I’m writing this while waiting for a flight to Paris, which means I won’t see the job numbers out of the US overnight. They will be important because a weak number could be good for inflation fears and the magnitude of interest rate rises ahead coming from the Fed.

Right now, the market expects a half-a-percent rise in the next two meetings and possibly another half-a-percent in September, before the US central bank pauses to see what’s going on with inflation.

‘Inflation has peaked’ signs are building but the Fed will want to see a softening of the jobs market as the real test that the big push on inflation in the US itself is dissipating.

Of course, if the numbers over the next few months are too soft, then the fear will be that a recession is coming, which could be another problem for stocks.

Bulls want a Goldilocks outcome — falling inflation and a reasonably growing US economy that will avoid inflation. However, it will take until about September before the market can get a handle on what’s happening to inflation and the prospects of a recession.

A Goldilocks outcome would mean fewer rate rises from the Fed this year and tech stocks would zoom higher, though not to previous silly levels. Fed boss Jerome Powell will never say he cares about Wall Street but if he over-spooks the big players on the New York Stock Exchange, he could easily be a recession creator.

Economists expect that 328,000 non-farm jobs were added in the latest month, compared with 428,000 in April. But if the number comes in lower but not too low, stocks should go higher. “Our view is cautious as we close out the second quarter,” said Rob Haworth, senior investment strategist at US Bank Wealth Management. “Global central bank uncertainty and the pace of tighter monetary policy, still-tight global energy … markets — which may lead to higher prices still — and headwinds for corporate earnings growth are risks for investors moving forward.”

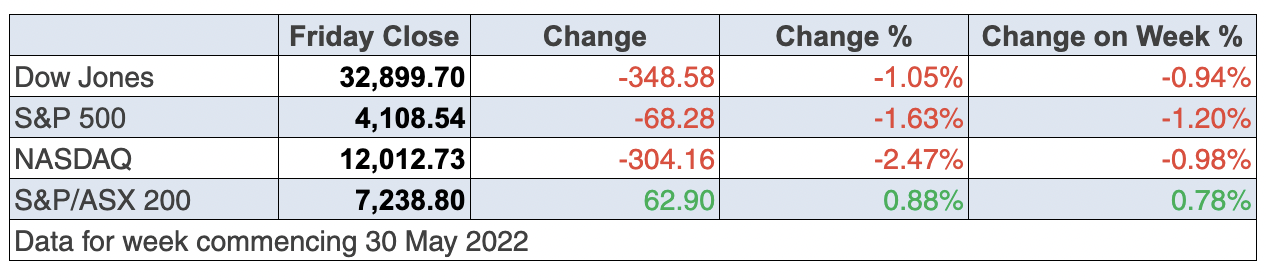

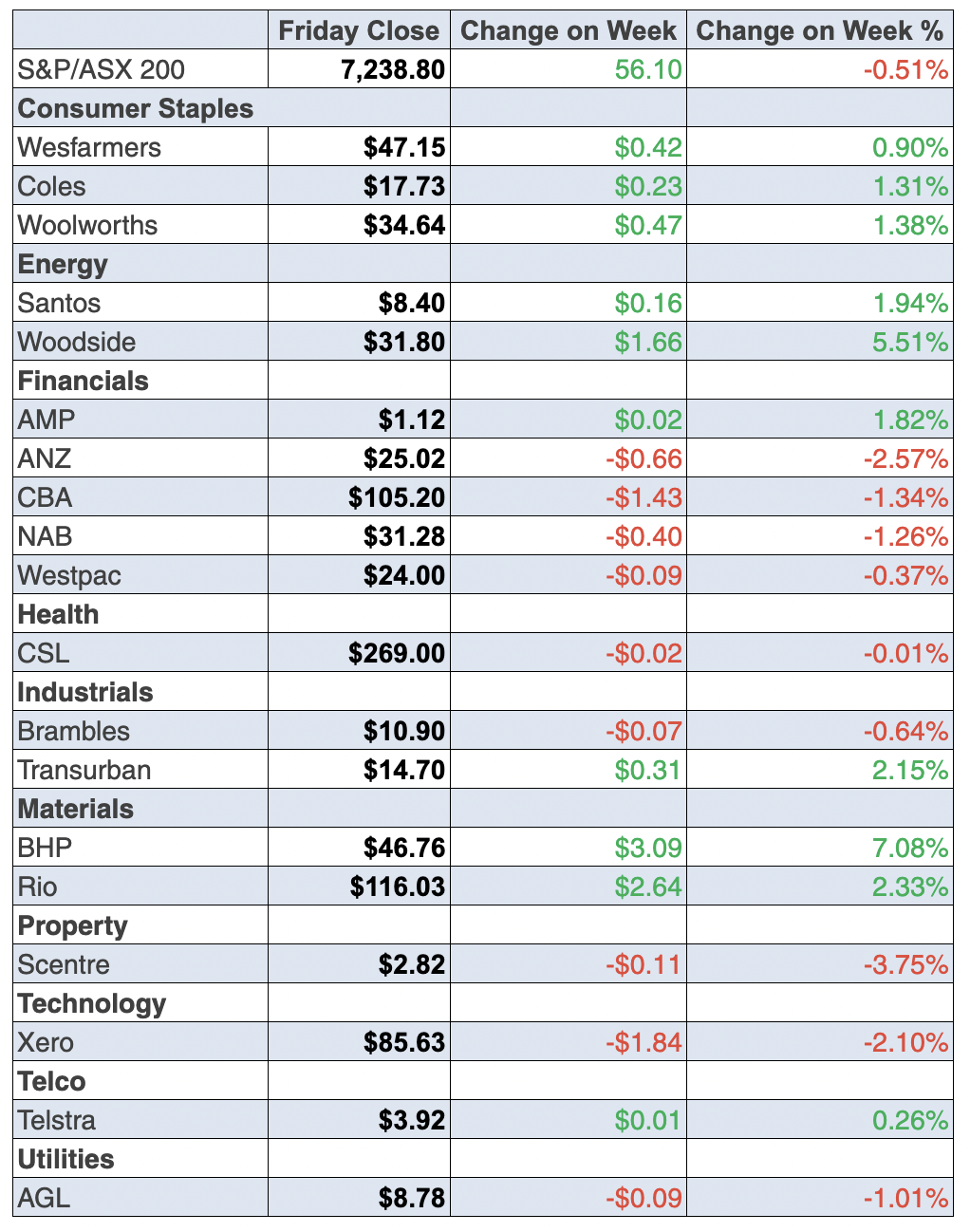

To the local story and the S&P/ASX put on 62.9 points (or 0.9%) to finish at 7238.8. And despite the overall fear and loathing this week about inflation, recession and interest rate rises, the Index was up 0.8%.

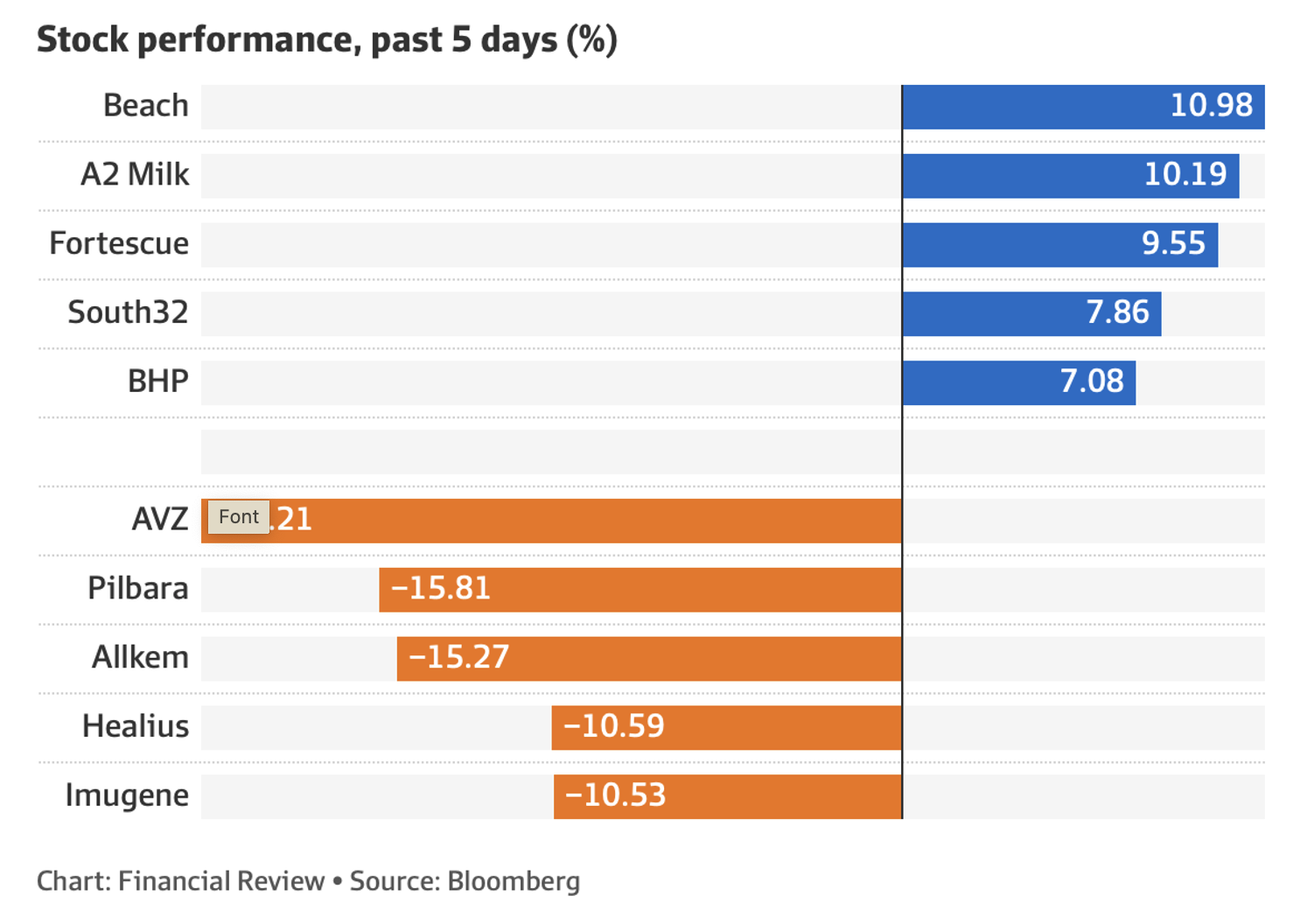

It’s been a good week for miners, with Champion Iron rising 8.14% to $7.84, Fortescue pumped up 8.27% to $21.46, BHP rose 5.67% to $46.76 but Rio added only 1% to $116.03.

Happily, the lithium sell-off was followed up by a rebound but Pilbara Minerals still lost 18.6% for the week, despite a 7.46% jump on Friday. Goldman Sachs and its lower price call for lithium and Argentina’s tax collectors have ruined the gains for many local lithium investors.

Tech had a similar story where the Friday gain didn’t wipe out the losses earlier in the week. Tyro rose 3.57% yesterday but lost 5.14% for the week to finish at $1.02.

The fact that any sign that interest rates won’t rise as high as economists have been predicting always helps tech stocks. This tells me that they’re not dead in the water but will need a few months before they’re successfully swimming against the tide of doubters out there.

The “at long last” result for the week was A2Milk which had a gain following the Australian company Bubs getting the thumbs up to sell into the duopoly infant formula market of the US. However, it wasn’t as big as it should’ve been, but who can expect rationality out of the market? That said, I’ll continue to hold A2 because if it gets into the US, it will be a game-changer.

What I liked

- The Australian economy grew by 0.8% in the March quarter to be up by 3.3% on the year. ‘Normal’ growth of the Australian economy is around 2.25%.

- The household savings rate fell from 13.4% to 11.4% in the March quarter, which means we’re starting to spend our lockdown-boosted savings, which is good for growth.

- The Australian Bureau of Statistics (ABS) said company operating profits rose by 10.2% in the March quarter to be up 25.3% on a year earlier. Profits hit a record high of $505.4 billion over the year to March.

- In terms of productivity, GDP per hours worked rose by 1.7% in the quarter, to be up 2.8% on the year.

- The trade surplus rose by $757 million to $10.5 billion in April. Australia has posted 52 successive monthly trade surpluses. In the year to April, the trade surplus was a record $129 billion.

- The CoreLogic Home Value Index of national home prices fell by 0.1% in May, the first fall in 20 months (since September 2020). Capital city home prices fell by 0.3% but regional prices rose by 0.5%. Usually, I’d hate price falls but this market needs to normalize and it could help the RBA not overdo interest rate rises.

- The AiGroup Australian Performance of Manufacturing Index (PMI) for manufacturing fell by 6.1 points to 52.4 in May. And the final S&P Global Australia Manufacturing PMI eased from 58.8 in April to 55.7 in May. Readings over 50 denote an expansion in activity. These two measures are still expanding as the readings were over 50 but the slower rate of growth also could help the RBA be measured with its rate rises.

- Wages & salaries (including changes in wages and employment) rose by 1.9% in the quarter to be up 5.2% on the year – well above the decade average annual growth rate of 3.3%, which is what the RBA wanted. Let’s hope the rises start becoming smaller.

- The ISM purchasing managers index (PMI) in the US rose from 55.4 to 56.1 in May (survey: 54.5), which helps hose down recession fears.

- The ADP employment report shows jobs rose by 128,000 in May (survey: 300,000). Even though this was a big miss, it actually helps with lower inflation expectations, which then might slow up the hikes in interest rates.

- European luxury good stocks rose 1.7% to 3.1% with investors encouraged by data showing Eurozone producer prices rising 1.2% from the previous month in April, below expectations of a 2.3% rise. Any lower-than-expected rise in prices is a good thing.

- The US Federal Reserve Beige Book showed the economy grew at a moderate pace from April through to late May, which is another good anti-recession indicator.

- Energy stocks fell 1.2% on reports that some OPEC members want to suspend Russia’s participation in the production deal to allow other members to pump more crude.

- Investors were encouraged by an easing of Covid restrictions in China, as well as new stimulus being unveiled by Chinese authorities.

What I didn’t like

- The Ukraine war.

- Oil price rises earlier in the week, which pulled back on OPEC talk that production might be increased but the price is still too high for good global growth going forward.

- US consumer confidence fell from 108.6 to 106.4 in May (survey: 103.9).

- New data showed Eurozone inflation at a record high of 8.1% in May, boosting chances for bigger rate hikes in future months from the European Central Bank. A war will do this to inflation!

I know the news looks bad but…

Have a look at “what I liked” (which numbered 14) against “what I disliked” (which only numbered 4). This could be a sign that we have the potential to really storm back economically and stocks-wise if we can see lower inflation in the next few months or an end to the war in Ukraine.

The week in review:

- There is a no more important question for any investor to ask right now than this: Have we seen the bottom of this stock market sell-off? In my article today I go through all the reasons why I think that the bottom is in sight.

- Paul (Rickard) takes a look at the dubious world of takeover bids and how the recent events of Canadian IT firm TELUS walking back on its bid for Appen showcase the fickle nature of ‘indicative, conditional’ offers. Paul uses this as the backdrop to consider how cautious investors should be about KKR’s takeover bid for Ramsay Healthcare. Paul then takes a look at the volatile month that was May and shares his insights about what Aussie investors might expect for June.

- Tony Featherstone examines how investors typically get it wrong when it comes to investing in megatrends, jumping in at the top of a hyped trend rather than looking for sectors that will sustain over the long term. As such, Tony outlines five megatrends of the future that he sees as opportunities for the long haul investor.

- James Dunn reports that there are many external factors influencing the performance of global food suppliers, some good, others not so good, and he assesses where Australia’s three largest agricultural exporters currently lie on this spectrum.

- n our “HOT” stock column, Michael Gable, Managing Director of Fairmont Equities, explains why he thinks it’s time to pick up some shares in Macquarie Group (MQG).

- In Buy, Hold, Sell — Brokers Say, there were 7 upgrades and 8downgrades in the first edition, 2 upgrades and 5 downgrades in the second edition.

- In Questions of the Week, Paul Rickard answers your queries about what is the cost base for my new Woodside shares and what happens to the cost base for my BHP shares? Is IGO a buy? Why has Credit Corp been smashed? What are the stocks with the biggest short positions?

Our videos of the week:

- What is the true pandemic of the 21st century? | The Check Up

- Julia Lee’s 5 small caps to buy & hold + 2 stocks Jun Bei recommends even for her children! | Switzer Investing (Monday)

- Is the worst of the stock market sell-off over? & What should AGL shareholders do? | Mad about Money

- The greatest interview with Rudi on the big issues around investing + Investing in defensive stocks? | Switzer Investing (Thursday)

- Boom! Doom! Zoom! | 2 June 2022

Top Stocks – how they fared:

The Week Ahead:

Australia

Monday June 6 – Inflation gauge (May)

Monday June 6 – Job advertisements (May)

Tuesday June 7 – Reserve Bank Board meeting

Tuesday June 7 – Purchasing managers index (May)

Wednesday June 8 – Labour account (March)

Thursday June 9 – Weekly payroll jobs and wages

Friday June 10 – New home sales (May)

Friday June 10 – Business turnover (April)

Friday June 10 – Skilled job vacancies (May)

Overseas

Monday June 6 – China Purchasing managers’ index (May)

Tuesday June 7 – US International trade (April)

Tuesday June 7 – US Consumer credit (April)

Wednesday June 8 – US MBA mortgage applications

Thursday June 9 – US Initial jobless claims

Thursday June 9 – China International trade (May)

Friday June 10 – US Consumer sentiment (June)

Friday June 10 – US Consumer price index (May)

Friday June 10 – China inflation (May)

Saturday June 11 – China lending and money supply (May)

Food for thought: “The most important quality of an investor is temperament, not intellect.” ― Warren Buffett

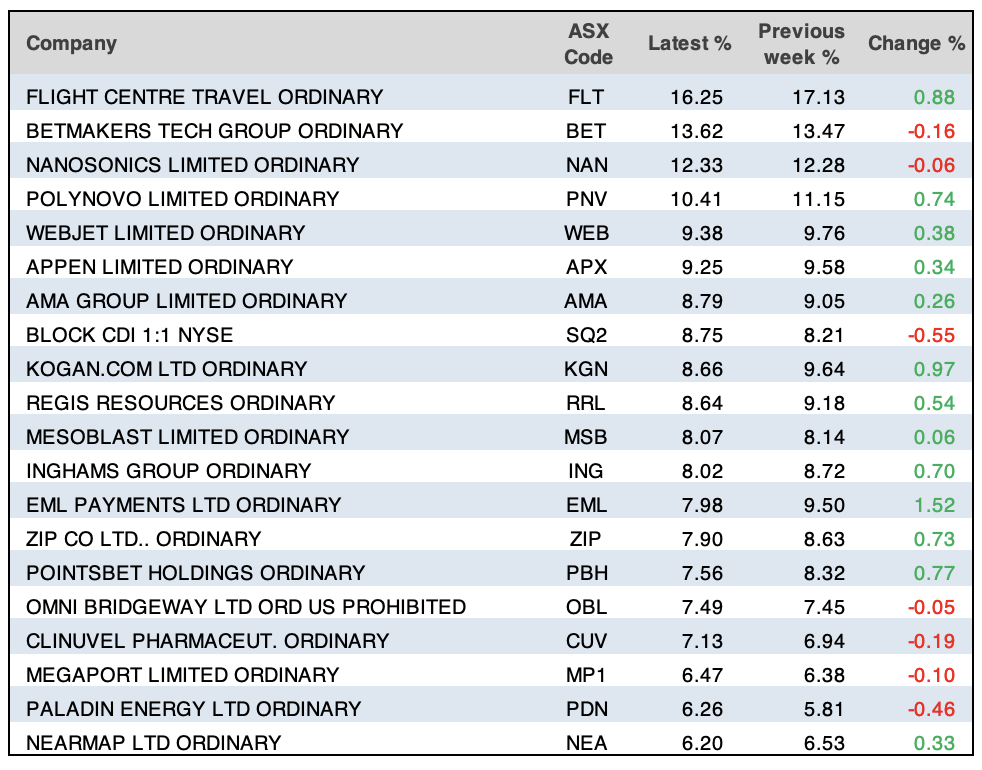

Stocks shorted:

ASIC releases data daily on the major short positions in the market. These are the stocks with the highest proportion of their ordinary shares that have been sold short, which could suggest investors are expecting the price to come down. The table shows how this has changed compared to the week before.

Chart of the week:

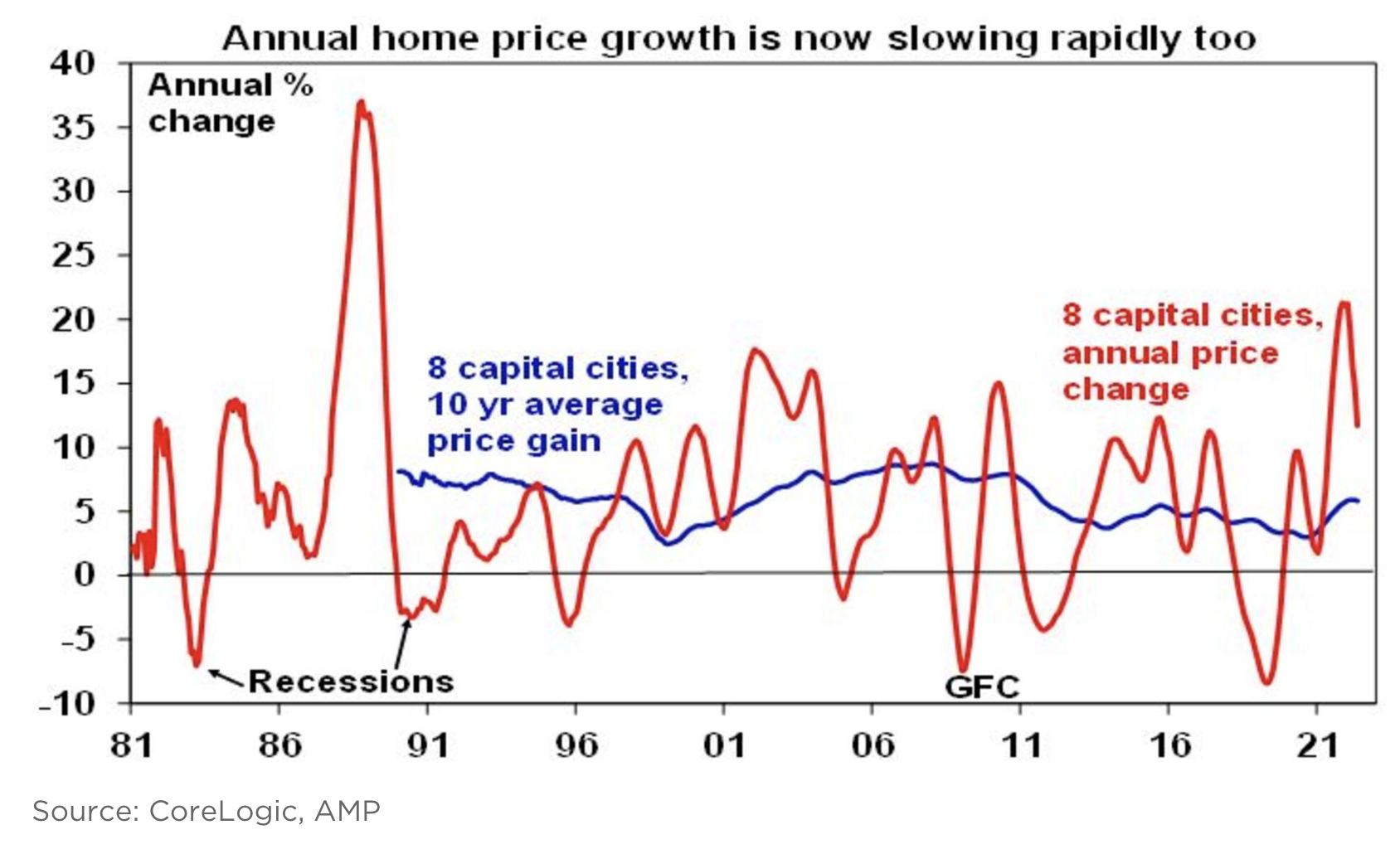

Our chart of the week provides further context behind why AMP Capital have tipped a 10-15% peak to trough drop in property prices.

“The slowing trend since March last year has been led by Sydney and Melbourne, reflecting their more expensive housing and greater vulnerability to higher interest rates at a time when interstate migration was still helping to boost demand in cities like Brisbane and regional property remained in hot demand, kicked off by the pandemic. However, other cities and regional areas are now also seeing a loss of momentum,” Shane Oliver of AMP Capital reports.

“The slowdown in monthly price growth is seeing annual price growth roll over too. Simple mean reversion after a period of well above average growth warns of a further slowdown ahead.”

Top 5 most clicked:

- Is the worst of this stocks sell-off over? – Peter Switzer

- Buy, Hold, Sell – What the Brokers Say – Rudi Filapek-Vandyck

- Assessing Australia’s 3 biggest agricultural exporters – James Dunn

- May was a choppy month for the market – what’s in store for June? – Paul Rickard

- 5 ETFs for the future – Tony Featherstone

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.