One insight from this week’s trading action is that you’re going to need some belief in the longer-term future of your portfolio, than what it might do in the coming weeks. Wall Street tried to rally on Thursday but sellers told buyers it was too soon to get positive.

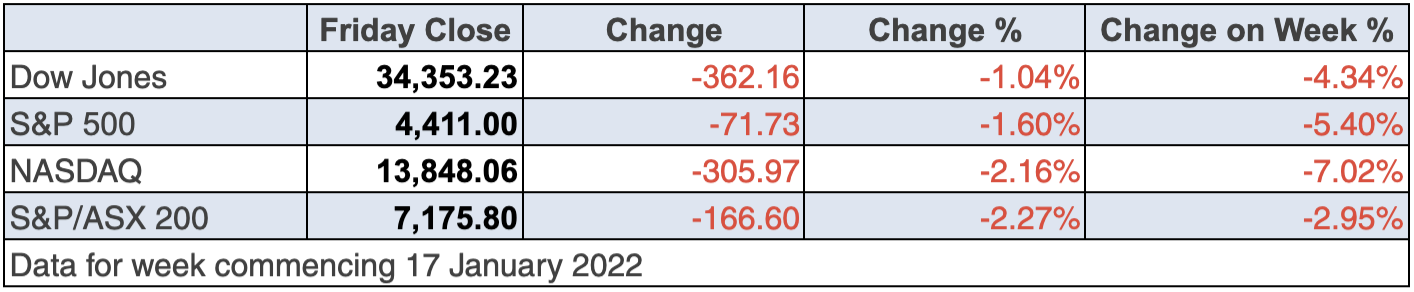

Our market took this onboard on Friday with a 166-point fall of the S&P/ASX 200 Index, with tech and payment companies still losing friends. But resource stocks also joined in the sell off. Of course, this won’t last forever and there will be a rotation back into tech stocks down the track but it won’t be any time soon.

European and US stocks were again down overnight and the big scare factor is the Fed meeting this week and what it will do for rising interest rates and central bank actions to decrease liquidity to rein in inflation. Rising rates and tech stocks are not a good combo, but what if the fears on rising interest rates are overblown? That is, sure, they rise, but over 2022 if inflation actually does come off the boil, the market view would be: “Oh, we’ve oversold tech!”. I’m not saying now is the time to buy tech stocks but I bet sometime this year, we will be asking: “Why did we ignore tech when the market oversold these businesses of the future?”

This week we saw a pre-emptive try at a re-rotation but it was short-lived. Out of Europe, Reuters reported that “positive earnings from the luxury goods sector and strong commodity prices helped investors momentarily look past concerns over rising interest rates”. British luxury brand Burberry rose 6.3% with full-price sales up in the third quarter.

And earlier in the week, news reports told us that US share markets fell sharply on growing investor expectations that the US central bank would have to boost interest rates earlier than anticipated to combat inflation. Meanwhile, not helping, was Goldman Sachs, whose shares plunged 7% after missing fourth-quarter profit expectations on weak trading activity. So far, many US banks have reported worse than expected, which hasn’t helped market positivity.

Also not helping positivity was famous US investor, Jeremy Grantham, who’s predicting a 45% crash of the S&P 500 Index. He’s had a couple of correct calls but has had a huge number of wrong big calls as well, which media outlets always seem to ignore.

I think a lot of the tech stocks that have driven up the S&P 500 Index are already in crash territory, being down over 20%, but as long as the US grows strongly this year and inflation subsides, then these worst-case scenarios can be avoided.

But it’s what the Fed says and does next week that has markets jumpy. The Fed’s interest rate team has implied three rate hikes this year but the futures market is thinking four or five! I’m hoping the Fed proves to be right and that will be good for stocks.

Also, the end of quantitative easing (or QE) is another worry for the market and the Fed meeting will have a take on that development as well next week.

“Given the level of uncertainty surrounding the Fed, I wouldn’t want to say that would be the extent of it,” said Emanuel, Evercore chief equity, derivatives and quantitative strategist. “You have to see how the combination of ‘FANG’ earnings and the Fed plays out. That’s not likely to make things any more certain.” (CNBC)

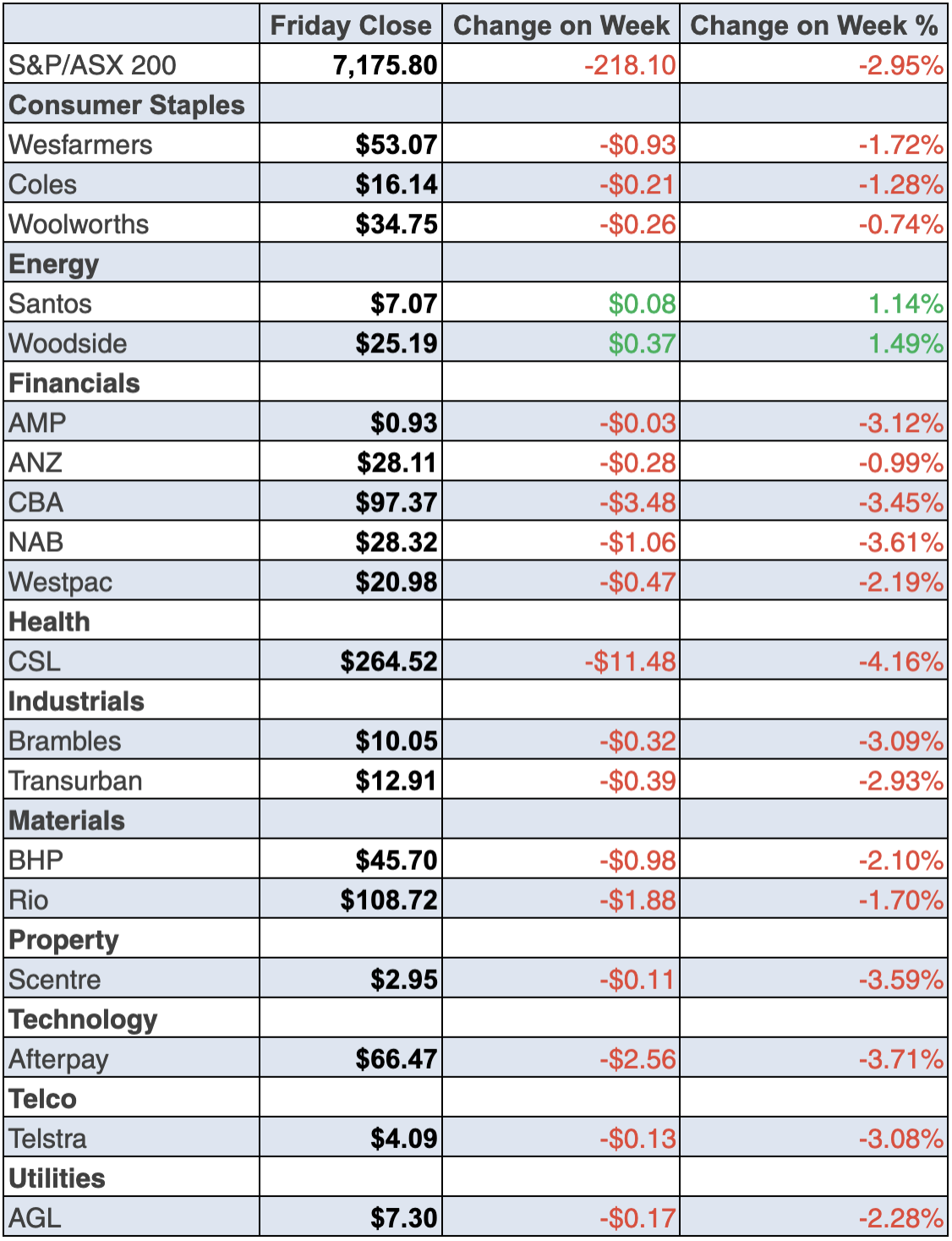

To the local story and the S&P/ASX 200 Index gave up 2.9% for the week but it was Friday’s 2.3% drubbing for the market that made it all look worrying. By the way, I pointed out recently that a huge year for stocks can often give birth to an ordinary January, and given my overall view on stocks this year, we are looking at a buying opportunity. But the question is: when do you move? (More on that on Monday.)

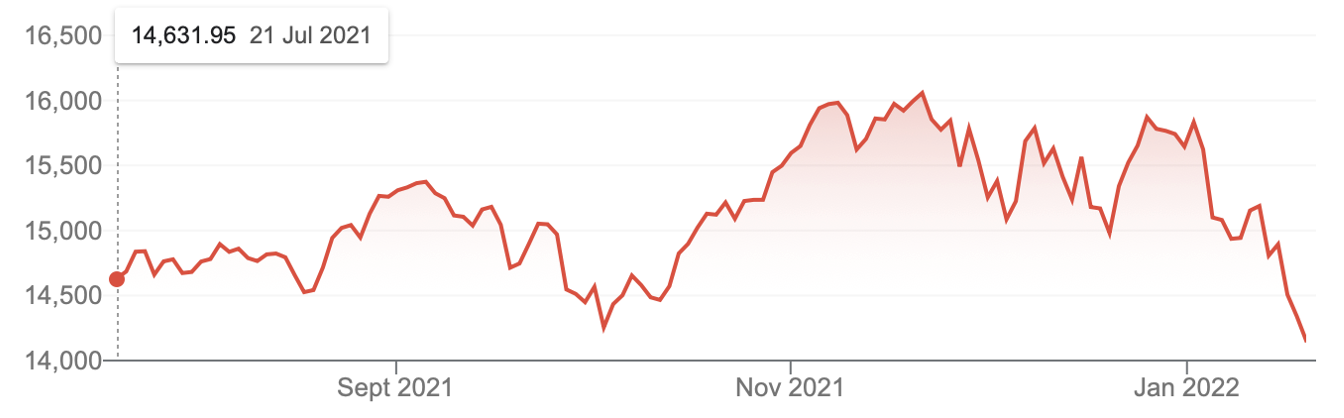

As I’ve said, next week is the US Fed’s interest rates meeting, and for some reason, we decided to worry about it on Friday. Spooking many is the Nasdaq’s correction, which is now down 11.8% since November.

Nasdaq

On Monday, I pointed out that 40% of the Nasdaq companies were 50% off their peaks, so it has been a real rotation out of once over-loved tech stocks that intensified over the lockdown periods. On Thursday Netflix plunged 19% overnight and Peloton gave up 23.9% and is now down 80% since January! These were classic beneficiaries of the pandemic lockdowns so a sell off makes total sense but the size of it is probably over the top.

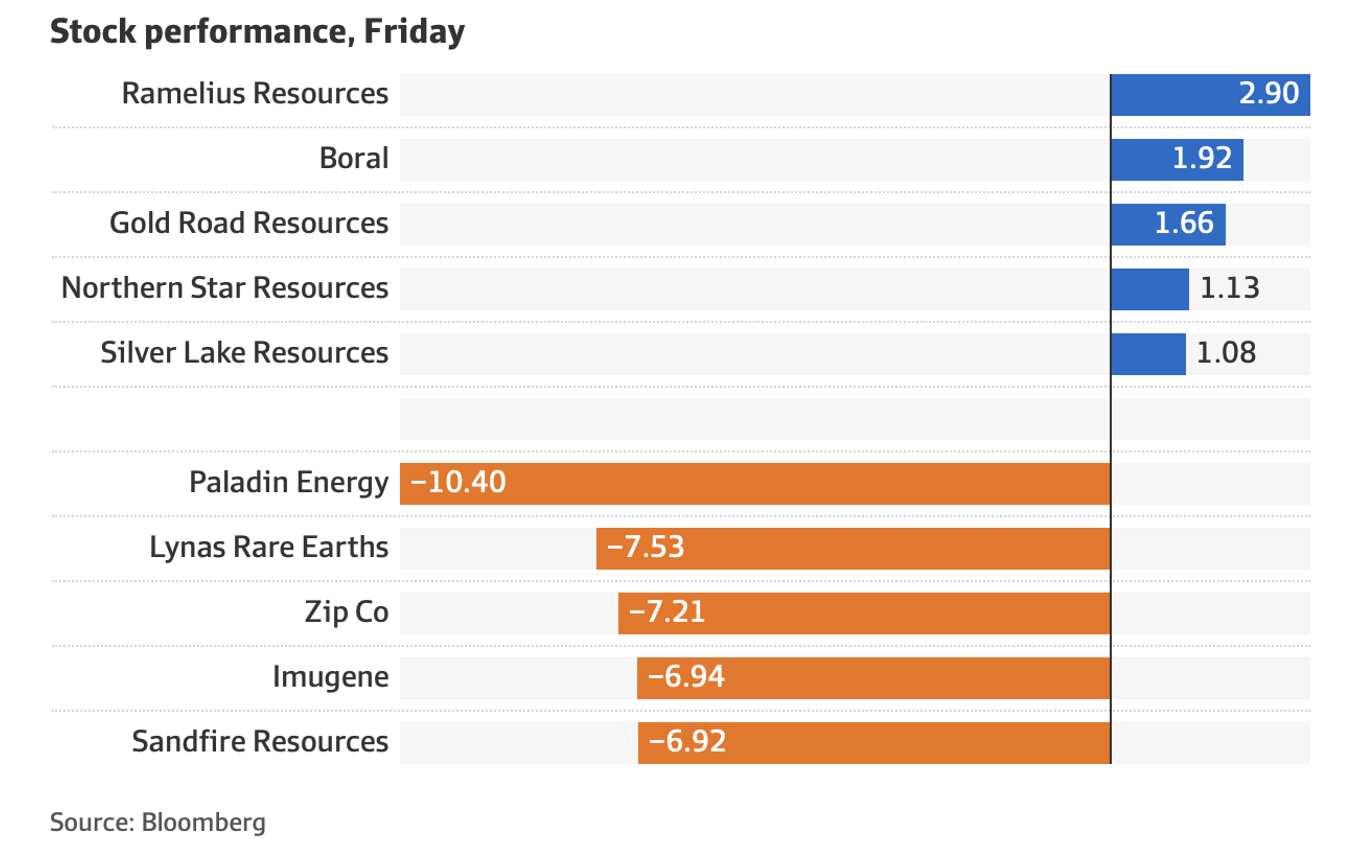

Here are our winners and losers for Friday, courtesy of Bloomberg and the AFR. Clearly, gold had a good day but past market darlings, such as Lynas and Paladin, lost friends.

Nuix continued its rough run after a trading update reduced the likelihood of a quick turnaround. The stock was smashed, down 22.82% to $1.59.

Lithium stocks were victims of profit-taking after a spectacular run. Allkem — that’s the new name for the merged Galaxy Resources and Orocobre — was down 6.67% to $10.35, while Pilbara Minerals gave up 6.1% to $3.56.

Meanwhile, the big miners copped it, with BHP off 4.8% to $45.70, Rio lost 4.69% to $108.72 and 2.10% to $20.94.

I could guess a reason why but I just think it’s profit-taking. And why wouldn’t you if you were a trader? But if you want a reason to buy BHP, well, look at my interview with Michael Gable on Thursday’s Switzer Investing show.

What I Liked

- Employment rose by 64,800 in December, with part-time jobs up by 23,300 and full-time jobs up 41,500. Total employment hit a record high of 13.242 million in December.

- The participation rate was unchanged at 66.1%.

- The unemployment rate fell from 4.6% to a 13-year low (since August 2008) of 4.2% in December.

- The Chinese economy grew at a 4% annual pace in the December quarter of 2021 (consensus: 3.3%). For the full year, the economy, as measured by gross domestic product (GDP) expanded by 8.1%, the fastest pace in a decade (consensus: 8%).

- The People’s Bank of China cut two key policy interest rates ahead of this week’s GDP release. China’s central bank cut the one-year medium-term lending facility (MLF) rate for the first time since April 2020, from 2.95% to 2.85%. It also lowered the seven-day reverse repurchase rate from 2.2% to 2.1%.

- In the US, the Philadelphia Federal Reserve manufacturing index rose from 15.4 to 23.2 in January (survey: 20).

- The German ZEW economic sentiment index lifted from 29.9 to 51.7 in January (survey: 32).

- Travel stocks led the gains on Thursday in Europe (up 2.9%) after Ryanair (up 4.2%) expressed confidence about a recovery in travel demand later this year.

- US building permits rose 9.1%, from 1.717 million to a 1.873 million annualised rate in December (survey 1.7 million).

What I didn’t like

- The weekly ANZ-Roy Morgan consumer confidence rating fell by 7.6% (the biggest drop since March 2020) to a 15-month low of 97.9 points. It was the weakest January consumer sentiment reading since 1992.

- The Bureau of Statistics (ABS) reported that national payroll jobs fell by 0.5% over the fortnight to December 18, which was the start of Omicron.

- The New York Empire State manufacturing index fell from 31.9 to -0.7 in January (survey: 25). That’s a big miss!

US stocks had to fall

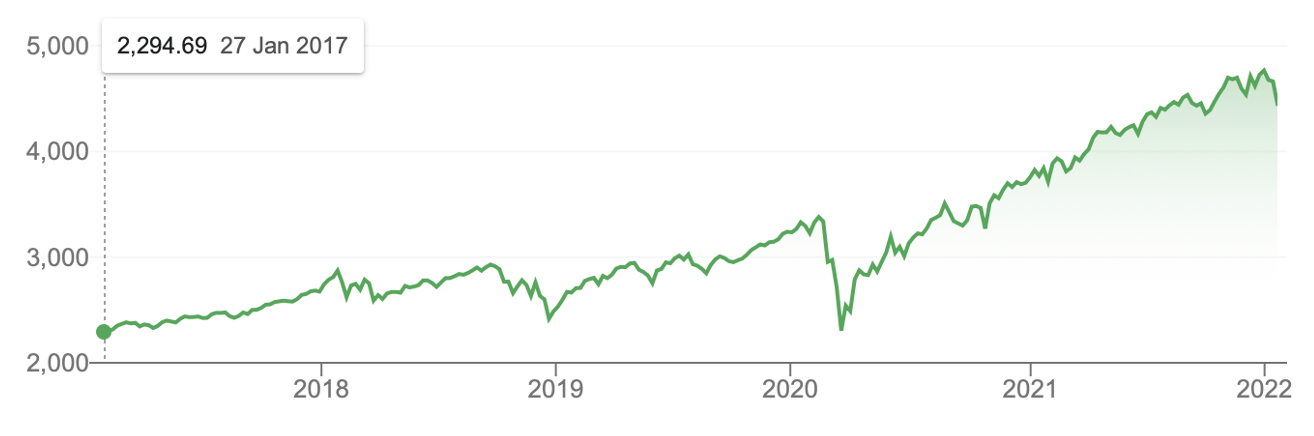

I’ve repeatedly shown the chart how much the US stock market has risen since the bottom of the Coronavirus crash of the stock market. That gain was about 106%. But using the pre-pandemic high, the gain was about 40%, while our market was only up about 4%.

The Yanks were in line for a reality bite when “interest rates to rise” talk intensified, but I can’t see a 45% sell-off in the wings. The S&P 500 Index has given up about 7% so far this year and more is likely, but if economic growth rises and inflation falls, then stocks can go higher, especially here.

S&P 500

At the Davos conference this week, Kristalina Georgieva, managing director of the International Monetary Fund, said that interest rate hikes by the Federal Reserve could “throw cold water” on already weak economic recoveries in certain countries.

This underlines just how important next week’s Fed meeting will be.

The week in review:

- This week in the Switzer Report, I tackle the issue of the tech-stock sector and how it has been taking a beating in recent times due to rising inflation in the US and climbing interest rates, forecast to arrive sooner than expected in Australia. With all that said, however, I give my thesis as to why I’m holding on to my ZEET stocks despite the bearish outlook in the near future.

- Paul Rickard graces us with an article on one of his favourite Aussie stocks, CSL Limited (CSL) and whether we should jump in on its share subscription plan between 1-7 February 2022. And in his additional article for the week, Paul contemplates whether the embattled AGL Energy (AGL) is in a buy zone, pending it can reclaim its highs of $25-27 in 2017.

- When it comes to the minerals sector, we tend to focus primarily on the mining companies themselves, which in a country like Australia is no mystery why! However, James Dunn decides to dig in (pun intended) to a more overlooked component pertaining to the sector, and that is companies providing the equipment to the miners, listing three to keep an eye on. And as it’s still early doors for 2022, James shares his prediction for the top 5 stocks for the year.

- Given the high inflation and interest rate environment, Tony Featherstone assesses the prominent sectors that will benefit from these conditions and those that will struggle, condensing his predictions into three trends.

- For our “Hot” stocks this week, Managing Director at Fairmont Equities, Michael Gable takes to the charts to show why TPG Telecom (TPG) is currently in a buying opportunity, a predicts a short term recovery “to at least $7”.

- SMSF expert Tim Miller stresses the importance of paying the annual minimum pension requirement for certain individuals, outlining who is most affected and the potential ramifications of failing to do so.

- This week in Buy, Hold, Sell – What the Brokers Say, there were 5 upgrades and 8 downgrades in the first edition, and 12 upgrades and 6 downgrades in the second edition, compiled from the 7 stockbrokers tabulated by FNArena.

- And finally, in Questions of the Week, Paul answers your questions on crypto ETFs, his recommendation for Aussie copper stocks, whether to be paid in cash or receive scrip for shares following a merger deal and if Leigh Creek Energy (LCK) is a buy at 15c.

Our videos of the week:

- Will ZIP, EML, ELO & Tyro surge this year? + Is the CSL share purchase plan a goer?

- Boom! Doom! Zoom! | 20 January

- We test if AGL, BHP, WPL, WBC, the ASX 200 Index and the lithium stock AKE, are buys right now?

- What can raise and lower the risk of dementia? | The Check Up

Top Stocks – how they fared:

The Week Ahead:

Australia

Monday January 24 – CommSec State of the States

Monday January 24 – Markit purchasing managers’ indexes (Jan)

Tuesday January 25 – Weekly consumer confidence (Jan 23)

Tuesday January 25 – NAB business survey (Dec)

Tuesday January 25 – Consumer Price Index (Dec quarter)

Wednesday January 26 – Australian markets closed

Thursday January 27 – International trade prices (Dec quarter)

Friday January 28 – Producer Price Index (Dec quarter)

Overseas

Monday January 24 – US Markit purchasing managers’ indexes (Jan)

Tuesday January 25 – US Home price indexes (Nov)

Tuesday January 25 – US Conference Board consumer confidence (Jan)

January 25-26 – US Federal Reserve meeting

Wednesday January 26 – US Advance goods trade balance (Dec)

Wednesday January 26 – US New home sales (Dec)

Thursday January 27 – China Industrial profits (Dec)

Thursday January 27 – US Durable goods orders (Dec)

Thursday January 27 – US Economic growth (advance, Dec quarter)

Thursday January 27 – US Pending home sales (Dec)

Thursday January 27 – US Kansas City Fed manufacturing index (Jan)

Friday January 28 – US Employment Cost Index (Dec quarter)

Friday January 28 – US Personal income/spending (Dec)

Food for thought: “Given a 10% chance of a 100 times payoff, you should take that bet every time.” — Jeff Bezos

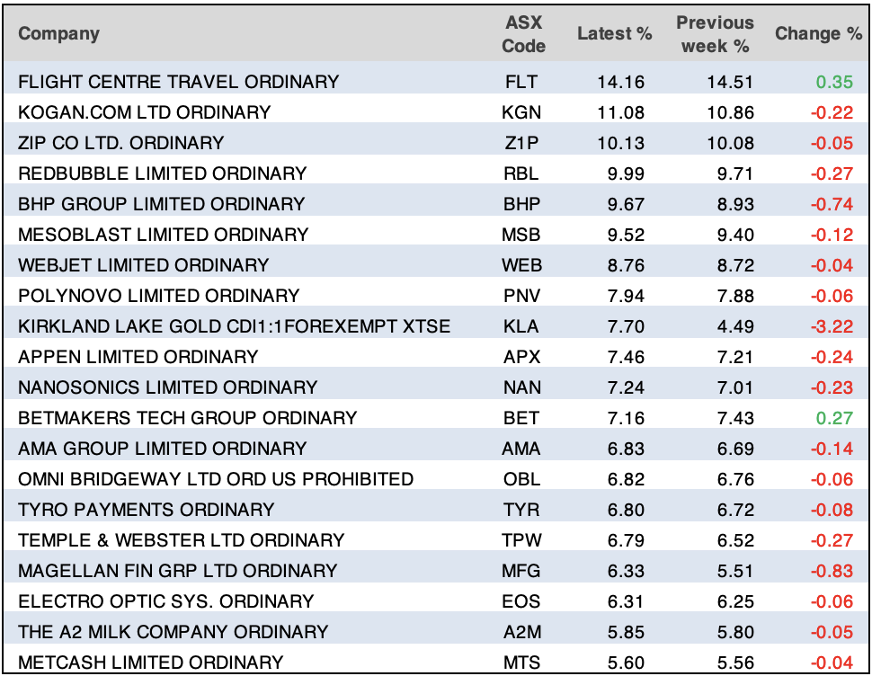

Stocks shorted:

ASIC releases data daily on the major short positions in the market. These are the stocks with the highest proportion of their ordinary shares that have been sold short, which could suggest investors are expecting the price to come down. The table shows how this has changed compared to the week before.

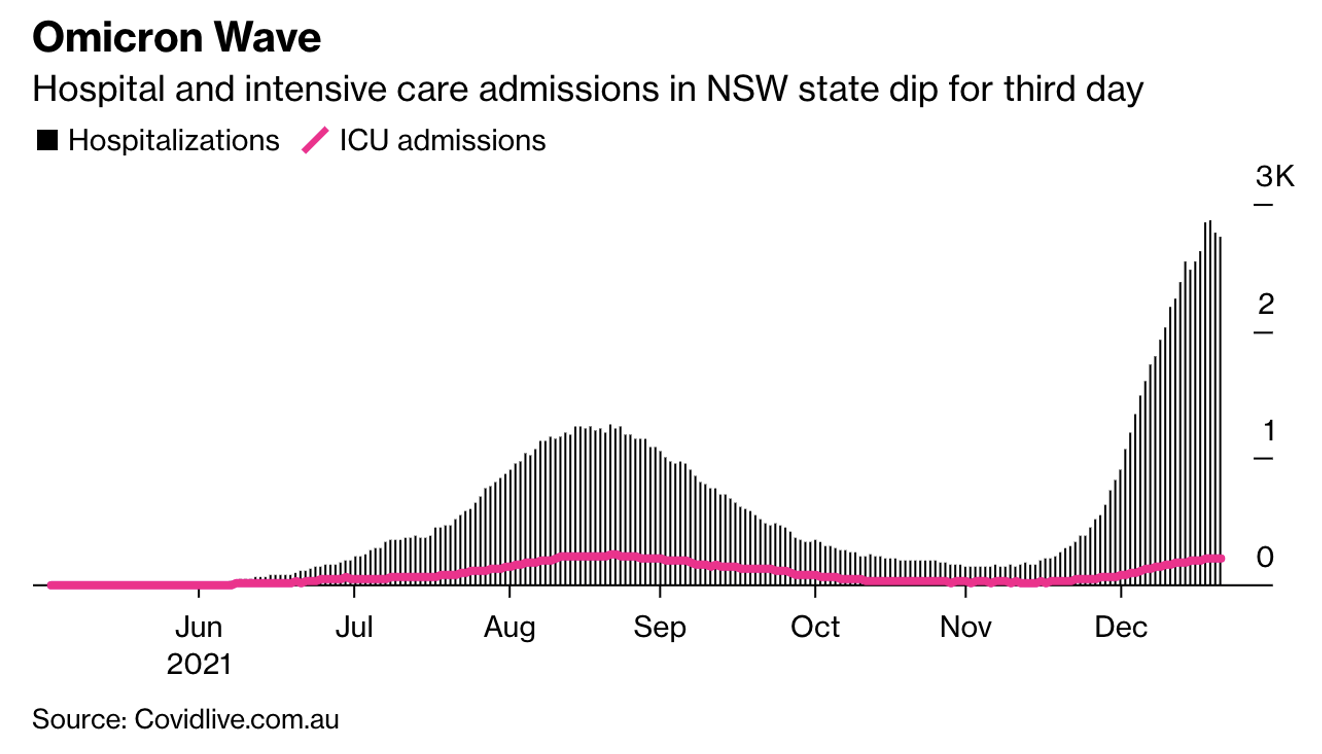

Chart of the week:

In our chart of the week, we can see that Omicron hospitalisations and ICU admissions are starting to mimic the predictions of the January peak in Australia’s most populous state. Despite the recent signs in NSW, “daily deaths continue to edge higher, with 46 reported in the state on Friday,” Bloomberg reports. “In Victoria, the second-most populous state, there are 1,096 people hospitalized and 121 in intensive care. It reported 20 deaths on Friday.” Western Australia announced on Friday that it will be foregoing its border reopening date on 5 February as Premier Mark McGowan said it would cause a “flood of disease” in the state.

Top 5 most clicked:

Top 5 most clicked:

- Why I’m sticking with my ZEET stocks – Peter Switzer

- Should I buy more CSL shares in the share subscription plan? – Paul Rickard

- 3 businesses that sell ‘shovels’ to the miners! – James Dunn

- My 5 stocks for 2022 – James Dunn

- Winners & losers from rising inflation and interest rates – Tony Featherstone

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.