Fear and anxiety around what Fed boss Jay Powell would say about tapering was overdone and while he did say the economy was doing well enough to cope with less bond purchases, he ruled out any imminent interest rate rise.

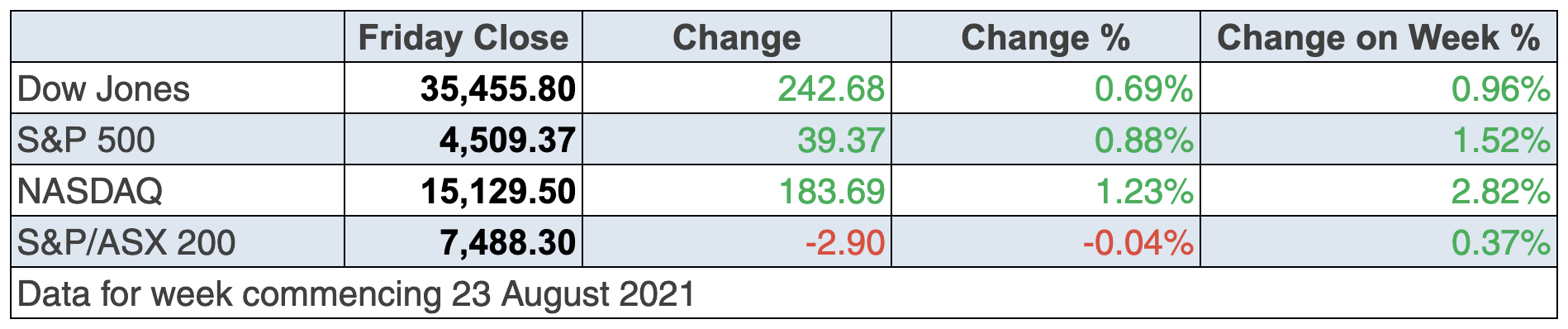

And yep, Wall Street liked that, with the S&P 500 Index closing up 0.8% while the Dow was up over 240 points (or 0.69%).

On the big economic issues that underpin company profits and stock prices, he said the jobs outlook had brightened, higher inflation would be temporary and an interest rate rise required “… a different and substantially more stringent test” than a decision to taper.

This last reference to rates helped the Nasdaq spike significantly (up 183 points or 1.23%) because the market links rising interest rates to problems for tech companies that often carry a load of debt. There was speculation when tapering might start, and September 22 has supporters but the consensus thinks November 3.

My bet is that if inflation ends up being more permanent, then both interest rates will rise and stock prices will be negatively affected — especially for tech stocks.

This captures the Wall Street reaction and hosed down any of my lower order fears that a usual August-September stock market sell off was to be expected.

“Interest rate hikes are far, far away and investors are happy about that,” Michael Arone said to CNBC. Arone is the chief investment strategist for the US SPDR Business at State Street Global Advisors. “I think Powell deserves some credit for navigating the tapering of assets, avoiding a tantrum. The market seems well prepared for the start of tapering.”

And all this ‘US rate rises are around the corner’ talk has weakened the greenback and strengthened the Oz dollar, which is now 73.15 US cents, after being 71.15 only eight days ago.

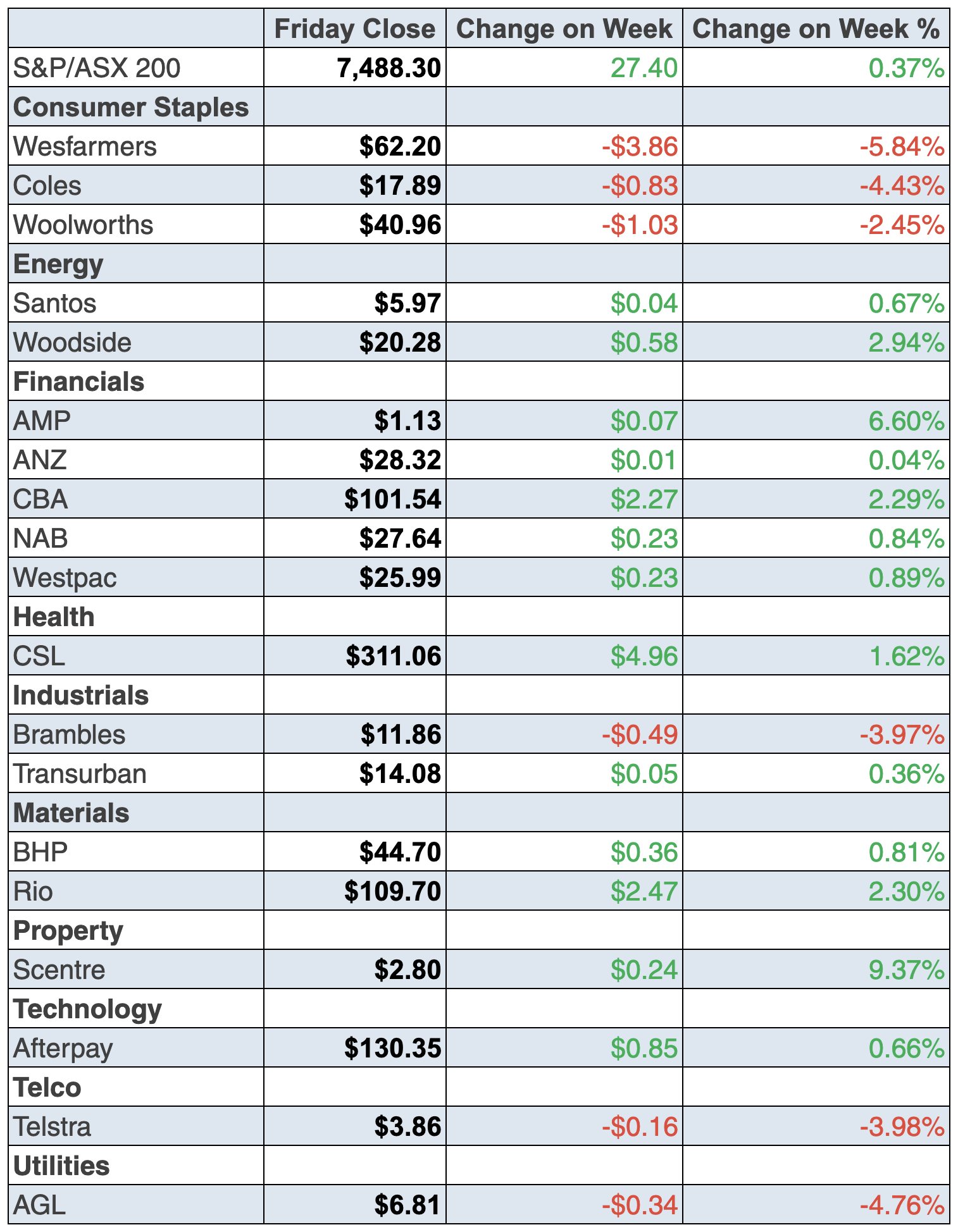

The local market defied gravity and the ill winds that often blow in August out of Wall Street, but not this year, at least for now! The S&P/ASX 200 Index rose a tick over 27 points (or 0.4%) to finish at 7488.3.

It was a strange one, with the winners and losers not really showing any consistent industry pattern.

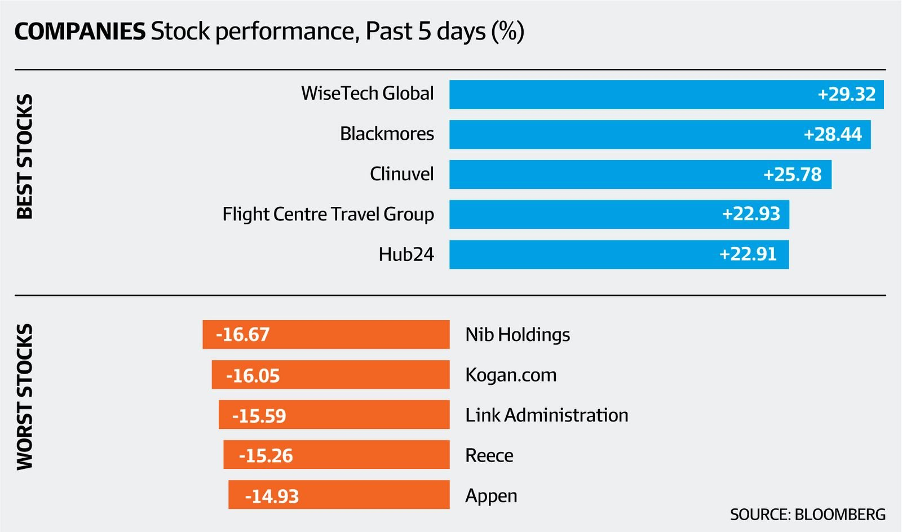

That said, travel stocks finally got the boost I’ve been predicting, with Qantas up 21.2% to $5.15 with the CEO Alan Joyce talking about a December kick-off for flying!

Flight Centre added 22.93% to rise to $16.89, Webjet put on 15.9% to $5.53 and Corporate Travel Management rose 10.9% to $23.39.

The patient are now being rewarded!

The banks were up for the week but it was nothing flash. CBA was up 2.3% to $101.54, NAB rose 0.8% to $27.64, while Westpac put on 0.9% to $25.99. ANZ was basically flat at $28.32.

In the tech space, Wisetech gained 29.3% to end at $46.35 from a better-than-expected report. And at long last, Blackmores gave shareholders an overdue reason to smile, with a 28% plus rise for the week to $98. Revenue was down but margins were up.

There were some weird ones, such as Reece that reported a 25% jump in profit, yet the stock price fell 15.3% to $21.05. And then there was Nib that hardly ever disappoints, but a big profit boost was greeted with a 16.7% dumping for the share price!

Appen lost 14.9% but that was predictable, with customers such as Facebook, Microsoft and Google wary of user tracking technology that’s called “intrusive.”

I think we need to talk to Appen’s CEO. Also Kogan.com was a bit of a shock as experts thought the lockdown was going to be good for the company, but this is a report to the end of June, and up to that time the company fessed up to an inventory management issue.

Those worried about their energy shares should note Woodside was up 2.94% for the week but is down nearly 8% for the month. It’s down 12% for the year-to-date but this news that interest rates will remain low for longer than was expected before Jay Powell spoke, has helped energy prices. “Energy stocks led the S&P, after being among the hardest hit on Thursday,” CNBC reported. Occidental Petroleum climbed 7%, Cimarex Energy and APA Corp rose 6%, Cabot Oil and Gas gained 5% and this should be good for our energy companies next week.

What I liked

- The weekly ANZ-Roy Morgan consumer confidence rating rose by 0.5% to 101.6 (long-run average since 1990 is 112.5). Obviously, the lucky states are making up for the unlucky lockdown states! But it’s still a laudable effort.

- The Australian Bureau of Statistics (ABS) said new business investment (spending on buildings and equipment) rose by 4.4% in the June quarter – the biggest quarterly lift in spending in almost nine years. The third estimate of expected investment in 2021/22 was 17.5% higher than the equivalent estimate for 2020/21 – the biggest annual gain in nine years. These are great numbers but they aren’t lockdown infected! That said, it shows us what will happen next year when vaccinations help open up our economy again.

- The Australian Bureau of Statistics (ABS) reported that there were just over 2.4 million actively trading businesses as at June 30, up a record 3.8% over the year (data goes back 18 years). The number of small businesses (1-4 employees) lifted by 15.2% over the year. The virus plus lockdowns have created a new army of entrepreneurs, which will pay off down the track.

- Residential building rose 8.9% over the year to June – the strongest annual pace in 5 years. The value of alterations and additions (renovations) were up by 24.5% over the year to June – the strongest growth rate in 21 years. Once again these are up to June numbers but they do show what lies ahead when the negativity of the virus and lockdowns are KO’d by vaccinations and the reopening of the economy.

- The US economy (GDP) grew at a 6.6% annual rate in the June quarter (survey: 6.7%).

- The ‘flash’ Markit purchasing managers’ index (PMI) for manufacturing in the US eased from 63.4 to 61.2 in August (survey: 62). The services PMI fell from 59.9 to 55.2 in August (survey: 59.2). The numbers are down but they’re still good stats.

- Hotels, restaurant, leisure and airline stocks in the US rose in further response to the regulatory approval of the Pfizer-BioNTech Covid vaccine. Booster shots will be a help to business in 2022.

What I didn’t like

- Retail trade fell by 2.7% in July (the most in seven months) to be down 3.1% on a year ago, the weakest annual growth rate in 15 months. Overall retail turnover hit a 9-month low of $29.8 billion. Spending fell by 8.9% in NSW in July – the third biggest monthly decline on record.

- The value of construction work rose by 0.8% in the June quarter to be up by 0.4% on a year ago, but were less than expected. Construction activity was 0.5% above pre-Covid levels in March 2020.

- The ‘flash’ or preliminary Australian IHS Markit Manufacturing Purchasing Managers’ index (PMI) fell from 56.9 in July to a 14-month low of 51.7 in August. The Services business activity index dropped from 44.2 to a 15-month low of 43.3 in August. The combined or composite PMI eased from 45.2 to a 15-month low of 43.5 in the month. Readings below 50 indicate a contraction in activity.

- On Thursday, investors turned cautious after explosions in Afghanistan, with reports of US military and Afghan civilian casualties.

- The US Richmond Federal Reserve manufacturing index fell from 27 points to 9 points in August (survey: 25).

You have to check the dates on data

Overnight, the Yanks got the largest year-over-year personal consumption expenditure increase since 1991, with the PCE Index rising 4.2% in July from the same time last year. But last year was a crazy Coronavirus year when spending was negatively affected. Similarly, the bad numbers we’ve seen locally are lockdown ‘infected’ and will eventually turn and surge when vaccination rates permit. That said, it’s good to go back to 2019 (pre-Covid) to assess the calibre of good economic readings and many of the bad numbers should not be over-hyped, when they tell us that terrible times are ahead. The rebound of travel stocks this week proves my point.

The week in review:

- Whether it’s socks or stocks, Warren Buffett says he likes buying quality at marked down prices. I’m of the same mind, and here are 3 stocks I believe will knock your socks off, if you’re patient: BHP (BHP), Woodside (WPL) and Newcrest (NCM).

- Paul Rickard is often asked whether Telstra (TLS) get back to $5 and if is still a relatively secure, tax-effective income stream. Here are his answers.

- James Dunn shared his selection of 3 great stock results from reporting season: Domino’s Pizza Enterprises (DMP), Adairs (ADH) and Corporate Travel Management (CTD).

- Tony Featherstone looked at 3 online marketplace stocks with improving medium-term prospects: Hipages Group Holdings (HPG), iSelect (ISU) and OFX (OFX).

- In our “HOT” stocks this week, Raymond Chan from Morgans selected OZ Minerals (OZL) and Michael Gable from Fairmont Equities looked at Corporate Travel Management (CTD).

- In the first Buy, Hold, Sell – What the Brokers Say of the week, there were 14 upgrades and 23 downgrades, and in the second edition there were 13 upgrades and 15 downgrades.

- And in Questions of the Week, Paul Rickard answered your questions about AGL (AGL), Spark Infrastructure (SKI), Sydney Airport (SYD) and the best ETF for dividends.

Our videos of the week:

- Boom! Doom! Zoom! | August 26, 2021

- Are these companies buys? TLS, CAR, DHG, DMP, JHX, EML, UWL, SHL, KGN? My experts say yes! | Switzer Investing

- We assess these stocks: CTD, HUM, AXE & more + will property prices fall in Spring? | Switzer Investing

Top Stocks – how they fared:

The Week Ahead:

Australia

Monday August 30 – Business Indicators (June quarter)

Tuesday August 31 – Private sector credit (July)

Tuesday August 31 – Balance of payments (June quarter)

Tuesday August 31 – Building approvals (July)

Wednesday September 1 – CoreLogic Home value index (August)

Wednesday September 1 – Purchasing Managers’ indexes (August)

Wednesday September 1 – National accounts (June quarter)

Thursday September 2 – International trade (July)

Thursday September 2 – Lending indicators (July)

Friday September 3 – Retail trade (July)

Friday September 3 – Motor vehicle sales (August)

Overseas

Monday August 30 – US Pending home sales (July)

Monday August 30 – US Dallas Fed manufacturing index (August)

Tuesday August 31 – China purchasing managers’ indexes (August)

Tuesday August 31 – US FHFA house price index (June)

Tuesday August 31 – US Consumer confidence (August)

Wednesday September 1 – US ADP private payrolls (August)

Wednesday September 1 – US ISM manufacturing index (August)

Wednesday September 1 – US Construction spending (July)

Thursday September 2 – US Challenger job cuts (August)

Thursday September 2 – US Factory orders (July)

Thursday September 2 – US Trade balance (July)

Friday September 3 – US Non-farm payrolls (August)

Food for thought:

“Earn as much as you can. Save as much as you can. Invest as much as you can. Give as much as you can.” – John Wesley

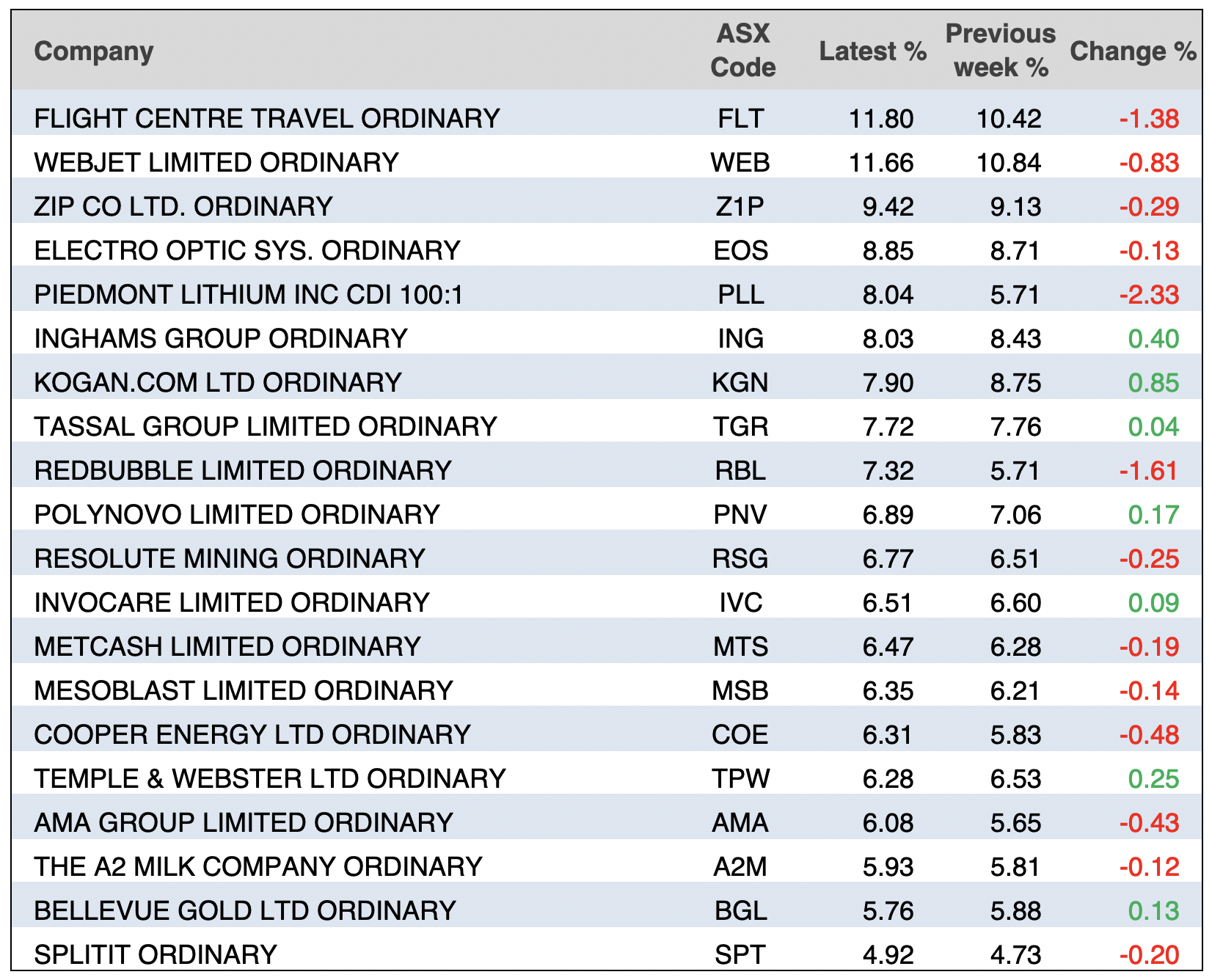

Stocks shorted:

ASIC releases data daily on the major short positions in the market. These are the stocks with the highest proportion of their ordinary shares that have been sold short, which could suggest investors are expecting the price to come down. The table shows how this has changed compared to the week before.

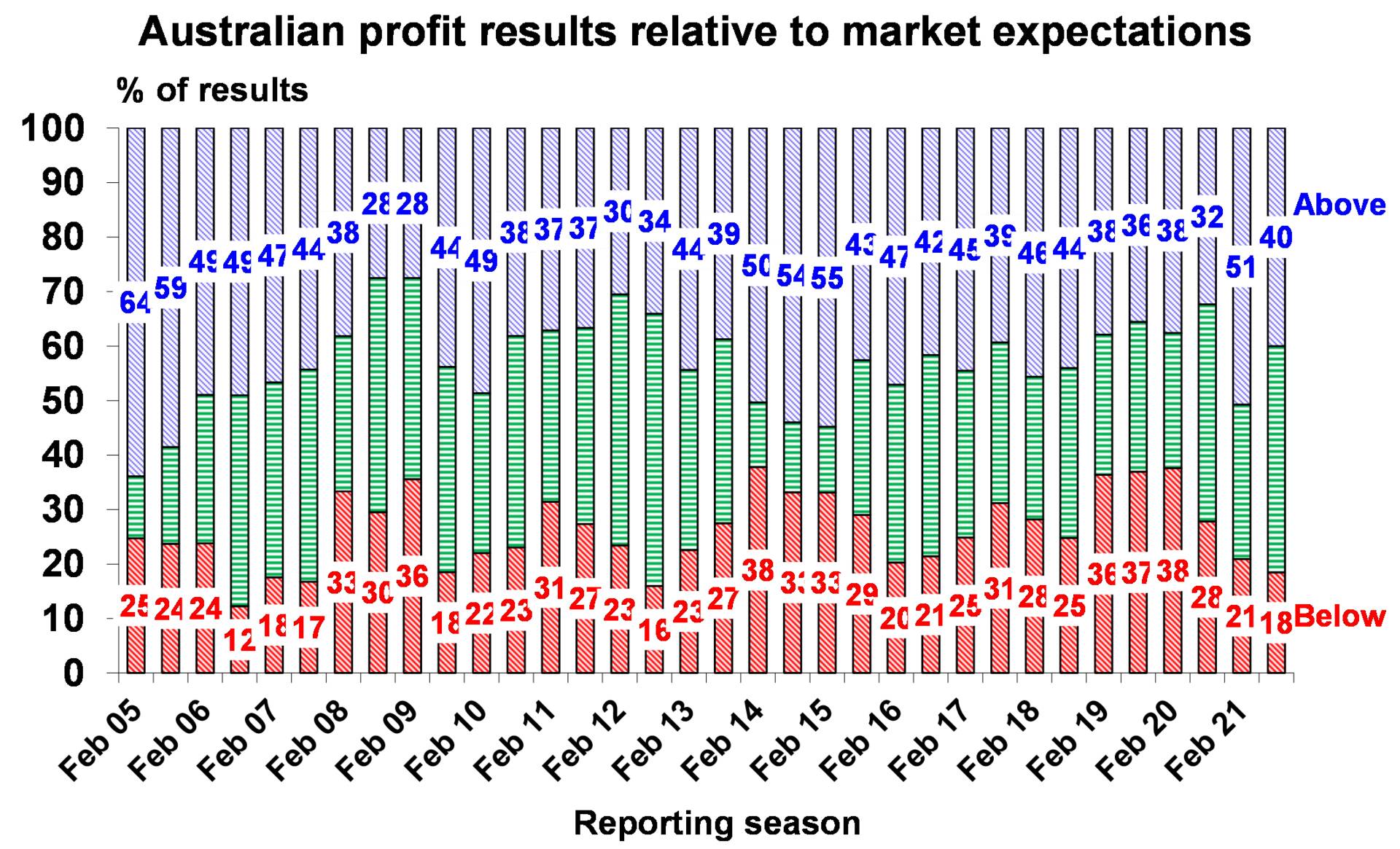

Chart of the week:

As reporting season comes to a close, Shane Oliver from AMP Capital noted that 40% of company results have beaten market expectations, below the average of 44%, while only 18% have reported below expectations compared to the average of 26%:

Top 5 most clicked:

- 3 stocks that will knock your socks off – Peter Switzer

- 3 great stock results from reporting season – James Dunn

- Could Telstra get back to $5? – Paul Rickard

- 3 small online marketplace stocks bouncing back – Tony Featherstone

- Buy, Hold, Sell – What the Brokers Say – Rudi Filapek-Vandyck

Recent Switzer Reports:

- Monday 23 August: 3 stocks that will knock your socks off

- Thursday 26 August: 3 small online marketplace stocks bouncing back

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.