I have to admit I am quite ‘one-eyed’ when it comes to CSL. Apart from being my favourite company, it would win (in my opinion) any award for “Australia’s best company”.

For shareholders, it has been outstandingly rewarding, particularly those who paid an effective $0.77 per share when floated from Commonwealth Serum Laboratories in 1992. On Friday it closed at $276.00. Shareholders who have come onto the registry since Covid haven’t enjoyed substantial returns, but that’s partly to do with Covid itself and the market going a little cold on “expensive stocks”.

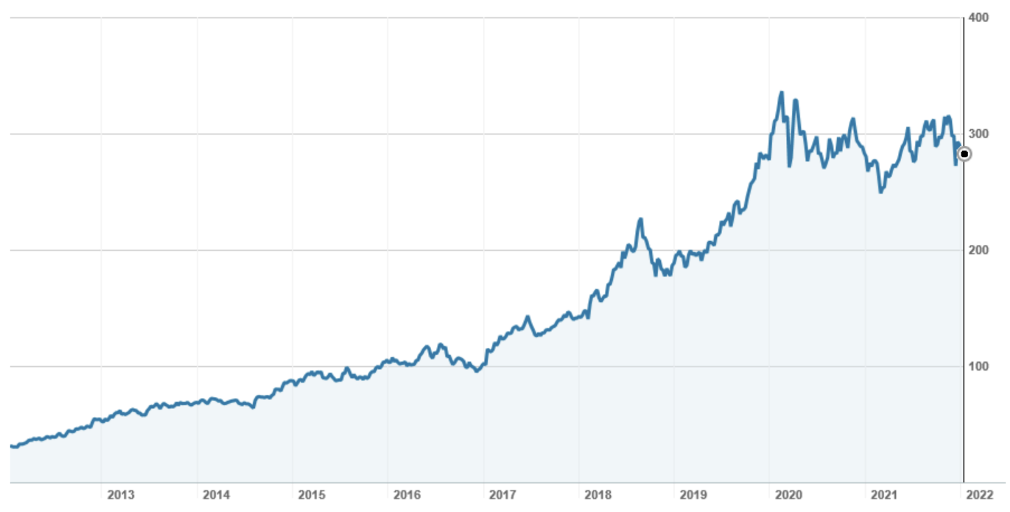

CSL – 2012 to 2022

Now, retail shareholders are being offered the opportunity to purchase up to $30,000 of additional shares through a share purchase plan.

The share purchase plan is targeting to raise up to $750 million, and allows shareholders to subscribe in a parcel with a dollar amount of $2,500, $5,000, $7,500, $10,000, $12,500, $15,000, $20,000, $25000 or $30,000.

The shares will be issued at the lesser of $273.00 or 2% below the average ASX trading price from 1 February to 7 February inclusive. The $273.00 is the same price that institutions paid in the $6.3bn raising by CSL in early December to part fund the purchase of Vifor Pharma (see below).

If CSL is flooded with applications and applies a scale back, it will do this on a ‘pro rata’ basis, that is having regard to the size of the shareholder’s existing holding. For example, if Shareholder A owns 100 CSL shares and Shareholder B owns 5,000 CSL shares and they both apply for $30,000 of new shares, in the event of a scale back, Shareholder B will receive more shares than Shareholder A.

The share purchase plan closes on Monday 7 February, with new shares issued on 14 February .

Of course, the share purchase plan arises from the purchase of Vifor Pharma and proceeds will go to help fund it – let’s have a look at this acquisition.

Vifor Pharma

CSL is paying in aggregate US$12.5bn (AUD$17.5bn) to acquire Swiss based Vifor Pharma. The transaction is funded by new equity of US$4.5bn (an institutional placement at AUD$273.00 per share), plus debt and cash funding of US$8.0bn.

Vifor Pharma is a US$2.0bn revenue business specialising in the treatment of renal (kidney) disease. It does this through three broad product areas: nephrology (diseases of the kidney), iron deficiency and dialysis. The latter is conducted through a unique partnership with Fresenius Medical Care, the global leaders in dialysis with more than 54 million treatments each year.

Nephrology accounts for 37% of revenue, products relating to dialysis bring in 28% and iron deficiency 36%. It is a global business, with 55% of sales in the US and 33% in Europe.

CSL says that the global renal disease market is forecast to grow from US$13bn in 2020 to over US$25bn in 2026, a double digit compound annual growth rate. Diabetes and high blood pressure have driven an increase of 8% pa in persons suffering from chronic kidney disease, with an estimated 15% of adults in the US sufferers. Dialysis patients are growing globally by an estimated 5% to 7% each year.

In addition to getting access to a market with strong growth tail winds, CSL says there is a complementary portfolio fit with it and Vifor Pharma across shared disease areas and adjacent disease areas.

Financially, the deal is forecast to be low to mid teens NPATA accretive (net profit after tax and before amortisation) in the first full year of CSL ownership (expected to be FY23). Free cash flow is forecast to increase from a proforma US$2.0bn to US$2.4bn, and revenue from US$10.3bn to US$12.3bn.

Post the acquisition, 70% of the CSL group’s revenue will be earned by CSL Behring (the blood plasma products business), 14% from Seqirus (influenza vaccines) and 16% from Vifor Pharma.

CSL reconfirmed full year FY22 profit guidance of US$2,150 million to US$2,250 million on a constant currency basis. FY22 will not be impacted by Vifor Pharma. CSL is due to release its first half results on 16 February.

What do the brokers say

The brokers are positive on CSL and positive on the purchase of Vifor Pharma, seeing it as being EPS (earnings per share) accretive in FY23. While there are some concern that CSL may be flagging that the plasma business will have moderating growth, most agree that the acquisition holds up well and that CSL will be able to leverage its global capabilities and R&D to drive growth.

Morgans summarised it as follows: “The broker doesn’t agree the deal suggests the core plasma business is ex-growth, but rather provides a defensible specialty product portfolio with strong market positions and growth opportunities”.

According to FNArena, for the six major brokers, there are 3 ‘buy’ recommendations and 3 ‘neutral’ recommendations. The consensus target price is $320.45 (about 16.1% higher than Friday’s close and 17.4% higher than the maximum price under the SPP). The range is a low of $280.00 up to a high of $340.00, as set out in the table below.

Looking at earnings, the brokers forecast EPS in FY22 of US$4.86 per share, rising in FY23 (when Vifor Pharma will be incorporated) to US$6.02 per share. Based on current exchange rates, this puts CSL on a PE of 41.8 times for FY22 and 33.8 times for FY23.

Bottom line

Apart from cash considerations, the only reason not to participate in this SPP is a concern that as a “high” PE stock, CSL is vulnerable to the current pressure on “growth” stocks.

CSL has been trading on a high multiple for many years, deservedly so due to its global market leadership and track record of product innovation, year on year growth and financial returns. While it can’t stand in the way of a global de-rating of growth stocks, my sense is that industry leaders like CSL will continue to be priced at a premium.

From both strategic and financial perspectives, the Vifor Pharma acquisition ticks the boxes. Further, CSL has a good track record in in delivering value for shareholders from acquisitions – the last major acquisition being the Seqirus influenza vaccines business.

I will be participating.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.