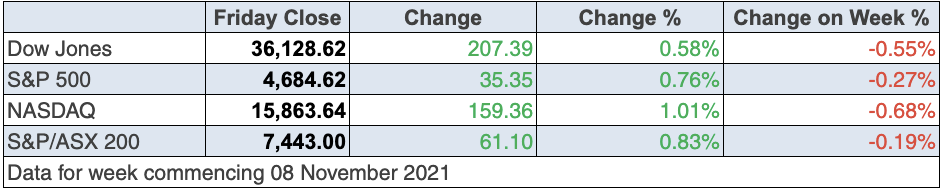

Despite fears of rising inflation that look justified with a 6.2% price rise reading (the worst result for 30 years!), US stock market indexes were tracking higher before the close but were unlikely to turn the week positive for the S&P 500.

That said, we’re only looking at a loss of less than 1% for the week and the monthly chart shows how positively cooked to a good story for stocks the market is into.

S&P 500 one month

And why wouldn’t it after the last reporting season?

“US September quarter earnings have come in 9% stronger than expected,” says Shane Oliver of AMP Capital. “92% of S&P 500 companies have now reported September quarter earnings and 81% have exceeded expectations, with an average beat of 9%.

“Earnings growth has slowed due to base effects, but at around 38% year-on-year, the quarter is well up from expectations for a 29% year-on-year rise at the start of reporting season. The US share market has now rallied through each of the last seven reporting seasons.”

“Base effects” is an economic term for the fact that making comparisons of performance of the economy or a company might be distorted by the effects of something like a Coronavirus that forces lockdowns, and the subsequent boom-creating reopenings. It’s why I’m careful about a lot of data — even a ‘scary’ 6.2% inflation number, which I, and others, think will be transitory.

The question is: when do the supply chain problems dissipate? This will be important for market positivity or negativity.

“Friday’s market action is a rebound from what happened earlier in the week,” said Victoria Fernandez, chief market strategist of Crossmark Global Investments to CNBC. “We’re starting to see maybe peak concern in the supply chain. We’ll get more information on that next week with retail earnings like Walmart and Target.”

By the way, if something is at a “peak”, the future for that supply concern should be falling.

One guy who thinks the market is too fixated on how long the supply problems will last is Jamie Dimon, the long-serving CEO of JPMorgan Chase & Co. He thinks Wall Street is losing sight of the big picture of an economic rebound with a current fixation on supply chain disruptions. “There’s not one company I know that is not working aggressively to fix their supply chain issues,” Dimon told analysts on the firm’s quarterly earnings call. “I doubt we’ll be talking about supply chain stuff in a year. I just think we’re focusing on it too much and it’s simply dampening a fairly good economy. It’s not reversing a fairly good economy.”

Dimon said credit card and debit card spending is up, the consumer sector remains healthy and the economy is growing by 4%-5%. (Marketwatch.com)

Keeping the spooked even more spooked was Friday’s consumer sentiment reading from the University of Michigan. “The University of Michigan’s Consumer Sentiment Index plunged to 66.8 in its preliminary November reading from October’s final reading of 71.7,” Reuters reported. “That was the lowest level since November 2011 and was far short of the median estimate among economists of 72.4 in a Reuters poll.”

Consumers are worried about how the supply chain problems are hitting things like the price of gasoline and other household items. Not helping is the impact on wage costs of what the Yanks are calling the Great Resignations.

CNBC says: “workers left their jobs in record numbers in September, with 4.43 million people quitting, the Labor Department reported Friday. The exodus occurred as the U.S. had 10.44 million employment openings that month, according to the report”.

By the way, those openings show that there is a solid demand for goods, services and workers in the US right now, which is a good forward indicator for economic growth.

The question is: are a lot of workers temporarily retiring until the Coronavirus leaves town? And like here, maybe a lot of foreign illegal workers have gone home but one day will return. We hope and need that here as well.

It underlines the importance of borders reopening ASAP but even with these supply-side inflation threats, many experts are still positive on stocks.

“The important drivers of the market, I think, remain intact — earnings and interest rates,” said Leo Grohowski, chief investment officer at BNY Mellon Wealth Management. “I think the Fed gave the equity market what it was looking for… which was an awareness of inflation without an overreaction to inflation. Meanwhile, we’re still digesting what’s been a really strong earnings season.” (CNBC)

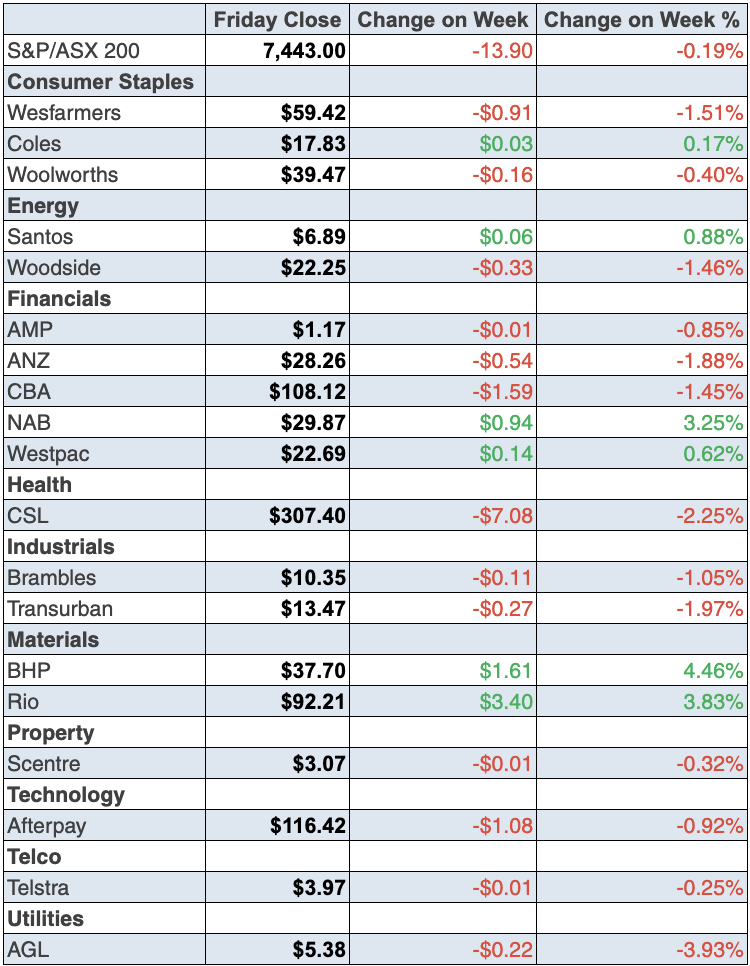

To the local story and China’s President Xi Jinping helped the share price of materials after giving a positive outlook for his economy, providing some uplift to our stock market after a pretty negative week.

We lost 0.2% for the week but that was after a 61-point (or 0.8%) gain on Friday. And trading confidence was helped by that ‘little’ trouble in big China called Evergrande. Concerns about what this huge property developer could do to financial markets have been a nagging worry but on Thursday European markets reacted first to the news that Evergrande avoided default by making interest payments on three bond tranches worth $US148 million. Interestingly, the price of base metals and iron ore rose.

It looks like one pothole in the road to a big economic recovery has been filled, and stock markets liked it.

For the week, Rio was up 3.57% to $92.21, BHP put on 3.89% and Fortescue a huge 10.14%, which makes iron ore supporters like Paul Rickard and myself happy with our ‘believer’ calls.

For Zip Co fans, the market liked its announcement that it has acquired a BNPL business in Europe called Twisto Payments. After a sliding week for its share price as tech companies lost friends with rising bond yields, Z1P was up 3.68% on Friday to $5.91.

Many of the businesses of the future (i.e. tech-related) have to deal with the market sentiment that is dropping tech stocks for cyclical/value stocks. However, some tech stocks are cyclical and will continue to rise. It’s why Microsoft is still rising but a tech stock like Zoom, which also was a Covid-19 lockdown stock, has lost ground recently.

Zoom de-zoomed 6 months

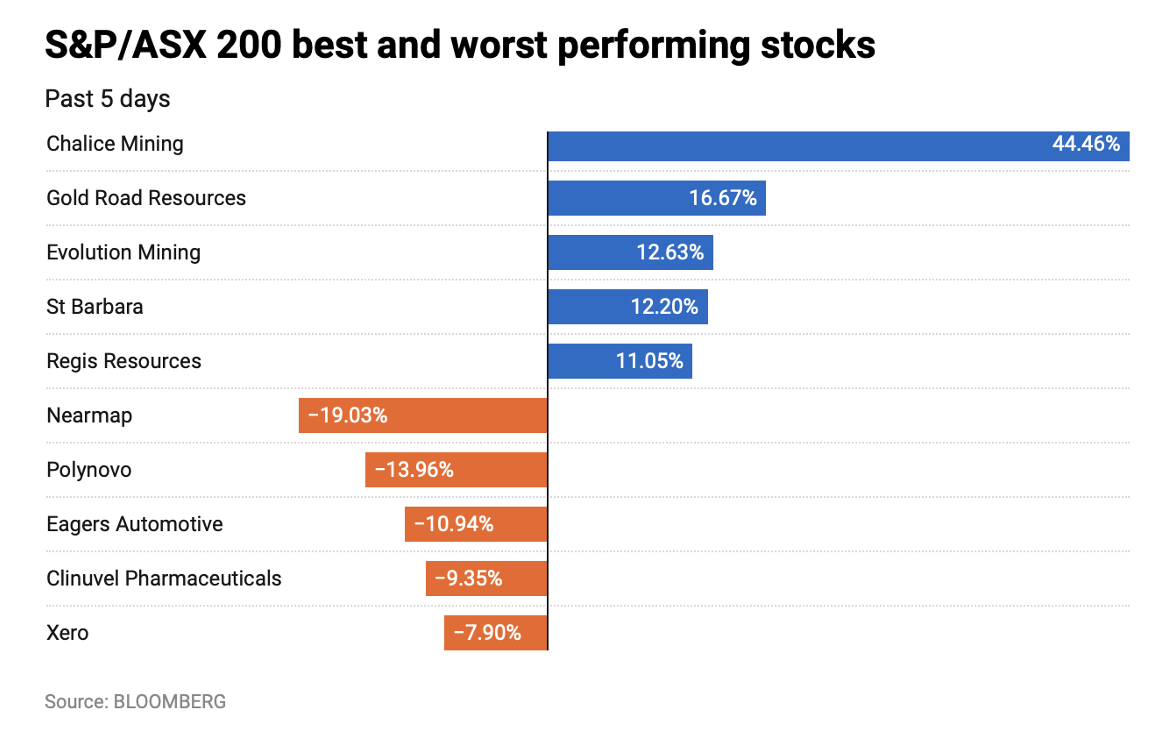

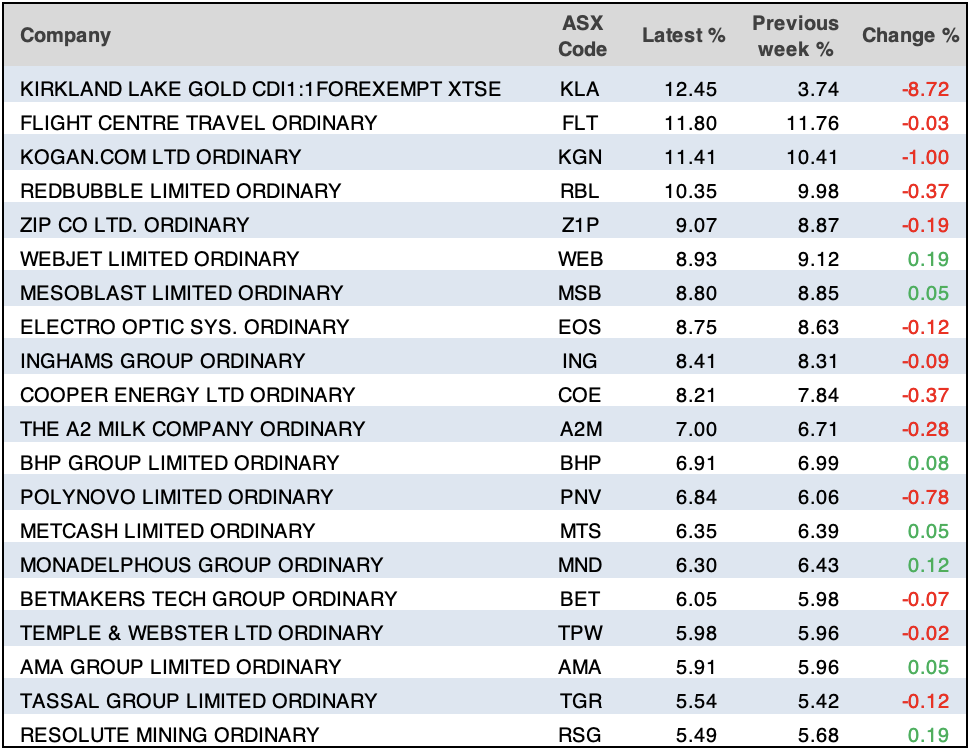

Here are the winners and losers for the week, according to Bloomberg:

What I liked

- The Westpac-Melbourne Institute consumer confidence index rose by 0.6% to 105.3 in November. The measure of unemployment expectations dropped (improved) by 11.1% in November to a record low.

- The NAB business confidence index rose by 11.2 points to 20.8 points in October – the second-highest result on record. Business conditions rose by 6 points to 10.8 points.

- The weekly ANZ-Roy Morgan consumer confidence rating rose by 0.6% in the past week – the eighth gain in nine weeks to a 17-week high of 109.

- The CBA Household Spending Intentions report was released. The CommBank HSI Index rose by a strong 6.6% in October to be at 108, led by gains in Travel, Transport and Household services.

- According to the Housing Industry Association, new home sales increased 11.1% in October compared to the previous month. Sales in the three months to October 2021 fell by 0.2%.

- The Bureau of Statistics (ABS) reported that national payroll jobs rose by 1.3% over the fortnight to October 16, with total wages down 0.9%.

- National skilled job vacancies rose by 7.8% in October to stand at a 13-year high of 250,882 positions.

- Chinese economic data was mixed with stronger-than-expected exports, weaker-than-expected imports and credit growth looking like it may have bottomed at 10% year-on-year. Producer price inflation surged further to 13.5% year-on-year but consumer price inflation remains weak at 1.5% year-on-year.

What I didn’t like

- Employment fell by 46,300 in October. Part-time jobs fell by 5,900 with full-time jobs down by 40,400 and the unemployment rate rose from 4.6% to a 6-month high of 5.2%. However, the data is dodgy being post lockdown and the survey method had problems.

(Employment fell because the labour force survey period ended on 9 October, which was before reopenings in NSW and Victoria, so the lockdowns still weighed on employment and yet participation rose as workers started to return in anticipation of reopening.)

- In September, the ABS monthly business turnover indicator showed falls in eight of the 13 industries due to lockdowns.

- US consumer prices rose by 0.9% in October to be up 6.2% on the year (survey: 5.8%) – the highest result in 31 years. Note economists did expect inflation to be 5.8%, which was big anyway.

- The US producer price index (PPI) rose by 0.6% in October to be up by a record 8.6% on the year (survey: 8.6%). The core PPI (ex-food and energy) was up 0.4% in October to be a record 6.8% higher on a year ago (survey: 6.8%).

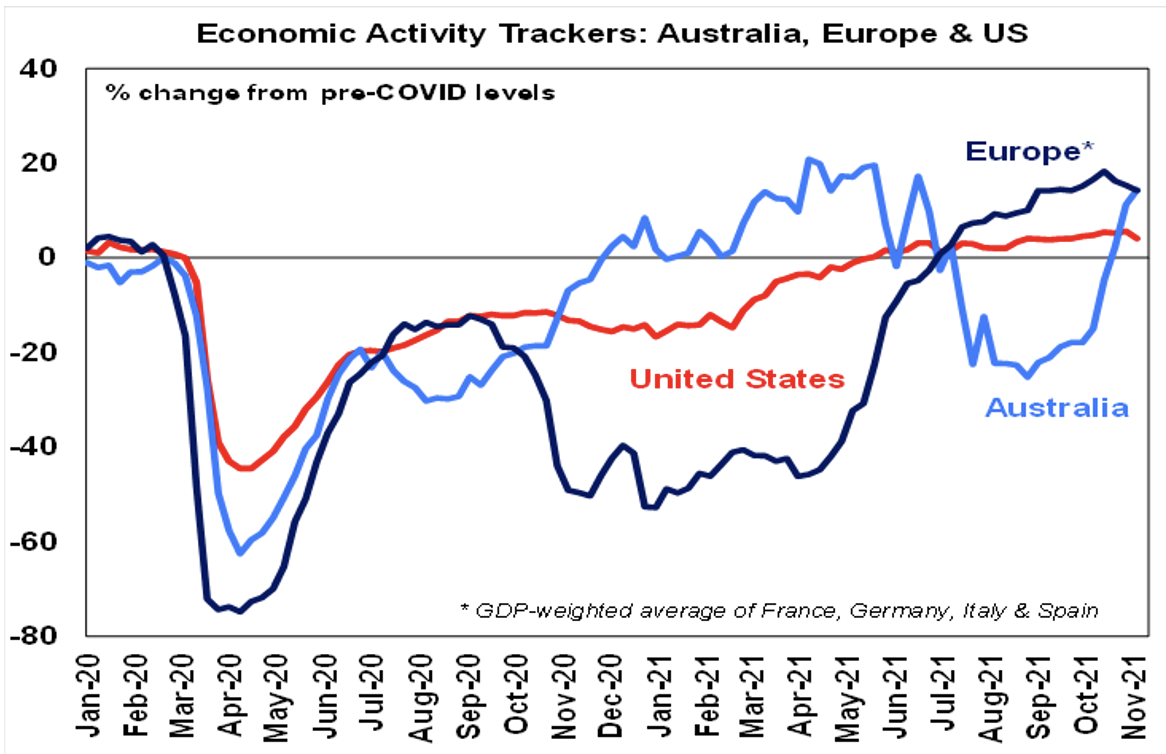

Love this chart!

Shane Oliver tracks how our economy is going with his Economic Activity Tracker chart and the blue line shows how we are making a nice economic comeback compared to the US and Europe. Why? Well, that’s the impact of the end of lockdowns, so imagine when those scaredy-cat premiers open up their states and overseas tourists start showing up in 2022.

The economy will boom and it will underpin rising company profits and stock prices.

It’s why I love this chart and you should too.

The week in review:

- This week in the Switzer Report, I take a look at the biggest driver in the Australian stock market, our top 20 companies on the ASX, and after factoring in the broker recommendations from FNArena, see an upside for the overall market in 2022.

- Paul Rickard addresses one of his most popular requests from subscribers about what are his favourite income paying stocks on the ASX. Based on eight criteria points, Paul reveals his five favourite income stocks.

- James Dunn considers how investors can potentially get an edge by opting to invest directly into listed investment funds. As opposed to simply leveraging the expertise of a fund manager to operate part or all of your portfolio, you can buy the shares of the company, and enjoy the benefit of many other people choosing the fund manager. By investing in the stock of the operating company, shareholders can benefit from other investors paying fees,” James says. He lists six investment funds worth considering, including whether the likes of Magellan Financial Group (MFG) and Platinum Asset Management (PTM) are good buys.

- As many workers return to their physical workspace, and hence the congestion on our roads creeps towards pre-pandemic levels, Tony Featherstone posits this bodes well for media and advertising companies, namely Ooh!media (OML) and Southern Cross Media Group (SXL).

- For our “Hot” stocks this week, Managing Director at Fairmont Equities, Michael Gable details why Australia’s largest bank Commonwealth Bank (CBA) presents a good buying opportunity.

- This week in Buy, Hold, Sell – What the Brokers Say, there were 6 upgrades and 5 downgrades in the first edition, and in the second edition, CSL (CSL) was one of 3 upgrades, with REA Group Limited (REA) one of 4 downgrades.

- In Questions of the Week, Paul Rickard answers your questions about Tabcorp (TAH) and its splitting of assets, the relationship between CIMIC (CIM) and its German parent company Hochtief, the merge between Milton Corporation (MIL) and Washington H Soul Pattinson (SOL), and National Australia Bank’s (NAB) final date for dividend payments.

- Paul also graces us with a bonus article on the booming lithium and EV sector and whether investors have missed the boat on some of Australia’s largest companies in the space.

Our videos of the week:

- Can these stocks rebound? Appen, A2Milk, Mesoblast, Lend Lease, PushPay, Splitit and Nuix

- Mad about Money: Bitcoin is at record high! Is Elon Musk a genius Tesla Tweet & are the banks a buy?

- Fund Manager David Allingham reveals his hot small cap stocks + why house prices won’t fall 25%

- Boom! Doom! Zoom! | November 11 2021

Top Stocks – how they fared:

The Week Ahead:

Australia

Tuesday November 16 – Reserve Bank Board minutes

Tuesday November 16 – Weekly consumer confidence index (November 14)

Tuesday November 16 – Speech by Reserve Bank Governor

Wednesday November 17 – Wage price index (September quarter)

Thursday November 18 – Speech by Reserve Bank official

Thursday November 18 – Detailed labour force (October)

Thursday November 18 – Speech by Reserve Bank official

Friday November 19 – State Accounts (June quarter)

Overseas

Monday November 15 – China monthly activity data (October)

Monday November 15 – US Empire State manufacturing index (November)

Tuesday November 16 – US Retail sales (October)

Tuesday November 16 – US Industrial production (October)

Tuesday November 16 – US Export/import prices (October)

Tuesday November 16 – US NAHB Housing Market index (November)

Wednesday November 17 – US Housing starts & building permits (October)

Thursday November 18 – US Philadelphia Federal Reserve index (November)

Thursday November 18 – US Leading index (October)

Thursday November 18 – US Kansas City Fed factory index (November)

Food for thought: “He who lives by the crystal ball will eat shattered glass” – Ray Dalio

Stocks shorted:

ASIC releases data daily on the major short positions in the market. These are the stocks with the highest proportion of their ordinary shares that have been sold short, which could suggest investors are expecting the price to come down. The table shows how this has changed compared to the week before.

Chart of the week:

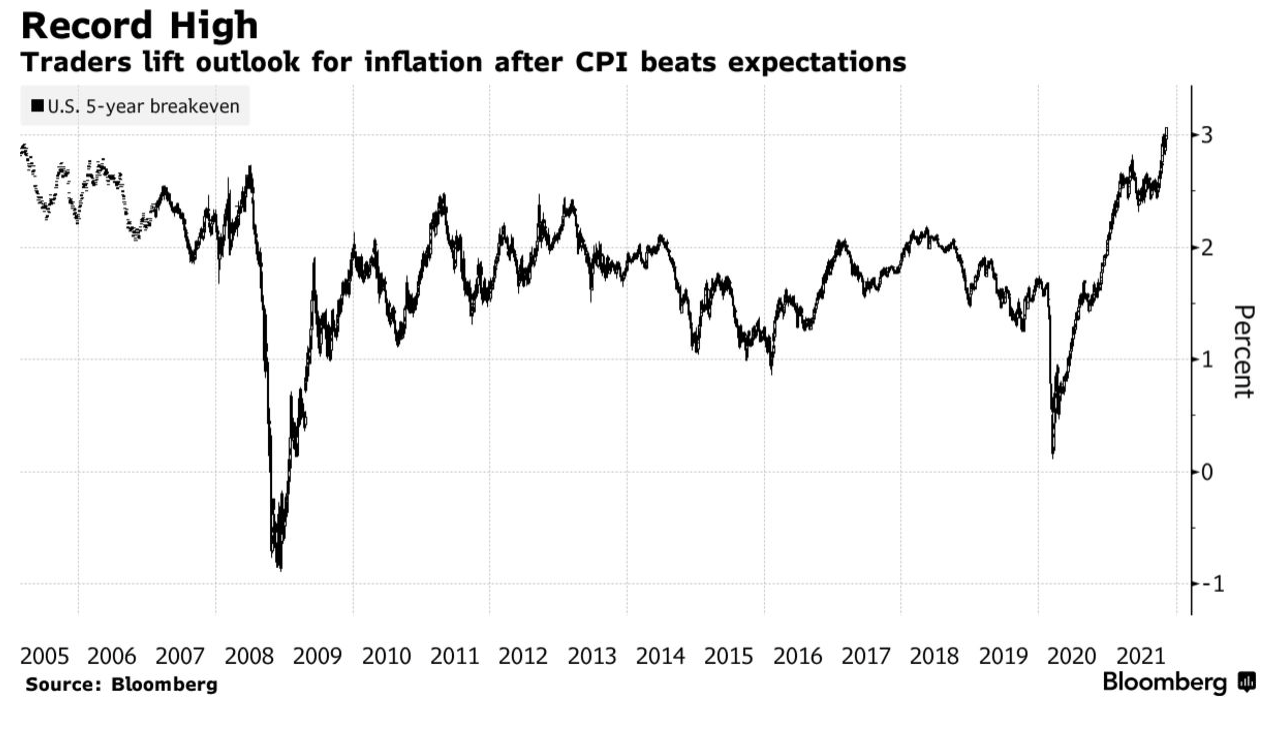

Market concerns this week have been dominated by the inflation narrative stemming from the US breaking record highs in its CPI numbers; the fastest surge it has seen in over 30 years since 1990. Bloomberg’s chart below shows that the CPI spiked 6.2% in October from a year prior, after already jumping 0.9% from September. Both increases exceeded all estimates in a Bloomberg survey of economists. “Fed Chair Jerome Powell said earlier this month that officials could be patient on raising interest rates — after announcing a start to reducing their bond purchases — but won’t flinch from action if warranted by inflation. Wednesday’s robust consumer price reading made traders suspect the later case will be borne out,” Bloomberg reports.

Top 5 most clicked:

- A look at our top 20 companies – Peter Switzer

- Five income favourites – Paul Rickard

- Are companies like Magellan and Platinum worth investing in? – James Dunn

- Buy, Hold, Sell – What the Brokers Say – Rudi Filapek-Vandyck

- Lithium & electric vehicle stocks: have you missed the boat? – Paul Rickard

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.