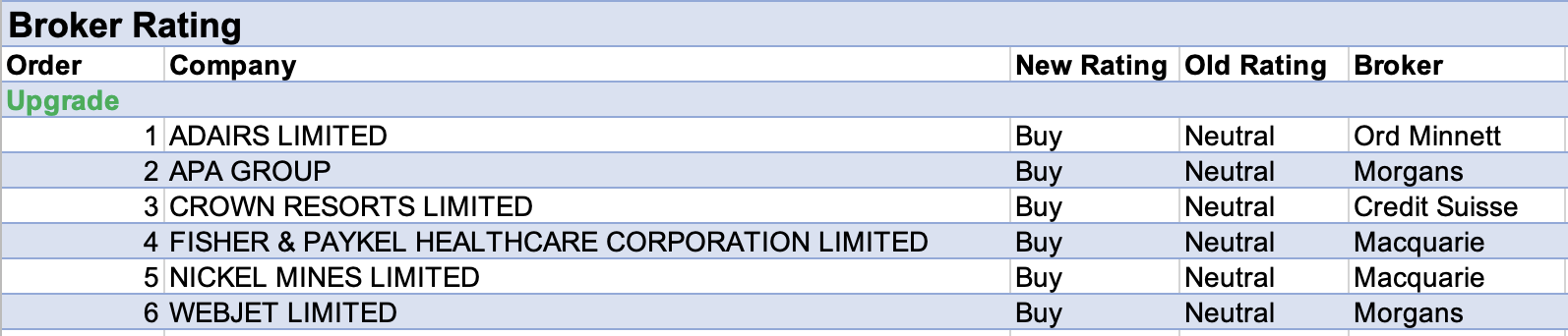

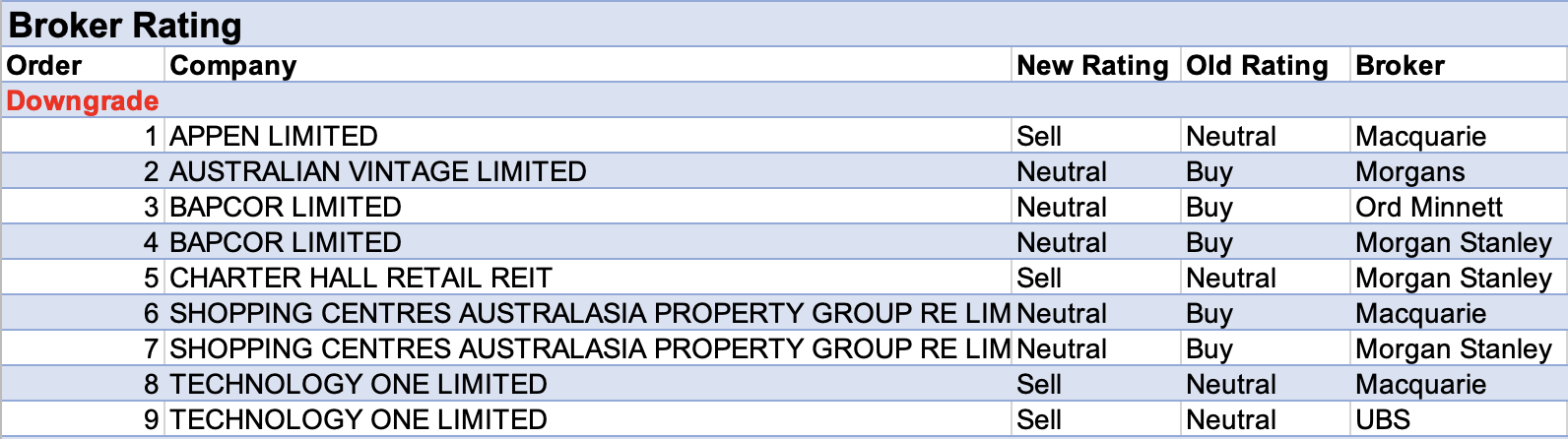

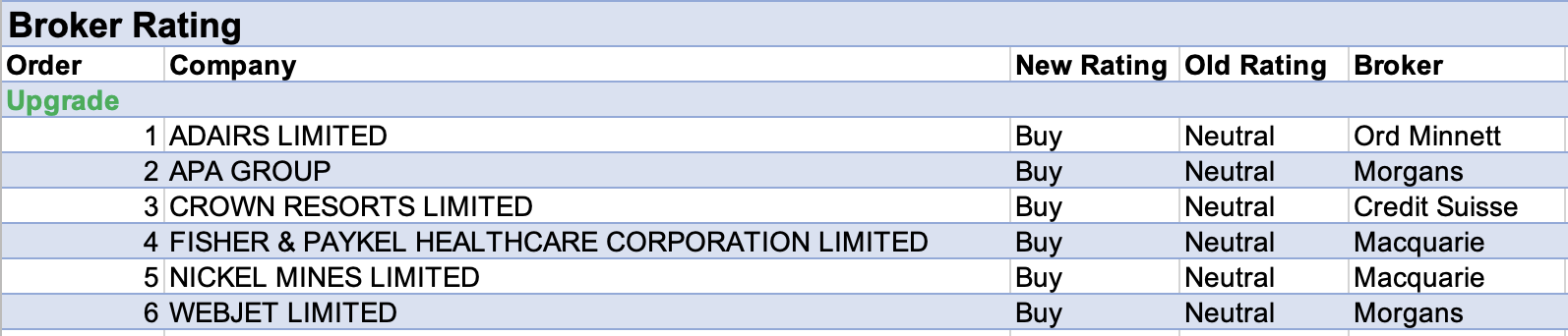

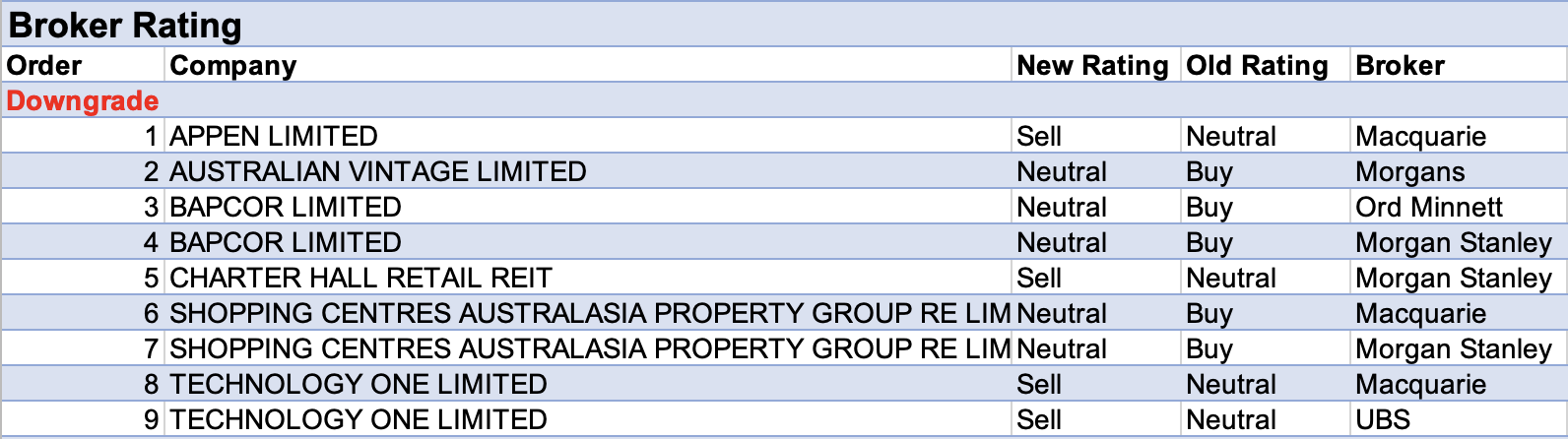

For the week ending Friday November 26, there were six upgrades and nine downgrades, led by Appen and Bapcor, to ASX-listed companies covered by brokers in the FNArena database.

The unexpected retirement of Bapcor’s CEO prompted downgrades to ratings from Morgan Stanley, to Equal-weight from Overweight, and Ord Minnett, to Hold from Buy.

Shopping Centres Australasia also received two rating downgrades from separate brokers last week. Macquarie (Neutral from Outperform) feels any upside is already encapsulated in the current share price.

UBS downgraded its rating for TechnologyOne to Sell from Neutral after a 30% share rally in the last three months, despite materially raising its earnings forecasts after the company’s FY21 results. Macquarie also raised earnings forecasts and reduced its rating to Underperform from Neutral after comparing multiples for domestic and overseas peers. Management’s lower revenue growth forecast was also taken into account.

TechnologyOne came second on the tables for both the highest percentage rise in forecast target price, and the highest percentage earnings forecast increase by brokers in the FNArena database last week.

Macquarie estimates Nickel Mines’ share of contained nickel production will rise to circa 87ktpa by 2024 following rights being secured to acquire a 70% interest in the Oracle Nickel Project. The broker increased its rating to Outperform from Neutral and lifted its target price to $1.45 from $1.10.

Ord Minnett also raised its target price to $1.45 from $1.10, and declared the company is now the broker’s top nickel stock pick.

Webjet had the largest percentage downgrade to earnings forecasts last week. Credit Suisse pushes out the timeline for a full travel recovery to the second half of FY23. In the near-term the company is thought at the mercy of government travel restrictions. Morgans expects the company to exceed FY19 underlying earnings in FY24. [Note: Brokers were at that point unaware of omicron ]

Finally, AGM commentary by Mineral Resources implied to Morgan Stanley that margins could come under pressure. Near-term production guidance was downgraded for Yilgarn and the economics at Ashburton are significantly worse than expected by the analyst.

Despite coming second on the list for forecast earnings downgrades last week, the company is one of Macquarie’s preferred stocks in the broader resources sector, with potential to capture downstream value via the ramp-up of Wodgina and the conversion of all spodumene to hydroxide.

Total Buy recommendations take up 55.62% of the total, versus 37.51% on Neutral/Hold, while Sell ratings account for the remaining 6.87%.

In the good books

ADAIRS LIMITED (ADH) was upgraded to Accumulate from Hold by Ord Minnett, B/H/S: 3/0/0

Adairs will acquire Australian furniture retailer Focus on Furniture for $80m as a relatively low-risk entry into the home furniture segment and a natural fit with its home furnishings segment, according to Ord Minnett.

The cost price represents 2.4 times underlying earnings achieved in FY21 which totaled $32.8m, but the broker expects earnings benefited from recent elevated spending in home segments. Double-digit earnings per share are expected to be achieved in FY23.

The rating is upgraded to Accumulate from Hold and the target price increases to $4.10 from $4.00.

CROWN RESORTS LIMITED (CWN) was upgraded to Outperform from Neutral by Credit Suisse, B/H/S: 2/1/0

Credit Suisse expects Blackstone’s $12.50 cash bid for Crown Resorts will be modified and then accepted by the board, notwithstanding a competing bid. Las Vegas Sands is known to be interested in acquisitions in Asia.

What Blackstone is offering could be accepted because what A&NZ casinos can offer (synergy and property restructure) is subject to execution risk, Credit Suisse notes. If the Victorian Royal Commission recommendations are accepted, Packer has to sell his 36%.

The broker believes the bid can be lifted to $13.00 and hence has raised its target to that price, up from $9.80, and upgraded to Outperform.

FISHER & PAYKEL HEALTHCARE CORPORATION LIMITED (FPH) was upgraded to Outperform from Neutral by Macquarie, B/H/S: 1/1/2

Macquarie raises its target price to NZ$37.57 from NZ$32.30 following 1H results that beat consensus estimates by 13% and the brokers forecast by 11%. The analyst considers there are strong signs of Nasal High Flow (NHF) Therapy adoption.

The broker lifts EPS forecasts for FY22-24 by 9%,13% and15%, respectively, to reflect upgrades to Hospital revenue. As a result, Macquarie lifts its rating to Outperform from Neutral.

The analyst points out around 70% of Hardware sales came from outside US/Europe, which augers well for clinical adoption and device utilisation.

WEBJET LIMITED (WEB) was upgraded to Add from Hold by Morgans, B/H/S: 3/4/0

While Webjet continues to feel covid impacts, and does not expect a return to pre-covid booking levels until the second half of FY23, Morgans notes the company did generate positive operating cashflow in the first half totalling $32.8m.

With Webjet’s larger businesses profitable in November, the broker is forecasting six months of positive underlying earnings. Given cost out targets, Morgans expects the company to exceed FY19 underlying earnings in FY24.

The rating is upgraded to Add from Hold and the target price increases to $6.60 from $6.20.

In the not-so-good books

APPEN LIMITED (APX) was downgraded to Underperform from Neutral by Macquarie, B/H/S: 2/1/1

In recent discussion with industry contacts, Macquarie has observed a trend where some big-tech companies are looking to directly crowdsource for annotation. This is in preference to using third party annotation companies including Appen.

The broker’s revised FY21-23 revenue estimates are now -7%-10% below consensus forecasts and the target price is lowered to $9.50 from $11.80. Macquarie’s rating is also lowered to Underperform from Neutral.

AUSTRALIAN VINTAGE LIMITED (AVG) was downgraded to Hold from Add by Morgans, B/H/S: 0/1/0

Higher-than-expected logistics costs have driven Australian Vintage to a FY22 underlying earnings guidance -12% below Morgans’ previous forecast. A -$4.5m logistics cost increase related to supply chain challenges is expected to add cost pressure in the first half.

Despite softer guidance, the broker notes metrics still demonstrate sustainable growth in recent years with guidance around 40% above FY20 results and just -5-7% below last year’s record. Morgans expects limited potential for additional capital return in FY22.

The rating is downgraded to Hold from Add and the target price decreases to $0.90 from $1.06.

BAPCOR LIMITED (BAP) was downgraded to Equal-weight from Overweight by Morgan Stanley, B/H/S: 5/2/0

Bapcor CEO Darryl Abotomey has announced his intention to retire in February 2022, at what Ord Minnett describes as a challenging time for the company.

Despite being well-placed for profit growth the news does spark concern of near-term risk, particularly as the company is part way through a supply chain overhaul that includes the consolidation of 13 distribution centres, a project already carrying execution risk.

The rating is downgraded to Hold from Buy and the target price decreases to $7.20 from $9.00.

While there may be a risk of further personnel churn, Morgan Stanley sees little impact upon near-term earnings from the unexpected retirement of Bapcor’s CEO, Darryl Abotomy.

However, reduced optionality for EPS upgrade catalysts, such as M&A and increased uncertainty around management leads the broker to downgrade its rating to Equal-weight from Overweight. The target price falls to $7.80 from $9.70. Industry view: In line.

CHARTER HALL RETAIL REIT (CQR) was downgraded to Underweight from Equal-weight by Morgan Stanley, B/H/S: 3/1/1

Morgan Stanley perceives the stability offered over the last two years by smaller-mall REITs with regional exposure may become relatively less attractive as mobility increases. It’s thought slowing regional migration and limited balance sheet capacity may also weigh.

As a result, the analyst’s rating for Charter Hall Retail REIT falls to Underweight from Equal-weight. In relative terms, the broker prefers Shopping Centres Australasia Property Group ((SCP)) which has a higher three year compound annual growth rate.

The price target falls to $4.05 from $4.10. Industry view: In-line.

SHOPPING CENTRES AUSTRALASIA PROPERTY GROUP RE LIMITED (SCP) was downgraded to Neutral from Outperform by Macquarie and to Equal-weight from Overweight by Morgan Stanley, B/H/S: 0/5/0

Even after Macquarie allows for a stronger post-covid-shop-local thematic for Shopping Centres Australasia Property Group, the broker lowers its rating to Neutral from Underperform. It’s estimated upside risk is encapsulated in the current share price.

The analyst makes slight upgrades to EPS forecasts and increases its target price to $2.94 from $2.90.

Morgan Stanley perceives the stability offered over the last two years by smaller-mall REITs with regional exposure may become relatively less attractive as mobility increases. It’s thought slowing regional migration and limited balance sheet capacity may also weigh.

As a result, the analyst’s rating for Shopping Centres Australasia Property Group falls to Equal-weight from Overweight. In relative terms, the broker prefers the group over the Charter Hall Retail REIT ((CQR)), which has a lower estimated three year compound annual growth rate.

The target price of $2.95 is unchanged. In-Line industry view.

Earnings forecast

Listed below are the companies that have had their forecast current year earnings raised or lowered by the brokers last week. The qualification is that the stock must be covered by at least two brokers. The table shows the previous forecast on an earnings per share basis, the new forecast, and the percentage change.

The above was compiled from reports on FNArena. The FNArena database tabulates the views of seven major Australian and international stockbrokers: Citi, Credit Suisse, Macquarie, Morgan Stanley, Morgans, Ord Minnett and UBS. Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.