With stock markets reminding us why the cliché “sell in May and go away” has become historically popular for share players (and knowing I said a few months ago — buy before May and stay”), let’s see if I have a good chance of being right.

One of my financial planners recently asked me what I thought about the market. And I replied: “It is what it is, until it’s not.”

I wasn’t trying to be too smart and evasive but realistic, so I quickly said that we’re in a negativity-inclined trap until some good circuit-breaking news comes along.

Right now, the market is like a kangaroo caught in the headlights and they’re fixated on the headwinds that tell short-term players to sell into rallies because the likelihood of a news story that can change the current negativity is a long way off.

4 things to turn sentiment around

So what could turn sentiment around? Try and pray for these if you like stock prices to rise:

- An end to the Ukraine war, which will take oil prices and inflation down.

- China needs to get out of its pandemic lockdown problem, which will also bring inflation down by reducing supply chain cost impositions.

- Inflation readings have to show inflation is peaking in the US importantly and the world generally, which of course includes us.

- Then as a consequence of slowing inflation, the outrageous calls on future interest rate rises inside a year would be toned down, which will be a signal to stock market influencers that the current negativity, which has KO’d share prices of growth and tech companies, was over the top.

Looking at all these, I can’t see any ground-breaking event to turn the market positive for at least three months or more.

Ironically, it could be around early September that markets might be accepting that this excessive negativity was exactly that — excessive — and that completes the old cliché: “Sell in May and go away, and come back on St Ledger’s Day”.

This is a day in a racehorse carnival in the UK and coincided with the end of the summer holidays when in the old days, stockbrokers and other market players got down to the serious business of investing and speculating, post-holidays.

Can optimism be restored?

So aside from Vladimir Putin and President Xi fixing up their negative contributions to stocks right now, what good news out there might make it easy to believe that the current pessimism will be replaced with optimism?

Citi’s Bear Market checklist

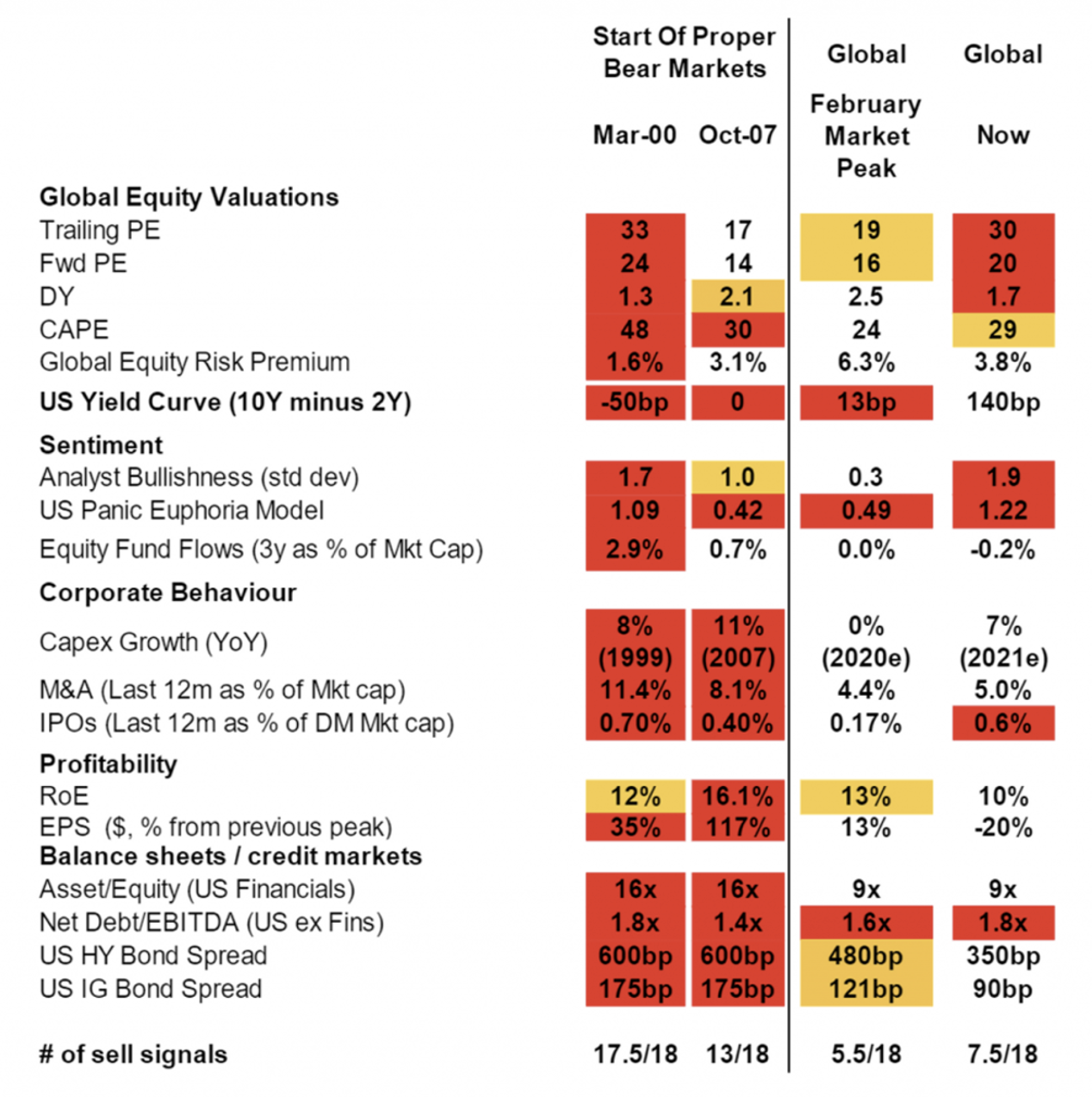

One reliable assessor of a market’s potential to defy gravity is the Citi Bear Market Checklist. This was released in late April and it looks at 18 indicators that can give warning signals that a stock market is likely to tank. Generally speaking, if there are 10 or more indicators with red flags, it pays to position your portfolio defensively.

Here’s the latest:

Before the dotcom crash, the score was 17.5/18 and prior to the GFC crash the count was 13/18 and now it is 7.5/18. The 5.5/18 before the Coronavirus crash shows the checklist has its shortcomings, but who would’ve expected a pandemic that would shut down the world economy?

What keeps me positive

I like the score 7.5/18 and helps keep me positive.

Last week, Macquarie put on a conference and its Viktor Shvets tipped inflation would be coming off the boil later in the year, which coincides with my view that positivity should be a goer in the December quarter, which starts in October, just after September.

Rates up, rates down

The AFR headlined his view with: “Rates are going up, then straight back down,” and remember tech stocks like falling rates and vice versa, as we’ve seen since November last year when interest rates/inflation fears dominated market talk.

US election

By the way, this is a mid-term election year for the US, which is held on November 8, which could be a fillip for stocks. The second year of a US Presidency is usually pretty bad but have a look at my latest discovery: “This ‘Presidential Election Cycle Theory’ was initially put forth by Yale Hirsch, the Stock Trader’s Almanac creator. It was furthered by Pepperdine professor Marshall Nickles, in a paper called ‘Presidential Elections and Stock Market Cycles,’ which presented data showing that one profitable strategy would be to invest on October 1 of the second year of a presidential term, and sell on December 31 of year four.”

The third year of a President tends to be the best followed by the fourth year, so there are good reasons to keep the faith.

The BIG negative

One of the biggest negatives for stocks is the view on what will happen to interest rates and Chris Joye, founder of Coolabah Capital, who writes in the AFR and who manages the Switzer High Yield Fund, thinks US stocks can fall a fair bit more.

He’s written about it and on February 9 tipped a 30% to 60% slump for the S&P 500 Index on my TV show. So far, the fall has been 10% but since the market started to slide in early January, the drop has been 14%, so we could be halfway there if Chris’ 30% call ends up being the max.

What will determine if he’s right and his big, bad calls turn out to be spot on? It’s simple — too many interest rate rises in a short period of time or a failure to beat inflation — so, it goes up when it should be going down.

Trouble in 2024

I’ve always said I believed there was another rally in 2022 but I’d become more defensive in 2023, suspecting some market trouble in 2024.

Why 2024? Well, even our RBA thought life wouldn’t be so tough for economies and businesses until 2024; when Dr Phil Lowe expected he’d give us his first interest rate rise.

Well, the bounce-back of economies has surprised central bankers, who understandably didn’t see a rerun of lockdowns in China and the Ukraine war but they did also underestimate how high inflation could go and how long it might hang around.

Near the bottom?

We’re in the hands of central bankers but I did like this from one of my favourite market-callers — Professor Jeremy Stiegel of the Wharton School of Business at the Uni of Pennsylvania, who told CNBC that “we may be near the bottom of the in markets”.

Be greedy when others are fearful?

This is all guesswork but I do know a lot of good companies of the future have been trashed, which invokes in me the words of Warren Buffett of “be greedy when others are fearful”.

Want an example? Try Zoom Video Communications, which is off 66% since mid-2021 and locally Megaport, which is down 62% in six months.

Everyone is right one day

Chris Joye will be right one day and his model comparing stock markets to interest rates shows that when rates get attractive enough for some investors to dump stocks for fixed interest, stock prices fall.

But understand this, interest rates are not high enough yet to justify getting out of stocks wholesale, and that’s why I think we have time for another rally or two before a strong economy rekindles inflation concerns and central banks restart raising interest rates.

Shvets thinks this could happen in late 2023 or early 2024, and if we get a big global economic rebound after the Ukraine war ends, China gets out of lockdown and central banks stop raising rates, as well as bond markets admitting that they went too far predicting excessively high rates, then it could be time to reduce your exposure to stocks and chase fixed income.

My view

I don’t think that time is now and I’m investing for a happy ending over 2022-23.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.