Even though I’ve been arguing that markets are trying to bottom and tech stocks would eventually make a comeback, I’ve also been telling you that we have to see reporting seasons (in the US now and here in August) before we get serious about buying stocks again safely.

If you’re a thrill-seeking investor, buying on the dips now should produce good results by Christmas. But if you want to buy when the worst of sell offs is over, then you’ll have to wait to buy until the December quarter.

That’s been my story and I’m sticking to it, but I have liked the enthusiasm for tech stocks this week.

But it was tech/social media stocks that had a shocker on US markets overnight. Snap (the parent of social media giant Snapchat) lost 38% from its stock price on the bad report. It hurt other social media players such as Meta, the owner of Facebook, which was down 7.48% before the close.

This is why I prefer to wait for reporting to end before going in hard on stocks. Until Snap’s bad show-and-tell, tech companies were in the love zone again, but now doubt is returning. “Snap has managed to snap the uptrend in the Nasdaq by reporting disappointing earnings, which has created a cascading effect on the S&P,” said Sam Stovall, chief investment strategist at CFRA Research to CNBC. “This is just an example of the volatility that investors should expect as earnings are reported, and, therefore, could cause fluctuations in prices in response to better than or worse than results.”

Sam is a smart technical analyst, who I interviewed a few years back when I took my finance show to the Big Apple. While he thinks the market will trend higher, he wouldn’t be surprised to see the US market test the June lows. The course of reporting over next week and the Fed’s interest rate meeting also next week, and then the CPI on August 10 will be huge for stocks. If that’s a good reading, then interest rate rise expectations will be pulled back and yep, tech stocks will be loved again!

By the way, Sam’s view is a more short-term take on what stocks will do. In contrast, respected US equity strategist, Art Hogan of B. Riley Wealth, says his chart puts the S&P 500 at 4500 by year’s end. If he’s right, it would mean a 13.8% rise from where the index is now.

On US profit stories so far, after nearly 20% of S&P 500 companies having reported their June quarter earnings estimates, 72% of companies beat on expectations, which is slightly less than the historical average of 76%. But remember, only 20% of companies have reported, which is why I want to wait until the “fat person” comes on stage and sings at the end of reporting seasons in the US and here. And that US inflation number on August 10, hopefully, will bring music to my ears!

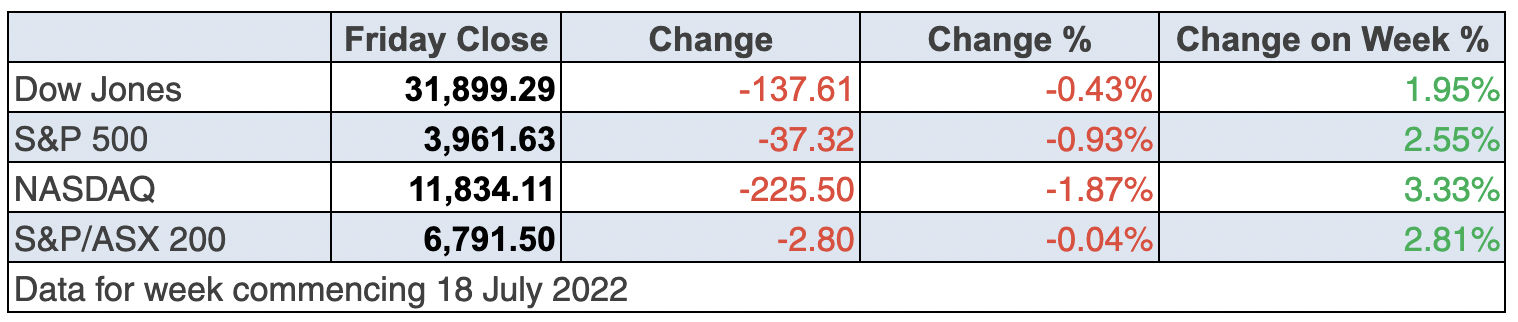

To the local story and it’s been a good week for stocks, with US reporting season and lower expectations around how high interest rates will go in the US helping tech stocks prove that recent market valuations were crazy.

As I said many weeks ago, we’re getting a sneak preview of what will happen when rate rises look to be over. That said, I’m not going to be keen to buy this market truly, madly, deeply until reporting season ends.

Our S&P/ASX 200 was up 2.8% for the week to finish at 6791.5. Tech stocks were up 7.1% and they figured in the winners of the week, at long last!

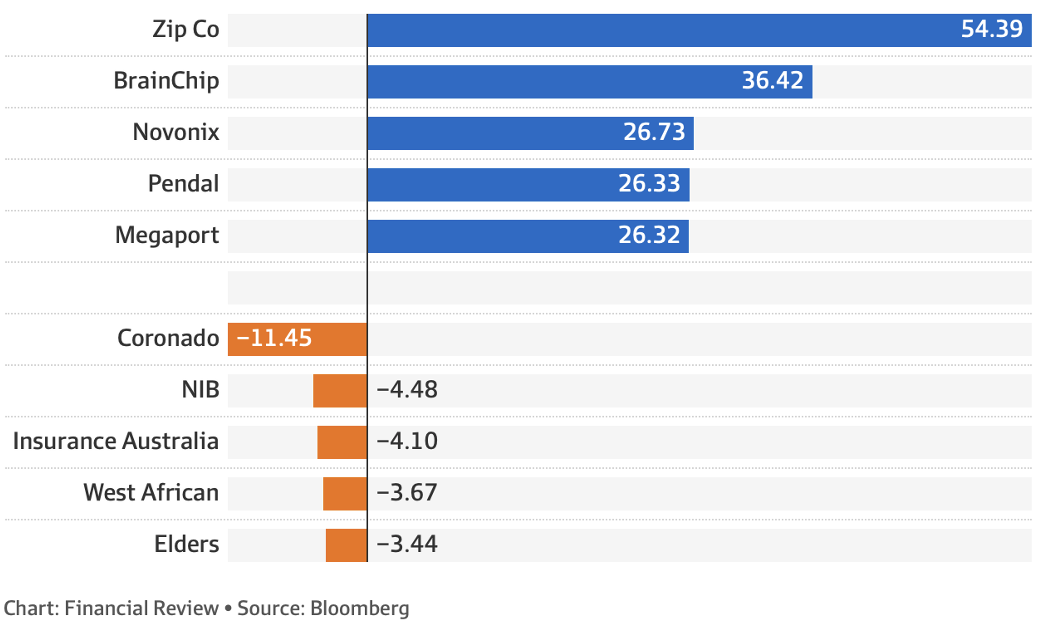

Stock performance, past 5 days (%)

Zip Co is showing what many tech stocks have to do to get loved again, and that’s cut costs and work to become a profitable business, even if it means less growth. It has dumped its purchase of Sezzle and is exiting its overseas growth plans.

Magellan was up 20.17% for the week after a better investing performance. In our Boom! Doom! Zoom! webinar, I’ve been saying MFG at a high $11 or low $12 looks to be a decent entry point, so a close of $14.12 on Friday was great to see. The company isn’t out of the woods but I think it will surprise many of its doubters over time, though I can’t see it making its old highs for a long time, if ever.

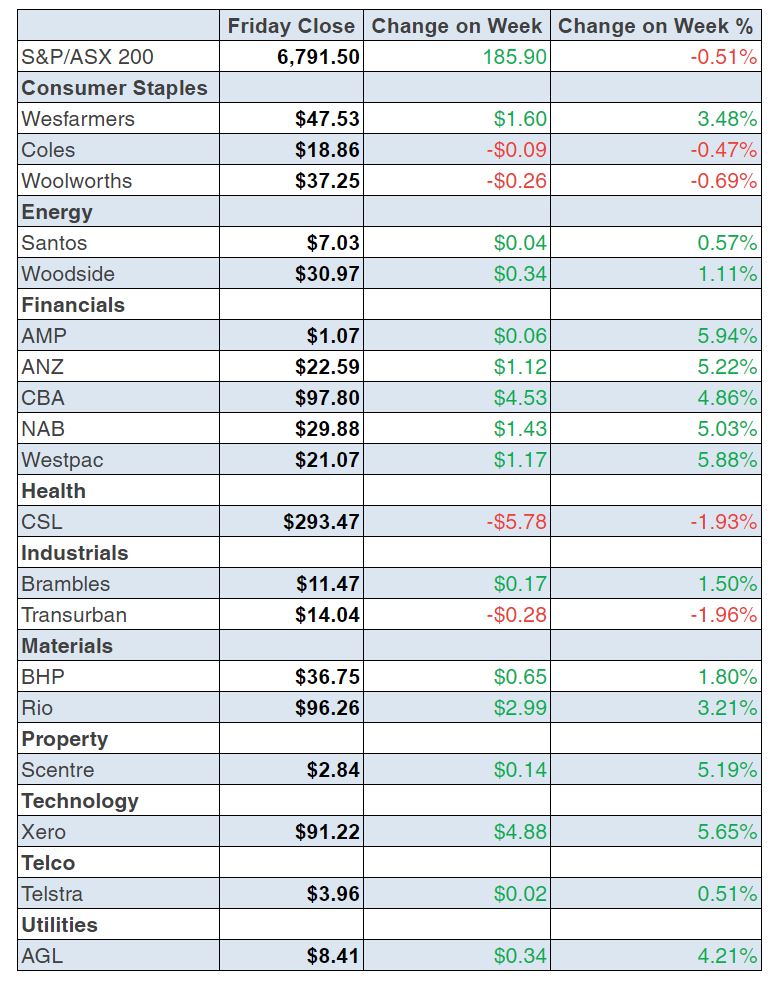

To the banks and ANZ was up on its play for Suncorp but not by much, rising 1.21% for the week to end at $22.59. Paul Rickard has covered this story in our Report this week and in summary said it’s a “no brainer” to take up ANZ’s rights offer. CBA put on 3.7% for the week to finish at $97.80, NAB rose 4.08% to $29.88 and Westpac gained 4.83% to $21.07, with market experts saying our banks were helped by the good profit reports for US banks lately.

What I liked

- In response to a question at a conference, the Reserve Bank Governor noted “…we have more interest rate increases to come. Two-and a half per cent is our rough estimate of the neutral rate. At some point I imagine that rates will get to at least that level. How quickly we need to get there and indeed whether we need to get there will be determined by the inflation outlook”. This says Dr Phil Lowe has no pre-determined view of when the cash rate needs to get to 2.5% and we might not need it so high for some time.

- The ANZ-Roy Morgan consumer confidence index rose by 0.2% last week to 81.8 points (long-run average since 1990 is 112). It was the first increase in confidence in three weeks.

- The national average unleaded petrol price fell by 8 cents to 204.1 cents a litre last week. The wholesale price fell by 17.5 cents a litre, so retail petrol prices should fall. This is great news for killing inflation.

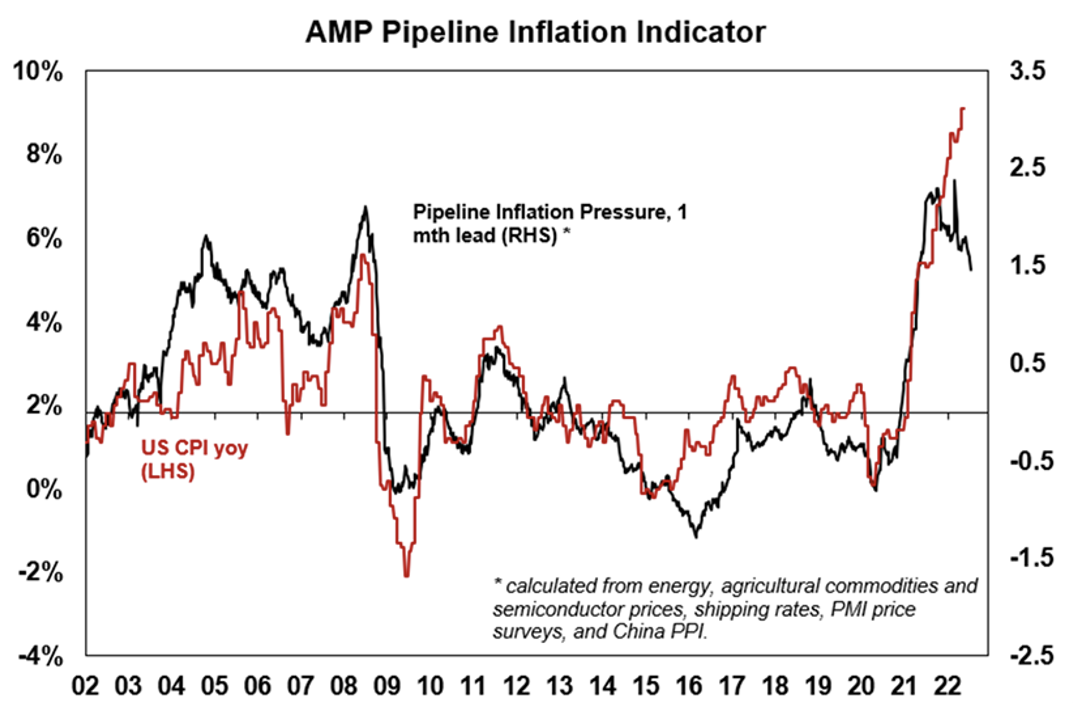

- From AMP’s economist Diana Mousina: “Lower commodity prices will be necessary to see a slowing in inflation. Our Pipeline Inflation Indicator (see chart below) continues to track down and points to a decline in inflation on a 6-12 month time horizon”.

- CBA’s internal credit and debit spending data to July 15 shows that consumers are reacting to higher interest rates and cost of living pressures by moderating their discretionary spending. We need to see this to believe that rate rises can slow down inflation.

- US housing starts fell by 2% from a 1.591 million annual pace to 1.559 million in June (survey: 1.58 million) and building permits fell from 1.695 million to 1.685 million (survey: 1.65 million). These were measured falls and they’re not suggesting the US is in recession.

- The Conference Board leading index dipped 0.8% in June (survey: -0.6%), which was a good measured fall.

- There was a report from Europe on Tuesday that Russian gas flows to Europe via the Nord Stream 1 pipeline were seen to have restarted on time following operational problems.

What I didn’t like

- The US PMI Composite output index (which tracks activity across the services and manufacturing sectors) fell to 47.5, indicating contracting economic output. That’s also the index’s lowest level in more than two years. While we need to see the US economy slow down to fight inflation, we don’t want to see a big recession in the world’s biggest economy. That said, the contraction still looks OK, but it’s still early days.

- Annual UK consumer price inflation rose by 9.4% in June, the strongest pace since February 1982 (survey: 9.3%). No wonder Boris has been shown the door.

- The National Association of Home Builders index in the US fell from 67 points to 55 points in July (survey: 65), the lowest reading since May 2020. This is a pretty big fall. Remember, we don’t want the US going into recession. A slowdown is good to help bring inflation down but a recession would hurt stocks.

- The Philadelphia Fed manufacturing index fell from -3.3 to -12.3 in July (survey: 0.8). This was a big drop and could be a bad sign for the US economy.

- US existing home sales fell by 5.4% in June to an annualised two-year low of 5.12 million (survey: 5.35 million). MBA mortgage applications fell by 6.3% last week (prior week: -1.7%). These are biggish falls but they have to follow the big hikes in interest rates in the US.

European rate rise helped stocks worldwide

The European Central Bank (ECB) raised all three of its main policy rates by 50 basis points (the biggest hike since 2000) for the first time since 2011 and the ECB President Christine Lagarde said: “We expect inflation to remain undesirably high for some time”.

This overdue move, delayed by the Ukraine war and its recessionary effects, sent the US dollar down and the euro and our currency up, but it also helped stocks and in particular US tech stocks that sell worldwide.

Why?

Morgan Stanley’s Michelle Weaver explained in a note to clients this week that the dollar’s rally since February 2021 was a headwind to earnings for US companies, which combined make roughly 30% of sales abroad. For example, IBM lost $US900 million from revenue because of the stronger dollar. Meanwhile, Netflix which earns 60% of its revenue overseas, saw its share price rise over 14% this week. The lower greenback and the expected lower dollar helped that spike in its valuation.

The week in review:

- This week in the Switzer Report, I discuss how Economic indicators don’t suggest crisis will continue. The next two weeks will be critically important for what stocks do for the rest of the year. Have a read of what I’ve collated, and you might even believe that a stocks comeback could show up even earlier.

- Paul (Rickard) in his earlier article this week, mentions ANZ’s has abandoned a plan to buy accounting software provider MYO. Now it will raise $3.5 billion to acquire Suncorp. Should you take up your entitlements?. Furthermore, in his second article of the week, Paul (Rickard) looks at JB Hi-Fi ‘pre-releasing’ on Tuesday. Results show both record sales and record earnings and Paul (Rickard) discusses 3 things he really likes about the company.

- This week Tony Featherstone discusses two essential investments for tough times. He discusses how investors who want to buy in this market should favour companies that provide the essentials and have some pricing power.

- Dividend yields are holding their own with regards to three of the banks, three of the big miners and two coal producers. It is a good time for yield-oriented share investors, with potential dividend yields on offer. James Dunn gives two industrial stocks for dividend yield investors.

- In our HOT stock column this week, Raymond Chan, Head of Asian Desk at Morgans, tells us why he likes the Energy sector, particularly Santos (STO). Furthermore, Michael Gable, Managing Director of Fairmont Equities, advises that at current levels Goodman Group (GMG) is a buy.

- In Buy, Hold, Sell — What the Brokers Say, there were 5 upgrades and 12 downgrades in the first edition and 7 upgrades and 2 downgrades in the second edition.

- And finally, in Questions of the Week, Paul (Rickard) answers your queries about how to take up your ANZ rights. Can you lower the overall risk in your portfolio without sacrificing too much growth opportunity? Why are the analysts always bearish on CBA? Is copper producer Aeris Resources a good buy?

Our videos of the week:

- Are e-cigarettes really safer than cigarettes? | The Check Up

- The 10 stocks that should be in your portfolio! + The experts like JBH, CSL and coal stocks?! | Switzer Investing (Monday)

- Stocks have been up recently, should you by now or later? + ANZ rights issue, good or a bad deal? | Mad about Money

- Rudi tells us his favourite tech stocks! + What stocks is Marcus picking up and which will he drop? | Switzer Investing (Thursday)

- Boom! Doom! Zoom! 21 July 2022

Top stocks – how the fared:

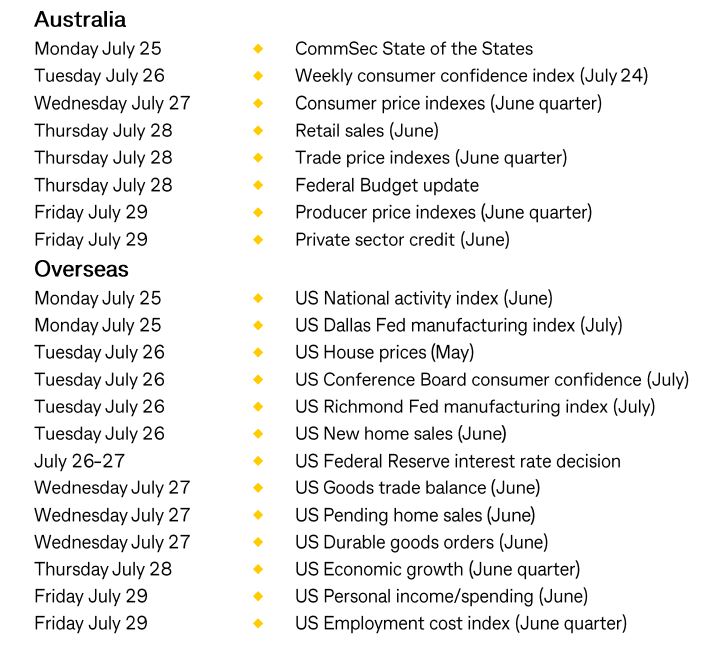

The Week Ahead:

Food for thought: A winning strategy must include losing. – Robert Kiyosaki

Stocks shorted:

ASIC releases data daily on the major short positions in the market. These are the stocks with the highest proportion of their ordinary shares that have been sold short, which could suggest investors are expecting the price to come down. The table shows how this has changed compared to the week before.

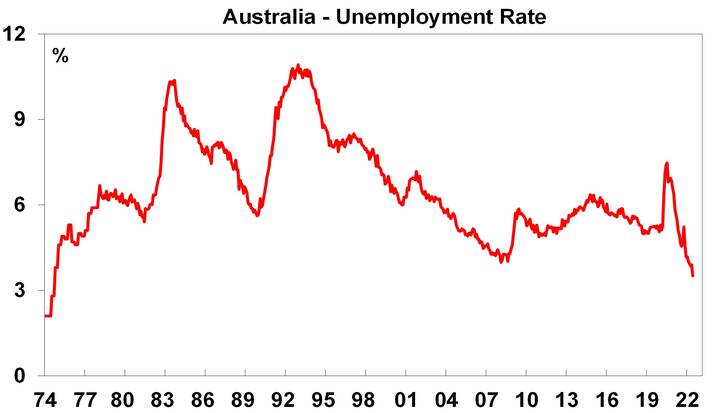

Chart of the week:

June saw another very strong jobs report in Australia with employment up far more than expected, unemployment falling to 3.5% which is its lowest since 1974, total labour market underutilisation remaining at its lowest since 1982 and labour force participation rising to a record high.

Source: ABS, AMP

Source: ABS, AMP

Top 5 most clicked:

ANZ to raise $3.5bn for Suncorp acquisition. Should you take up your rights? – Paul Rickard

Economic indicators don’t suggest crisis will continue – Peter Switzer

Buy, Hold, Sell – What the Brokers Say – Rudi Filapek-Vandyck

Two industrial stocks for dividend yield investors – James Dunn

Two essential investments for tough times – Tony Featherstone

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.