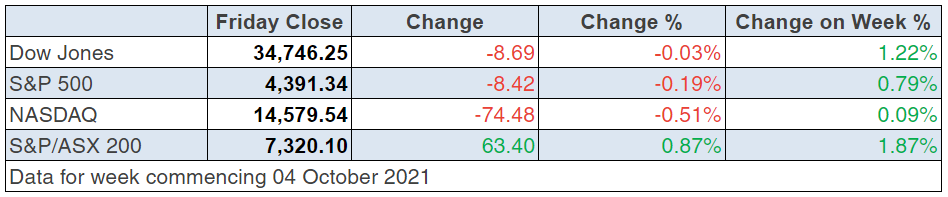

The Coronavirus has not only infected the world’s populations, it has affected the reliability of key economic stats we use to work out how we should play stocks. A case in point was the much-anticipated US jobs report for September, which has attracted assessments such as “disappointing” and, significantly, “crazy!”

So the economists (experts on the US economy) expected 500,000 jobs to show up in the numbers but they fell, with only 194,000 new positions recorded.

That was a big miss, given the ADP private jobs number out earlier in the week said there’d been a bigger-than-expected 568,000 created, meaning the economists’ forecasting models were unreliable, again.

Softening the blow was a bigger-than-expected fall in the jobless rate to 4.8% from 5.2% a month earlier.

US Unemployment Rate

Also, the July and August results were revised up by 169,000 and average hourly earnings were 0.6% higher, however, the participation rate was down, which assists in explaining the big drop in the unemployment rate.

Okay, the next question to answer is this: if the jobs coming down the pike aren’t strong, why was the market reaction, before the closing bell, so restrained?

The news isn’t expected to change the Fed’s attitude towards tapering its bond purchases but it doesn’t do anything to make market players expect that interest rates will rise any sooner than is currently expected. In fact, it could delay any upcoming rise in 2022. Also, the month of September did bring some one-off challenges.

One such job-killer was hurricane Ida. And public education hiring dropped notably because of the virus and the supply of workers generally, because the pandemic is still a problem. Concerns about the looming debt-ceiling, which could have shut down US government departments, could also have affected job hiring. That potential threat has now been deferred until early December after Republican leaders agreed to play ball and keep funding flowing.

So what does this news mean for the market?

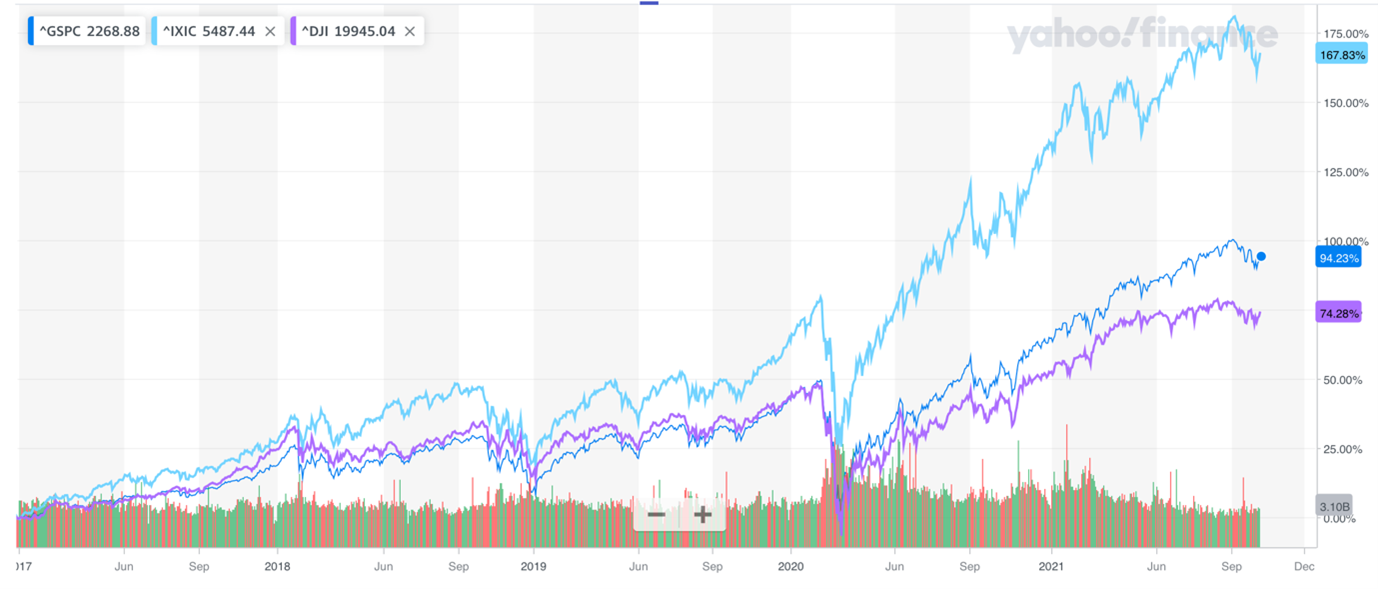

S&P 500

This chart of the US stock market shows how last October there was an early rise out of a September slump, but then an October drop was quite significant before the usual November to April climb took over. There was a February sell off that was offset by another strong rise until another drop in May. Then July brought another fall and importantly, the current slip has remained above the July lows, which is seen by market analysts as a good sign.

That said, I won’t be complacent about October until it ends. High energy prices along with the northern hemisphere going into colder months (which could increase the Delta strain threat to unvaccinated lives) might hit economic growth as a consequence.

Also, the third-quarter US earnings show-and-tell starts soon, which could make or break share player optimism, though the general feeling is positive about what companies will say about their third quarter performances.

Tom Lee of Fundstrat Global Advisors has predicted an “everything rally” into the end of the year. Recently he told CNBC that the selling pressure of late was driven by “…the gridlock in Washington, which he characterized as a historically good time to buy stocks.

“When Washington plays tough, that’s not a time to panic on stocks,” he said. “It’s almost always been a great buying opportunity.”

Tom is a smart guy but there is an argument that tech won’t enjoy the months ahead as much as old-world stocks, such as energy, commodities, industrials and financials, which fall into the value stock play that often works at this time of the stock market cycle.

The chart below does show how the Nasdaq has fallen harder than the Dow Jones Industrial Average, which is less tech-dominated and probably is a clue to what lies ahead for the overall tech sector, though some standout companies could defy this softening trend.

To the local story and if ever you needed a reason to believe in portfolio diversification, this week has driven home the message. At the start of the week, tech stocks were trashed, but energy stocks (after being disappointing for months) have become saviours!

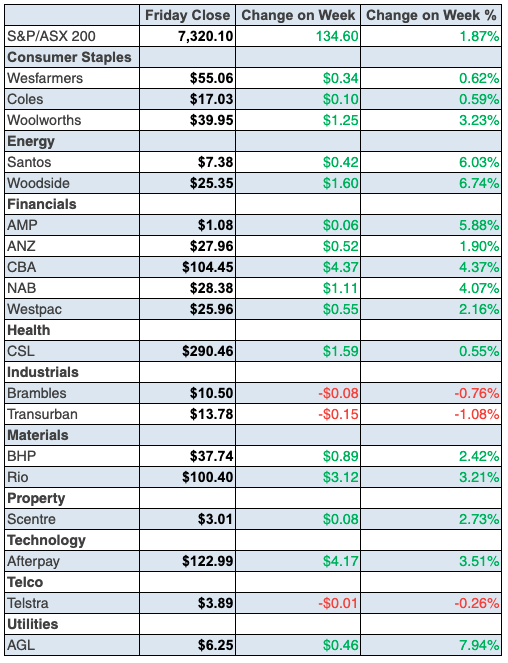

The S&P/ASX 200 Index was up 134.6 points (or 1.9%) for the week to finish at 7320.1, but given the instability and volatility, it might be too soon to dive into stocks with optimism.

On Friday when we learnt China wants our coal again, we saw Woodside up 5.3% to $25.35 this week and I’m glad I kept the faith with that one! Santos was up 3.9% to $7.38 and even Origin and AGL delivered, with the former up 5.4% to $5.07, while the latter spiked 7.1% to $6.25!

And despite the APRA move to slow down lending, CBA rose 1.64% to $104.45, NAB put on 2.27% to $28.38, Westpac added 0.5% to $25.96, while ANZ rose 0.9% to $27.96.

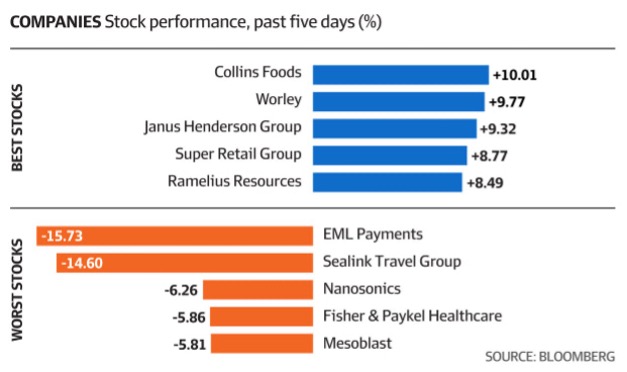

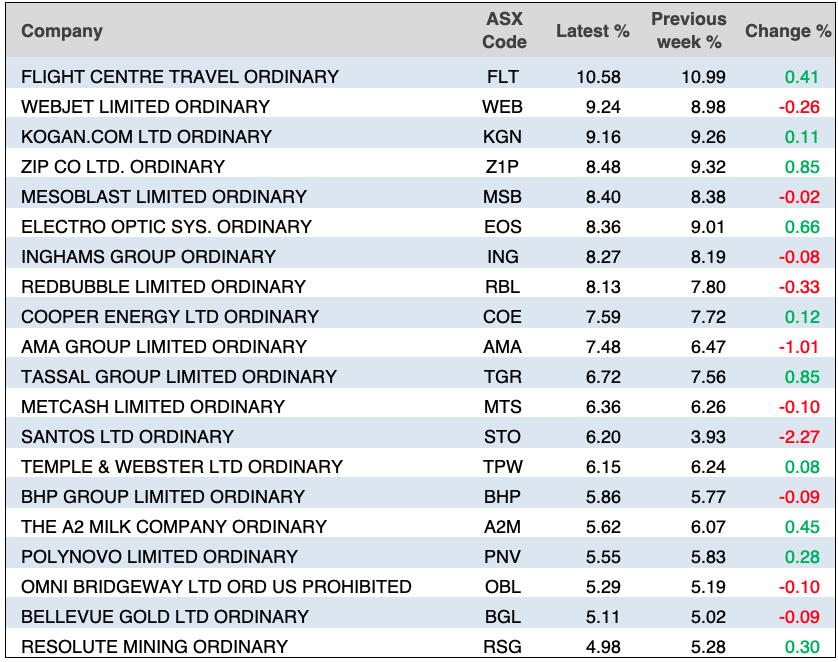

Here’s Bloomberg’s winners and losers list for the week.

EML is still in trouble with the Irish central bank, which explains the share price slide. In simple terms, the uncertainty of the bank’s demands on the company is spooking the market.

What I liked

- APRA moved to slow down house prices by raising the serviceability buffer to 3%.

- The weekly ANZ-Roy Morgan consumer confidence rating rose by 0.9% to a 12-week high of 104.6 (long-run average since 1990 is 112.5).

- The Performance of Construction rose by 14.9 points to 53.3 points in September.

- Total wages lifted by 1.8% over the fortnight to 11 September 2021 to be 5% above pre-pandemic levels on 14 March 2020.

- The trade surplus increased from $12.7 billion in July to a record $15.1 billion in August.

- New vehicle sales totalled 83,312 units in September and 1,088,217 over the year – a 25-month high.

- US Senate Majority Leader Chuck Schumer said lawmakers reached a deal on a short-term debt ceiling increase, avoiding a US government default. The deal will extend the debt ceiling through to early December.

- US private sector payrolls, as reported by ADP, increased by 568,000 in September (survey 430,000).

- The ISM services index in the US rose from 61.7 to 61.9 in September (survey: 59.9).

- The composite purchasing managers index in the EU remained strong at a reading of 56.2, but down from 59 in August.

- US factory orders rose by 1.2% in August (survey: 1%).

What I didn’t like

- Retail trade fell by 1.7% in August, though online spending rose by 15.1%. And you can blame lockdowns.

- The AiGroup Performance of Services Index (PSI) rose from 45.6 in August to 45.7 in September — any number under 50 says the sector is contracting.

- Job advertisements (as tracked by ANZ) fell by 2.8% in September to be up 60.8% on a year ago.

- Challenger job cuts rose by 14% to 17,895 in September (survey: 16,000).

- The IBD/TIPP economic optimism index in the US fell from 48.5 to 46.8 in October (survey: 50).

- The EU is concerned that soaring oil and gas prices intensified concerns inflation will dent economic growth.

I liked the rebound this week

Even though I’m still cautious about the rest of October, the fact that we ended up nearly 2% for the week augurs well for the future for stocks. The debt-ceiling deal helped the US market rebound, and while another bout of Washington wrangling lies ahead in December, a resolution is certain, and that will help stocks going into 2022.

We need some Winston Churchill observations to help us believe that the Yanks will get their debt argument resolved and that will be a plus for stocks. As Churchill once noted: “You can always count on the Americans to do the right thing, after they have tried everything else.”

The week in review:

- Tony Featherstone reveals his two favourite airline stocks: Qantas (QAN) and Alliance Aviation Services (AQZ).

- Tim Miller discusses how one can change their SMSF trustee and the key reasons why they may want to do so.

- For our “HOT” stocks this week, Raymond Chan from Morgans explores Orica (ORI) and Michael Gable from Fairmont Equities talks about Beacon Lighting (BLX).

- In Buy, Hold, Sell – What the Brokers Say this week, there were 4 upgrades and 0 downgrades.

- And in Questions of the Week, Paul Rickard answered questions from subscribers about Woolworths (WOW), Commonwealth Bank of Australia (CBA), Milton Corporation (MLT), Australian Foundation (AFI), Argo Investments (ARG), Elmo Software (ELO), Appen (APX) and Hotel Property Investments (HPI).

Our videos of the week:

- Boom! Doom! Zoom! | October 7th, 2021

- Rudi Filapek-Vandyck gives 5 must-buy stocks for a new investor + Why is A2M being sued?

Top Stocks – how they fared:

The Week Ahead:

Australia

Tuesday October 12 – Weekly consumer confidence (October 10)

Tuesday October 12 – NAB business survey (September)

Tuesday October 12 – Labour force status of families (June)

Wednesday October 13 – Monthly consumer confidence (October)

Wednesday October 13 – Building activity (June quarter)

Wednesday October 13 – Overseas arrivals & departures (August)

Thursday October 14 – Labour force (September)

Thursday October 14 – RBA Deputy Governor Guy Debelle speech

Friday October 15 – Monthly business turnover indicator (August)

Overseas

Tuesday October 12 – US NFIB business optimism index (September)

Tuesday October 12 – US JOLTS job openings (August)

Wednesday October 13 – China international trade (September)

Wednesday October 13 – US Consumer prices (September)

Wednesday October 13 – US Federal Reserve meeting minutes (September)

Thursday October 14 – China inflation (September)

Thursday October 14 – US producer prices (September)

Friday October 15 – US retail sales (September)

Friday October 15 – US import/export prices (September)

Friday October 15 – US consumer confidence (October)

Friday October 15 – US Empire State manufacturing index (October)

Food for thought: “The biggest secret in venture capital is that the best investment in a successful fund equals or outperforms the entire rest of the fund combined” – Peter Thiel

Stocks shorted:

ASIC releases data daily on the major short positions in the market. These are the stocks with the highest proportion of their ordinary shares that have been sold short, which could suggest investors are expecting the price to come down. The table shows how this has changed compared to the week before.

Chart of the week:

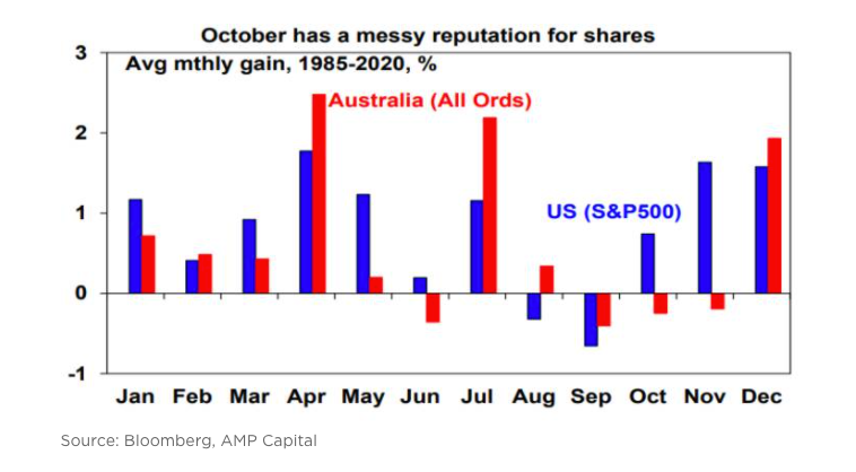

Shane Oliver from AMP Capital shared the following chart this week regarding the infamous month of October for share prices. Owing to large scale impacts such as the Evergrande debacle, Europe and China’s energy crisis and rising bond yields, US and Australian shares are down 5% and 6% respectively. Despite this, Oliver says that: “ultimately, we see the issues being resolved in a way that does not severely threaten global growth and so, with global monetary policy likely to remain relatively easy for some time, we continue to see the broader trend in shares remaining up. Reopening will also help local shares”.

Top 5 most clicked:

- My two favourite airline stocks: Qantas and alliance Aviation – Tony Featherstone

- How to change your SMSF trustee – Tim Miller

- Buy, Hold, Sell – What the Brokers Say – Rudi Filapeck-Vandyck

- “Hot” stocks – Maureen Jordan

- Questions of the Week – Paul Rickard

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.