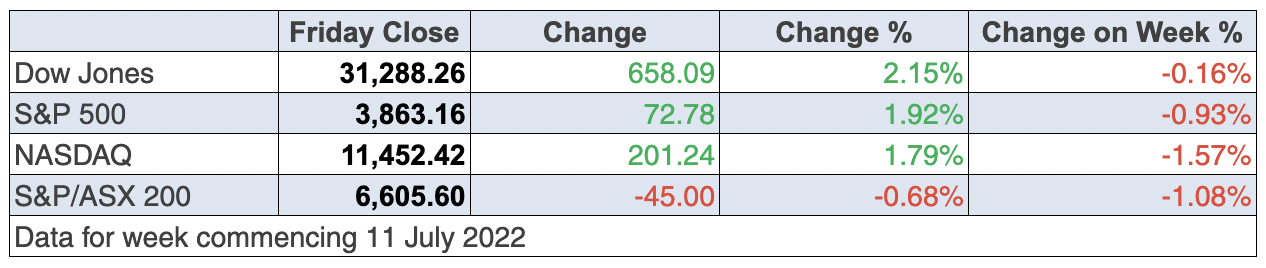

Just when you had to be saying “what a week!”, with US inflation, our jobs report and China’s latest growth story all screaming that another leg down for stocks was looming, the US reporting season brought better-than-expected news driving the Dow up over 2%!

Earlier in the week, reporting didn’t start well with shares of JPMorgan Chase off 3.5% and Morgan Stanley down 0.4% after US banks reported a slump in quarterly profits and warned of an impending US economic slowdown. Clothing retailer Gap dropped 5% on the day its CEO quit, but Pepsi went up 0.6% after beating expectations and Boeing’s share price soared 7.4% after the plane maker’s June aircraft deliveries were the highest since March 2019.

But overnight reporting news topped that, with Citi’s stocks up a whopping 14.4% at one stage and Wells Fargo up 6.8%, following their respective show-and-tell reports. Rising interest rates are helping their future profits and there’s a growing belief that if a recession looms, it will more likely be mild rather than deep.

Retail numbers overnight also helped those arguing a serious recession isn’t on the cards, as this from Reuters shows: “U.S. retail sales rebounded strongly in June as Americans spent more on gasoline and other goods amid soaring inflation, which could allay fears of an imminent recession but not change the view that economic growth in the second quarter was tepid.”

This from Sal Guatieri, a senior economist at BMO Capital Markets in Toronto, looks like a believable explanation: “Padded by high savings and rising wages, American households are spending nearly as much money as they did earlier, but largely to keep up with higher prices, not to actually buy more stuff … that said, today’s report may cool talk of a near-term recession”.

Another plus is a reduced expectation that the Fed will look at that 9.1% inflation number reported this week for June, and then decide to raise the official interest rate by 1% at the next FOMC meeting over 26-27 July. (By the way, in July we get our next inflation number, which will be important for our future interest rate rises.)

This turnaround for stock market sentiment for Wall St on Friday helped all sectors rise, meaning it was a broad-based rally and added positivity to something I noticed this week i.e. US stocks didn’t really sell-off hard after that 9.1% inflation number. But why?

There’s a growing chorus that inflation peaked in June with oil prices and commodity prices on the slide, which is bound to be reinforced by China’s economic growth coming at a lower-than-forecasted 0.4% for the year, which was the weakest since the March quarter in 2020 when the first Covid lockdowns were imposed worldwide. The big negative came from the June quarter GDP reading that showed a 2.6% contraction, which brought the annual number down.

But it’s not all bad news in China, with AMP’s Shane Oliver reporting that “industrial production, retail sales, investment and credit growth all continuing to recover in the month of June and unemployment fell as the lockdowns eased and policy stimulus measures impacted. Export growth also surprisingly accelerated. This is all consistent with the improvement seen in business conditions PMIs”.

Back to the better-than-expected market reaction to the big US inflation number, President Joe Biden called it “old news”, pointing to nearly half of the rise coming from gasoline and energy prices. Importantly, oil prices had fallen significantly in July.

This has added to the number of experts now thinking inflation has peaked. And it’s why many experts are now ruling out the Fed raising by 1% at the next FOMC meeting.

Respected Wall St investment expert, Bob Doll, who’s now the Chief Investment Officer at Crossmark Global Investments, is in the “inflation has peaked” camp. Doll is no slouch when it comes to the US economy. He said on CNBC that lower US consumer inflation expectations are a good sign for inflation going forward.

I interviewed Bob when he was the chief equity strategist at the world’s biggest funds management business, BlackRock. He has a good track record for perceptive calls.

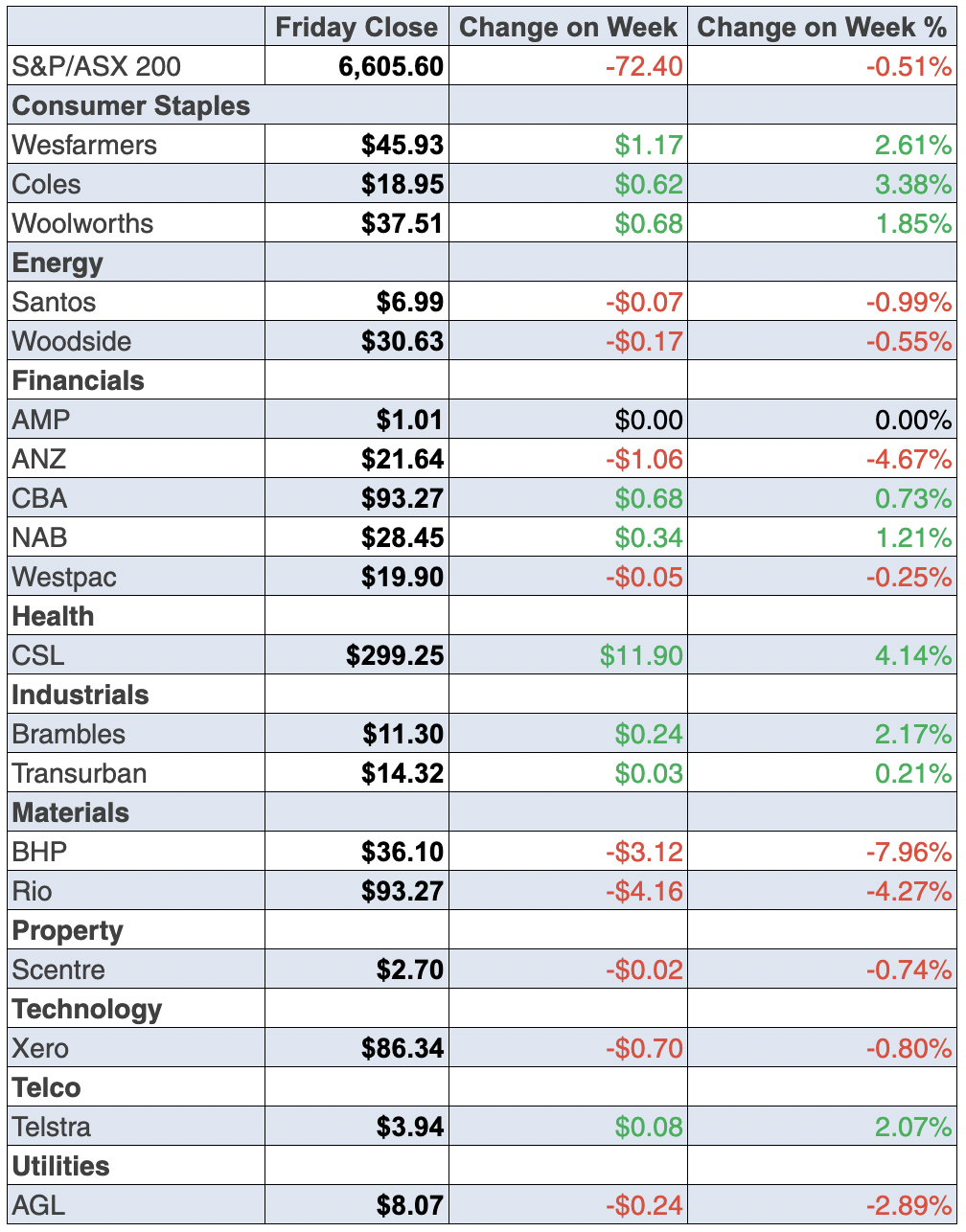

To the local story and the “what a week!” theme operated here as well, with the great employment story giving life to speculation that a 0.75% interest rate rise has become a real option for the next RBA decision on the cash rate. Add that to the bad news story of China’s slow economic growth revelation and it’s no surprise that our market saw the S&P/ASX 500 give up 1.08% (or 72.4 points) for the week to end at 6605.6.

And that was after three good days on a trot of positive finishes.

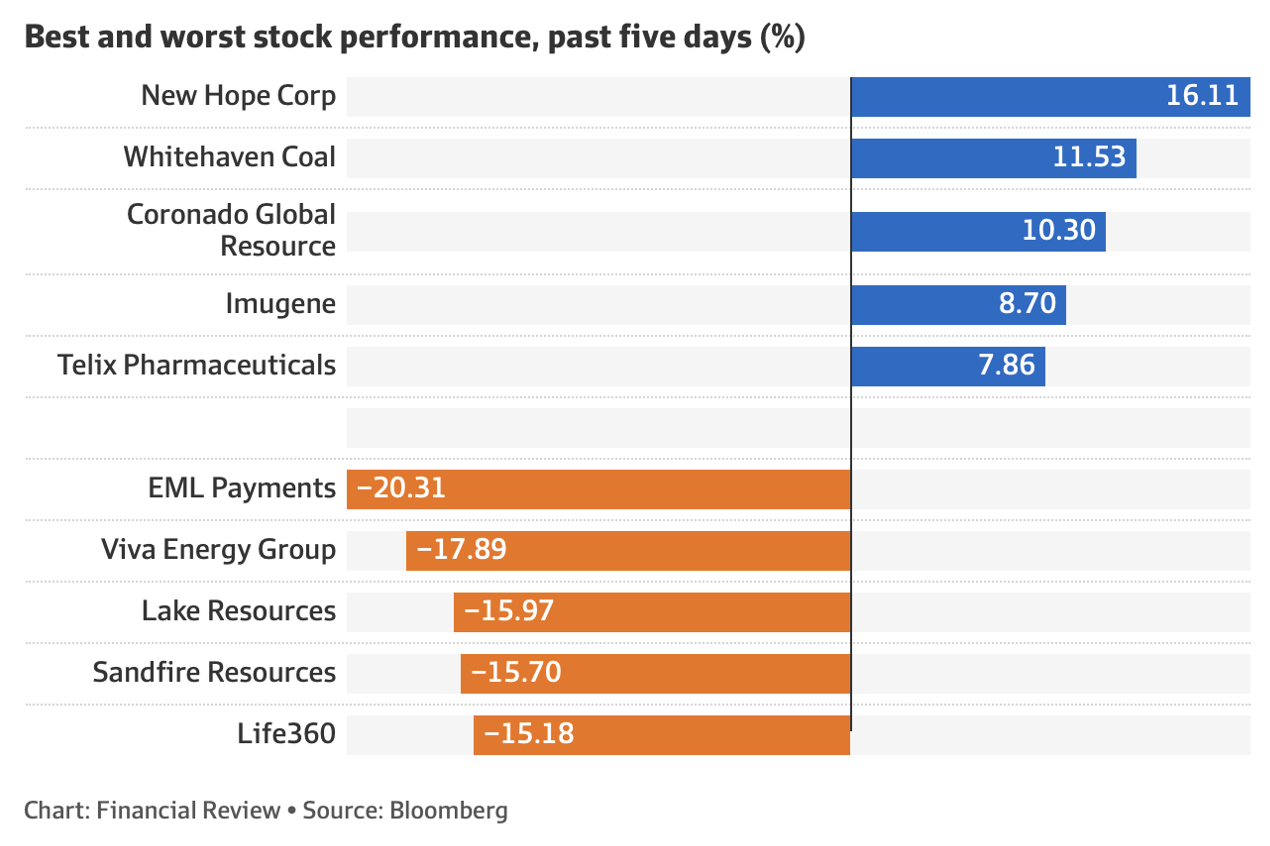

Here were the big winners and losers for the week:

The China news was negative for our miners, not helping an already poor week, with BHP down 6.3% to $36.10, Rio slipped 3.24% to $93.27, Fortescue gave up 5.06% to $16.33 and South 32 had a shocker, off 8.58% to $3.41.

The bad run for funds management businesses continued, with Pendal losing 7.84% on Friday and 15.12% for the week. Outflow reports will do that.

It was good to see a tech company report well, with Wisetech up 3.42% on Friday and 6.11% for the week. I wonder how many other beaten-up tech companies will stick it to the excessive sellers based on interest rate fears?

Happily, for Paul Rickard and myself, who’ve been telling you to have faith in CSL (CSL) and healthcare stocks, this has been a nice week. The world-class Aussie company ended the week at $299.25, up 1.03% on Friday, 3.73% for the week and 15.88% for the month. I love making money on quality companies when the market beats up on them. It looks like rotation is now favouring healthcare, with ResMed (RMD) up 14.81% for the month and Cochlear (COH) 11.93% higher.

One day it will be tech stocks’ turn to benefit from rotation and I’m betting it will be in the December quarter.

What I liked

- The value of residential and commercial building work in the pipeline stood at a record $121.6 billion at the end of March 2022, up by 27.7% on a year ago. I want a slower Oz economy but not a recession and this is a good number for the overall economy.

- The National Australia Bank (NAB) business confidence index fell from 6.3 points in May to a 6-month low of 1.4 points in June (long-run average: 5.4 points). And the business conditions index eased from 15.3 points in May to 13 points in June (long-run average: 6 points). These are falls but moderate falls, which might be consistent with a slowdown that might even help slow down inflation.

- I should hate this number but we have to beat inflation and so the Westpac-Melbourne Institute consumer sentiment index falling by 3% in July (a seventh successive monthly decline in 2022) to a 23-month low of 83.8 points and down 23% on a year ago, is a plus.

- In June, provisionally, there were 736,650 overseas arrivals to Australia – the most since Covid-19 international border restrictions were imposed in March 2020. And there were 885,290 overseas departures from Australia last month – the most since February 2020. The comeback for tourism will be important for the economy rolling into 2023 and foreign workers come with lots of holidaymakers. And given those job numbers, we need backpackers and foreign students and fast!

- The US Federal Reserve Beige Book said the US economy grew at a “modest” pace since mid-May, with all districts experiencing “substantial” price increases. It would be good if the US defies experts tipping a recession and maybe end up with a slowdown. This will help confidence and stocks, especially if inflation starts to fall in July.

What I didn’t like

- Our employment rose by 88,400 in June (consensus: 30,000), with full-time jobs up by 52,900 and part-time jobs lifting by 35,500. Total employment hit a record high of 13.6 million in June. And the unemployment rate fell from 3.9% in May to 3.5% in June (lowest since August 1974). The number of unemployed fell by 54,300 in June. I hate to say that the numbers were too good and now threaten a 0.75% increase in interest rates from the RBA!

- Commonwealth Bank (CBA) economists reported the CBA Household Spending Intentions (HSI) index rose by 0.9% in June to an equal record high of 117.3 points. This should be a “like” but it’s pro-inflationary.

- The US consumer price index (CPI) rose by 1.3% (the biggest lift in 17 years) in June (survey: 1.1%) to be up 9.1% over the year (survey: 8.8%), the highest annual rate since November 1981. The core CPI rose by 0.7% (survey: 0.5%) to be up 5.9% over the year (survey: 5.7%).

- The Chinese economy, as measured by GDP, grew by 0.4% in the June quarter (consensus: 1.2%) from a year earlier, slowing from the March quarter’s 4.8% pace. The growth rate was the weakest since the steep 6.9% slump in the March quarter of 2020 at the initial stages of the Covid-19 pandemic.

- The US producer price index (PPI) rose by 1.1% in June to be up by 11.3% on the year (survey: 10.7%)

- Italian Prime Minister Mario Draghi resigned, with his coalition government collapsing. Draghi was smart and was the former boss of the ECB.

- The NFIB small business optimism index in the US fell from 93.1 to a 9-year low of 89.5 in June (survey: 92.5).

- Germany’s ZEW economic sentiment index dropped from -28 to -53.8 in July (survey: -40.5), thanks to Putin’s damn war!

Lots of dislikes. Am I worried?

No, I’m not worried but I will be more relaxed after the next two weeks of US reporting. Despite the fact that my “dislikes” have grown this week, I like the lower US inflation in July and the chance that the Fed might be close to taking a breather on rate rises.

Brent Schute, chief investment strategist at Northwestern Mutual, told CNBC that US stocks have established a bottom and he’s not alone. I suspect he’s in a bit early but we’re close. As I say, I want to see the next two weeks of reporting but I like what I’m seeing and I’ll look at this on Monday.

My base case has been that the December quarter (starting in October) will bring a more convincing rebound in stocks, even if things start looking better in September. That said, I hope I’m wrong and the rebound for stocks comes earlier. Ultimately, we’re in the hands of the Fed and its inflation view, as well as the upcoming earnings reports.

What a week! I can’t wait for the weeks ahead!

The week in review:

- And during this crazy week, in the Switzer Report, I discuss whether you should sell up and go to cash. And I’d like to point to the investing team at the US-based Dimensional Fund Advisors that manages $881 billion in money, which concluded: “There’s no proven way to time the market— targeting the best days or moving to the sidelines to avoid the worst— so the evidence suggests staying put through good times and bad.”

- In recent weeks the healthcare sector has been performing well and Paul (Rickard) thinks the sector will continue to outperform over coming months, picking 3 healthcare stocks for you to consider. Paul also contests the adage that investing in government bonds or bond funds is meant to be a “defensive”, given the last financial year will go down as one of the worst ever for bond funds. However, in his second article for the week, Paul explains why the odds are against a repeat performance in 2022/2023.

- While aiming for a single-digit portfolio return and capital preservation this year won’t get your pulse racing, if you can weather what could be a bumpy couple of years, your portfolio will be well placed for an eventual strong recovery. Tony Featherstone dissects 3 ETFs that fit his strategy of defensive equity investing.

- James Dunn says that Biotech is always an exciting sector as there’s always some good news around somewhere, dissecting three biotech stocks where the risks of life science product development appear to be in investors’ favour.

- In our HOT stock column this week, Raymond Chan, Head of Asian Desk at Morgans, tells us why Oz Minerals Limited (OZL) has been upgraded back to ADD after a sharp price correction. Also, Michael Gable, Managing Director of Fairmont Equities, advises you to keep your eye on Mineral Resources (MIN).

- In Buy, Hold, Sell — Brokers Say, there were 8 upgrades and 2 downgrades in the first edition, and 9 upgrades and 6 downgrades in the second edition.

- And finally, in Questions of the Week, Paul (Rickard) answers your queries about whether Northern Star Resources is a buy; What’s happening with the Ramsay Health Care takeover, and how should you play this?; As the big iron ore miners have been smashed – is now a good time to buy? Are there any changes to the super caps this year?

Our videos of the week:

- Is having A2 milk instead of A1 milk, better for our bodies? | The Check Up

- Is the ASX stock market poised to take off? + Do the charts say to buy – MP1, MFG, ALL and more? | Switzer Investing (Monday)

- A big data drop is coming that could help or hurt the stock market and is BNPL dead in the water? | Mad about Money

- Ron Weinberger from EMVision (EMV) | The CEO Masterclass

- Is EML still in the buy zone? What energy stock is still worth buying? + How bad is the house price crash? | Switzer Investing (Thursday)

- Boom! Doom! Zoom! | 14 July 2022

Top Stocks – how they fared:

The Week Ahead:

Food for thought: “The trick is not to learn to trust your gut feelings, but rather to discipline yourself to ignore them. Stand by your stocks as long as the fundamental story of the company hasn’t changed.” – Peter Lynch

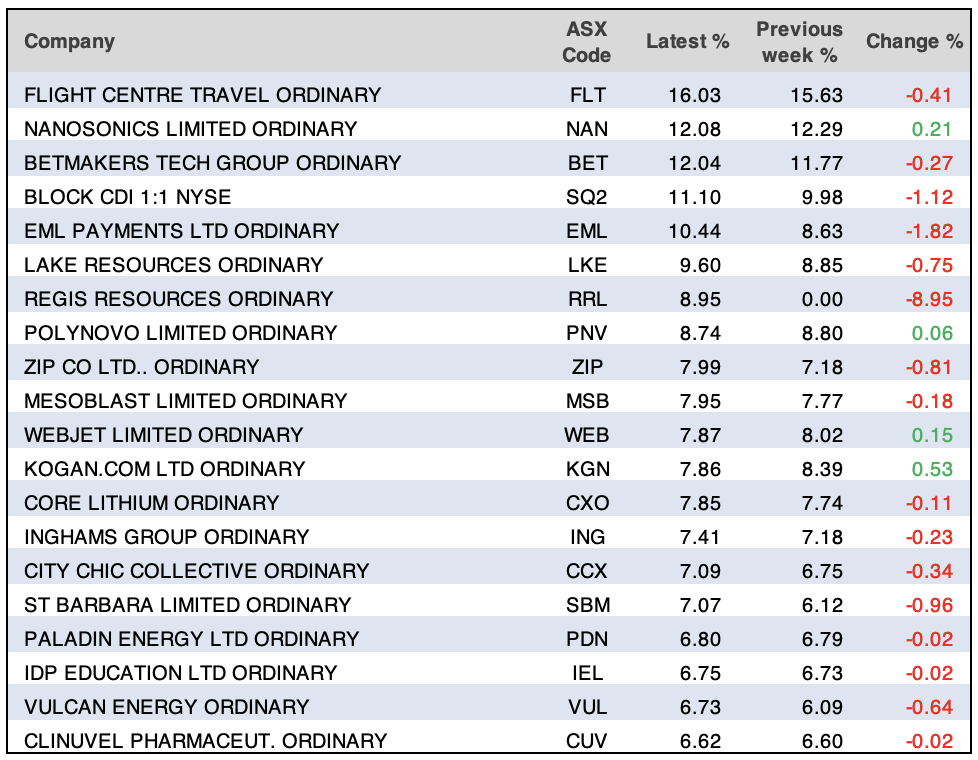

Stocks shorted:

ASIC releases data daily on the major short positions in the market. These are the stocks with the highest proportion of their ordinary shares that have been sold short, which could suggest investors are expecting the price to come down. The table shows how this has changed compared to the week before.

Chart of the week:

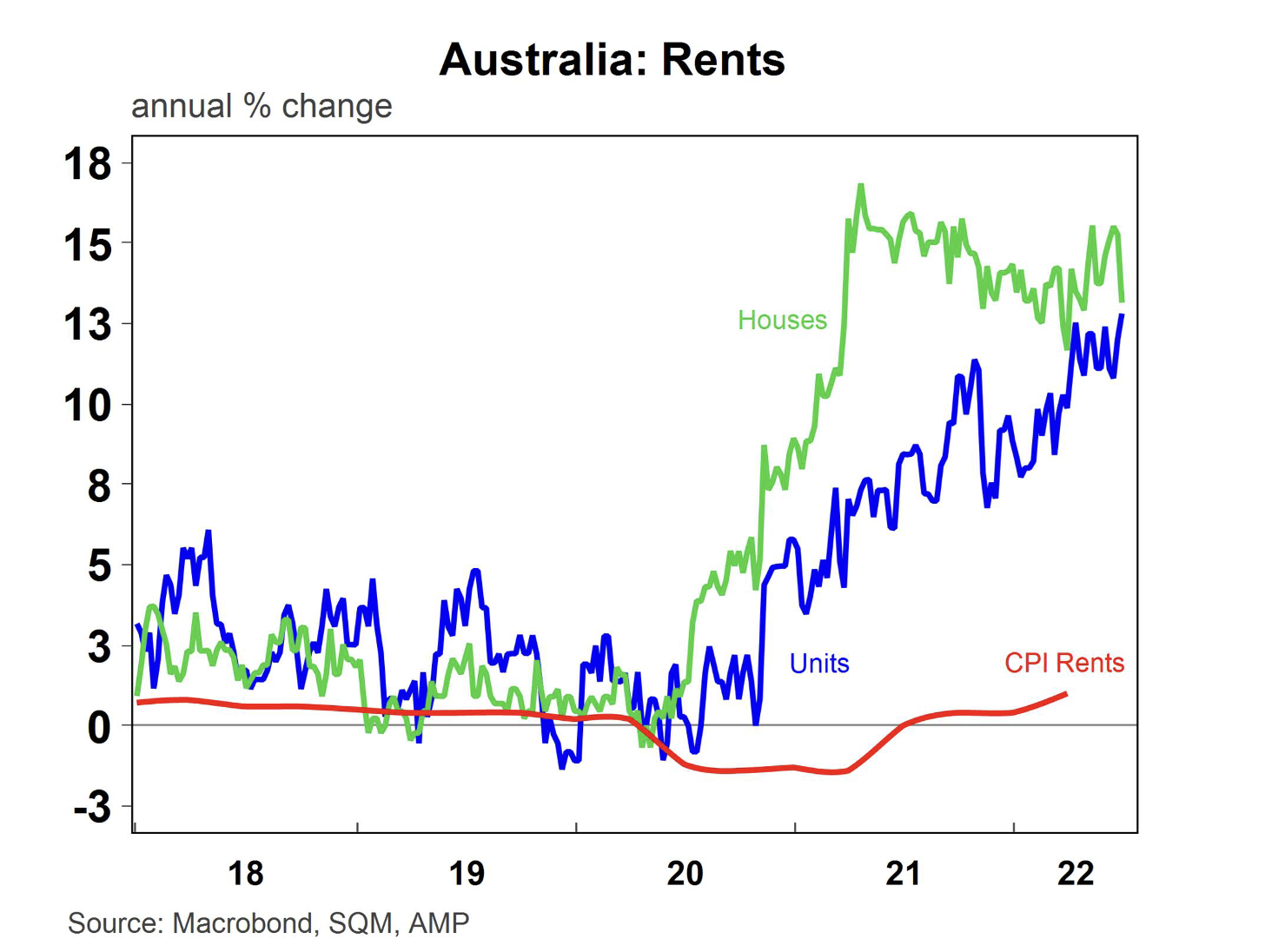

Our chart of the week looks at the knock-on effects of rising residential vacancy rates as well as interest rates on Australian renting costs.

“The low vacancy rate is lifting rents. Asking rents (rents for properties newly advertised) are running at 12% year on year for houses and units and are much higher than the rents in the quarterly consumer price index data (which include all rents) which are still tracking at only 1% year on year to March (but further rises are likely from here),” Diana Mousina of AMP Capital reports.

“Despite the lift in interest rates, rising rents could encourage investors into the market, especially as home prices decline (we expect a 15-20% peak-to-trough fall in national dwelling prices into 2023) which will lift rental yields.”

Top 5 most clicked:

- Should you go to cash? – Peter Switzer

- 3 healthcare companies on the rise – Paul Rickard

- My 3 biotech picks – James Dunn

- Buy, Hold, Sell – What the Brokers Say – Rudi Filapek-Vandyck

- Questions of the Week – Paul Rickard

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.