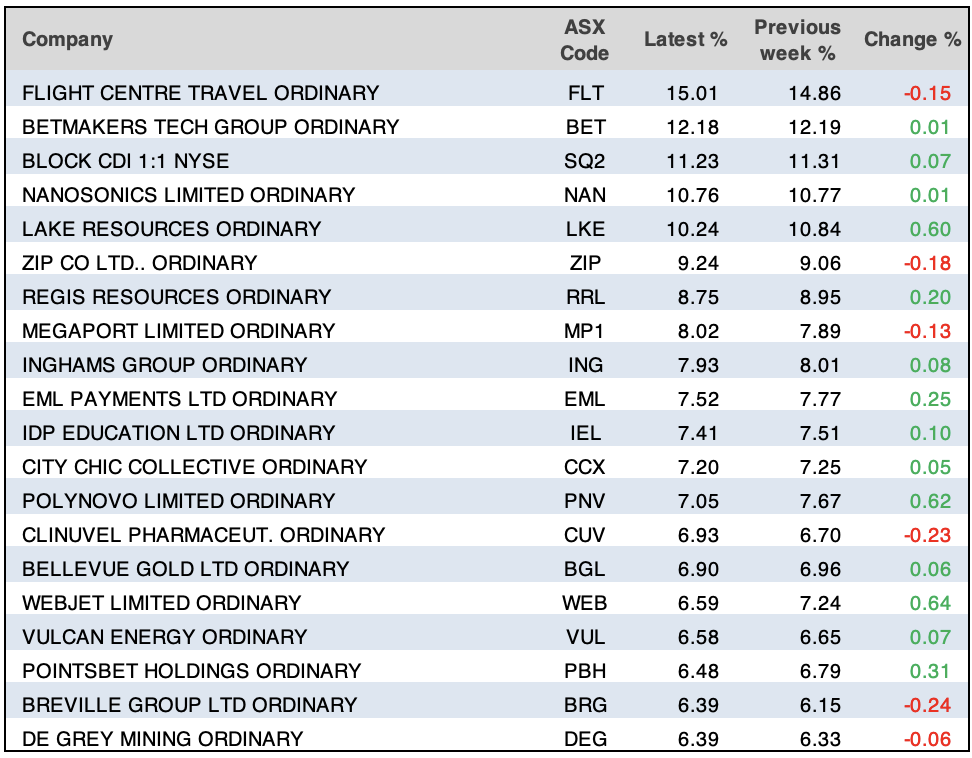

Stocks shorted:

ASIC releases data daily on the major short positions in the market. These are the stocks with the highest proportion of their ordinary shares that have been sold short, which could suggest investors are expecting the price to come down. The table shows how this has changed compared to the week before.

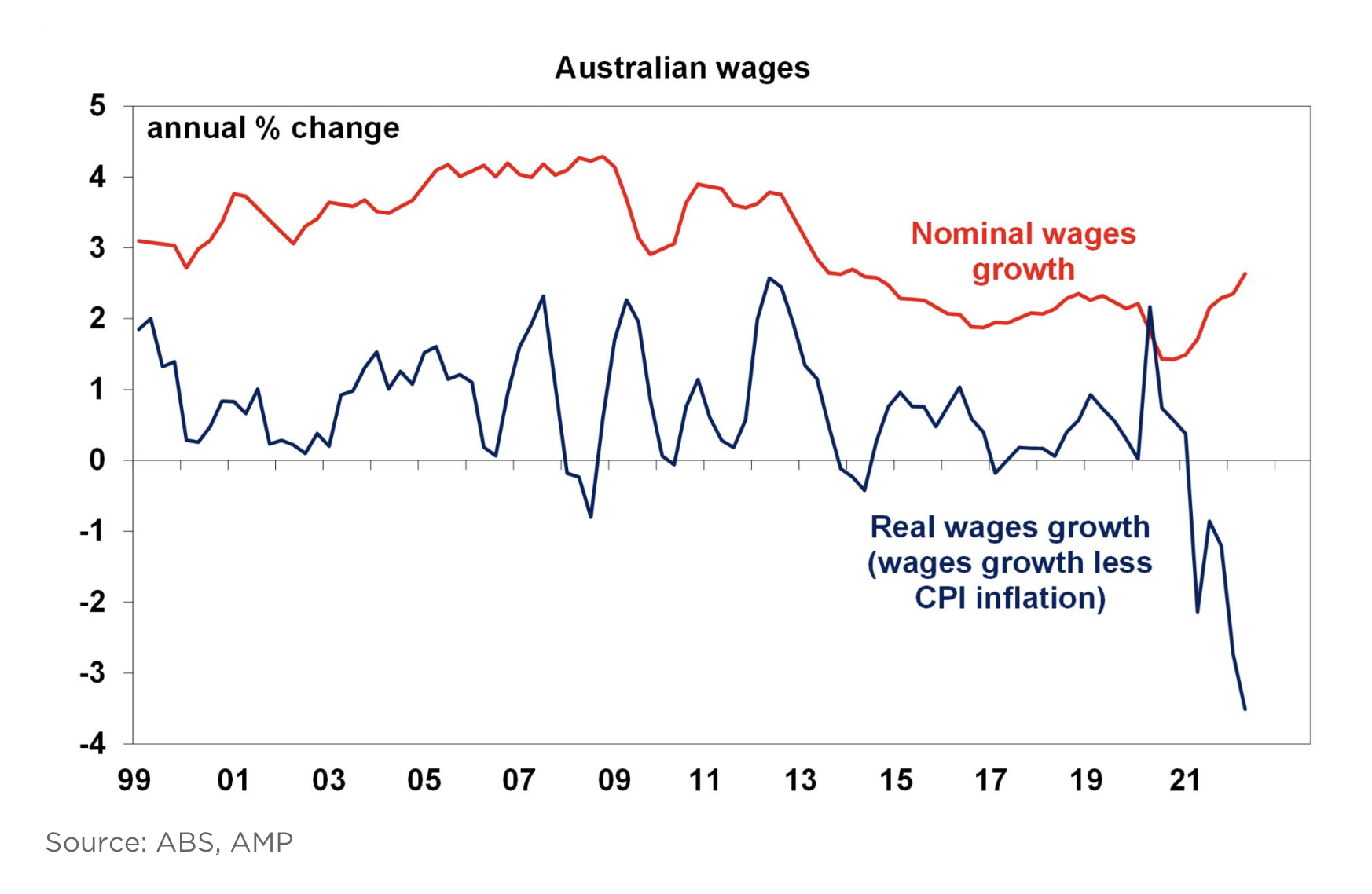

Chart of the week:

In our chart of the week, Diana Mousina of AMP Capital breaks down the June quarter wages data released on Thursday. The sharp difference between nominal wages and real wages is a sight for sore eyes.

“The June quarter wage price index released today showed a rise of 0.7% (below expectations of 0.8%) with a lift in annual growth to 2.6%. Private sector wages rose by 0.7% and public sector wages were up by 0.6% which shows that there is still some inertia in public-sector wage settings. Including bonuses, wages were stronger and rose by 0.8% indicating that employers are compensating staff with additional benefits which makes sense as the labour market is tight,” Diana notes.

“While wages growth is rising, it is occurring slowly which reduces [the risk of] a wage-price spiral but also means that real wages growth has fallen as inflation has outpaced wage prices. Real wages growth is down by 3.5% over the year – no wonder consumer sentiment has tanked to recession-like levels!”

Top 5 most clicked:

- 10 tech stocks the analysts love – Peter Switzer

- Telstra is a classic “annuity” stock – Paul Rickard

- My 4 latest rare earth picks – James Dunn

- Two stand-out Asian tech ETFs on the ASX – Tony Featherstone

- Buy, Hold, Sell – What the Brokers Say – Rudi Filapek-Vandyck

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.