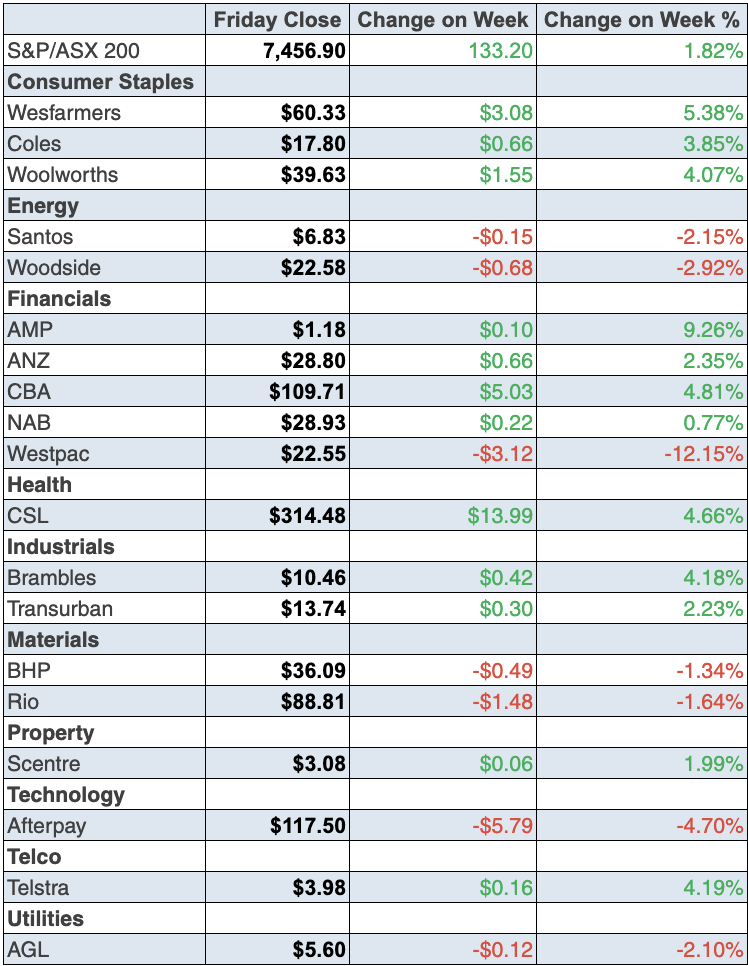

The record highs for US stock market indexes gained justification overnight with a ripper of a jobs report, which screamed that the world’s most important economy was definitely on the comeback trail. This followed disappointing monthly reports in August and September, which incidentally were revised up.

In August, 735,000 jobs were expected but only 235,000 showed up, while in September 500,000 new employees were expected by economists surveyed by Dow Jones and a mere 194,000 were created.

This 531,000 result in October, which beats the 450,000 tipped by economists, is a breath of fresh air for those who might have been doubting the US economic recovery. Don’t forget, the Yanks are dealing with the Delta variant, with a big chunk of the population very anti-vaccination.

Right now the US is at 67%, which is the same as Australia, with both countries way behind the big vaxxers Portugal on 88%, Singapore 82%, Spain 79% and Canada as well as South Korea at 75%.

And the US has what’s called the Great Resignation, which may prove to be a ‘cross-infection virus’ coming out of the Coronavirus, which I suspect will show up here as well. One local employer actually made that point to me only yesterday.

For numbers types, the October Jobs Report saw unemployment fall to 4.6% from 4.8% but it was the participation rate that was the worry. “The most disappointing part of the report i.e. the number of people who joined the labor force, only rose by 104,000,” wrote Market Watch’s Jeffry Bartash. “That left the rate of participation at a paltry 61.6%. The labor-force participation rate has barely budged over the past year and remains near the lowest level since the early 1970s. The economy can’t grow much faster unless more people go back to work.”

And that’s despite the fact that businesses have raised the hourly rate by 4.9% over the past year, which is one of the biggest hikes for pay in decades!

Labour market experts tell us the problem is that there is a lot of backfilling going on that undermines the quality of the job creation figures from an economic forecasting point of view. Backfilling happens when a firm takes on 10 new employees but four of those ‘new’ positions were to fill four resignations.

That’s why there are concerns about the Great Resignation trend that is just a new thorny issue investors have to deal with in the proverbial wall of worry, which the stock market always puts up.

Evan Sohn, CEO of Recruiter.com told CNBC that the resignations were more a lifestyle choice rather than a demand for better pay. This is going to be an important development for the economy and stock prices going forward.

The good job news aside, financial markets here also loved the news from Pfizer, which announced that it has an easy-to-administer Covid-19 pill, used in combination with a widely used HIV drug, which cuts the risk of hospitalisation or death from the Coronavirus by 89% in high-risk adults!

The news was great for businesses such as airlines and cruise ship operations. Ahead of the close, all stock market indexes were in positive and record intraday territory.

I won’t be surprised if reopening trade stocks will get a boost on Monday as this new pill reduces the chances of something going terribly wrong that could derail the move back to normalcy, even if it is a new normalcy.

More importantly, leading US medical experts believe this pill is so important that they’re declaring the end of the pandemic, which has to be big for stocks. Even without this, we seem to be set up for stocks to go higher over the better period for share players (i.e. November to April) but the question we have to grapple with is: will there be another buying opportunity or is it up, up and away from here?

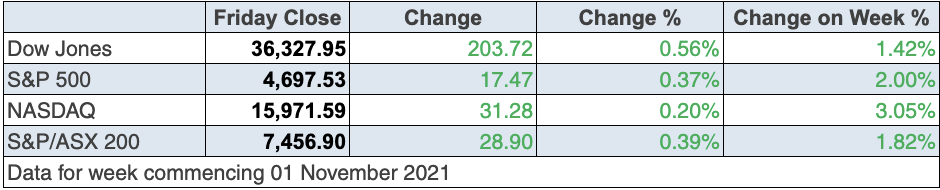

S&P 500

This chart shows the September/October sell off, which looks done and dusted, but I will be researching this over the upcoming week to see if we might get one more buying opportunity or whether we should bite the bullet and buy stocks from here.

It’s a tough job, but that’s my beat!

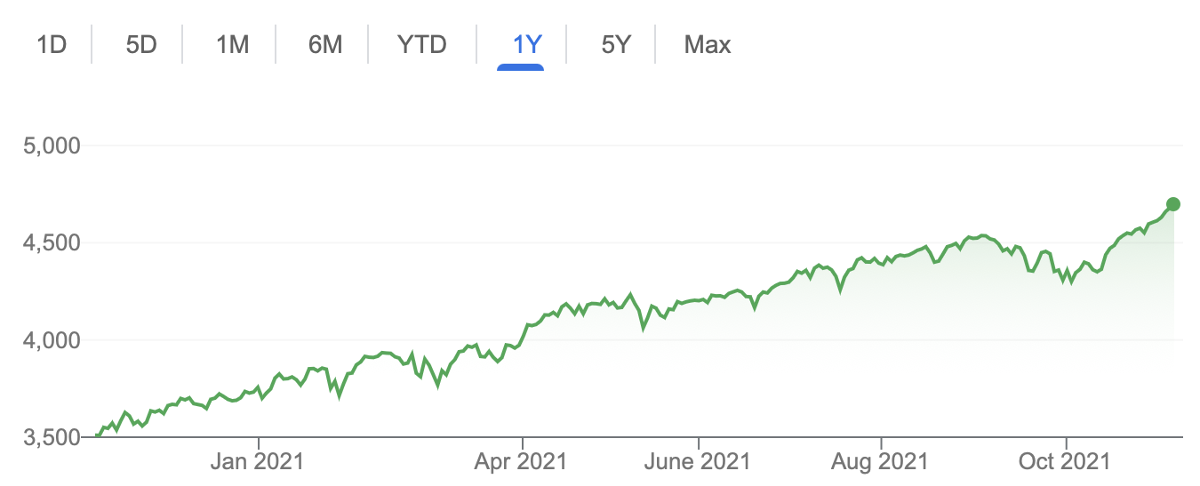

To the local story and overall it was a good week for the optimists, with the S&P/ASX 200 up 1.8% for the week to finish at 7456.9.

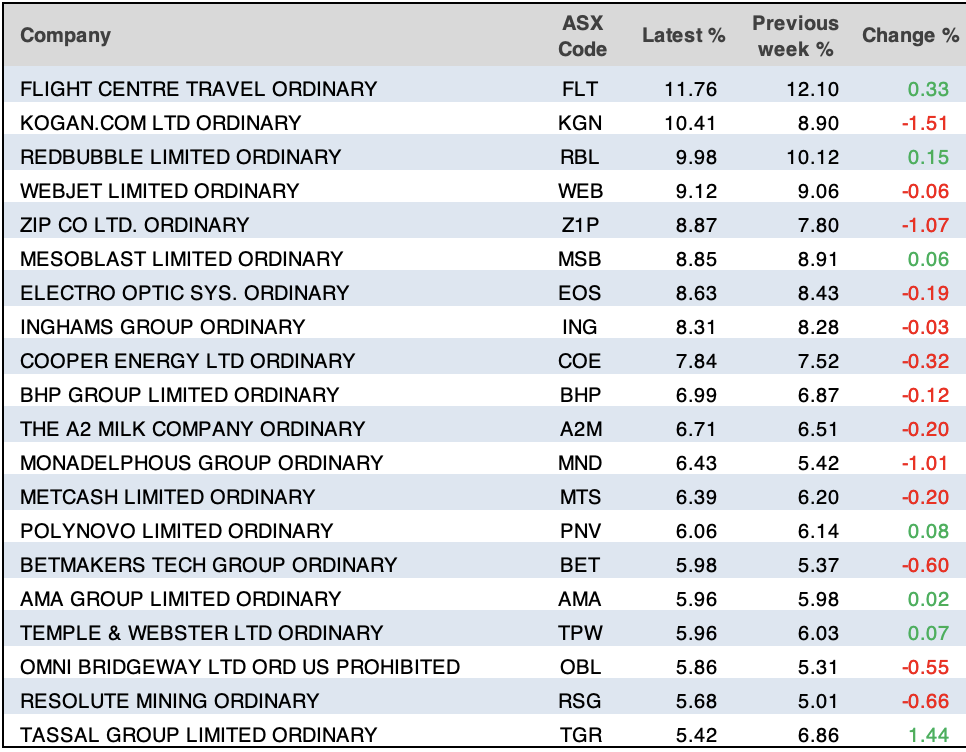

The winners and losers from Bloomberg show that there was no strong pattern for the week — it tended to be individual stories pertaining to respective businesses.

On Monday’s TV show, Julia Lee made a good case for the likes of Nufarm and the market delivered. Also, Michael Gable’s charts gave Pro Medicus a thumbs up and he was proved right.

Tyro copped a strange reaction to a ‘misreport’ (well that’s what I heard) but the market hasn’t changed its view. I’ll try and get its CEO Robbie Cooke to do a ‘please explain’. If my mail is right, Tyro could be a buy but I want to hear it from the horse’s mouth. This is one of my ZEET stocks so I have a vested interest in knowing the real story.

News Corp and REA reported well and the latter’s share price spiked 5.6% to $176.81 on Friday alone!

The CBA’s crypto play was given the thumbs up so its share price was up 3.81% for the week to $109.71.

Woodside disappointed with its report on gas reserve forecasts and lost 3.01% to $22.58, which was annoying with oil and gas prices still on the rise and expected to keep doing so.

A big story of the week is the Carlyle private equity group’s takeover offer for Link Group. The company received a $5.38 per share offer and its share price ended up 8.55% on Friday to end at $4.70.

Disappointment of the week was Westpac, whose share price fell 7.96% for the week to $22.55 after an underwhelming report, which raises the question: “What is the CEO Peter King up to?” Answer: “Clearly not enough!”

Is it a buy? Probably, but I bet you’ll have to wait 6-12 months before you’ll be on good terms with yourself.

What I liked

- The weekly ANZ-Roy Morgan consumer confidence rating rose by 1.5% to a 16-week high of 108.4 — this is an end of lockdown reaction.

- Retail trade rose 1.3% in September but volumes fell by a record 4.4% in the September quarter. Online sales soared 3.4% in September to record highs. Given it was lockdown-dominated, it was a good result.

- Love a trade surplus! Our trade surplus eased from an all-time high of $14.7 billion in August to $12.2 billion in September. The trade surplus with China hit record highs on the back of record exports.

- SEEK national job advertisements lifted 10.2% in October to be up 63.2% on a year ago.

- Job advertisements (as tracked by ANZ) rose by 6.2% in October to be up 56% on a year ago.

- The AiGroup & HIA Performance of Construction index rose from 53.3 to 57.6 in October.

- The final Australian IHS Markit Services Purchasing Managers’ index (PMI) rose from 45.5 to 51.8 in October. This is the plus out of lockdown.

- The US Federal Reserve left its target range for the federal funds rate unchanged at 0-0.25%. But the Fed said that it will begin reducing the pace of its monthly bond purchases starting “later this month”. The process will see reductions of US$15 billion each month from the current US$120 billion a month of purchases. This is a sign that central bank rescues are becoming unnecessary.

What I didn’t like

- New vehicle sales totalled 74,650 units in October, down 8.1% on a year ago. Used car prices were up 12.7% on the year — blame supply chain problems and a lack of microchips. Modern cars have 100 chips per unit!

- Building approvals fell by 4.3% in September, but are up 12.8% on a year ago. Approvals to build detached houses dropped 16.1% in September – the biggest monthly decline in 21 years but again these bad numbers are lockdown-infected!

- New home loans fell by 1.4% in September. But while owner-occupier loans fell by 2.7%, investor loans rose by 1.4%. Renovation loans are just off record highs. These bad numbers were lockdown-affected.

- US unit labour costs surged by 8.3% in the quarter (survey: 7%), which shows a wage push on inflation.

- The IBD/TIPP economic optimism index in the US fell from 46.8 to 43.9 in November (survey: 47.5).

- The ISM manufacturing purchasing managers index (PMI) in the US fell from 61.1 to 60.8 in October (survey: 60.5). The US Markit manufacturing PMI fell from 60.7 to 58.4 (survey: 59.2). Construction spending fell by 0.5% in September (survey: 0.4%).

The RBA wakes up

This week the RBA saw the light and this is CommSec’s summary of the central bank’s new take on their job ahead:

- The Reserve Bank has abandoned the April 2024 bond yield target of 0.1%.

- It also removed its previous forward interest rate guidance. It had previously said that the conditions for an interest rate lift-off were unlikely to be met before 2024. Instead, now the RBA says“The Board will not increase the cash rate until actual inflation is sustainably within the 2% to 3% target range. This will require the labour market to be tight enough to generate wages growth that is materially higher than it is currently. This is likely to take some time. The Board is prepared to be patient, with the central forecast being for underlying inflation to be no higher than 2½% at the end of 2023 and for only a gradual increase in wages growth.”

- Next year’s economic growth is now seen to be a good 5.5% and unemployment will be 4.5% by the end of 2022.

That’s great news for stock players, though the first interest rate rises will spook the market, though I suspect I will call it a buying opportunity. On my present calculations, I could get more cautious on how I invest in 2023, so let’s enjoy the year ahead!

The week in review:

- This week in the Switzer Report, I take a look at five stocks that are great long-term holds, with my picks helped along by insights from my interview with Marcel Von Pfyffer last week for Switzer TV as well as gauging what the leading market analysts are saying.

- Paul Rickard re-evaluates his stance on A2 Milk Company (A2M) now that the economy is starting to reopen post-lockdown, specifically the opportunity for A2 to reignite daigou trade with China, as well as taking a look at what the brokers are saying.

- There are some great companies in Australia currently working in the 3D and aerial data, and Data-as-a-service (DaaS) sectors. As such, James Dunn suggests three stocks for prime exposure in the sector, with Aerometrex (AMX) his pick of the bunch.

- With business forecasters predicting stronger revenue growth in insurance broking as our economy recovers from various Covid lockdowns with business activity roaring back to life, Tony Featherstone explores two insurance company stocks that could ride the impending wave.

- SMSF expert Tim Miller breaks down how one can maximise their contributions to an SMSF and how to reduce their personal tax liability in the process.

- For our “Hot” stocks this week, Raymond Chan, Head of Asian Desk Retail, looks at ResMed (RMS) and Managing Director at Fairmont Equities, Michael Gable shares his interest in Aristocrat Leisure Limited (ALL).

- This week in Buy, Hold, Sell – What the Brokers Say, there were 17 upgrades and 5 downgrades in the first edition, and in the second edition, Macquarie Group (MQG) received an upgrade while Westpac (WBC) received 2 downgrades.

- And in Questions of the Week, Paul Rickard answers your questions about the effect of the bond market on equities, whether to reinvest in Westpac (WBC), the implications of Paradigm Biopharmaceuticals (PAR) receiving FDA approval, and whether BHP Group (BHP) and Rio Tinto (RIO) are currently a good buy.

Our videos of the week:

- Monthly Webinar: Is it time to load up on stocks for the usual November to April surge? If so, which stocks?

- The treatments we have regarding Covid-19 | The Check Up

- 4 rising stocks — can they go higher: Promedicus, Xero, Novonix and CBA + is Westpac a buy?

- Is freedom one week away for NSW + Interest rates to rise with the RBA in retreat

- 5 tech stocks with upside: Megaport, Audinate, ELO, & more + will house prices slump 20%?

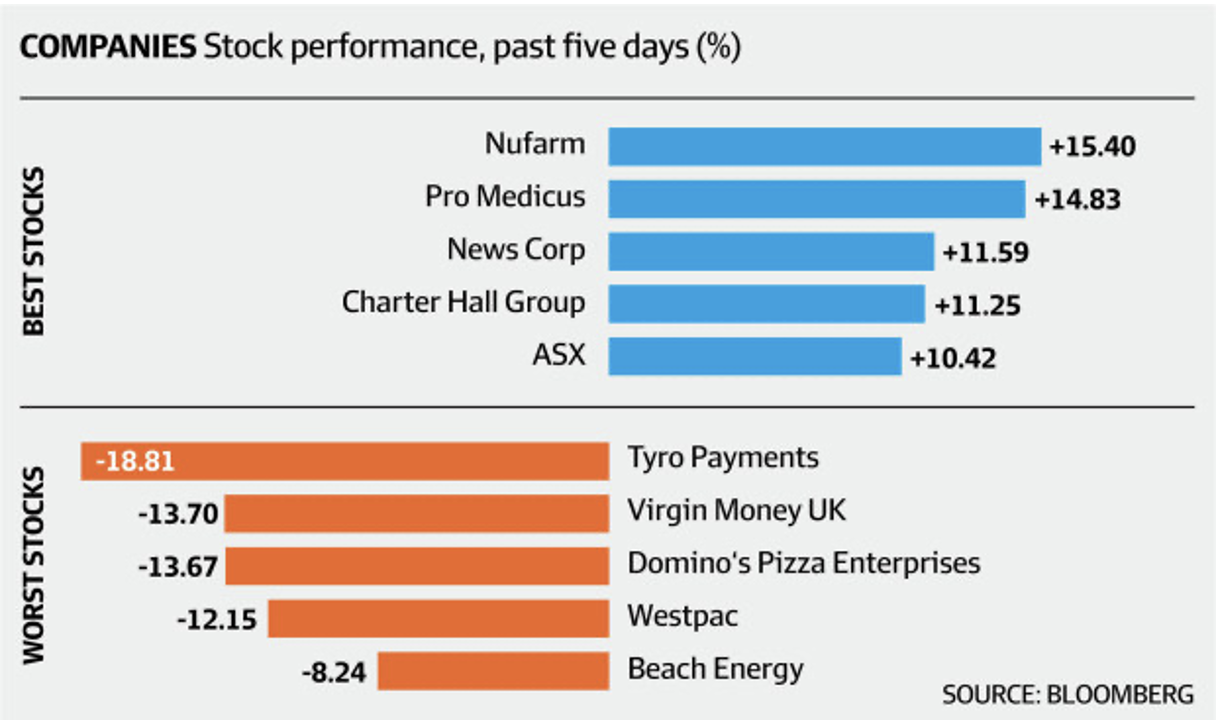

Top Stocks – how they fared:

The Week Ahead:

Australia

Monday November 8 – Preliminary skilled job vacancies (October)

Tuesday November 9 – Weekly consumer confidence index (November 7)

Tuesday November 9 – NAB business survey (October)

Wednesday November 10 – Monthly consumer confidence index (November)

Wednesday November 10 – Weekly payroll jobs & wages (October 9)

Wednesday November 10 – Monthly business turnover indicator (September)

Thursday November 11 – Labour force (October)

Thursday November 11 – Consumer inflation expectations (November)

Friday November 12 – Overseas arrivals & departures (September)

Overseas

Sunday November 7 – China international trade (October, annual)

November 8-9 – US Federal Reserve Chair Powell speeches

Monday November 8 – US consumer inflation expectations (October)

Tuesday November 9 – US NFIB small business optimism index (October)

Tuesday November 9 – US producer prices (October)

Wednesday November 10 – China consumer & producer prices (October)

Wednesday November 10 – US consumer prices (October)

Wednesday November 10 – US wholesale inventories (September)

Wednesday November 10 – US monthly budget statement (October)

Friday November 12 – US JOLTS job openings (September)

Friday November 12 – US Uni of Michigan consumer sentiment (November)

November 9-15 – China credit growth data (October)

Food for thought: “It is remarkable how much long-term advantage people like us have gotten by trying to be consistently not stupid, instead of trying to be intelligent” – Charlie Munger

Stocks shorted:

ASIC releases data daily on the major short positions in the market. These are the stocks with the highest proportion of their ordinary shares that have been sold short, which could suggest investors are expecting the price to come down. The table shows how this has changed compared to the week before.

Chart of the week:

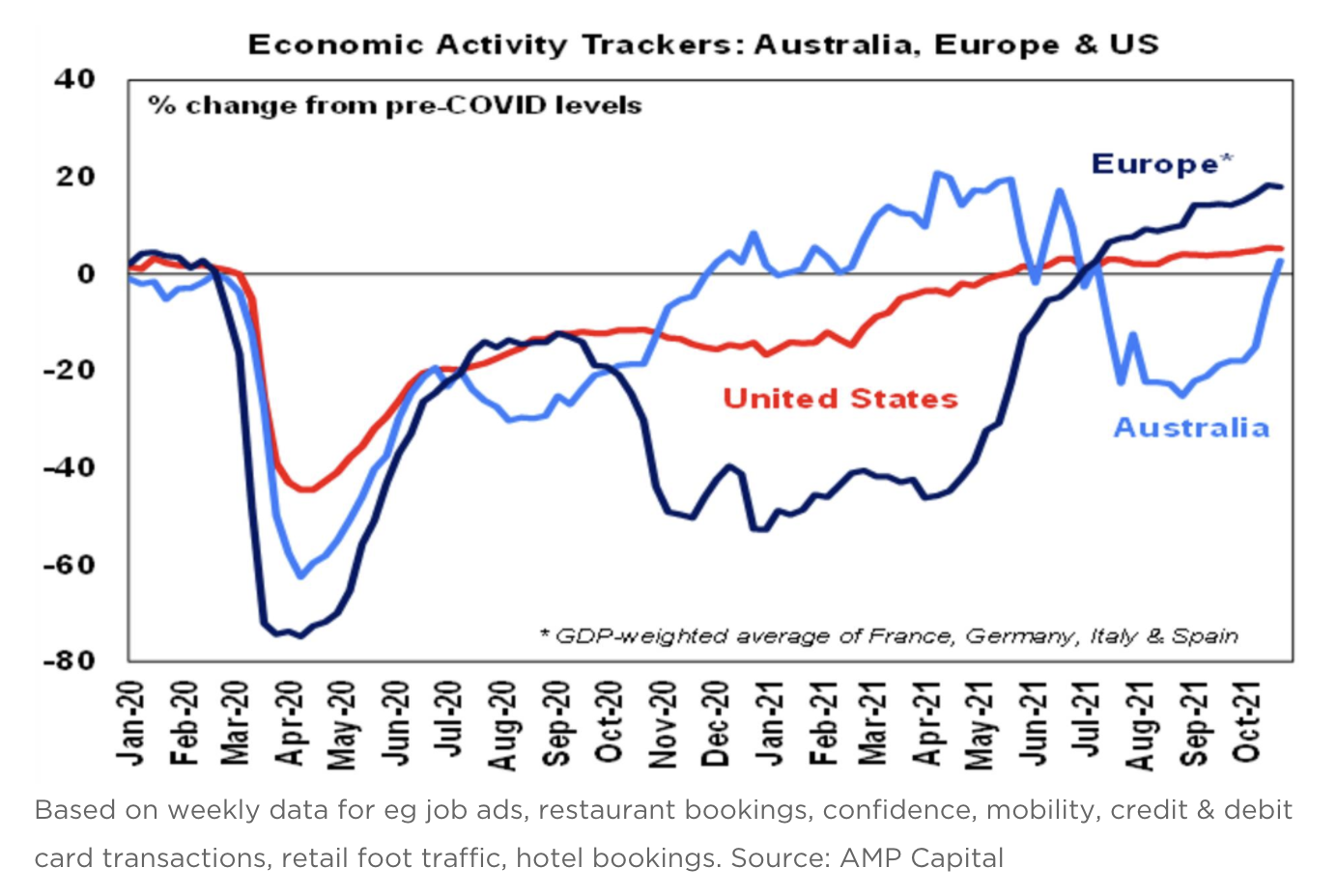

This week, Shane Oliver of AMP Capital examined some of the main driving forces behind central banks becoming more hawkish on interest rates as they put a grip on various monetary policy. Dr Oliver says the primary influence is of course, the sharp rise in inflation seen globally. “Much of it can be traced to pandemic-driven distortions to supply and demand – basically a surge in goods demand at a time when supply has been constrained by pandemic-related disruptions and a boost to various services prices from reopening,” he says. A second key factor, as shown in the chart below, is that “economies have been recovering with coronavirus outbreaks having smaller impacts on economic activity. [In] Australia, recovery now looks to be back on track after the recent east coast lockdowns. This is evident in a sharp rebound in our Australian Economic Activity Tracker”.

Top 5 most clicked:

- 5 stocks that are great long-term holds – Peter Switzer

- Is A2 Milk still worth holding? – Paul Rickard

- 3 stocks in the 3D & arial data space – James Dunn

- Buy, Hold, Sell – What the Brokers Say – Rudi Filapek-Vandyck

- Opportunities in AUB & Steadfast – Tony Featherstone

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.