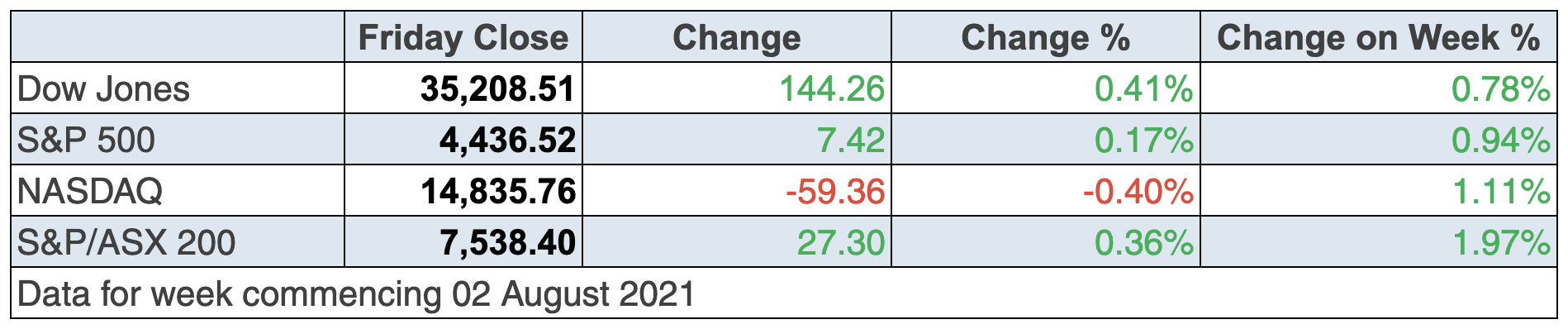

A better-than-expected jobs report kept US stock markets driving into record territory, with the data confirming a believable economic recovery is in train.

This led to the often infallible-rated bond market to push 10-year yields higher after weeks of doing the opposite!

It looks like the bond market has got it wrong, at least for the moment. But the news won’t be great for tech stocks, as higher yields imply higher interest rates, which hurt tech companies.

Mind you, I think this relationship is overplayed and overthought by the market, but it is what it is. And while the job numbers were bad for tech stocks, they were great for value stocks, with banks, industrials and energy stocks having a good day at the office.

To the actual state of the labour market report and the consensus tipped 845,000 jobs but 943,000 showed up, pushing the jobless rate down to 5.4%, which was much better than the economists’ guess of 5.7%.

James Paulsen is a US expert from who I’ve gained insights for decades. James is chief investment strategist for The Leuthold Group nowadays and this is how he saw the report’s market impacts: “The S&P isn’t doing much, but the undertow here has shifted toward cyclicals and smalls, maybe even international markets to some degree, those more sensitive to the economy, and away from growth and defensive stocks, which have been leading for a while here.” (CNBC)

To be clear, the tech stocks were lagging the overall market overnight, but it wasn’t a huge dumping. Higher bond yields hurt growth/tech stocks because the thinking is that they’ll eventually force the Fed to reduce bond purchases and raise interest rates earlier than was thought. This will hurt the earnings of tech companies, many of which carry debt and aren’t as preoccupied with profit, as they’re mad keen on revenue.

Did I say there was too much thinking on this subject? In addition, there’s simply a lot of stock selling, where fund managers have made money, so being herdlike, they’ll now chase value stocks. This creates buying opportunities in tech for long-term investors, but you’ve heard this from me many times before!

And yes, it does work.

But what about the elephant in the room i.e. the Delta Variant, with infection rates spiking in low-vaccinated states? The Wall Street Journal painted this picture of the new strain’s impact in the US this way: “The U.S. is currently averaging more than 89,400 Covid-19 cases a day, CDC Director Rochelle Walensky said at the briefing. Hospitalizations, now about 7,300 a day, are up 41% from the previous week, and the U.S. is averaging about 381 Covid-related deaths a day.

Seven states (Florida, Texas, Mississippi, Arkansas, Louisiana, Missouri and Alabama) account for about half of new cases and hospitalizations, while making up less than a quarter of the U.S. population.”

Working against this potential negative vibe for stocks are two important milestones that will help market positivity. First, the Yanks hit a vital benchmark in the fight against the Delta variant, with 60% of the US population now fully vaccinated. And the future numbers are bound to pick up, with United Airlines telling its 67,000 US employees to get vaccinated against Covid by no later than October 25 or risk losing their job!

Similarly, the 120,000 employees at Tyson Foods were also given the same message. I expect the same story to be told to many US employees in coming months. It’s bound to be the same here when the Pfizer supplies increase, making it easier for governments and bosses to play hardball with anti-vaxers.

The second stimulant for stocks is the US reporting season. By yesterday, Refinitv said 427 companies in the S&P 500 Index had posted their quarterly results, and 88% topped earnings estimates. Meanwhile, 87% have exceeded expectations on revenue, which shows the impact of vaccinations on the reopening of the economy following the previous period of huge government spending and historically low interest rates.

By the way, helping also was a bipartisan infrastructure bill that went to the US Senate, which includes a $US550 billion spend over five years

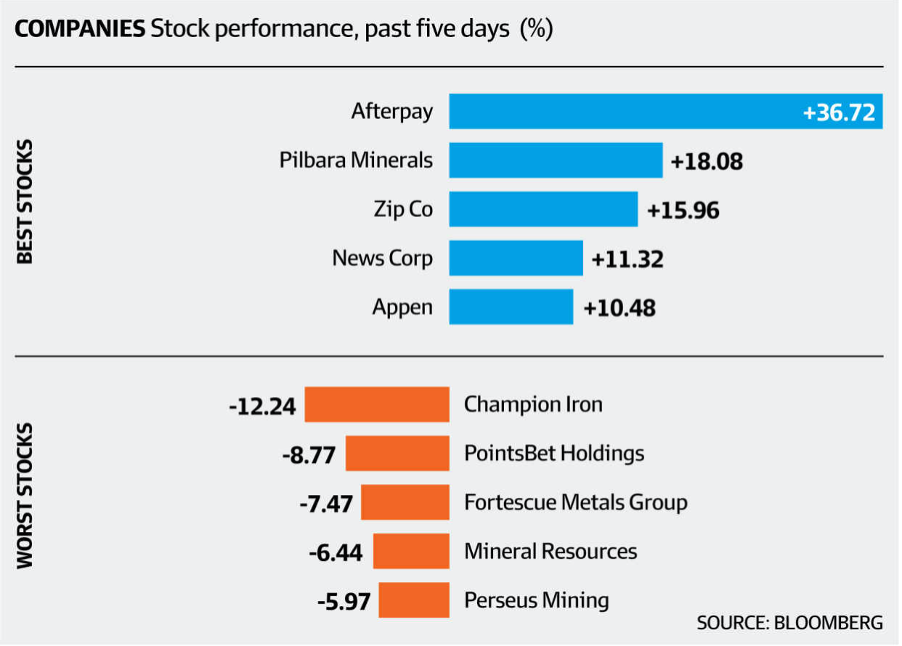

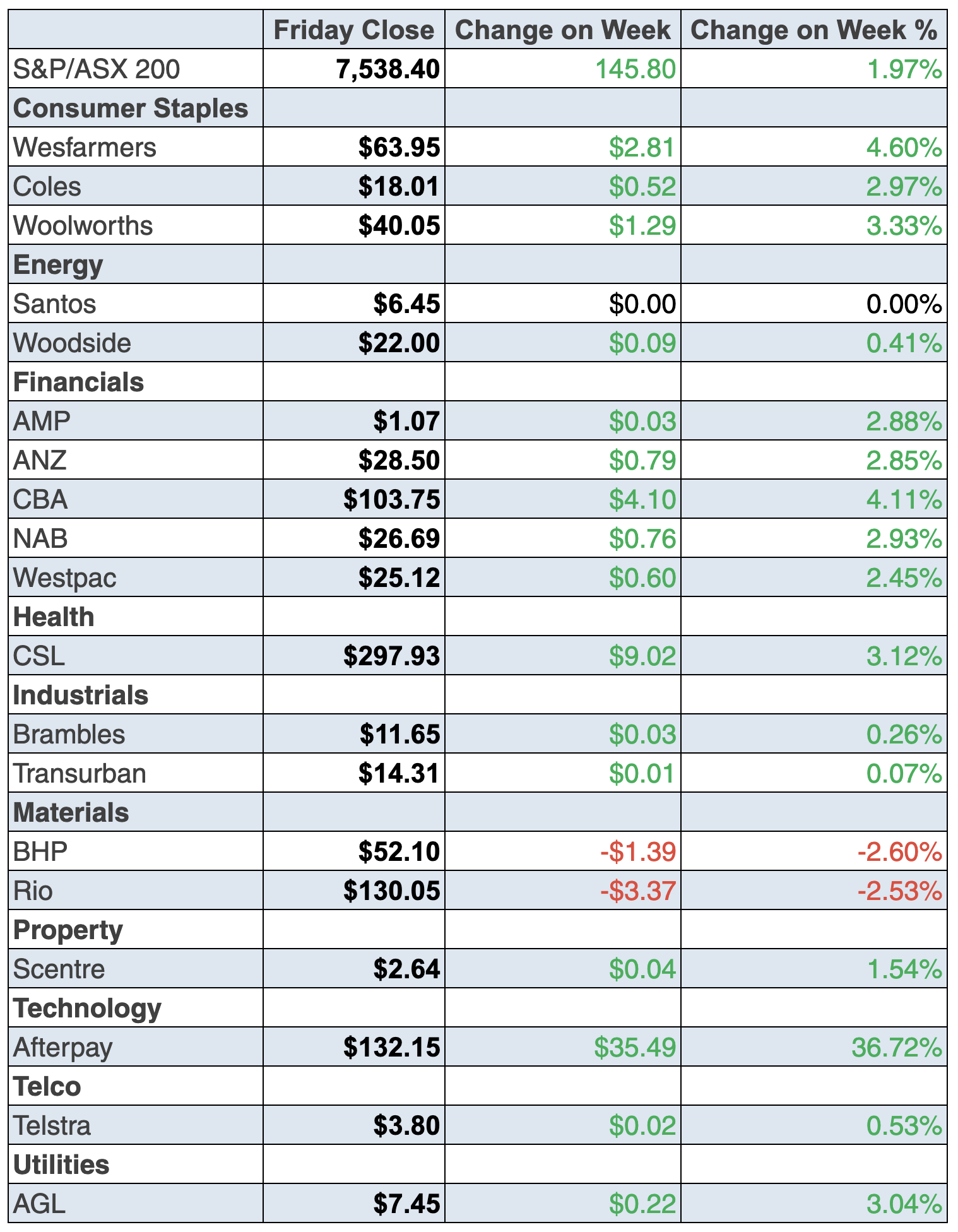

To the local story, and Afterpay doubters were hit ‘square’ between the eyes and in their hip pockets, with the Square $39 billion offer helping to push the overall market to record highs. The S&P/ASX 200 was up 145.8 points (or 2%) for the week and is now at a new record high of 7538.4.

Afterpay put on 36.7% to $132.15, while my favourite, Zip, wacked on 16% to $7.70.

Meanwhile, the banks joined the party, with CBA up 4.1% to $103.75, NAB up 2.9% to $26.69, Westpac up 2.4% to $25.12 and ANZ 2.9% higher to $28.50.

Here are the week’s big winners and losers:

It was interesting to see more conventional miners head south, while Pilbara Minerals (a lithium player) spiked 18.1%. My interview with Luke Smith on Monday’s TV show and in my podcast tipped that these kinds of miners are the future, and others agree.

BHP dropped 2.6% to $52.10, Rio gave up 2.5% to $130.05 and Fortescue lost a big 7.47% to $23.05.

What I liked

- The Reserve Bank has trimmed economic growth forecasts for calendar 2021 and 2021/22 because of lockdowns. But the RBA has lifted growth forecasts for 2022 and 2022/23. The Reserve Bank has slightly reduced forecasts for the unemployment rate in 2022 and the first half of 2023.

- This from CommSec’s Craig James: “The Reserve Bank believes the economy will rebound quickly once restrictions are eased. But it will take time for inflation and wages to lift to desired annual growth rates. Wage growth should remain below 3% over the next few years. So official interest rates are expected to stay low until 2024. Bank margins and revenues tend to rise more in a rising rate environment. Bank shares today were up 0.2% in a flat market.

- The weekly ANZ-Roy Morgan consumer confidence rating rose by 1.1% to 101.8 (long-run average since 1990 is 112.5), despite lockdown issues!

- In 2020/21, retail trade rose by 6.1% in real (inflation-adjusted) terms and rose by 9.1% in nominal terms – the latter being the fastest growth in 31 years.

- The Reserve Bank (RBA) left the target rates for both the cash rate and 3-year government bond yield (April 2024 maturity) at 0.1%. The RBA will continue to purchase government securities at the rate of $5 billion a week until early September, and then $4 billion a week until at least mid-November. This is a sign that the RBA is not expecting these lockdowns to be too bad for the economy. Hope they’re right!

- The trade surplus increased from $9.3 billion in May to a record $10.5 billion in June. Australia has posted 42 successive monthly trade surpluses. The rolling annual surplus hit a record high $89 billion in the year to June. Exports to China rose by 8.2% in June to a record $19.1 billion.

- New vehicle sales totalled 84,161 units in July and 1,053,677 over the year. Notably a record 540,197 sports utility vehicles were sold over the year and a record 284,114 light and commercial vehicles. Not bad considering lockdown challenges.

- The ‘final’ IHS Markit manufacturing index in the US lifted from 62.1 to 63.4 in July (survey: 63.1). The ISM manufacturing index fell from 60.6 to 59.5 in July (survey: 61). Both were good numbers.

- US factory orders rose by 1.5% in June (survey: 1%). The IBD/TIPP economic optimism index eased from 54.3 to 53.6 in August (survey: 54) but is still a good number.

- Challenger job cuts in the US fell by 7.5% to a record low 18,942 in July (survey: 35,000).

What I didn’t like

- Retail trade fell by 1.8% in June (the most in six months) to be 2.9% higher than a year ago. But retail trade volumes rose by 0.8% in the June quarter, to be up 9.2% on the year – the biggest annual gain in 17 years. The bad news here is lockdown-related but it won’t last.

- ANZ job advertisements fell by 0.5% in July from 12½-year highs — blame the lockdowns.

- The Bureau of Statistics (ABS) reported that national payroll jobs fell by 2.4% over the fortnight to July 17 but were up 3.3% on a year ago.

- More lockdown data drama, with the ‘final’ IHS Markit services purchasing manager index falling from 56.8 in June to a 14-month low of 44.2 in July. The Australian Industry Group (AiGroup) and HIA (Housing Industry Association) Performance of Construction index (PCI) dropped from 55.5 in June to a 9-month low of 48.7 in July. Readings below 50 indicate a contraction of activity.

- ADP private payrolls (employment) in the US increased by 330,000 in July (survey: 690,000). The ‘final’ IHS Markit services index fell from 64.6 to 59.9 in July (survey: 59.8) These weren’t great but the ADP numbers can be unreliable.

Warning about the Delta threat

AMP Capital’s chief economist Shane Oliver concluded the following this week before the jobs report, where the economic growth going forward story seemed to trump virus fears for the moment: “Shares and bonds seem to be telling us a contradictory story, with bond markets seemingly more worried about the threat to growth from COVID-19’s Delta variant but shares are just powering on.”

The bond market has changed its tune on the better employment data but it can easily turn on a dime, as we’ve seen in the past.

That said, one interesting take is that the Fed will be reluctant to tighten monetary policy while this Delta threat persists, which will give the economy and stock players more time before they really have to worry about rising interest rates.

The week in review:

- If you should buy more BHP (BHP), at what price? And if you should sell BHP, what should you buy with the cash from the sale?

- Paul Rickard said that, on valuation, AGL (AGL) looks cheap and the demerger should be positive for the stock. Here’s why he thinks it’s in the ‘buy” zone for long-term investors.

- James Dunn looked at 4 of the best-positiond Australian gold miners: Gascoyne Resources (GCY), Resolute Mining (RSG), Red 5 (RED) and Regis Resources (RRL)

- Tony Featherstone wrote that his preference is high-quality, large-cap stocks that still trade below their intrinsic value and will benefit as borders reopen: Qantas Airways (QAN), The Star Entertainment Group (SGR) and Flight Centre Travel Group (FLT).

- In our “HOT” stock articles this week, Julia Lee from Burman Invest chose Kogan (KGN) and Michael Gable from Fairmont Equities highlighted BlueScope Steel (BSL).

- There were 12 upgrades and 18 downgrades in this week’s first Buy, Hold, Sell – What the Brokers Say, and 4 upgrades and 2 downgrades in the second.

- And in Questions of the Week, Paul Rickard answered questions about Aurizon (AZJ) and APA Group (APA), BHP (BHP), mFunds and Afterpay (APT).

Our videos of the week:

- Webinar: The likely gold medal stocks of reporting season

- Do you buy or sell Afterpay? Are these good buys: KGN, MNY, OPY, PDN, BHP | Switzer Investing

- After the Afterpay takeover offer, what other companies look like targets? Z1P, TYR, PPS, NWL & OZL? | Switzer Investing

Top Stocks – how they fared:

The Week Ahead:

Australia

Monday August 9 – Skilled job vacancies (July)

Tuesday August 10 – Weekly consumer sentiment index (August 8)

Tuesday August 10 – NAB business survey (July)

Tuesday August 10 – Building approvals (June)

Wednesday August 11 – Monthly consumer confidence index (August)

Thursday August 12 – Consumer inflation expectations (August)

Overseas

Monday August 9 – China consumer and producer prices (July)

Monday August 9 – US JOLTS job openings (June)

Tuesday August 10 – US NFIB business optimism index (July)

Tuesday August 10 – US Unit labour costs (June quarter)

Tuesday August 10 – US Non-farm productivity (June quarter)

Wednesday August 11 – US Consumer prices (July)

Wednesday August 11 – US Monthly Budget Statement (July)

Thursday August 12 – US Producer prices (July)

Friday August 13 – US Import & export prices (July)

Friday August 13 – US Consumer confidence index (August)

August 9-14 – China credit growth (July)

Food for thought:

“Intelligence is not only the ability to reason; it is also the ability to find relevant material in memory and to deploy attention when needed.” – Daniel Kahneman

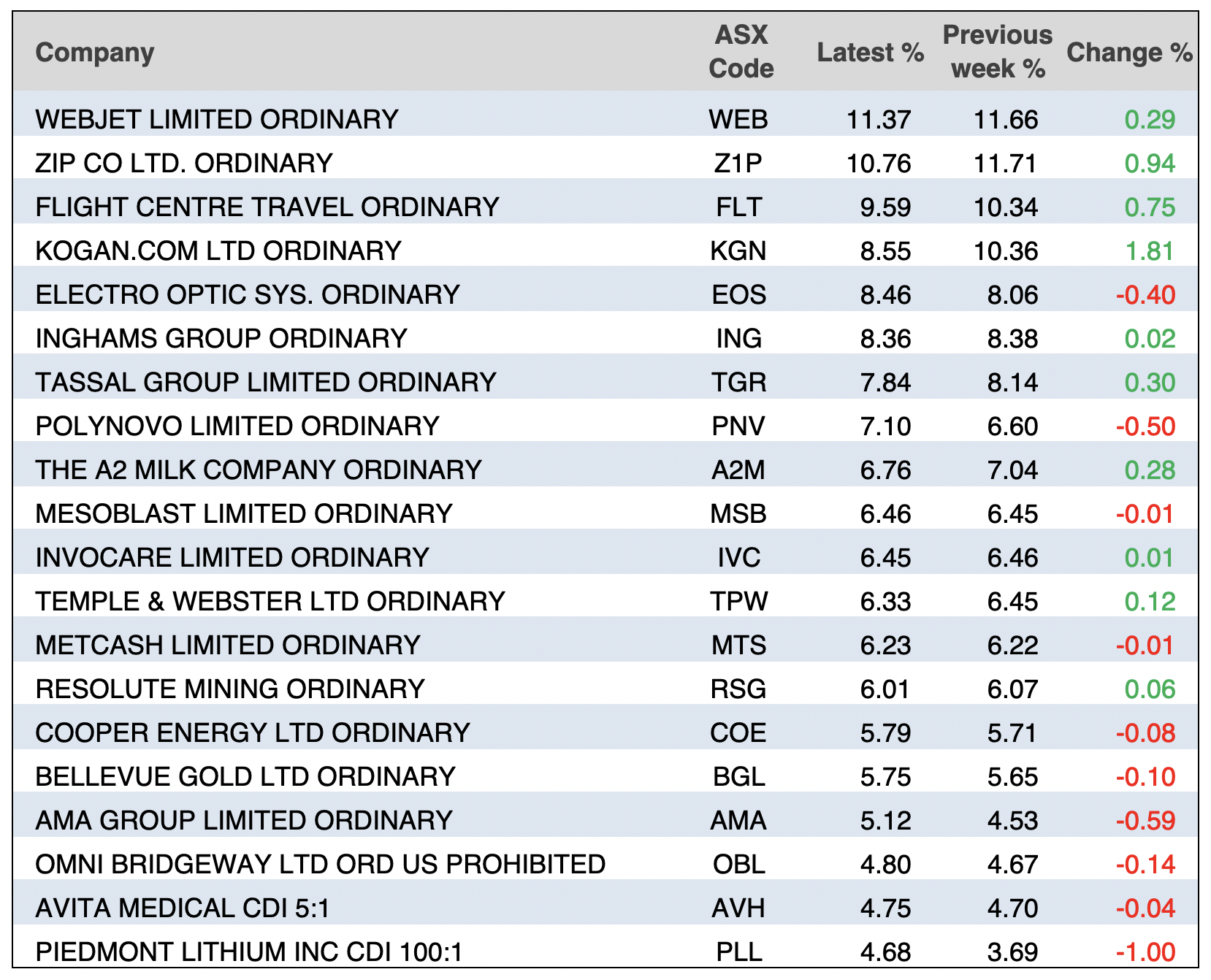

Stocks shorted:

ASIC releases data daily on the major short positions in the market. These are the stocks with the highest proportion of their ordinary shares that have been sold short, which could suggest investors are expecting the price to come down. The table shows how this has changed compared to the week before.

Chart of the week:

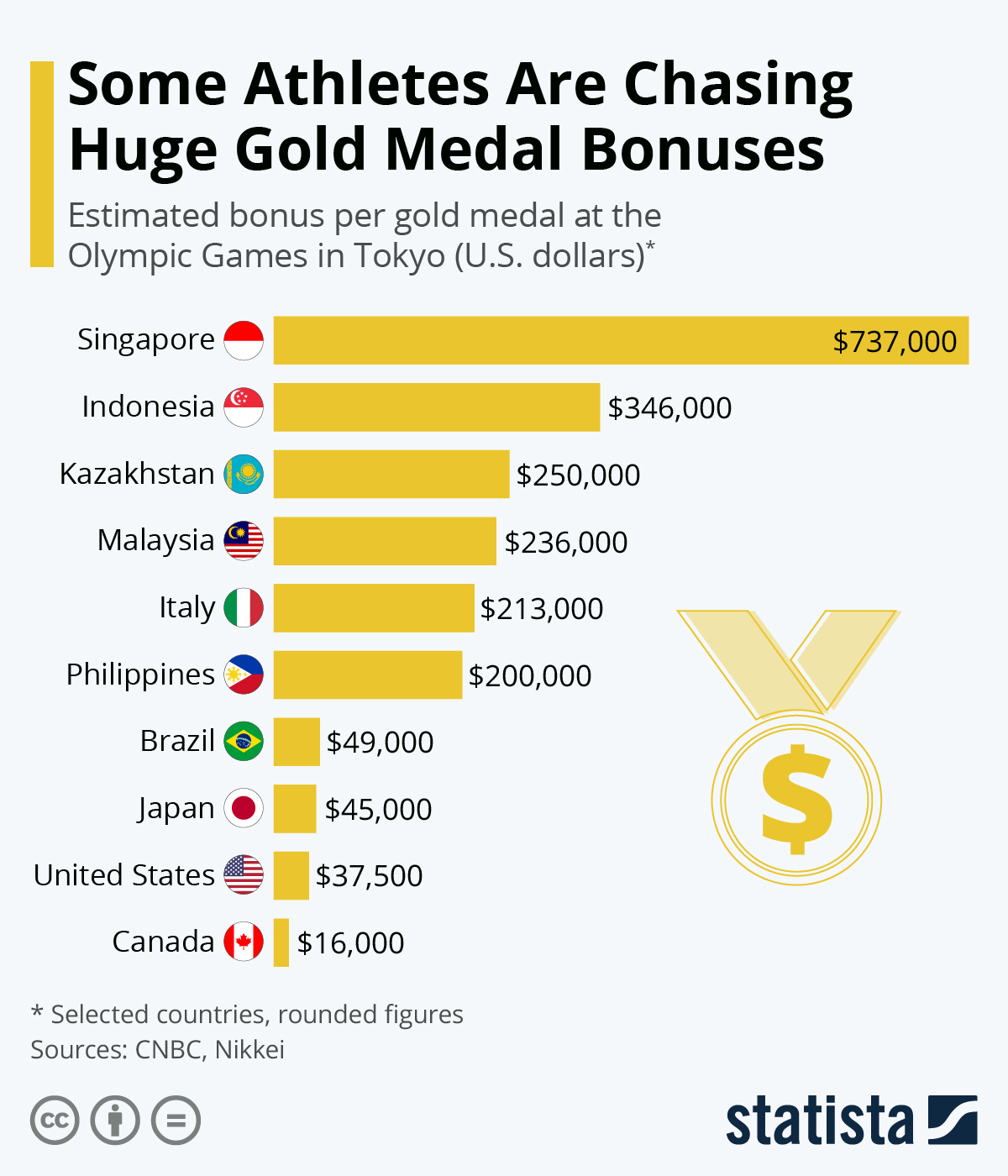

With the Tokyo Olympics wrapping up this weekend, Statista published the following chart that shows how much money athletes from selected countries will take home for winning gold (Australian gold medal winners receive $20,000 or about US$15,000 in comparison):

Top 5 most clicked:

- Is the iron ore party over? Is BHP a buy or a sell? – Peter Switzer

- Get ready for these 3 ‘reopening’ buys! – Tony Featherstone

- 4 of the best-positioned Australian gold miners – James Dunn

- Is AGL in buy territory? – Paul Rickard

- Buy, Hold, Sell – What the Brokers Say – Rudi Filapek-Vandyck

Recent Switzer Reports:

- Monday 2 August: Should you buy, hold or sell BHP?

- Thursday 5 August: Get ready for these 3 ‘reopening’ buys!

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.