Those investors who’ve been market-punished for believing in businesses of the future since November last year that saw their share prices escalate downwards from January have been given a relief rally this week, especially yesterday.

Xero was up 9.44% on Friday, Tyro 9.8% and Megaport 9.57%. But the question has to be this: can this comeback be sustained? Happily, we’ve woken up to another day of positivity for tech stocks from the Nasdaq on Times Square in the Big Apple.

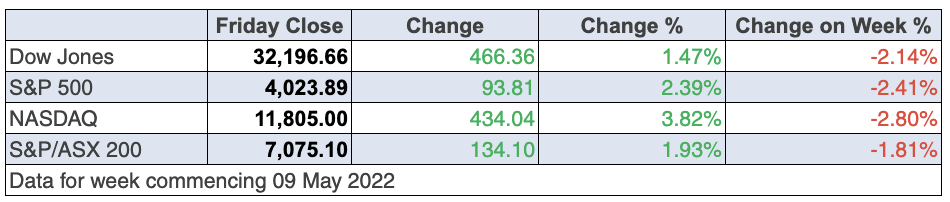

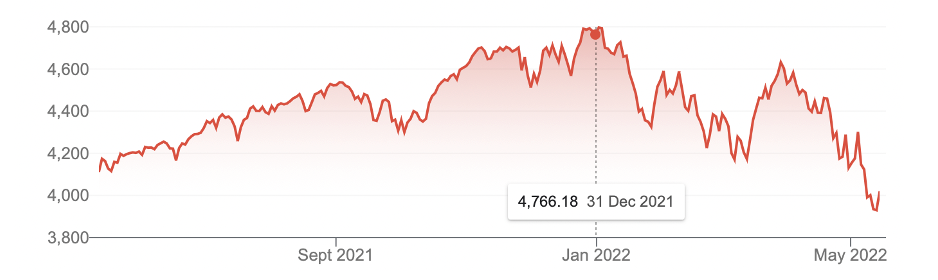

This has helped take the US-based S&P 500 Index away from a bear market situation. The index was down a tick over 16% at the close, but this week it was off 19% until 3 pm on Thursday when US stocks started heading up.

S&P 500 Index

CommSec’s Ryan Felsman told us what the trigger was, and here it is: “After plunging almost 2% earlier in the session, the S&P 500 index almost erased its losses into the close of trade after Federal Reserve Bank of San Francisco President, Mary Daly, said that a 75-basis point rate hike is “not a primary consideration”.

Of course, Mary’s words meant more than just talking about the next rate rise in the US, with the May one being only 0.5%, despite some economists and central bank officials suggesting a 0.75% hike was on the table. What she could be telling the market is something I’ve been canvassing, arguing that this tech stock sell-off has been over-the-top if you’re a long-term investor.

Looking for a trigger to get out of this stock-dumping phase of the market, we’d like the Ukraine war to cease and China to escape Beijing’s lockdown. But more importantly, we’d like a message from central banks that the predictions of interest rate rises in a short time were excessive. That would then make market-influencers say: “Gee, we’ve oversold those tech stocks — those businesses of the future.”

I can’t promise you this tech terrorization is over but we may have been given a sneak preview of what might lie out there if inflation starts to fall and the fired-up interest rate worries also get hosed down.

That said, this could be a relief rally that could eventually give in to bear market forces in coming weeks, but I still argue the case that we’ve at least seen a glimpse of what lies out there.

Right now, you can’t believe the worst is behind us because Mary Daly’s words have to be backed up by positive developments either from better-than-expected economic data on inflation and growth or some surprise development in Ukraine or China. And growth is important because some of the recent selling is linked to recession fears.

Positive reports and comments from CEOs of companies such as Tapestry which owns high-end brands such as Coach, and buy-now-pay-later companies such as Affirm (whose stock spiked 19% overnight on a great earnings report), all help the bulls contain the bears.

But keeping us real are observations like this that can’t be easily dismissed: “You’re getting this market that really is begging for a bottom, for a relief rally. But, at the end of the day, there really hasn’t been a capitulation day,” Andrew Smith, chief investment strategist at Delos Capital Advisors told CNBC.

On the other hand, as Mike Santoli pointed out in his daily notes on CNBC: “The forward returns historically, after we get the kind of sentiment washout and fairly quick 15%+ drop in stocks, are generally favourable if you look out a year, but with a couple of huge downside exceptions (2000, 2008).”

Recall that 2000 was the dotcom bust and 2008 was the GFC. Right now, you could argue that we don’t have the mission-critical threat to profits, growth and stock prices that went with those previous scary times for investors. Only a Fed and other central banks over-raising rates and creating a recession, or a failure to beat down inflation to acceptable levels will deliver the market madness of those two years.

The forward price earnings for the S&P 500 were dragged down to 16 this week so I like this from Santoli: “When the index sank to roughly 14x forward earnings at the end of the 2015-16 and 2018 corrections, it spent almost no time there.”

Remember: if the US sell-off resumes in coming weeks if a capitulation is near, it’s highly likely we won’t spend much time at very low stock prices.

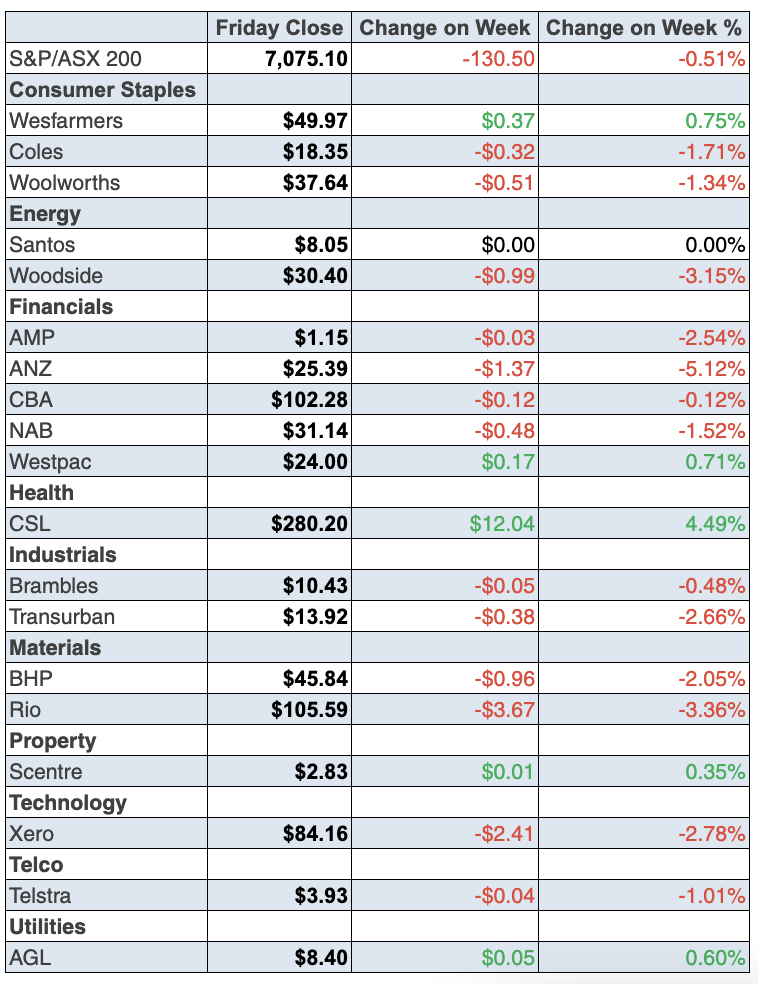

Back to the local story, and as alluded to, the overdue revaluation of smashed tech companies extended to local operations, with Friday’s rebound taking the weekly loss for the S&P/ASX 200 Index to only 1.8%. That 1.9% (or 134-point gain) was a relief for local investors.

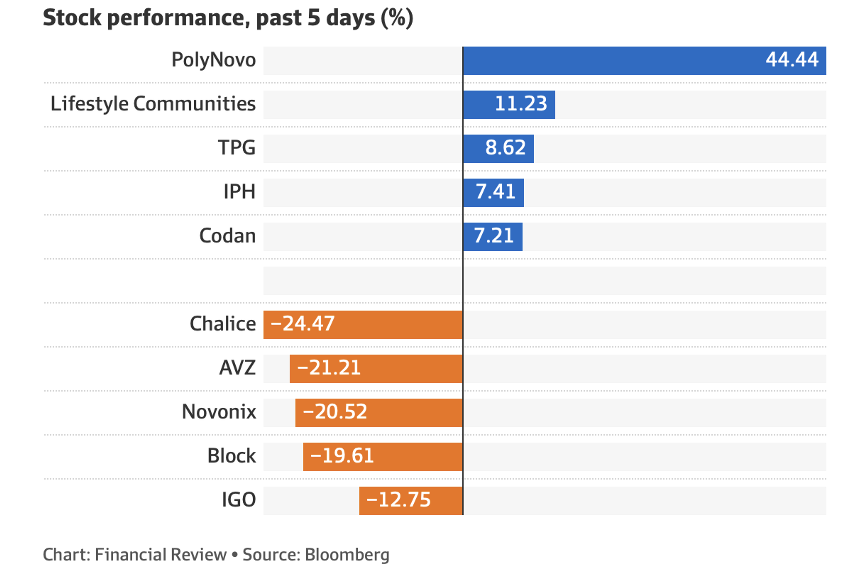

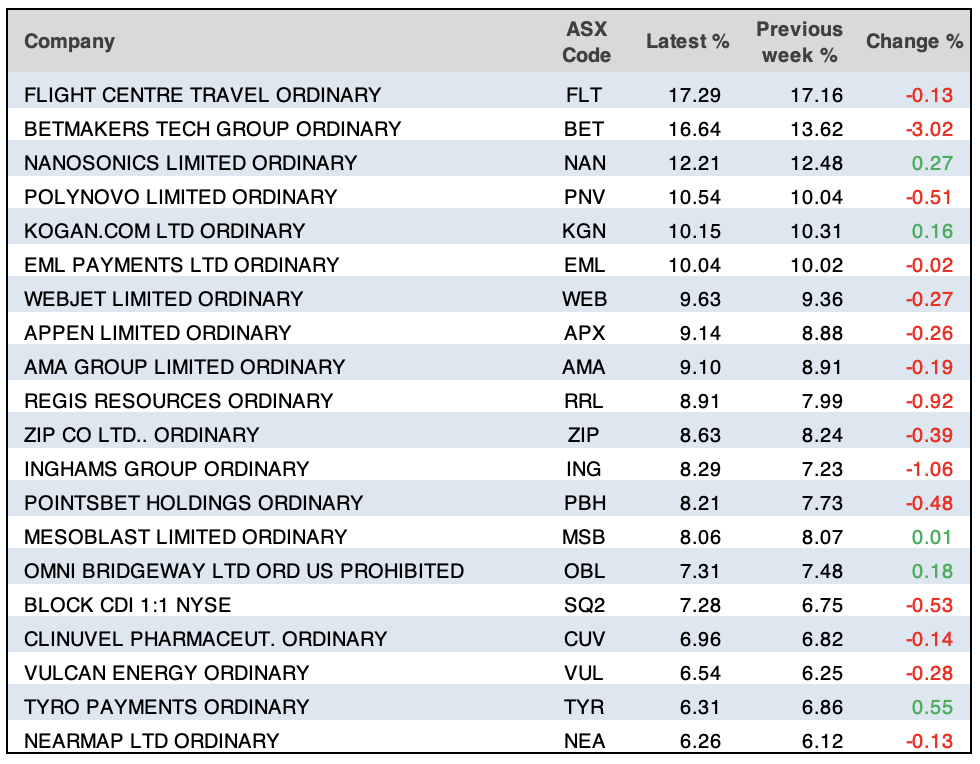

Here are the big winners and losers of the week but I can’t do a hand-on-heart promise that the worst of this negatively-inclined volatility is over just yet.

On the negative side, oil price rise anxiety saw the likes of Santos rise 3.21% to $8.05, while Woodside put on 2.7% to $30.40, all powered by an expected European ban on Russian crude oil imports.

The big four banks made gains on Friday, with NAB topping it, rising 1.04% to $31.14 but the stellar riser was Macquarie, up 4.51% to $183.11 (though the gain for the week was only 0.09%). This investment bank that earns about 70% of its profits overseas, needs the S&P 500 to make a comeback to help make traders expect a lift in its potential profit and price.

It was a bad week for bitcoin players with the price down 9.31% to $43,807 after a high of $83,843 in November of last year! I’m glad I stuck to my investing mantra, taught to me by Warren Buffett, that “if you don’t understand it, don’t invest in it!”

What I liked

- Retail trade rose 1.6% in March to record highs, with spending up 9.4% on the year.

- NAB’s business conditions index rose from 14.9 points in March to a 10-month high of 20.1 points in April (long-run average: 5.9 points). In quarterly terms, purchase cost growth (up 4.6%) and labour costs (up 3%) both hit record highs in April.

- In March, business turnover lifted in 12 of the 13 selected industries, according to the Australian Bureau of Statistics(ABS). Turnover rose by the most for arts and recreation services (up 18.3%) and electricity, gas, water and waste services (up 7.3%), but fell for wholesale trade (down 4.2%).

- SEEK job ads rose by 2.9% in April, marking the fourth consecutive record month of new job vacancies. Job ads are up by 22.5% on a year ago. But applications per job fell by 7.6% in April.

- The preliminary Internet Vacancy Index (IVI) from the National Skills Commission rose by 8% in April (or 23,135 available positions) to a record high (series since January 2006) of 311,083 available positions. Recruitment activity was up by 33.2% (or 77,525 ads) in April on a year ago and was 84.9% (or around 142,800 available positions) higher than pre-Covid levels.

- The CBA’s latest credit and debit card spending data for the fortnight ended 6 May 2022, “continued to show strength in the household sector. Spending on services continues to recover, and as a share of total spending is back to its pre-pandemic levels.”

- Consumer inflation expectations fell from 6.6% to 6.3% in April (survey: 6.8%).

- The UK economy shrank by 0.1% in March but expanded by 0.8% for the first quarter of 2022 (survey: 1%).=

What I didn’t like

- The Westpac-Melbourne Institute Index of Consumer Sentiment fell by 5.6% (the biggest fall in 21 months) in May to a 21-month low of 90.4 points, down 20.1% on a year ago.

- The ANZ-Roy Morgan consumer confidence index fell by 0.2% last week to a 20-month low of 90.5 points (the long-run average since 1990 is 112.4). Consumer views on whether it is a good ‘time to buy a major household item’ dropped 2.2% in the past week to a 2-year low of -15.9 points.

- The National Australia Bank (NAB) business confidence index fell from 16.3 points in March to 9.9 points in April (long-run average: 5.4 points).

- According to the Housing Industry Association (HIA), private detached new home sales fell by 1.2% in April.

- CBA economists reported the CommBank Household Spending Intentions (HSI) Index fell by 3.8% to 112.3 points in April, led by falls in home buying, health and fitness, and transport spending.

- The US Consumer Price Index (CPI) rose by 0.3% in April (survey: 0.2%) to be up 8.3% over the year (survey: 8.1%)

- The Producer Price Index (PPI) lifted by 0.5% in April to be up by 11% on the year (survey: 10.7%). The core PPI (ex-food and energy) rose by 0.4% in April to be 8.8% higher on a year ago (survey: 8.9%).

Not sure if I like or dislike this!

Global oil prices jumped up to 6% on Wednesday but this was related to the good news that Covid-19 infections in Shanghai and Beijing dropped on Tuesday, boosting the demand outlook for crude oil. So, a China out of lockdown sooner rather than later because of success in fighting the virus would push up oil prices because they use oil. That’s bad for inflation and interest rates. However, China out of lockdown improves the supply of products for businesses and consumers, which will bring inflation down.

Given the short-term negative impact on oil and the longer-term positive from China in full production again sooner than might have been expected, I like this news.

The week in review:

- This week in the Switzer Report, I continue to look at the main factors that need to change that will result in a bounce back to stocks. I’m investing for a happy ending over 2022-23.

- Paul (Rickard) reviews the performance of three of the four banks that have reported over the last few days, looking at 10 key attributes. Paul also reveals his top-of-the-three pick and which one the brokers like.

- Tony Featherstone says private equity (PE) firms are always circling listed companies and he expects more to swoop, setting the scene for a new wave of takeovers. While you should never buy a stock based only on its takeover prospects, Tony looks at three companies that look a good fit for PE.

- James Dunn says that with many commodity prices hitting new highs, and the market only just waking up to the scale of mining expansion that will be needed in the “transition to clean energy”, the global mining industry is an interesting place to look for investment exposure. One way to gain this he says is to look at the companies that provide services to the miners. As such, James unearths 4 bargain buys in the sector.

- In Buy, Hold, Sell — Brokers Say, there were 8 upgrades and 12 downgrades in the first edition, and 7 upgrades and 13 downgrades in the second edition.

- In our “HOT” stock column, Michael Gable, Managing Director of Fairmont Equities, explains why he thinks Wesfarmers (WES) is a buy.

- In Questions of the Week, Paul Rickard answers subscribers’ queries about whether he supports the proposed AGL demerger? Why has Goodman Group’s share price fallen? Is Arb Corporation a buy? When will Westpac pay its dividend?

- And finally, Paul heralds Macquarie Bank as one of our best companies even though it has fallen from grace. Given it is a quality company, he asks: Is this a buying opportunity?

Our videos of the week:

- Why coffee is so beneficial for our bodies | The Check Up

- Chris Joye on when will the stock market crash & house prices fall!? + Nightmare on Wall St! | Switzer Investing

- How worried should we be about this sell-off? + Has Westpac turned the corner? | Mad about Money

- Will stocks rise and are they a buy? Experts say property prices don’t have to crash! | Switzer Investing

- Boom! Doom! Zoom! | 12 May 2022

Top Stocks – how they fared:

The Week Ahead:

Australia

Tuesday May 17 – Weekly consumer confidence (May 15)

Tuesday May 17 – Reserve Bank Board meeting minutes (May 3)

Tuesday May 17 – Household impacts of Covid-19 survey (April)

Wednesday May 18 – Wage Price Index (March quarter)

Thursday May 19 – Labour force (April)

Overseas

Monday May 16 – China Retail sales/production/investment (April)

Monday May 16 – US NY Empire State manufacturing index (May)

Tuesday May 17 – US Retail sales (April)

Tuesday May 17 – US Industrial production (April)

Tuesday May 17 – US NAHB Housing Market Index (May)

Tuesday May 17 – US Business inventories (March)

Wednesday May 18 – US Housing starts (April)

Wednesday May 18 – US Building permits (April)

Thursday May 19 – US Philadelphia Fed manufacturing index (May)

Thursday May 19 – US Existing home sales (April)

Thursday May 19 – US Conference Board leading index (April)

Friday May 20 – China 1- and 5-year loan prime rates

Food for thought: “Success is walking from failure to failure with no loss of enthusiasm.” – Winston Churchill

Stocks shorted:

ASIC releases data daily on the major short positions in the market. These are the stocks with the highest proportion of their ordinary shares that have been sold short, which could suggest investors are expecting the price to come down. The table shows how this has changed compared to the week before.

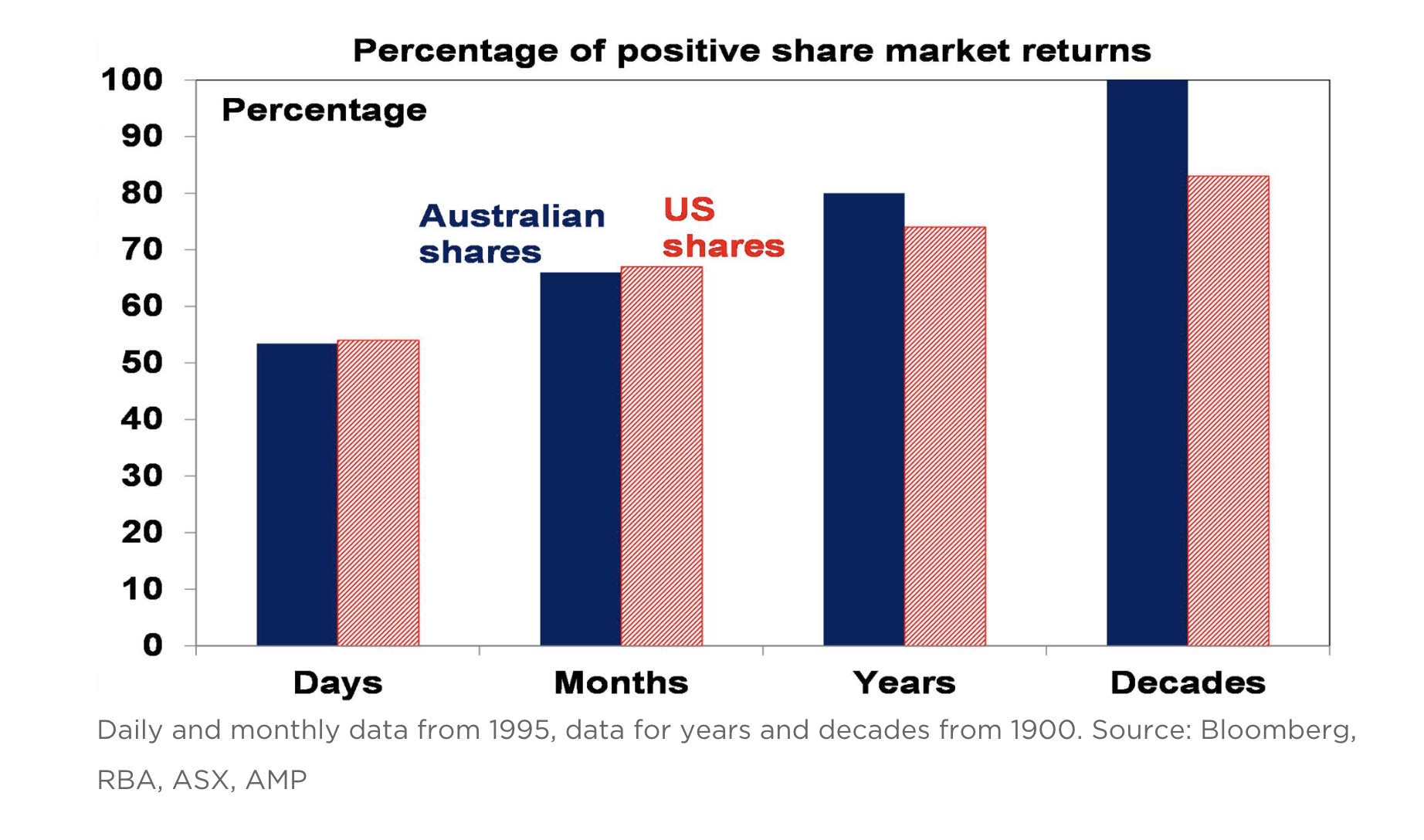

Chart of the week:

During these bearish times, it is only fitting that our Chart of the Week explores how investors can keep calm and collected without exiting the market. AMP Capital’s Shane Oliver says, If you look at the daily movements in the share market, they are down almost as much as they are up, with only just over 50% of days seeing positive gains.

“So day by day, it’s pretty much a coin toss as to whether you will get good news or bad news. But if you only look monthly and allow for dividends, the historical experience tells us you will only get bad news around a third of the time. Looking only on a calendar year basis, data back to 1900 indicates the probability of a loss slides to just 20% in Australian shares and 26% for US shares. And if you go all the way out to once a decade, since 1900 positive returns have been seen 100% of the time for Australian shares and 82% for US shares.”

“Key message: the less you look at your investments, the less you will be disappointed. This matters as the more you are disappointed, the greater the risk of selling at the wrong time.”

Top 5 most clicked:

- When will this negativity end and will there be a happy ending soon? – Peter Switzer

- Which bank is my pick following half-year results? – Paul Rickard

- Is Macquarie in the buy zone? – Paul Rickard

- 4 cheap-as-chips mining contractors – James Dunn

- Buy, Hold, Sell – What the Brokers Say – Rudi Filapek-Vandyck

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.