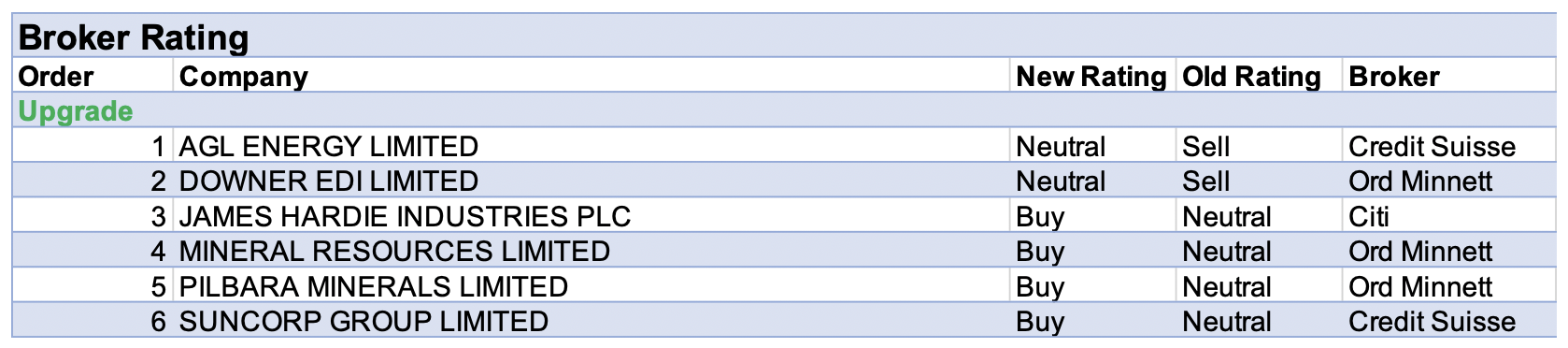

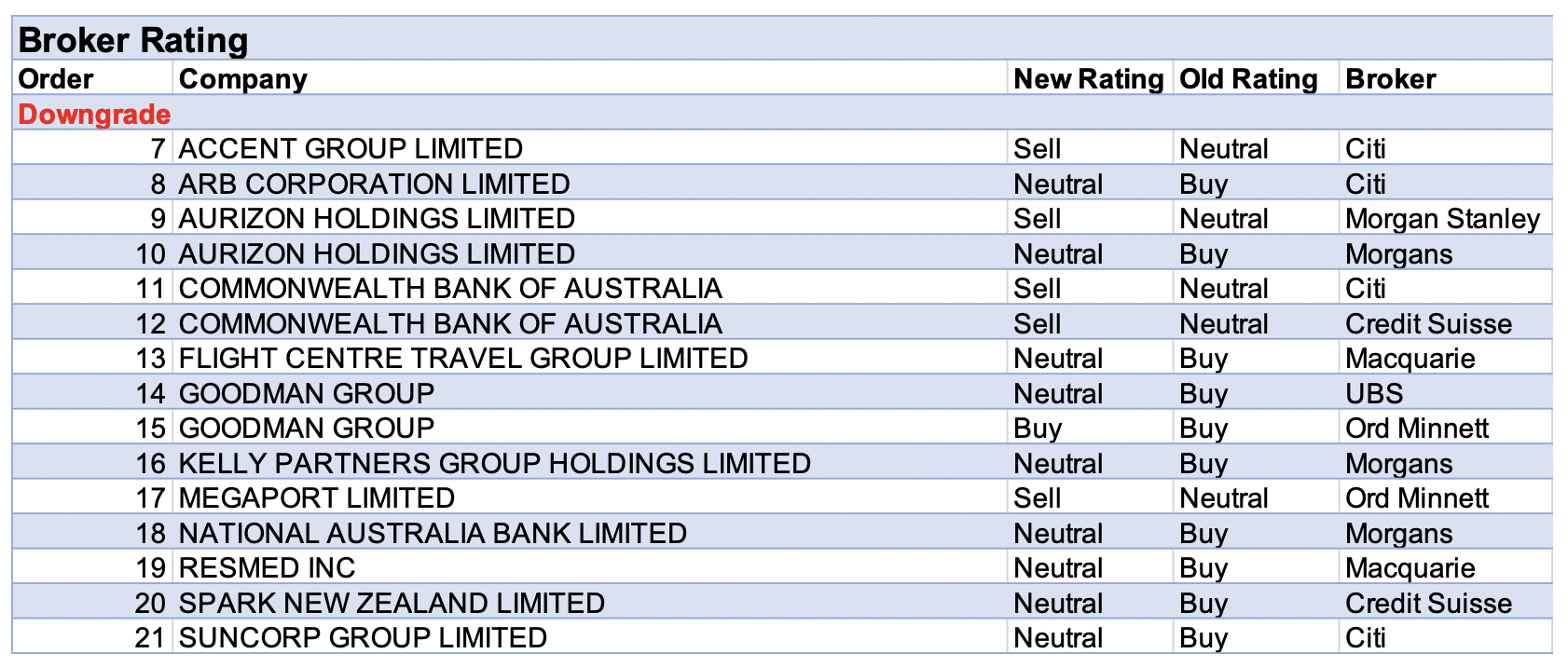

For the week ending Friday 13 August, there were 6 upgrades and 15 downgrades to ASX-listed companies by brokers in the FNArena database.

In the wake of FY21 result announcements, there were two broker ratings downgrades apiece for Commonwealth Bank, Goodman Group and Aurizon Holdings.

Credit Suisse downgraded earnings estimates for Commonwealth Bank because of a lower net interest margin and higher expenses. Given the shares are trading on high multiples the broker sees little upside, and downgrades its rating to Underperform. Meanwhile, Citi downgrades its rating to Sell, suggesting excess liquidity is having an adverse effect on the ability to generate revenue. The analyst expects only 1% revenue growth in FY22, and notes underlying core earnings are declining.

Both UBS and Ord Minnett downgraded Goodman Group’s rating to Neutral and Accumulate, respectively, based upon valuation only, and considered the result was in line with estimates.

For Aurizon Holdings, Morgan Stanley anticipates continued share price underperformance as reliance upon fossil fuel will impact investor appeal and downgrades to Underweight. Morgans also reminds investors of the balance between long-term sustainability issues facing the Coal and Network divisions, and the generation of strong cashflow to support a pivot into Bulk. However, despite downgrading to Hold the broker acknowledges the FY21 result beat the analyst’s expectations.

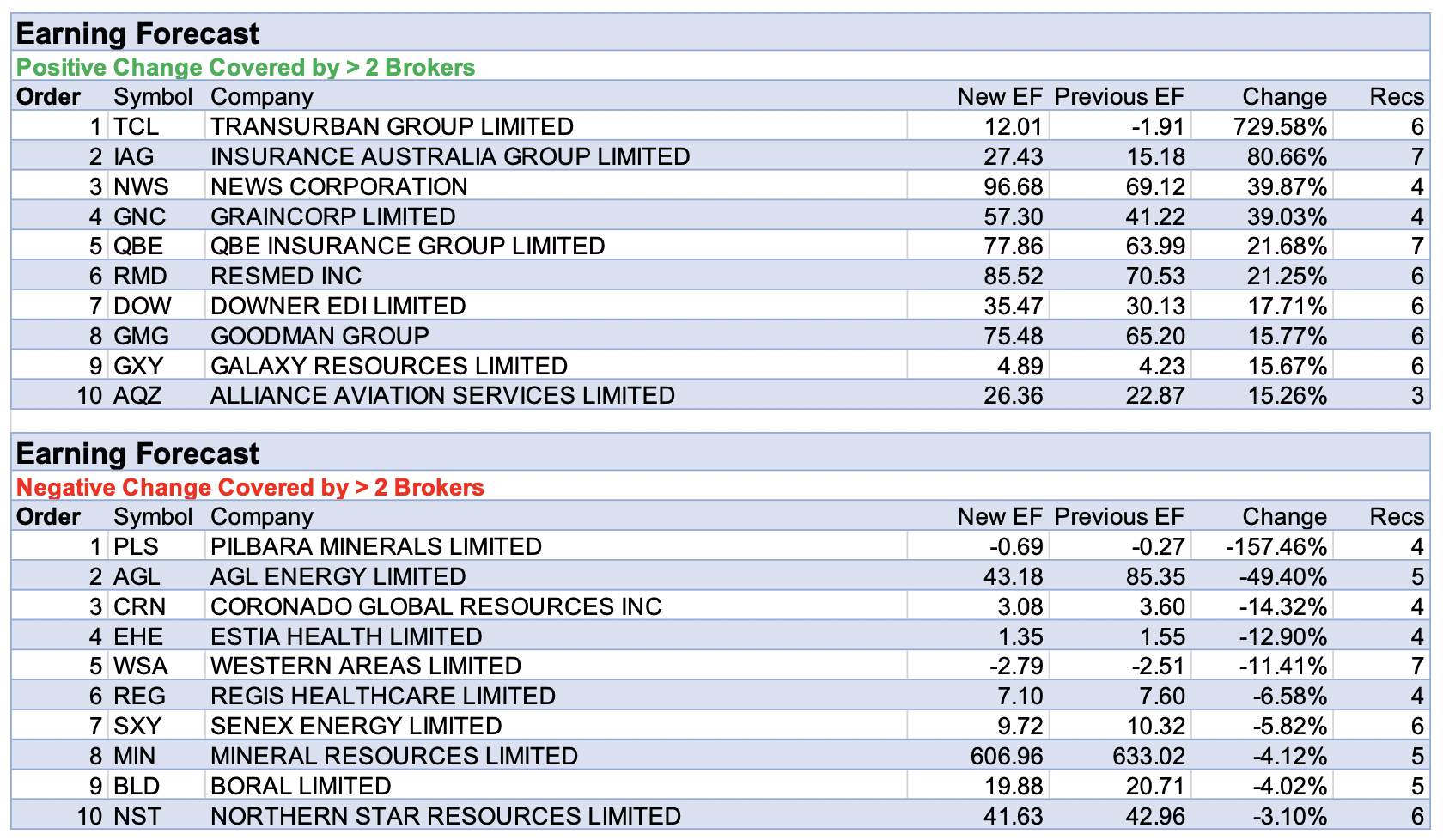

Transurban Group had the largest percentage rise in forecast earnings by brokers in the FNArena database last week, as target prices were both raised and lowered.

Morgans assumes that traffic will recover to trend by 2022 (one year further covid-delayed for the airport-linked roads), and will grow at 2% thereafter, until capacity constrained. Ord Minnett also suggests traffic will rebound quickly when lock downs in Australia end.

A maximum of seven brokers cover Insurance Australia Group. Five raised target prices, reflecting the company’s second place on the list for percentage earnings upgrades.

Citi highlighted the company has scope to drive improvements in intermediated margins, while Macquarie believes gross written premium growth targets of ‘low single-digit’ in FY22 are too low. Meanwhile, the final dividend was slightly ahead of Credit Suisse forecasts and the broker is now more confident on the outlook, given the extra detail disclosed on underlying claims improvement and industry tailwinds.

Next up was News Corp. After releasing FY21 results, Morgan Stanley suggests the performance and outlook for Move Inc/Realtor.com and Dow Jones are encouraging. Credit Suisse assessed there’s limited downside risk to its FY22 estimates, forecasting that growth will be supported by payments from Facebook/Google and a number of acquisitions.

GrainCorp’s forecast earnings by brokers also rose, following a second FY21 profit upgrade. FY22 outlook commentary was considered upbeat by Morgans, due to the planted area and favourable outlook for the 2021/22 winter crop. It’s also thought benefits will derive from upgraded carryover grain. UBS also noted demand for Australian grain is booming amid supply challenges in the northern hemisphere, which is driving higher exports, stronger supply chain margins and elevated levels of forward contracted sales for the company.

Finally, forecast earnings upgrades and QBE Insurance Group do not normally appear in the same sentence. However, last week’s first half result was met with general applause by brokers, and was even described as ‘cracking’ by UBS after a 32% EPS beat.

There was considered to be strong rate-driven gross written premium growth (GWP), higher margins and a cash return on equity (ROE) of 11.9%. In further good news, GWP growth was not only rate-driven, as around 7% came from new business and higher retention, pointed out the broker.

In the good books

AGL ENERGY LIMITED (AGL) was upgraded to Neutral from Underperform by Credit Suisse B/H/S: 0/3/2

Credit Suisse upgrades its rating to Neutral from Underperform and raises its target price to $7.30 from $6.70, now that consensus and guidance are consistent with forward prices. The broker estimates FY21 earnings (EBITDA) were in-line, with higher Customer earnings being largely offset by lower Wholesale Gas. The midpoint of FY22 guidance was -5% below consensus, while FY22 profit guidance -12% below, explains the analyst.

DOWNER EDI LIMITED (DOW) was upgraded to Hold from Lighten by Ord Minnett B/H/S: 5/1/0

Ord Minnett lifts its rating for Downer EDI to Hold from Lighten and increases its target price to $5.60 from $5.30, after FY21 underlying net profit came in 10% ahead of the analyst’s forecast. An unfranked final dividend of 12 cents was declared. The broker highlights earnings (EBITA) margins in the second half were returned to the company’s five-year pre-pandemic average (FY15–19). To get more positive on the stock, Ord Minnett would look for continued execution of the urban services strategy and further margin expansion.

In the not-so-good books

COMMONWEALTH BANK OF AUSTRALIA (CBA) was downgraded to from Neutral by Credit Suisse and to Sell from Neutral by Citi B/H/S: 0/1/5

Following the FY21 result Credit Suisse downgrades earnings estimates by -1.3% because of lower net interest margin and higher expenses. The bank underperformed expectations in FY21 despite the investment in technology providing some operating leverage, and the broker envisages little upside for a stock trading at 21x PE. As a result, Credit Suisse downgrades to Underperform from Neutral and maintains a $95 target.

Citi reports excess liquidity has enabled balance sheet normalisation for Commonwealth Bank of Australia, with a $6bn off-market buy-back, approximate 75% dividend payout ratio and provision write backs. Despite this, the broker notes excess liquidity is also having adverse effect on the ability to generate revenue. The broker expects only 1% revenue growth in FY22, and notes underlying core earnings are declining. Citi has downgraded cash earnings forecasts for FY22 and FY23 by -6-7%, and increased underlying cost growth. The rating is downgraded to Sell and the target price decreases to $94.50 from $96.75.

GOODMAN GROUP (GMG) was downgraded to Accumulate from Buy by Ord Minnett and to Neutral from Buy by UBS B/H/S: 5/1/0

Goodman Group reported an FY21 operating profit of $1.22bn, or 65.6c per share, up 14% on FY20 and in line with Ord Minnett’s $1.21m forecast. The result was underpinned by a 25% increase in development earnings, with development work in progress (WIP) lifting from $4.1bn two years ago to $10.6bn. Ord Minnett believes this should result in strong increases in development earnings over the next two to three years, in turn driving strong assets under management (AUM) growth. The broker believes Goodman carries material built-up development and performance fee profits, which have been held back for future years, and expects more than 10% earnings per share (EPS) growth in each of the next three years. An unfranked final dividend of 15c was declared, taking the full-year payout to 30c per share. Ord Minnett downgrades the rating to Accumulate from Buy and the price target increases to $24 from $21.

FY21 earnings growth of 14% was in line with UBS estimates. The key metrics that are driving the medium-term earnings outlook suggest guidance for growth of 10% is very conservative. The broker forecasts 14% and anticipates upgrades to guidance throughout FY22. UBS points out the new 10-year investment plan is market-leading in its alignment with security holders but comes at a cost. The company has extended the testing period to four years and the vesting period to 10 years and included more challenging hurdles and ESG targets. The broker downgrades to Neutral from Buy on valuation grounds and higher market expectations. Target is raised to $22.50 from $21.20.

KELLY PARTNERS GROUP HOLDINGS LIMITED (KPG) was downgraded to Hold from Add by Morgans B/H/S: 0/1/0

Despite reporting an underlying FY21 profit (NPATA) rise of 27.5% on the previous corresponding period, Morgans downgrades the rating to Hold from Add, as the stock is trading in-line with its upgraded valuation. The target price rises to $3.44 from $2.35. FY21 revenue growth of 7.5% was primarily driven by acquisitions of 4.8%, with accounting organic growth contributing 1.5% and complementary businesses 1.2%. Total dividends (including specials) for the year were 5.84 cents, up 8.3%. Management commented that the group was “inundated” with further acquisition opportunities and further partnerships remain core to the strategy.

Earnings forecast

Listed below are the companies that have had their forecast current year earnings raised or lowered by the brokers last week. The qualification is that the stock must be covered by at least two brokers. The table shows the previous forecast on an earnings per share basis, the new forecast, and the percentage change.

The above was compiled from reports on FNArena. The FNArena database tabulates the views of seven major Australian and international stockbrokers: Citi, Credit Suisse, Macquarie, Morgan Stanley, Morgans, Ord Minnett and UBS. Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.