Market confusion got more challenging with the US economy, technically in a recession, producing a strong jobs report. And Wall Street players didn’t run for the exits, dumping stocks along the way.

How did that happen?

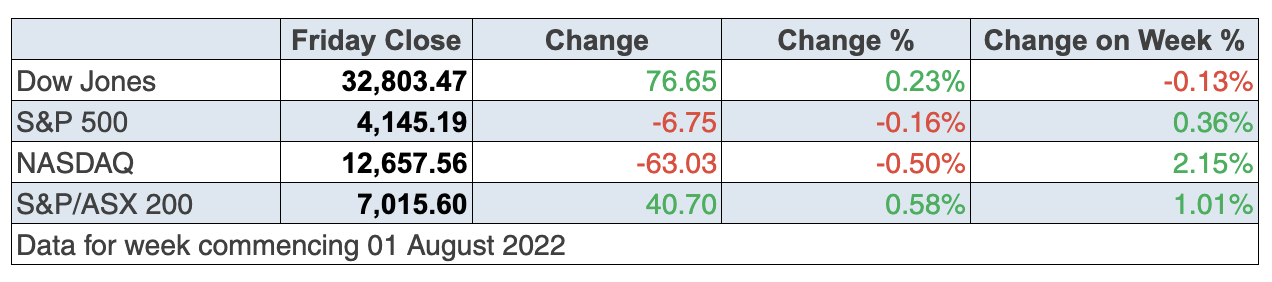

Before I reveal how strong the jobs numbers were, remember the stock market is caught between fears of inflation and persistent interest rate rises from the Fed, and the threat of a recession.

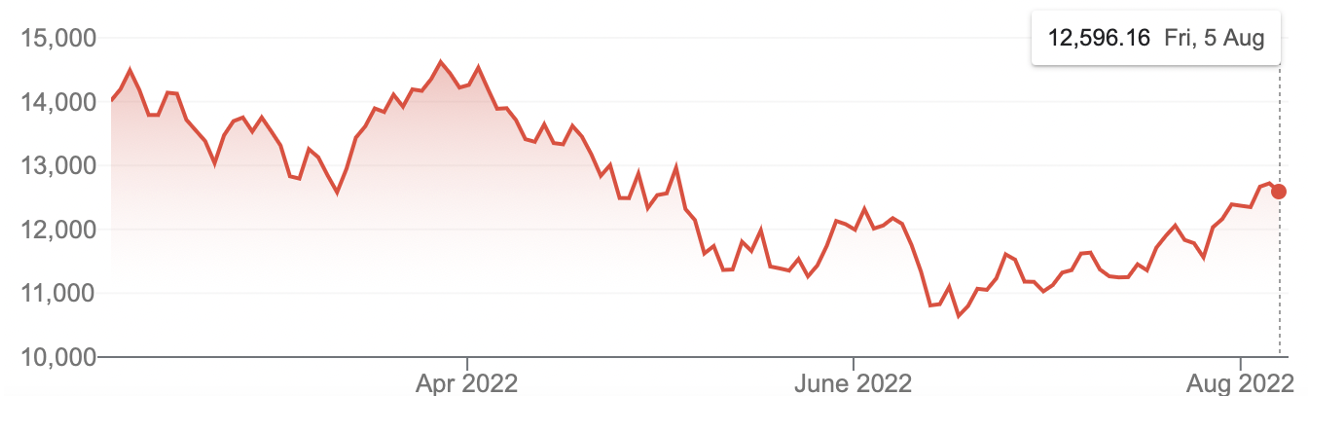

Right now, the S&P 500 has been rebounding — up 12.6% since June 16. This has been helped by how the recession fear has brought bond yields down and therefore reduced the number of interest rate rises the market expected to see from the US central bank.

This lower expectation about how high interest rates would go has really helped stocks, especially tech stocks, rebound. The Nasdaq is up 18% since June 16!

Nasdaq Composite

Until Friday, the consensus view that has taken US and our stock markets up has been helped by the economic slowdown/recession expectation in the States, but how does a labour market report bringing 528,000 jobs in July, which looks huge compared to the 258,000 predicted by economists surveyed by Dow Jones.

Also, unemployment dropped from 3.6% to 3.5% and wages growth was 0.5% for the month, which was higher than predicted.

It can’t be great for powering stocks higher because of the inflation and interest rates implications, but Wall Street didn’t overreact. What does that mean?

“Anybody that jumped on the ‘Fed is going to pivot next year and start cutting rates’ is going to have to get off at the next station, because that’s not on the cards,” said Art Hogan, chief market strategist at B. Riley Financial to CNBC. “It is clearly a situation where the economy is not screeching or heading into a recession here and now.”

The Fed meets in September and the next jobs report for August will be seen before the central bank doles out its next rate rise. And this puts the focus firmly on the July Consumer Price Index reading out on August 10. If there’s no discernible fall in inflation, the market will expect another 0.75% rate hike from the Fed and that can’t be great for this rally that started in mid-June.

That rally was predicated on a belief the Fed was set to slow down how quickly it raised interest rates and that CPI number on August 10 will be a ‘make it or break it’ statistic for stocks.

Helping positivity has been reporting season, with FactSet revealing that after 87% of US companies in the S&P 500 having reported, 75% had come in with better-than-expected earnings per share results. Considering the news about recession, inflation and aggressive interest rate rises, that’s not a bad result.

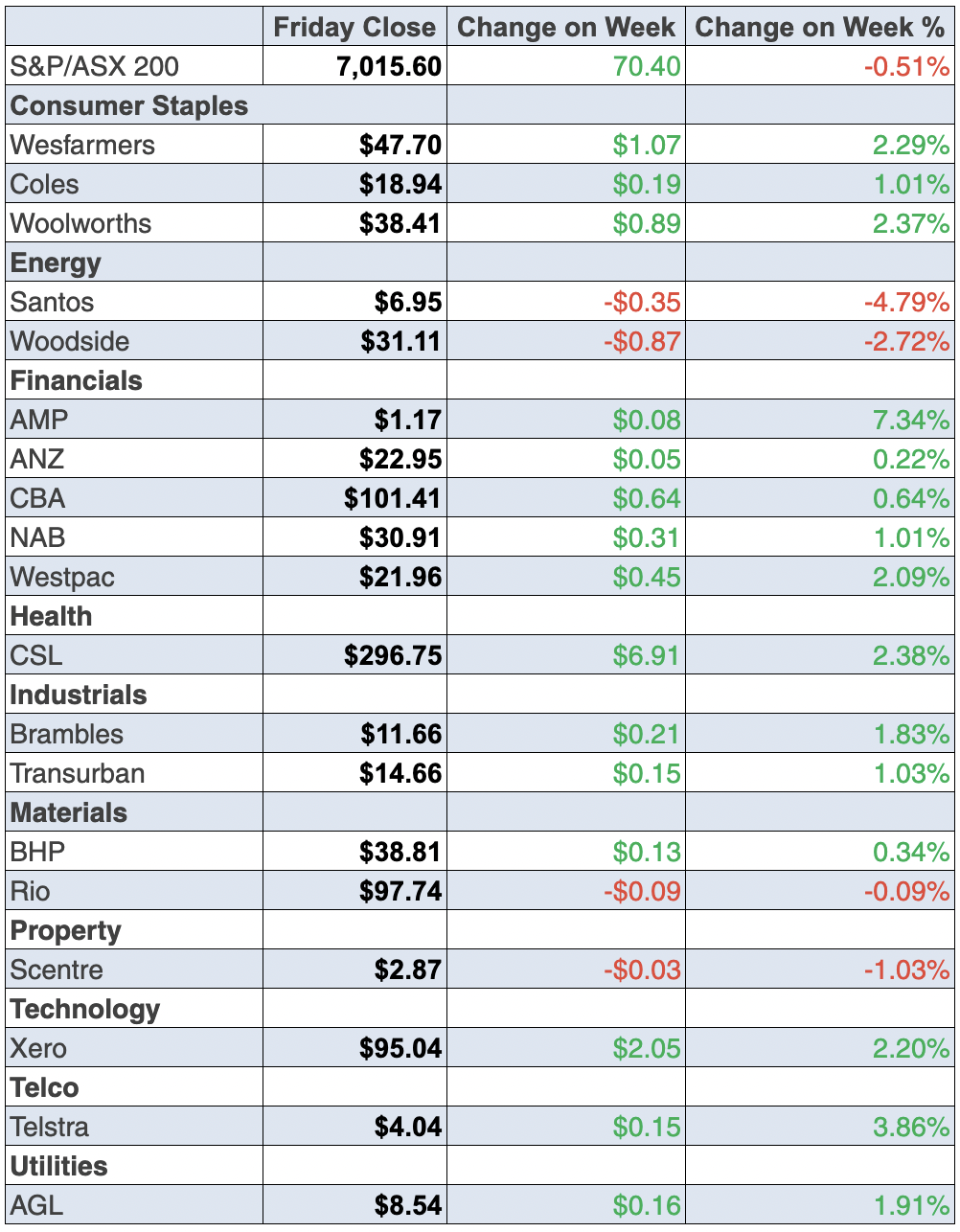

To the local story and the S&P/ASX 200 hit a two-month high, vindicating the cautious optimism I’ve been sharing with you since late June. The Index finished at 7015.5 and that was a 70-point or 1% gain for the week, which means a 6.4% rise for the month.

Since the June 20 low, there has been a 9% rise, which means for the year so far the sell-off has been only 6.94%. The former high was August 13 so the drop has been about 8%.

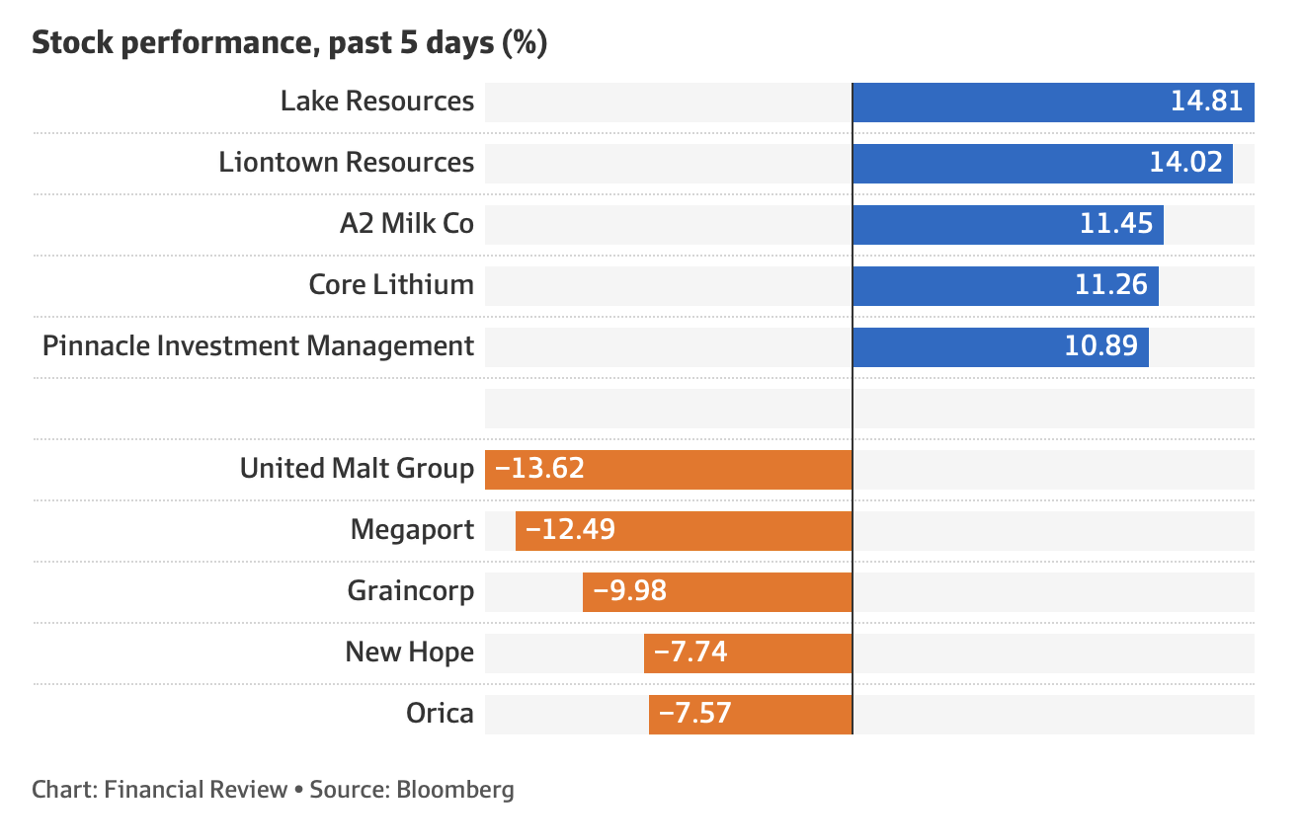

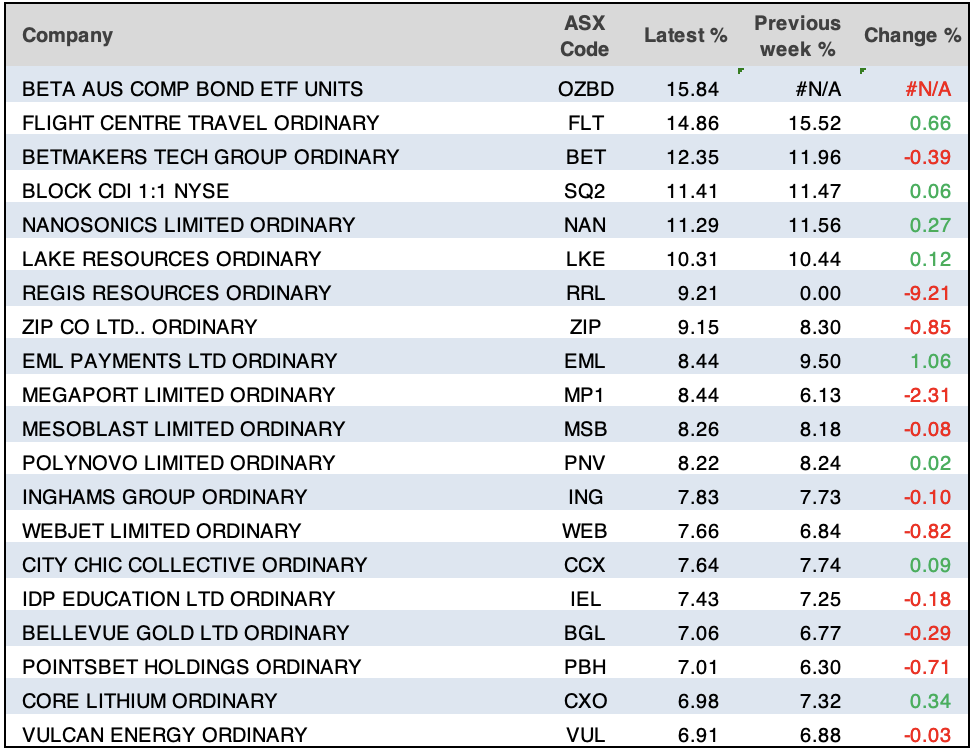

Here are the winners and losers for the week.

With reporting season out of the blocks, those with good stories will win friends and vice versa. There’s also profit-taking afoot, with the likes of recent star performer Megaport down 12.49% for the week, but it’s still up 35.46% for the month.

Lithium miners and battery players are back in favour, with Mineral Resources up 5.76% for the week. Novonix wacked on 5.48% for the week but year to date it’s down 70.72%!

And at long last A2 Milk has started to repay patient investors with an 11.45% jump this week following reports that the US Food and Drug Administration (FDA) would approve A2 Milk to sell infant formula products in the US. However, in an announcement to the market, A2 Milk said: “The company wishes to confirm that while we have been informed by the FDA that our application is under active review, at this stage there is no certainty as to the outcome of the application or the timing of any approval.”

Meanwhile, Appen, a perennial disappointment, lost 24% this week after the company’s CEO revealed that the underlying earnings before interest, tax, depreciation and amortisation (EBITDA) for the first-half of this year were 69% below what was heralded by its CEO Mark Brayan. This was also under the expectations of analysts. Media reports say “its five major customers, which account for 80 per cent of its revenue, may be growing less dependent on its services!” (SMH)

What I liked

- The RBA Board said that it “expects to take further steps in the process of normalising monetary conditions over the months ahead, but it is not on a pre-set path”.This is an important addition to the final paragraph of the statement to indicate that future rate hikes could be either smaller or larger depending how data evolves.

- The value of new home loans to owner-occupiers fell by 3.3% in June, with loans to investors down 6.3%. It looks like the rate rising policy is slowing down demand.

- More evidence that rate rises are working with the number of dwelling approvals falling by 0.7% in June following an 11.2% increase in May, but rate rises have been more aggressive since then. In the 2021/22 year, approvals were down by 9.4%.

- In July, ANZ job ads fell by 1.1% – only the second fall in the past six months. This should help slow down inflation.

- Retail trade rose 0.2% in June to be up 12% on the year. In the June quarter, sales rose by 1.4% in real (inflation-adjusted) terms, to be up 5.5% on the year. A small rise in retail is OK.

- A total of 84,461 vehicles were sold in July bringing the year-to-date total to 622,319. This result represents a 0.4% increase on the same month in 2021.

- The ANZ-Roy Morgan consumer confidence index rose by 2.1% last week to 84.1 points – the biggest rise in five weeks (long-run average since 1990 is 112), which is good for believing a recession is not on the cards.

- The seasonally adjusted goods and services surplus increased by $2,654 million to a record $17,670 million in June. Australia has now posted 54 successive monthly trade surpluses.

- The ISM services index in the US rose from 55.3 to 56.7 in July (survey: 53.5).

- The ISM manufacturing index in the US fell from 53 to 52.8 in July (survey: 52). Any number over 50 means the sector is still expanding, which supports the view that the US is not in a real recession.

- The S&P Global manufacturing purchasing managers index fell from 52.7 to 52.2 in July (survey: 52.3) but again, the number is still over 50.

What I didn’t like

- The Melbourne Institute monthly headline inflation gauge rose by 1.2% in July – the biggest monthly rise in 20 years. The annual rate rose from 4.7% to a 19-year high of 5.4%.

- The Reserve Bank (RBA) Board has lifted the cash rate by 50 basis points (half of a percent) for an unprecedented third straight month, taking the cash rate to 1.85% – the highest level since April 2016. CommSec says that this represents the most aggressive monetary policy action since 1994. We have to hope that the RBA hasn’t overplayed its hand.

- The RBA has cut forecasts for economic growth and significantly raised forecasts for inflation. The economy is expected to expand by 2.25% over the year to June 2023 (previous: 3%), before slowing to a 1.75% annualised rate through to 2024.

- The Bank of England raised interest rates by 50 basis points to 1.75%, the most in 27 years. At the same time, the BoE warned about the potential for recession, predicting a 2.1% fall in output from highs

- The S&P Global services index fell from 52.7 to 47.3 in July (survey: 47).

- The US House of Representatives speaker Nancy Pelosi visited Taiwan, creating tensions between the US and China and weighing generally on investor sentiment.

Sneak preview of good news

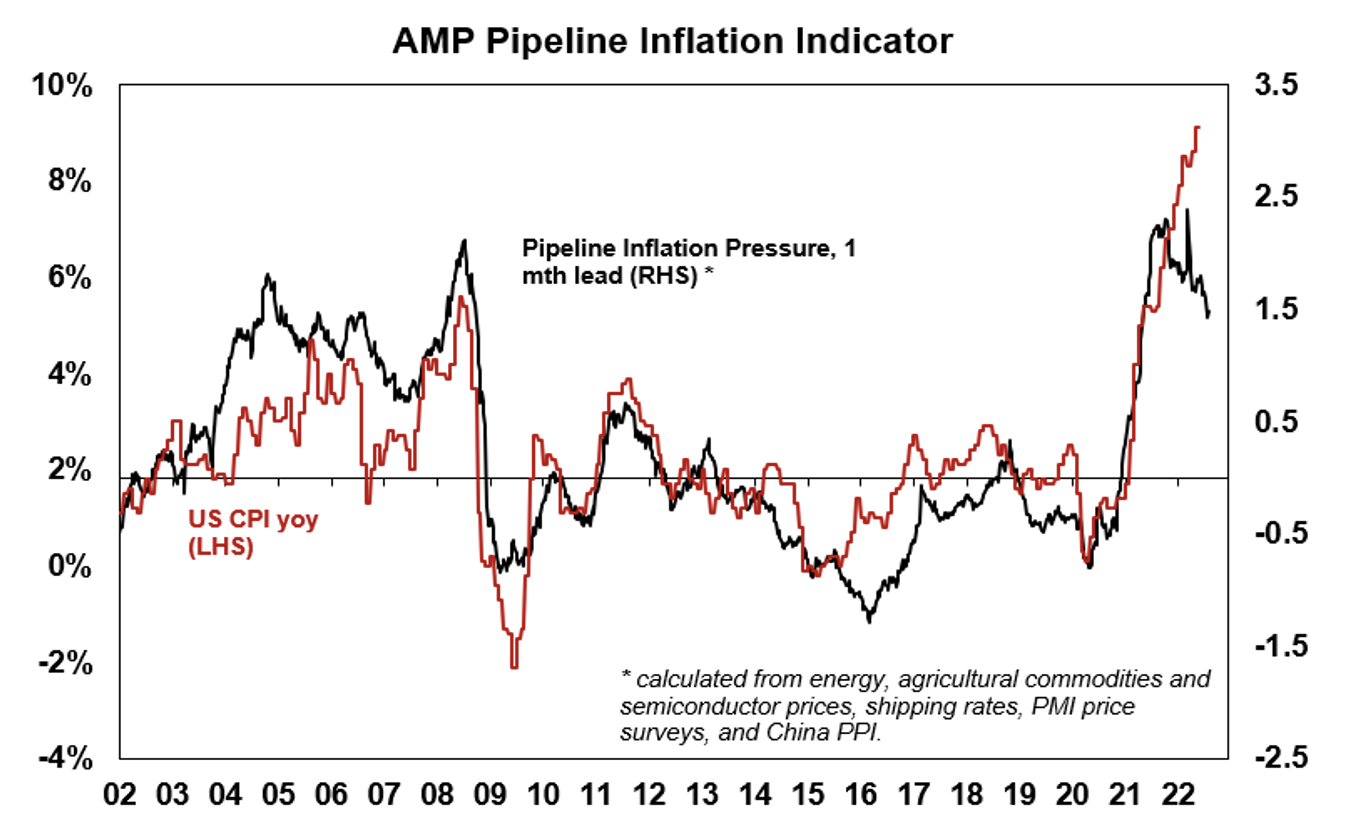

Shane Oliver’s inflation watch suggests US inflation is falling, which is really important for stocks. “Our US Pipeline Inflation Indicator is continuing to trend down reflecting a combination of a falling trend in work backlogs, freight rates, metal prices, grain prices and even oil prices,” Shane wrote this week. “This was also evident in the ISM business survey showing falling delivery times, order backlogs and price pressures.”

Note how US CPI (the red line) has been rising but the Pipeline Inflation Indicator (PII) is falling pretty strongly.

I’m hoping that the US inflation reading out this week (August 10) shows what the PII is showing.

The week in review:

- Regular readers know I’ve been canvassing the idea that the market has been trying to put in a bottom over the past month, so the question I asked this week in the Switzer Report is: Can I dare say to investors: “Ready, steady, buy!”?

- Paul (Rickard) says that investing in a royalty company like Deterra isn’t one of the most glamorous investment ideas, but it’s an interesting proposition for income seekers, particularly when the yield on offer is 7% fully franked. But as Paul says, like any investment, royalty investments carry risk. Even so, Paul likes the look of Deterra (DRR), at the “right price”. Paul also looks at Orica going up the value chain with acquisition and capital raising but asks: Is it a ‘screaming’ buy and should you invest in its share purchase plan?

- Quality tech companies are part of Tony Featherstone’s game plan because every company relies on tech. Tony says focusing on the world’s top tech companies makes sense and their recovery will be more sustainable as markets become confident that inflation is cooling and the trajectory of rate rises will start to even out. On that note, he suggests two tech ETFs to watch.

- James Dunn says that environmental, social and governance (ESG) investing is ever more entrenched as mainstream – with the ‘E’ part of it taking the lion’s share of both the assessment and the investor attention. The four companies James nominated this week not only show a clear and demonstrable social good, but they also stack up as an investment.

- In our “HOT” stocks column this week, Raymond Chan, Head of Asian Desk at Morgans, says that his top picks going into reporting season are CSL (CSL) & ResMed (RMD). Then Michael Gable, Managing Director of Fairmont Equities, says James Hardie Industries (JHX)’s share price is on the move again and he’s tracking it.

- In Buy, Hold, Sell — Brokers Say, there were 9 upgrades and 11 downgrades to ASX-listed companies covered by brokers in the FNArena database 3 upgrades and 6 downgrades from the 7 stockbrokers monitored by FNArena so far this week.

- In Questions of the Week, Paul (Rickard) answers your queries about whether profit reserves that most LIC’s (listed investment companies) report are included in their calculation of NTA (net tangible asset) value?; Why the prices on Nabtrade are different to the ASX’s website; If you sell your ANZ entitlements, how much will you get and will you need to pay tax? Will Mineral Resources (MIN) pay a final dividend?

Our videos of the week:

- Why taking Vitamin D is so beneficial for our bodies | The Check Up

- Is EML worth gambling on with a new CEO? Zip and Megaport on a rebound? + ELMO’s FY22 results! | Switzer Investing (Monday)

- Is the RBA about to pause the interest rate increases? Should RBA Governor fall on his sword? | Mad about Money

- Is it time to have the guts to buy stocks? + Can’t buy where you want to live? Try rentvesting! | Switzer Investing (Thursday)

- Boom! Doom! Zoom! | 4 August 2022

Top Stocks – how they fared:

The Week Ahead:

Food for thought: “Fame and wealth without wisdom are unsafe possessions.” – Democritus

Stocks shorted:

ASIC releases data daily on the major short positions in the market. These are the stocks with the highest proportion of their ordinary shares that have been sold short, which could suggest investors are expecting the price to come down. The table shows how this has changed compared to the week before.

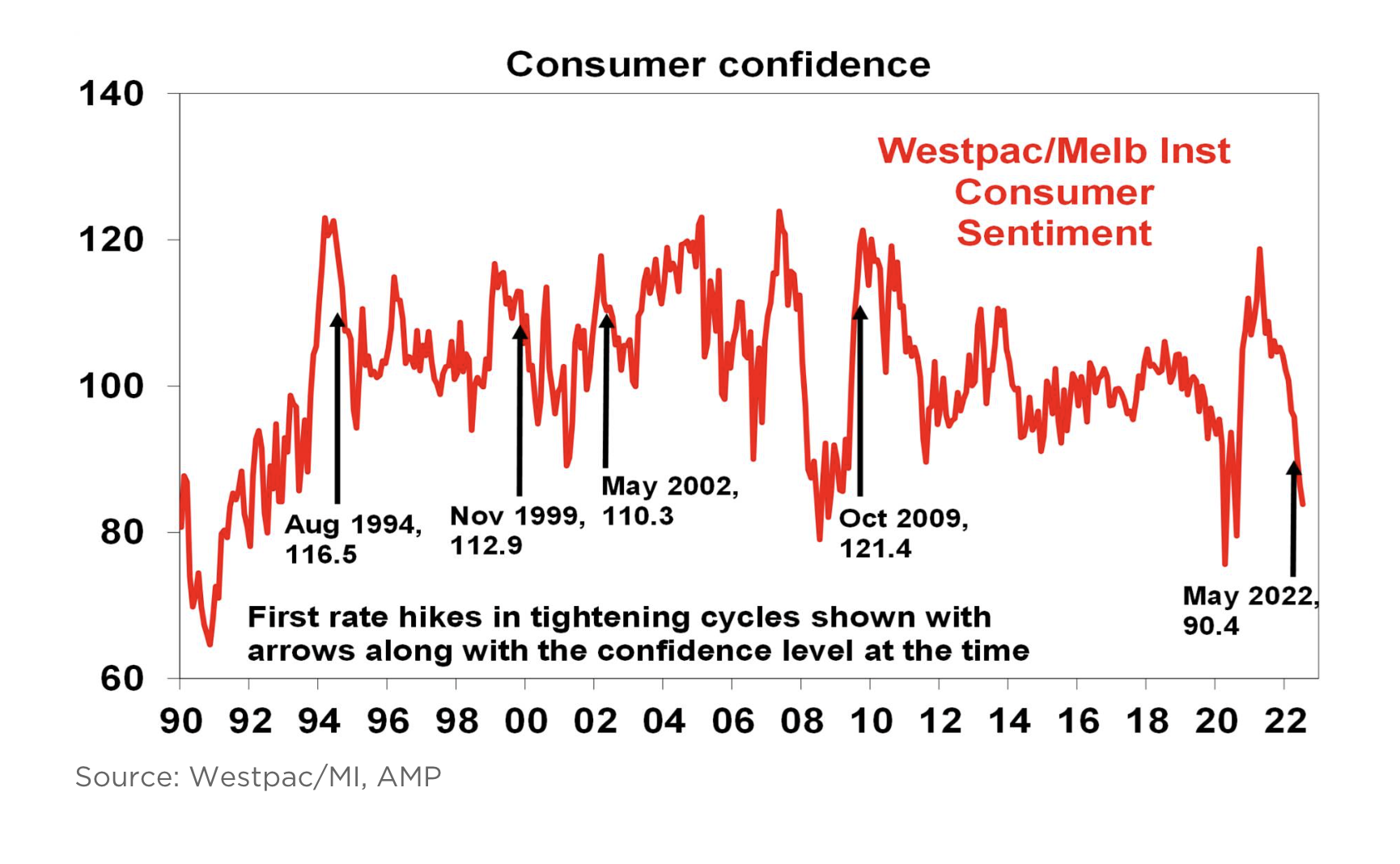

Chart of the week:

In our chart of the week, Shane Oliver of AMP Capital looks at the slowing in consumer confidence as a marker of interest rates potentially peaking in the 2% margin rather than 3%+.

“While job indicators are still strong these are lagging indicators. By contrast consumer confidence is at recessionary levels & well below where it’s been at this point in past RBA rate hiking cycles,” Shane says.

Top 5 most clicked:

- A stock with a forecast 7% franked yield? – Paul Rickard

- Is it ready, steady, buy time for stocks? – Peter Switzer

- 4 stocks putting the ‘S’ in ESG – James Dunn

- Buy, Hold, Sell – What the Brokers Say – Rudi Filapek-Vandyck

- Two tech ETFs to watch – Tony Featherstone

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.