Well, I warned you that 2022 would be a year of volatility so welcome to exactly that. It’s unpredictable and can really shock you, not only what can happen in one trading day but even within the last hour before the closing! And we saw that this week. But are we out of the woods?

I doubt it because not enough positive stuff to nullify what has spooked the stock market has come along yet. As I write, three hours before the closing bell at the New York Stock Exchange, the Dow was up only 21 points and European markets closed in the red with both the German and UK market off over 1%.

The latest US economic growth number out on this week was a nice but insufficient positive to turn sentiment around from selling to buying.

This take on the number by the Wall Street Journal explains why the strong reading wasn’t enough to turn around the market’s pessimism. “The U.S. economy grew rapidly in the fourth quarter of last year, advancing to a 6.9% annual rate, capping the strongest year of growth in nearly four decades as the country rebounded quickly from the pandemic-induced recession,” wrote Josh Mitchell. “But growth recently has run into obstacles that could lead to more modest growth this year, economists say.”

And the number of interest rate rises is a big one. If there are too many, as the market is now expecting, then it can only be spectacular growth driving bigger-than-expected profits that will get stock prices rising again.

Not making positivity instantly believable is the VIX. This is ‘the fear index’, which is now over 30, which says to expect more volatility. Also, the market now expects five interest rate rises after the Federal Open Market Committee Meeting earlier this week. “The FOMC meeting did not bring any surprises in terms of monetary policy, however, it may be perceived as more hawkish than expectations owing to Chair Powell’s suggestion of a need to enter a ‘steady’ phase of policy normalization,” Chris Hussey, a managing director at Goldman Sachs, said in a note. (CNBC)

The best outcome for stocks will be solid US economic growth and a measured number of rises in interest rates, helped by less supply problems, which force up inflation rates. For this to happen, we need to see the Omicron-like threats to economic and social normalcy take root this year ASAP.

I’m betting on this happening and very good pandemic news could be a circuit-breaker to beat the current negativity, but we will have to be patient ahead of the market saying “we have overreacted”. We saw a bit of that on the local market on Friday but I’ll be surprised if that was a signal that we’re out of the volatile ‘woods’ yet.

It will come but I suspect we might have some waiting and enduring sell-off days in the near future. And remember, the market isn’t just worried about the Fed and interest rate rises, there’s Vladimir Putin and his army hovering on the Ukraine border, which isn’t helping positivity. The idea of a war with Russia as China flexes its muscles in its region has to make for a more defensive approach to investing.

Morgan Stanley’s Mike Wilson thinks the S&P 500 is vulnerable to a 10% plunge in coming weeks but his number is only a guess. He anticipates challenging earnings reports and guidance will give investors a wake-up call regarding slowing growth.

China and Russia aside, stock prices this year will rest on economic growth and what happens to inflation. And the impact of the pandemic will be crucial. It could be the game-changer that unleashes higher growth expectations and lower inflation forecasts.

Omicron virus data is far more important to me than economic readings right now. I never thought I would’ve said that before February 2020 when the word Coronavirus changed us forever!

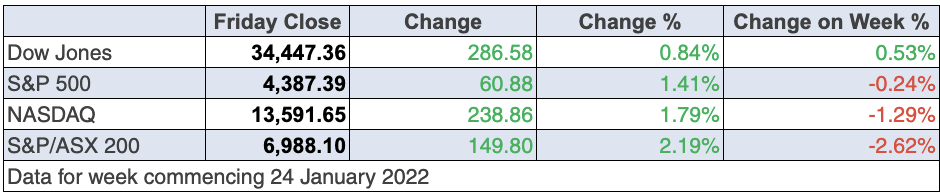

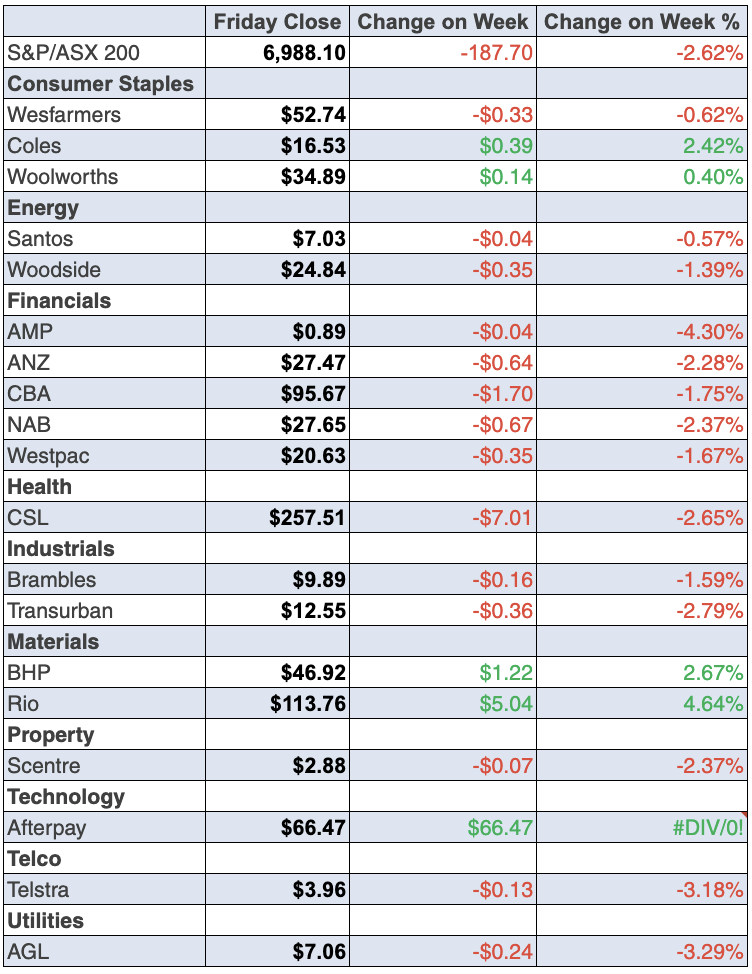

To the local story and the S&P/ASX gave up 2.6% to 6988.1 so that Friday rebound of 2.2% (or 149.8 points) was really important.

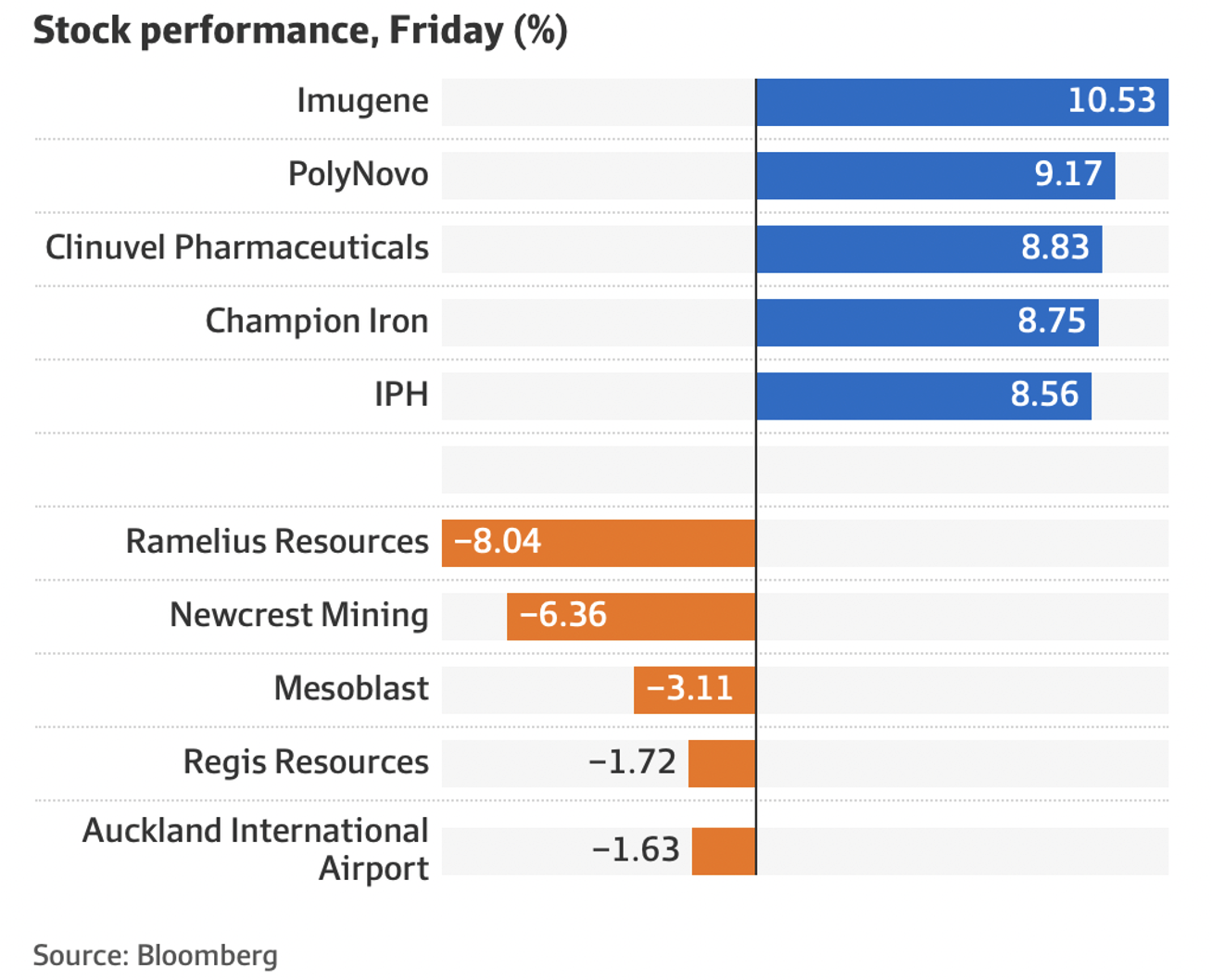

I loved that all 11 market sectors were in the green. I have always argued that we could have a better year for stocks than the US because their stock market has surged ahead of us and their bounce-back of all sectors adds to my cautious optimism on the matter. Helping was “the price of iron ore, [which] edged 0.5% higher to $US138.75 a tonne as traders prepared for a pick-up in demand after the Beijing Winter Olympics, which starts next Friday. Rio Tinto firmed 4.1% to $113.76, Champion Iron climbed 8.8% to $6.34, and BHP added 2.7% to $46.92”. (AFR)

I won’t concentrate on stock moves because both the sell-offs and buybacks were driven by panic, though noting those stocks that could draw friendly buying on a very positive day looks a little worrying.

What I liked

- The weekly ANZ-Roy Morgan consumer confidence rating rose by 2.2% (the biggest lift in 17 weeks) to 100.1 points (neutral level is 100). That’s a big effort. It could be linked to the fact that we’re travelling again within Australia (except for WA) and Omicron numbers appear to be peaking.

- The US economy grew at a 6.9% annual rate in the December quarter (survey: 5.5%).

- US new home sales rose by 11.9% to a 0.811 million annual rate in December (survey: 0.76 million).

- The Markit manufacturing purchasing managers index in the US fell from 57.7 to 55 in January (survey: 56.7). The services index eased from 57.6 to 50.9 (survey: 55). Any number over 50 means expansion.

- European share markets rose on Wednesday, recording their best sessions since early December. Gains were broad-based, with oil & gas up 4%, travel up 3.4%, miners up 2.6% and technology up by 2.2%. If there were no Russian and rates fears, stocks wouldn’t be selling off so madly.

What I didn’t like

- The main measure of inflation in Australia i.e. the Consumer Price Index (CPI) rose by 1.3% in the December quarter (consensus: 1%). The annual rate of the CPI rose from 3% to 3.5%. This was a pretty good result compared to the US, which has a 7% inflation number, but I suspect the March number for Australia will be higher. Why? Try this: the prices of imported goods rose by 5.8% in the December quarter (the most in eight years) to be up by 13.8% on the year.

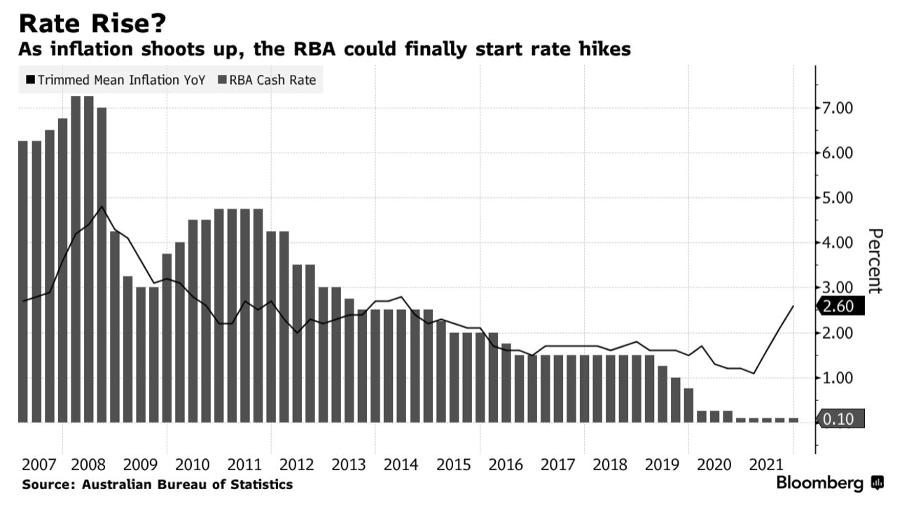

- The ‘underlying’ CPI or trimmed mean rose by 1% in the quarter (consensus: 0.7%) with the annual growth rate lifting from 2.1% to a 7½-year high of 2.6% (consensus: 2.3%), which is in the middle of the Reserve Bank’s 2-3% target range.

- The NAB business confidence index fell by 24.5 points in December (the third-biggest fall on record) to a 19-month low of -12.4 points. Business conditions fell from 10.7 points in November to 7.8 points in December.

- The preliminary IHS Markit Australia Composite Purchasing Managers’ index (PMI) fell from 54.9 in December to a 5-month low of 45.3 in January. Readings below 50 indicate a contraction of activity. But input price inflation hit a record high of 67.8 in January.

Reporting starts this week

Ten companies do show-and-tell this week but the real action starts the week after. Outlook statements will be really important for market reactions. Interestingly, on Thursday’s Switzer Investing show, Rudi Filapek-Vandyck talked about some companies that had upgrades. Seek was one of these and coincidentally Macquarie saw Seek having good prospects for 2022, along with Origin Energy, Santos and Amcor.

The week in review:

- This week in the Switzer Report, I dive headfirst into the spooky outlook for the equities markets as the Fed confirms interest rate hikes in March, with other central banks (including the RBA) set to raise rates sooner than anticipated. Despite this, and the eventual stock market sell off that we are already witnessing, I detail why I’m not afraid of a 45% correction.

- Paul Rickard once again addresses the nuanced topic of the Westpac (WBC) share buyback and which investors will benefit most. Later in the week, he looked at some internal restructuring of another ASX heavyweight, namely the unification of BHP Group (BHP) and whether it will have a positive impact on its share price.

- James Dunn does some homework for the yield-hungry investor, sharing his two stock picks for healthy dividend returns.

- Tony Featherstone believes there is much volatility and headwinds in store for equities in markets like Australia and the US, and while investors may see current prices as a buying opportunity, Tony warns “that long-duration growth stocks, such as big tech companies, [are] vulnerable to heavier price falls – and [it is] too soon to buy tech”. It has prompted him to look elsewhere, namely the emerging tech sector in Asia, and names 2 Asian-focused tech ETFs on his radar.

- For our “Hot” stocks this week, Managing Director at Fairmont Equities, Michael Gable factors in why engineering services company Worley (WOR) could push above its current levels despite facing revenue and margin headwinds, as he holds the view “that oil prices should continue to strengthen from here due to global supply issues and underinvestment”.

- Michael then takes centre stage for a long form article, giving you his handpicked favourite stocks for 2022.

- This week in Buy, Hold, Sell – What the Brokers Say, there were 21 upgrades and 13 downgrades in the first edition, and 7 upgrades and 5 downgrades in the second edition.

- And finally in Questions of the Week, Paul answers your questions on how the banking sector will perform in 2022, his recommendations for overseas share funds, the complexities of the Westpac share buyback, and whether Metrics Credit Partners funds are safe.

Our videos of the week:

- Rudi gives 5 stocks upgraded by experts. Is Telstra a buy? + 7 tips to invest in property

- Boom! Doom! Zoom! | Thursday 27 January

- Could the stock market really fall by 45%? Julia says no & is buying Lynas + Jun Bei & tech stocks

- What you should do if you are showing signs of possible dementia | The Check Up

Top Stocks – how they fared:

Note: As of 19 January 2022, Afterpay (APT) ceased trading on the ASX under Listing Rule 17.2 following its acquisition from NYSE-listed Block (formerly Square). Afterpay shareholders were afforded the opportunity to elect to receive the scheme consideration of 0.375 shares in Block for every 1 share in Afterpay as either direct shares in ‘SQ’ listed on the NYSE, or as ASX-listed Chess Depositary Interests (CDIs) trading under the ticker ‘SQ2’. As such, APT will be replaced by Xero (XRO) in our ‘Top Stocks’ segment for the technology sector moving forward.

The Week Ahead:

Australia

Monday January 31 – Private sector credit (Dec)

Tuesday February 1 – Weekly consumer confidence (Jan 30)

Tuesday February 1 – CoreLogic Home Value index (Jan)

Tuesday February 1 – Lending indicators (Dec)

Tuesday February 1 – Retail trade (Dec & Dec quarter)

Tuesday February 1 – Reserve Bank Board meeting

Wednesday February 2 – Reserve Bank Governor speech

Thursday February 3 – New vehicle sales (Jan)

Thursday February 3 – International trade (Dec)

Thursday February 3 – Building approvals (Dec)

Friday February 4 – Statement on Monetary Policy

Overseas

Sunday January 30 – China purchasing managers’ indexes (Jan)

Monday January 31 – US Dallas Fed manufacturing index (Jan)

Monday January 31 – US Chicago purchasing managers’ index (Jan)

Tuesday February 1 – US ISM manufacturing index (Jan)

Tuesday February 1 – US JOLTs job openings (Dec)

Tuesday February 1 – US Construction spending (Dec)

Wednesday February 2 – US ADP employment change (Jan)

Thursday February 3 – US Challenger job cuts (Jan)

Thursday February 3 – US Labour costs & nonfarm productivity (Dec quarter)

Thursday February 3 – US ISM services index (Jan)

Thursday February 3 – US Factory orders (Dec)

Friday February 4 – US Nonfarm payrolls (Jan)

Food for thought: “The four most dangerous words in investing are, it’s different this time.” — Sir John Templeton

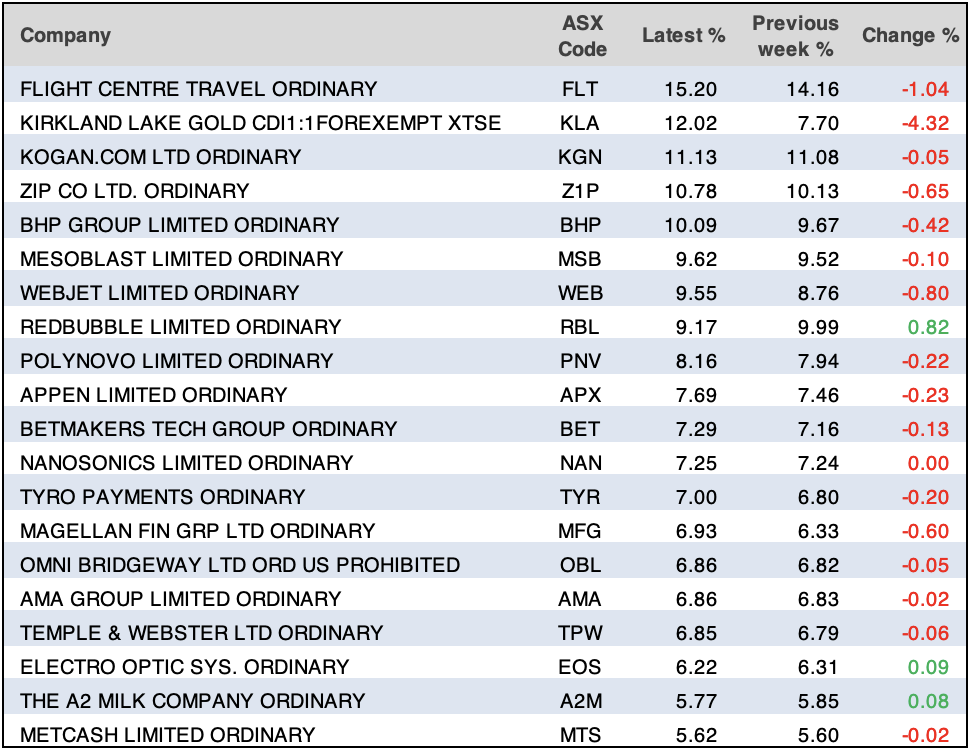

Stocks shorted:

ASIC releases data daily on the major short positions in the market. These are the stocks with the highest proportion of their ordinary shares that have been sold short, which could suggest investors are expecting the price to come down. The table shows how this has changed compared to the week before. NOTE: No data released from ASIC for week commencing Monday 24 January 2022. As such, the above table has been compiled from the most recent data released by ASIC on Friday 21 January 2022.

Chart of the week:

Our chart of the week poses a rather gloomy outlook for investors and borrowers, although one that we are none too surprised to see given recent outcomes. Australia has seen heavy than expected inflationary pressure and coupled with rising interest rates flagged by the Fed, the RBA is set to bring forward its rate hikes. It “holds its first policy meeting of the year on Feb. 1, when the board is likely to scrap a A$4 billion-a-week bond buying program. That expectation reflects recent strong economic data — including unemployment falling to a 13-year low — and a global move away from pandemic-era ultra-easy policy,” Bloomberg reports. Further, senior economist at Aware Super, Belinda Cheung said: “The most important thing that will come out of next week’s meeting is the change in the language around the forward guidance for the cash rate target … That will give us a hint about interest rate liftoff”.

Top 5 most clicked:

- I’m not afraid of talk of a 45% stock market sell off – Peter Switzer

- My stocks to watch in 2022 – Michael Gable

- Enhanced terms make Westpac’s buyback a “no brainer” for some shareholders – Paul Rickard

- Buy, Hold, Sell – What the Brokers Say – Rudi Filapek-Vandyck

- 2 Asian-focused tech ETFs on my radar – Tony Featherstone

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.