The proverb “every dog has its day” clearly wasn’t intended for share markets. Too many dog companies are put down because they never have a period of good fortune.

But could FY22 be the Year of the Dog. Proponents of the Dogs of the Dow theory hope so. They buy the worst stocks on June 30, believing they will be the best performers a year later.

The theory assumes retail investors have an advantage at the end of the financial year. As fund managers dump underperforming stocks to avoid condemnation from asset consultants – a process known as “window dressing” – value is created for retail investors.

Like any investment “rule of thumb”, the Dogs of the Dow is not foolproof. Some studies I’ve read suggest it works better in the United States than in Australia. If the Dogs of the Dow was such a money-spinner, more people would use it, thus reducing the opportunity.

I prefer to think of the Dogs of the Dow as a useful exercise in deep-value, contrarian investing. And an important investing discipline: it’s not easy buying the market’s worst performers, and often its most despised stocks at the time, even though value exists.

Care is needed with Dogs of the Dow studies in Australia. Some take the worst-performing stocks in the S&P/ASX 200 index and average out the return. Then, compare that return to the ASX200 to highlight outperformance from Dogs of the Dow stocks.

There are two problems. First, one big result in the Dogs can skew the return average. Second, you are comparing stocks with a market-weighted index. A better approach is considering how many Dogs beat the ASX 200 over the following 12 months.

Caveats aside, I find myself paying more attention to the Dogs of the Dow theory. That’s partly because my style leans more towards value than growth. And also because in an increasingly expensive market, deep-value investing (the Dogs theory) has more merit.

According to some insightful analysis from Altas Funds Management, the top-10 Dogs from the ASX 200 in FY21 were The A2 Milk Company (A2M), AGL Energy (AGL), AMP, Northern Star (NST), Origin Energy (ORG), Orica (ORI), Aurizon (AZJ), Newcrest Mining (NCM), Evolution Mining (EVN) and Beach Energy (BPT).

Of those, I have written favourably on The A2 Milk Company, Origin Energy, Orica and Aurizon in the past year. They have mostly disappointed in a growth-focused market.

That is the nature of deep-value contrarian investing. Nobody ever precisely picks the bottom. True deep-value contrarian investing requires patient capital, a long-term approach and a willingness to accept further short-term losses in badly out-of-favour stocks.

Some deep-value ideas have paid off this year. In October 2020, I dedicated a column to BlueScope Steel, which at the time was $15.31 and unloved. BlueScope is now $23.80. The beauty of contrarian ideas like BlueScope is you are buying quality companies at depressed prices.

Here are three other deep-value contrarian ideas:

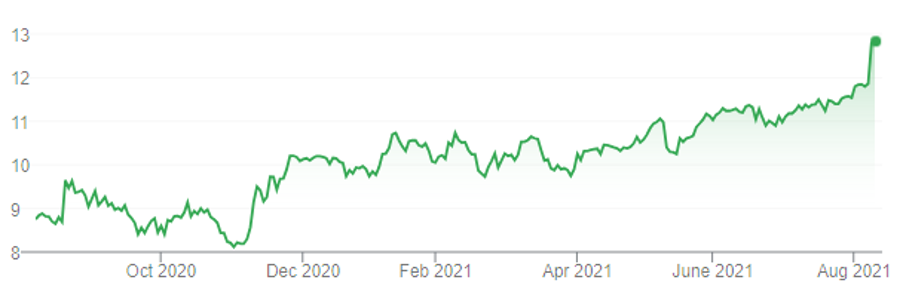

1. Suncorp (SUN)

I wrote favourably about Suncorp and Bank of Queensland in this report in late July.

Suncorp delivered on the best profit results so far in the latest reporting season, jumping almost 7% on the news. The result ticked a lot of boxes.

Suncorp’s turnaround is just starting. Longer term, Suncorp’s insurance and banking operations are well placed as Queensland is relatively less affected by Covid-19 than other East Coast states.

Share-price gains might be muted for a while as the market digest Suncorp’s latest result. But there’s a lot to like about its strategy and how management is implementing it.

Chart 1. Suncorp (SUN)

Source: ASX

2. Challenger (CGF)

Challenger typifies the frustrations with deep-value contrarian investing. It is a quality company that is superbly leveraged to growth in retirement savings and rising demand for annuities. Operationally, little has changed for the company in the past six months.

Yet Challenger has had a tough time on the market. I wrote positively about the company at the start of 2021, believing it offered deep value, only to watch the stock fall from around $6.50 to $5, before recovering to $5.84.

Challenger met its FY21 profit guidance and showed strong operating momentum. Funds under management grew 30% and it had record Life sales in retirement-income products. Challenger said it is now one of Australia’s fastest-growing active fund managers.

For all the short-term price volatility, Challenger remains a leading provider of annuities in a market that has long-term tailwinds from growth in retirement investing as the population ages.

Challenger’s latest result reinforces my view that it is undervalued and that the market is focusing too much on near-term issues, such as record-low rates, and not enough on the company’s long-term growth as demand for retirement-income products rises.

Chart 2: Challenger (CGF)

Source: ASX

3. Alumina (AWC)

I’ve been itching to add Alumina to the list of deep-value ideas. Alumina owns 40% of Alcoa World Alumina and Chemicals (AWAC), the western worlds’ largest alumina business.

Alumina has underperformed over three years: the average annualised return is about minus 10%. Over 10 years, it has returned 4.4% annually.

From just above $3 in 2018, Alumina has fallen to $1.68. That’s an opportunity for deep-value contrarian investors who can position for a long-term recovery in the company.

The falling benchmark alumina price in the past few years was the main problem. The alumina (commodity) price averaged US$472 per metric tonne in 2018. In its first-quarter 2021 earnings release, Alcoa said the alumina price averaged US$301 a tonne.

Four factors support my positive view on Alumina at the current price. First, the alumina price should rise in the next 12 months, albeit with continued volatility. At the current price, much alumina production is uneconomic. As supply contracts, the price should rise.

Second, as global economic growth recovers after Covid, demand for commodities such as alumina, should improve. The aluminium price has rallied this year and some investment banks tip further gains in that commodity (alumina is used in the production of primary aluminium). At some point in FY22, the alumina price should start to catch up.

Third, for all its share-price underperformance, Alumina is a major shareholder in AWAC, one the world’s lowest-cost producers in its market. AWAC has a high-quality, long-life asset and greater capacity to withstand lower commodity prices.

Fourth, Alumina is on a forecast Price Earnings (PE) ratio of almost 7 times earnings in FY22 on Morningstar numbers. If the alumina price rises above US$300 a tonne, Alumina should have a fully franked double-digit yield in FY22.

In the medium term, Alumina should benefit from global economic growth and commodities demand. Longer term, it should gain from aluminium’s use in vehicle electrification.

Opportunities aside, Alumina has higher risk. It has single-commodity exposure and is subject to an irrational Chinese supply response at times. Also, aluminium production has abundant supply and low barriers to entry. Being a minority partner of AWAC means Alumina has limited scope to influence business decisions for its shareholders.

Still, Alumina offers a significant margin of safety at $1.68. The company is one of the more attractive deep-value contrarian ideas for investors who can hold it for at least three years (preferably longer) and have higher risk tolerance.

Chart 3: Alumina (AWC)

Source: ASX

Tony Featherstone is a former managing editor of BRW, Shares and Personal Investor magazines. The information in this article should not be considered personal advice. It has been prepared without considering your objectives, financial situation or needs. Before acting on information in this article consider its appropriateness and accuracy, regarding your objectives, financial situation and needs. Do further research of your own and/or seek personal financial advice from a licensed adviser before making any financial or investment decisions based on this article. All prices and analysis at 10 August 2021.