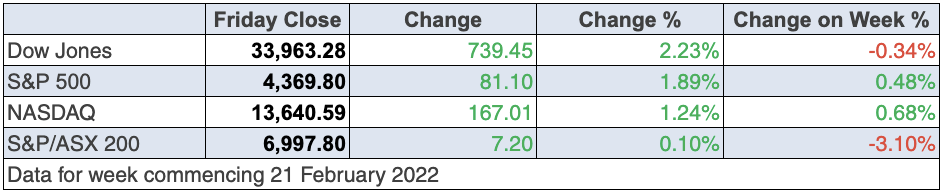

Those ‘weird and wonderful’ Wall Street influencers have continued their lack of concern for the implications of the Russia-Ukraine conflict, with all US stock market indices strongly in the green. But this was not just an out-of-touch Yank thing because even European share players discounted the potential problems created by Vlad the invader.

The German DAX was up 3.67%, the FTSE in the UK was up 3.91% and the French CAC was 3.44% higher, indicating a new assessment of market participants on how this war will affect individual companies’ profits and share prices. And what augurs well for our market on Monday, as utilities, mining firms and banks led the gains, with each sector climbing more than 4%.

This comes as the West looks likely to ramp up sanctions against Russia. “The prospect of a decision to target the SWIFT international payments system or a coordinated move to hit Russia’s oil and gas exports could have broader implications for the global economy,” CNBC’s Sam Meredith suggested.

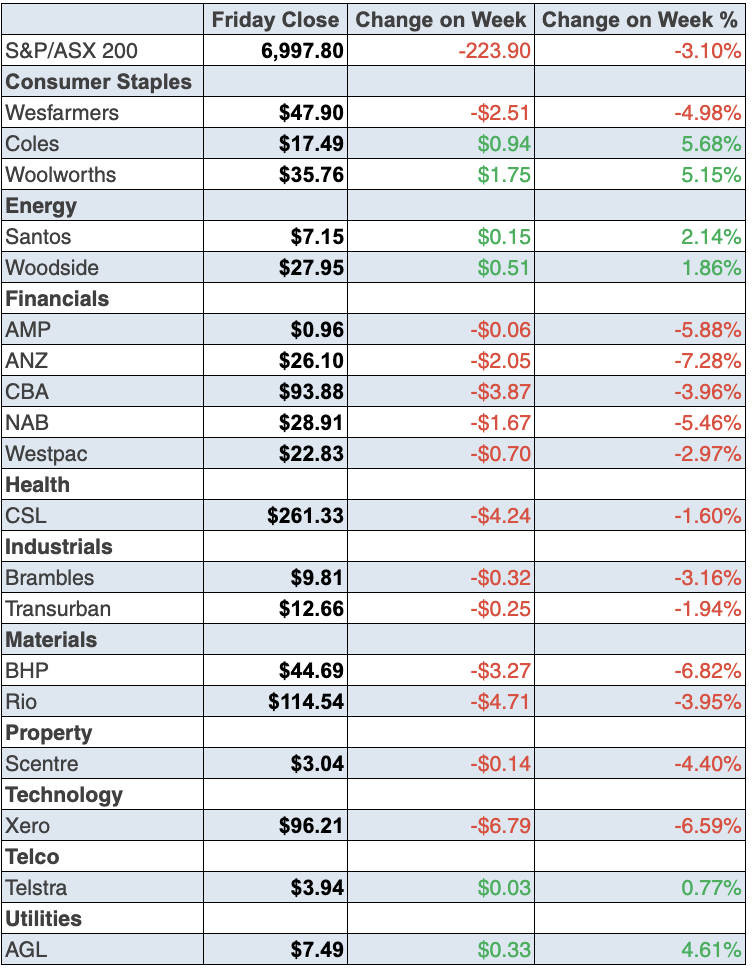

This could have further positive price consequences for the likes of Woodside, which was up 0.95% last week to $27.95 and Santos, which put on 4.23% to $7.15 in the past five days.

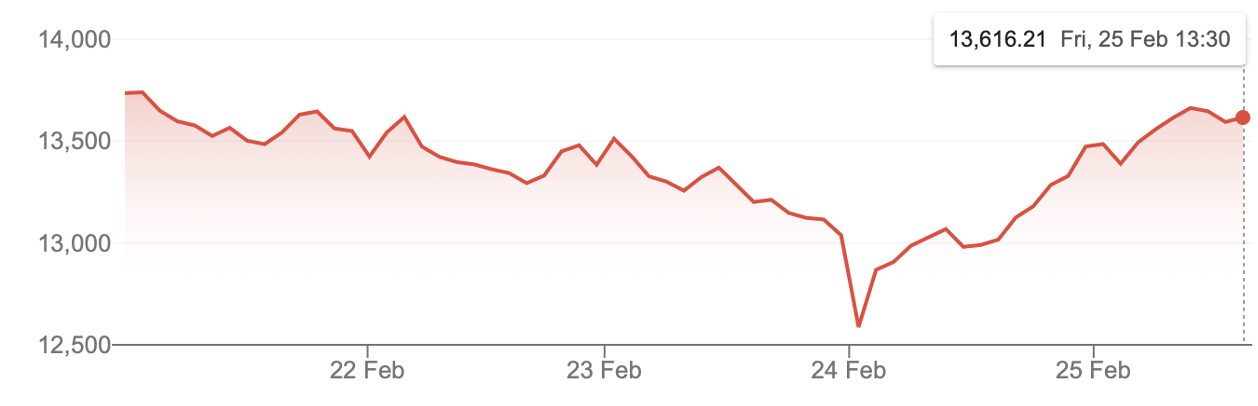

To the land of optimism — the US — and with two and a half hours to trade, the Dow Jones index was up 781 points or over 2.3%. Clearly, the bargain hunters (who were responsible for the Nasdaq putting in a 6% turnaround of its index in the last couple of hours of trade on Thursday), were not done yet showing us that the earlier sell-off this week was over-the-top.

Nasdaq Composite’s huge bounce-back

This was a point I was making for most of the week, though I could get a little more negative if Putin seriously acts consistent with his threats towards Finland, if they give up on neutrality to join NATO. That would be a huge, new curve ball for stock markets.

Against that negative speculation, which could be exaggerated, there were reports that Putin was prepared to send a delegation to Minsk in Belarus for negotiations with Ukraine’s leadership.

But let’s be real here, we have to expect volatility in the coming weeks, as the Ukraine tragedy and the West’s economic/sanctions response eventually mix in with the Fed’s decision on interest rates.

Overnight, the signs were broadly positive, with gold falling 1.9% in early trade after rallying for weeks on the back of Russia’s threat of war. Treasury yields held relatively steady, which suggests the fear-driven flight to safety we saw earlier in the week is on the wane, for now.

On the subject of what the Fed will do with rates at the 16-17 March meeting, hopes of a more measured increase lifted as inflation readings for January were “roughly in line with economists’ expectations, though it was still high. It also showed the main engine of the US economy, spending by consumers, strengthened by more than economists expected,” CBS.com revealed. “The economic reports could be enough to convince the Federal Reserve to hold off on raising short-term rates next month by double its usual increase, at least for now, said Brian Jacobsen, senior investment strategist at Allspring Global Investments.”

One last point on the market’s reaction since Thursday. Tom Lee of Fundstrat Global Advisors thinks the recent stock market pain could be near an end. Note I did say, “near”.

Inflation concerns have been the main driver for the decline of stocks with the Nasdaq in correction territory, down over 15% from its highs in November last year.

Lee pointed out “that markets typically sell off into the build-up of a geopolitical escalation, but rally on the day of the invasion”.

The firm looked at stock price movements surrounding the Vietnam War, the Gulf War, the Afghanistan War, the Iraq War and the Crimean Crisis and found that five out of five times, stocks bottom just before the invasion! (CNBC)

Lee also thinks the VIX or ‘fear index’ is telling us that the worst of the current stocks sell-off is over, though the Putin plays and what the Fed does next month could be curveballs that keep stocks volatile.

To the local story and the S&P/ASX 200 lost 222 points or 3.08% to finish at 6997.8, but Friday saw the market cope with the Ukraine-Russian created anxiety to go up 7.2 points, helped (believe it or not) by a tech rally!

The overall tech sector was up 8.1%, which the AFR’s Richard Henderson says was the best one-day gain since 2007!

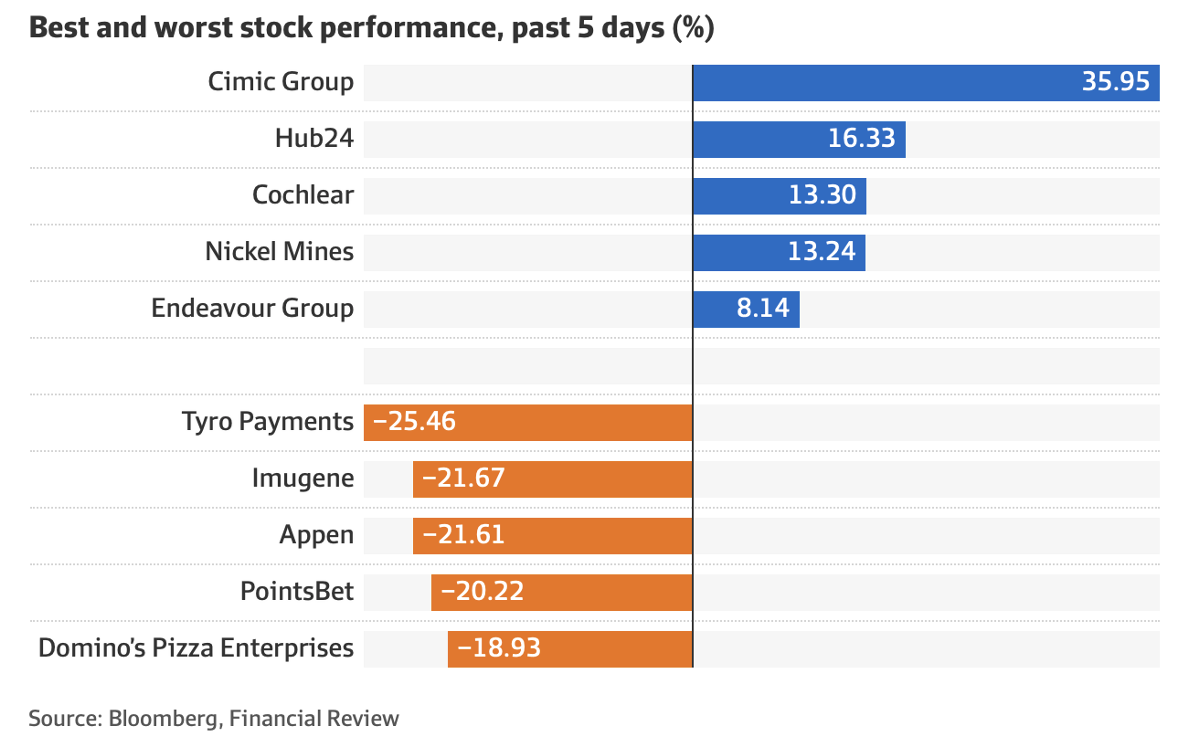

But they needed a rebound after being smashed earlier in the week, with Tyro Payments really copping it. The company lost 25% for the week but put on 10.92% on Friday finishing at $1.62. (Thursday night’s Switzer Investing saw me give my take on Tyro and for those suffering it might be worth a peek.

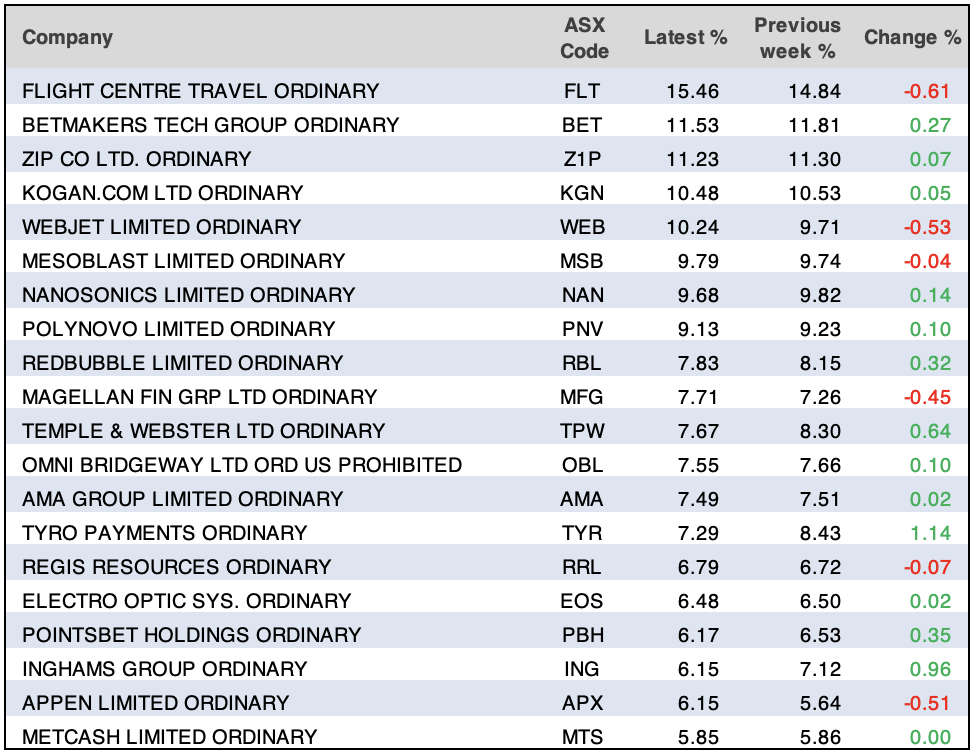

Here are the big winners and losers for the week:

Interestingly, Block, which now holds Afterpay, surged 32.5% to $153.75 after their results showed that the market is not always the best judge of a company!

Not surprisingly, Zip was up 6.25% on Friday but was off 12.3% for the week.

It was a weird week with a company like Life 360 up 22.1% on Friday but it was down 15.66% for the week. I suspect the old saying that “where there’s smoke, there’s fire” will prove to be valid for beaten-up tech stocks sometime this year, as I predicted in Monday’s story.

Troubled fund manager Magellan lost 10.1% on Friday after it was revealed that it has lost more funds under management. With the media constantly looking at the company’s woes, $10bn has left MFG in two weeks.

Finally, the war headlines haven’t been good for our big miners. BHP lost 7.09% for the week to $44.69, Rio 3.9% to $114.54, despite a whopper of a dividend announced this week and FMG gave up 4.62% to finish at $18.60.

What I liked

- This CNBC headline: ‘Geopolitical shocks to the stock market tend to be fleeting’, says BMO’s Belski. And more to the point, “data complied by BMO shows that, since the 1930s, the S&P 500 averages a return of about 8% in the 12 months after a geopolitical conflict had begun”.

- The Australian Bureau of Statistics (ABS) said new business investment (spending on buildings and equipment) rose by 1.1% in the December quarter to be up 9.8% on the year.

- The first estimate of expected investment in 2022/23 is 10.8% higher than the equivalent estimate for 2021/22 – the strongest result in a decade.

- The preliminary IHS Markit Australia Composite Purchasing Managers’ index (PMI) rose from 46.7 to an 8-month high of 55.9 in February. Readings below 50 indicate a contraction in activity.

- “CBA card spending to the week ending 18 February showed a rebound in spending after a small fall last week. Spending in-store and spending on services both continued to trend higher over the week.”

- The Australian Bureau of Statistics (ABS) Household Spending Indicator shows household spending rose by 8.6% over the year to December 2021. The largest annual spending increases were on furnishings and household equipment (up 27.4%) and hotels, cafes and restaurants (up 23.6%).

- The Wage Price Index (WPI), grew by 0.7% in the December quarter – the strongest quarterly lift in wages in 7½ years (since the March quarter 2014). Annual wage growth lifted from a 2.2% to 2.3% pace in the December quarter, the equal strongest rate in three years (since December quarter 2018). But it wasn’t too high to force the RBA to raise interest rates too soon.

- The US economy grew at a 7% annualised rate in the December quarter (survey: 7%).

- The Markit composite purchasing managers index rose from 51.1 to 56 in February (survey: 51.9). The S&P/Case Shiller home price index rose 18.6% in the year to December (survey: 18%).

- The Federal Reserve’s primary inflation gauge rose 5.2% from a year ago, the Commerce Department reported Friday. Economists surveyed by Dow Jones expected a 5.1% print. (It was high but it didn’t shock and might help the Fed not overreact when it raises interest rates in March.)

What I didn’t like

- Building costs rose by 2.5% in the December quarter – the biggest lift in 21 years.

- The ANZ-Roy Morgan consumer confidence index fell by 1.4% to 101.8 points last week but weekly readings will become less important as our economy throws off virus fears.

- US consumer confidence fell from 111.1 to 110.5 in February (survey: 110).

- The European stock market reaction was a worry with banks down 8.2% and automakers fell most. The German Dax index lost 4%, with the UK FTSE index lower by 3.9%.

And this was also good to know

National Securities’ Art Hogan also points out that the Russia-Ukraine crisis should pose a limited risk to US stocks, given there are few US/Russia economic ties.

“As investors, we must focus much more on the potential economic implications to those same events,” Hogan said in an email. “When we look at the direct economic ties between both Russia and the United States, it would be very difficult to build a case that this military conflict would cause significant economic damage to the S&P 500.”

The week in review:

- This week in the Switzer Report, I stress the message about patience in investing, and explain (again!) why patient investors could be rewarded handsomely this year, especially with growth and tech stocks.

- Paul (Rickard) takes a look at Telstra’s half year earnings report,and although it hasn’t shot the lights out, its promising signs considering the company’s checkered past. Later in the week, Paul continues the company reporting theme and takes a look at Woolworths’ (WOW) earnings results and posits whether it can go further.

- James Dunn provides some much-needed context for the current oil boom seen around the globe, offering his favourite stock plus some viable alternativesto ride this uptrend.

- IVF companies Monash IVF Group and Virtus Health last year noted greater focus on families and individual wellbeing among their patients. Tony Featherstone asks: who knows if these positive attitudes towards family will persist after Covid? Tony says he prefers to back well-established trends like population growth, higher female workforce participation, smaller family sizes and people in western countries spending more on their kids. He says these positive trends bode well for leading baby-goods retailers and childcare operators – and he nominates two he likes.

- In our “HOT” stock column, Michael Gable, Managing Director of Fairmont Equities, explains whyhe thinks NRW Holdings (NWH) is a buy.

- In Buy, Hold, Sell – What the Brokers Say,there were 11 upgrades and 12 downgrades in the first edition and 16 upgrades and 8 downgrades in the second edition.

- And finally, in Questions of the Week,Paul Rickard answers subscribers’ queries about whether it’s now the time to take profits on oil stocks such as Woodside; if I re-weight my portfolio to make it more defensive, should I invest in bonds or term deposits?; when do BHP shareholders get shares in Woodside?; I’m a long suffering AMP shareholder – should I cut and run?

Our videos of the week:

- The vital importance of having a healthy gut microbiome | The Check Up

- These stocks look like winners following reporting season: BHP, WPL, the banks, SEK, DHG & even A2M | Switzer Investing

- What effect will the Ukraine “war” have on the stock market & when will tech stocks rebound? | Mad about Money

- Boom! Doom! Zoom! | Thursday 24 February

- Why I bought Tyro this week! + Will our $ rise and when will rates go up? | Switzer Investing

- Brendan Boyd from Silk Logistics (SLH) | The CEO Masterclass

Top Stocks – how they fared:

The Week Ahead:

Australia

Monday February 28 – Business Indicators (Dec quarter)

Monday February 28 – Retail trade (Jan)

Monday February 28 – Private sector credit (Jan)

Tuesday March 1 – CoreLogic Home Value Index (Feb)

Tuesday March 1 – Lending indicators (Jan)

Tuesday March 1 – Balance of Payments (Dec quarter)

Tuesday March 1 – Reserve Bank (RBA) Board meeting

Wednesday March 2 – National accounts (GDP, Dec quarter)

Thursday March 3 – International trade (Jan)

Thursday March 3 – Building approvals (Jan)

Friday March 4 – Retail sales (final estimates for Jan)

Overseas

Monday February 28 – US Advance goods trade balance (Jan)

Monday February 28 – US Dallas Fed manufacturing index (Feb)

Tuesday March 1 – China purchasing managers’ index (Feb)

Tuesday March 1 – US ISM manufacturing index (Feb)

Tuesday March 1 – US Construction spending (Jan)

Wednesday March 2 – US ADP employment change (Feb)

Wednesday March 2 – US Federal Reserve Beige Book

Wednesday March 2 – US Federal Reserve Chair Powell speech

Thursday March 3 – US Challenger job cuts (Feb)

Thursday March 3 – US Factory orders (Jan)

Thursday March 3 – US ISM services index (Feb)

Friday March 4 – US Non-farm payrolls

Food for thought: “It’s not how much money you make, but how much money you keep, how hard it works for you, and how many generations you keep it for.” — Robert Kiyosaki

Stocks shorted:

ASIC releases data daily on the major short positions in the market. These are the stocks with the highest proportion of their ordinary shares that have been sold short, which could suggest investors are expecting the price to come down. The table shows how this has changed compared to the week before.

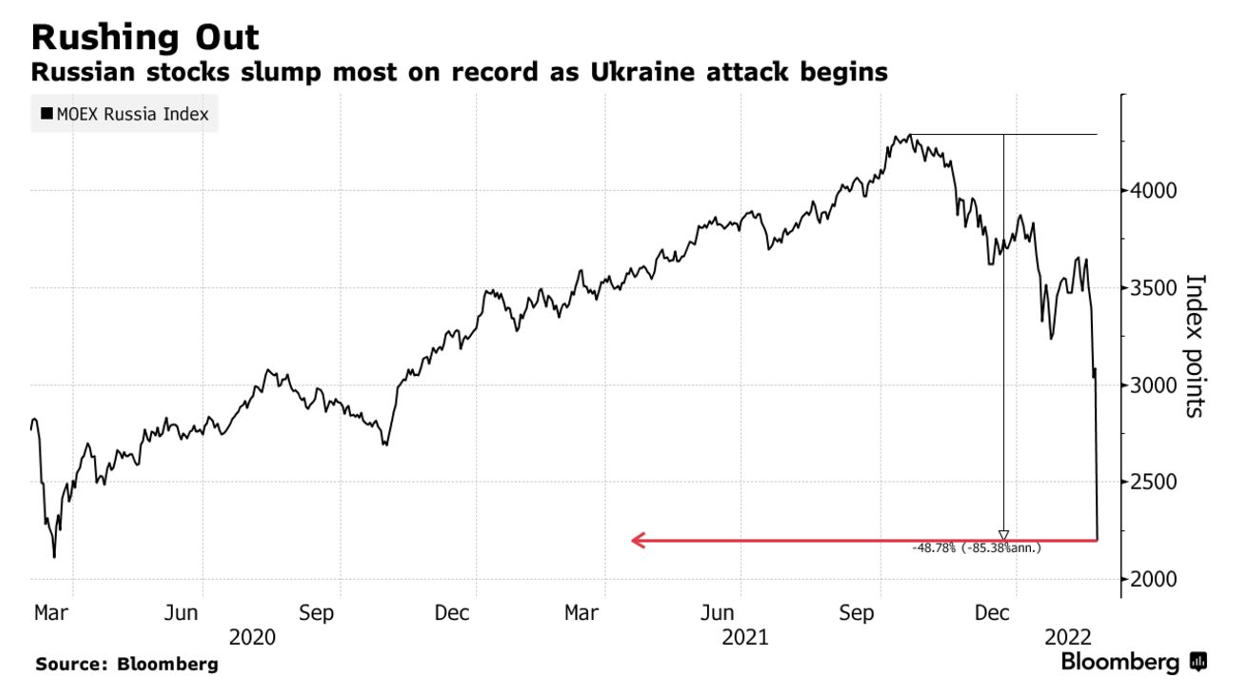

Chart of the week:

In keeping with the news taking the world by storm, our chart of the week shows that while many of the global indices saw a rebound late in the week, Russia’s invasion of Ukraine has had a deleterious impact on its stock market. Bloomberg reported on Thursday: “Russian equities fell the most on record on Thursday, erasing more than $150 billion in value, after President Vladimir Putin ordered an operation to ‘demilitarize’ Ukraine and targets were attacked across the country. The benchmark MOEX Russia Index is down about 50% from its October record high and along with the dollar-denominated RTS is the worst-performing stock market globally this year. The news of the invasion fuelled a hunt for safe havens, with investors fleeing equities around the world.”

Top 5 most clicked:

- Big returns for stocks means playing the waiting game – Peter Switzer

- My number 1 stock to play the oil boom – James Dunn

- Telstra’s “workmanlike” result – can it go higher? – Paul Rickard

- Buy, Hold, Sell – What the Brokers Say – Rudi Filapek-Vandyck

- Here’s my snapshot of Baby Bunting & G8 Education – Tony Featherstone

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.