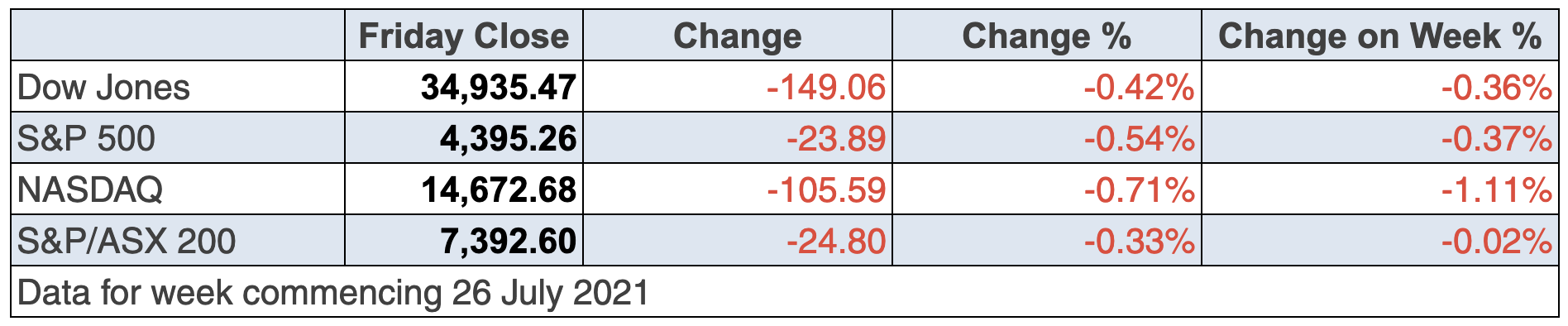

In the first week of the Olympics, market action locally was a competition tussle between the pessimism of the local lockdown versus overseas optimism about earnings, which is also shared by analysts here about what our companies will tell us in August’s reporting season.

However, there is an increasing concern that the Delta strain of the Coronavirus is growing in the US, especially in the foolhardy who have refused to be vaccinated. US stock market indices were negative overnight, but you can’t simply blame Delta dramas and disturbances to businesses now or into the future.

Cruise line Carnival saw its share price down nearly 5% on Friday and American Airlines were off around 4%.

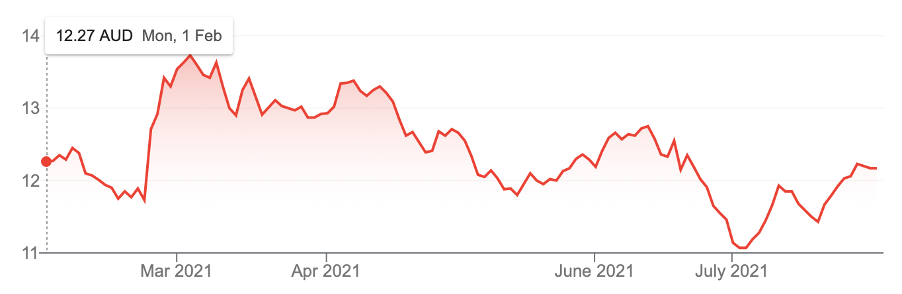

But a pullback is overdue, with the S&P 500 up over 90% since the bottom of the Coronavirus crash. And taking out the V-shape rebound (that you can see in the graph below), the market gain from the previous high, before the virus closed down the US, is 30%.

S&P 500

In that latter context, a 30% gain from February 2020 to now is like a 12-month gain of 19% followed by an 11% gain for seven months. And all this is quite understandable when you factor in the big pluses from huge government spending and record low interest rates.

It also should be pointed out that the US market has had six months in a row of rises, which is historically quite unusual. Throw in the memories that September and October can be scary months for stocks, then a pullback wouldn’t be totally a big surprise.

Of course, if the Delta threat escalates over the next month and starts to really worry the US, then there could be something bigger to the downside. I’m not saying it’s my expected scenario, but I can’t rule it out.

This in a note from Brian Belski (chief investment strategist at US-based BMO) sums it up for anyone who wouldn’t be surprised to see an eventual pullback for US stocks: “There has been quite a bit of volatility and price choppiness in the market in recent weeks…Increased concerns over the Delta variant and its potential implications for reopening momentum seemed to play a key role in the price action, while peak themes related to economic growth, earnings and policy support also remained an overhang on risk sentiment.” (CNBC)

Also, inflation was up 3.5% but this was a tick less than what economists predicted. And annualized GDP growth was 6.5%, compared to the blowout forecasts of 8.5%. This latter number could have been seen as a reason to believe that the Fed could be worried into an interest rate rise before what’s currently expected.

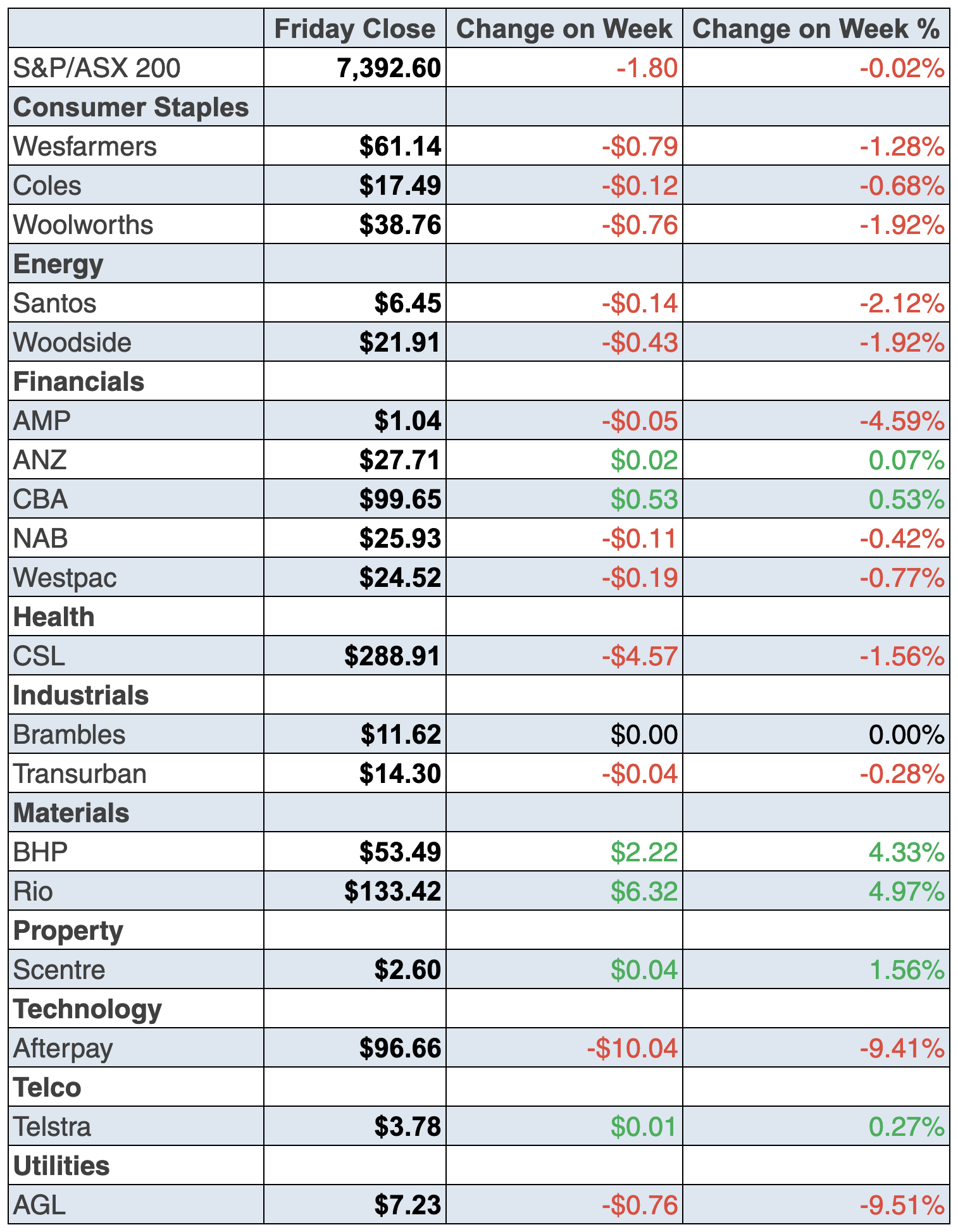

To local story and the lockdown pressure only just offset the optimism on overseas markets, such that we only lost around 2 points for the week, as we hover around record high levels. Actually, we hit a new high of 7431.4 this week but couldn’t hold it.

Considering the NSW Premier put another month of restrictions on this country’s biggest economy, responsible for 30% of its GDP, that wasn’t a bad effort and proves that a share market is forward-looking.

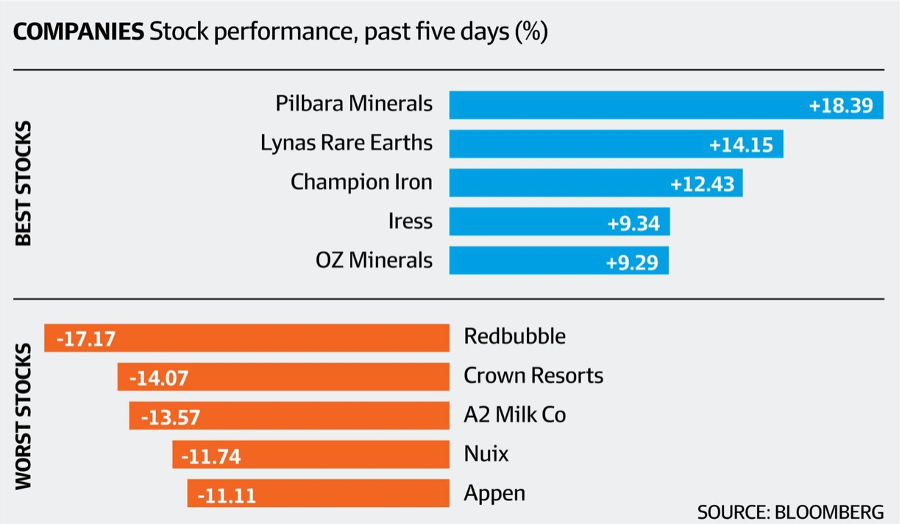

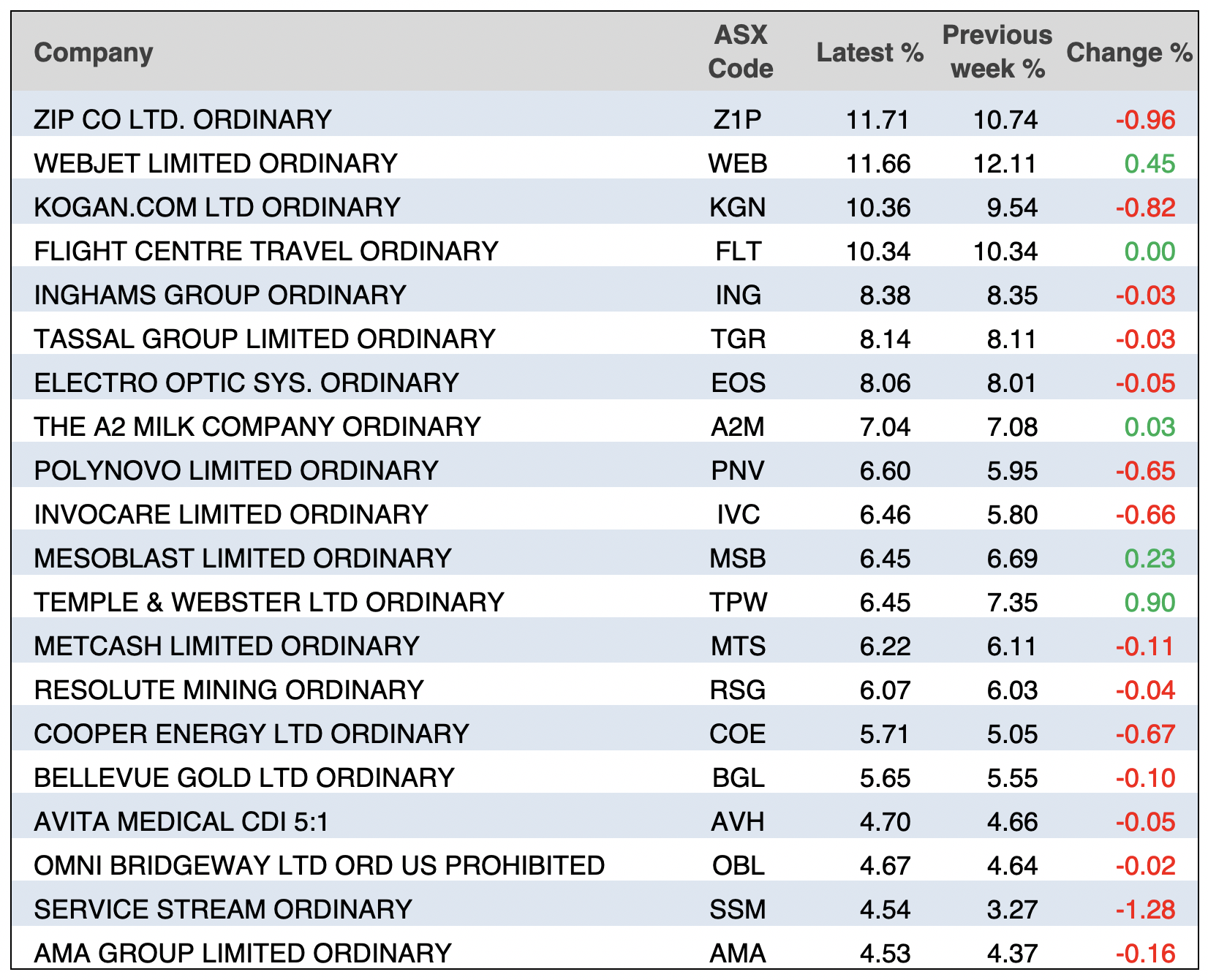

Here are the big winners and the losers.

It was a bad week for tech stocks, with Zip off 6.3%, EML 6.8%, Afterpay 9.4%, and the rest can be seen above.

The courageous would see this as a buying opportunity but as I said, it’s for the courageous. I’m tempted to sell some of my duds to load up on some of these for a year down the track. I might test this out for Monday’s story here in this Report.

Miners were the stars, with the materials sector up 2.82% for the week after Rio announced its best six-month profit ever! The dividend was a huge $US5.61 a share, which pumped Rio’s share price 5% to the upside!

And there was a knock-on effect, with BHP up 4.3% to $53.40 and Oz Minerals put on 9.3%, which was a strong tip from Raymond Chan this week on my TV show.

Luke Smith from Ausbil likes both BHP and Oz Minerals because of their copper exposure, and they did have a good week on cue.

Spark Infrastructure’s (SKI) share price rose 5.9% after KKR and its partner put in a higher takeover offer, while another takeover target, IRESS, said no to its on-the-table offer from EQT but its share price spiked 9.3%.

What I liked

- The Consumer Price Index (CPI) rose by 0.8% in the June quarter (consensus: 0.7%). The annual rate of price growth lifted from 1.1% to 3.8% – the fastest pace since the September quarter 2008. The more important ‘underlying’ CPI (or trimmed mean) rose by 0.5% in the quarter (consensus: 0.5%), with the annual growth rate lifting from a record low 1.1% to 1.6%, still well below the Reserve Bank’s 2-3% target range.

- The “final demand” component of producer prices (business inflation) rose by 0.7% in the June quarter to be up 2.2% on a year ago – the strongest annual growth in almost seven years. The RBA wants inflation.

- Export prices rose by 13.2% in the quarter, to be up 26% on the year.

- “The terms of trade probably rose by around 8-10 per cent in the June quarter and most likely to record highs,” CommSec’s Craig James said.

- The US economy grew at a 6.5% annual rate in the June quarter and even though 8.5% was expected, it was a good number anyway.

- European share markets were firmer on Wednesday, with encouraging earnings results over the week.

What I didn’t like

- The weekly ANZ-Roy Morgan consumer confidence rating fell by 3.55 to an 8-month low of 100.7 (long-run average since 1990 is 112.6).

- The new home sales in the US fell by 6.6% to a 0.676 million annual rate (survey: 0.8 million). The Dallas Federal Reserve manufacturing index fell from 31.1 to 27.3 in July (survey: 32).

- US-listed Chinese shares fell after Beijing last week announced new rules on private tutoring and online education firms. Shares in E-commerce company Alibaba Group fell by 7.2% and search engine Baidu Inc fell by 6%. The Beijing bully boys are at it again!

A US trend

On the subject of the market getting less optimistic, the fund flows watched in the US indicate that defensive stocks, understandably, are attracting more support. Those who’ve made big money out of tech and other growth plays can’t expect great returns out of cash, so defensive shares make sense. These include staples, utilities and real estate.

Lendlease (LLC)

The struggling Lendlease (LLC) has attracted some friends in July, so maybe there is something in this move towards defensive plays. The analysts think 8% upside, but Citi expects a whopping 31.22% gain ahead! Paul Rickard will hope these guys are right.

And make sure you catch up on last week’s stocks in focus in the Report below.

The week in review:

- Here are several stocks I’m tied to for the long term and will always buy more of when the opportunity strikes.

- Did your super fund return 18% last year? In Paul Rickard’s article this week, he asked whether you should be running an SMSF if you’re not doing a good job.

- An area of Australia’s mineral endowment that is rapidly coming into its time in the spotlight is rare earths. James Dunn has taken a closer look at 8 fascinating stocks in this category: Lynas Rare Earths (LYC), Northern Minerals (NTU), Hastings Technology Metals (HAS), Australian Rare Earths (AR3), Arafura Resources (ARU), Australian Strategic Materials (ASM), RareX (REE) and Ionic Rare Earths (IXR).

- Tony Featherstone said that he’s right and Queensland performs relatively better during and after Covid than the southern states, investors should look at Bank of Queensland (BOQ) and Suncorp (SUN).

- Tim Miller wrote that transition-to-retirement income streams (TRIS) can play a vital role in the estate planning process, and noted that there are also other taxation benefits that can be achieved via their use.

- For our “HOT” stocks this week, Raymond Chan from Morgans highlighted BHP (BHP) and Michael Gable from Fairmont Equities selected Xero (XRO).

- There were 11 upgrades and 11 downgrades in the first Buy, Hold, Sell – What the Brokers Say of this week, and 8 upgrades and 11 downgrades in the second edition.

- And in Questions of the Week, Paul Rickard answered your questions about ETFs for investing overseas, AGL (AGL), Magellan Financial Group (MFG) and Boral (BLD).

Our videos of the week:

- Boom! Doom! Zoom! | July 29, 2021

- Are Z1P, QAN & CWN good buys now? BHP & OZL too? + 4 spec companies fund managers rate | Switzer Investing

- Do you buy Z1P, APT, QAN, WPL, WBC now or wait? Is XRO rising? + Is it too late to buy Microsoft? | Switzer Investing

Top Stocks – how they fared:

The Week Ahead:

Australia

Monday August 2 – CoreLogic Home Value index (July)

Monday August 2 – ANZ job advertisements (July)

Tuesday August 3 – Reserve Bank Board meeting

Tuesday August 3 – Weekly consumer confidence index (August 1)

Tuesday August 3 – Building approvals (June)

Tuesday August 3 – Lending indicators (June)

Wednesday August 4 – Retail trade (June & June quarter)

Wednesday August 4 – New vehicle sales (July)

Thursday August 5 – International trade (June)

Thursday August 5 – Weekly payroll jobs and wages (July 17)

Friday August 6 – Reserve Bank Statement on Monetary Policy

Friday August 6 – Testimony by Reserve Bank Governor Lowe

Overseas

Monday August 2 – China Caixin manufacturing index (July)

Monday August 2 – US Construction spending (June)

Monday August 2 – US ISM manufacturing index (July)

Tuesday August 3 – US Factory orders (June)

Wednesday August 4 – China Caixin services index (July)

Wednesday August 4 – US ADP employment change (July)

Wednesday August 4 – US ISM services index (July)

Thursday August 5 – US Challenger job cuts (July)

Thursday August 5 – US Trade balance (June)

Friday August 6 – US Non-farm payrolls (July)

Saturday August 7 – China international trade (July)

Food for thought:

“If past history was all there was to the game, the richest people would be librarians.” – Warren Buffett

Stocks shorted:

ASIC releases data daily on the major short positions in the market. These are the stocks with the highest proportion of their ordinary shares that have been sold short, which could suggest investors are expecting the price to come down. The table shows how this has changed compared to the week before.

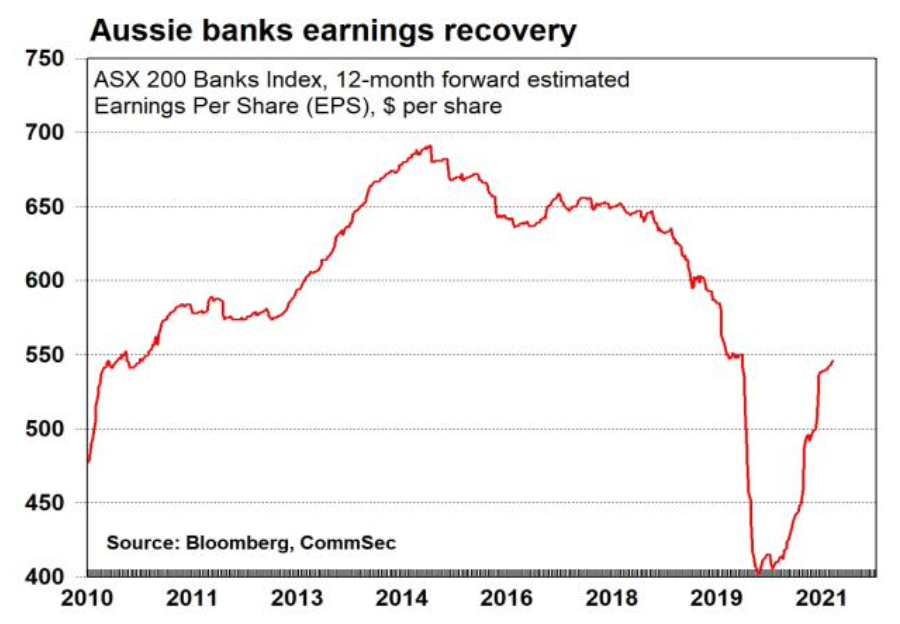

Chart of the week:

CommSec’s Ryan Felsman shared the following chart this week that shows the recovery of Australian banks earnings since the depths of the pandemic:

Top 5 most clicked:

- I’m in love with these stocks! – Peter Switzer

- Did your super fund return 18% last year? – Paul Rickard

- 8 fascinating rare earth stocks – James Dunn

- My “HOT” stock: BHP – Maureen Jordan

- One bank, one insurer, and a state that’s on the march – Tony Featherstone

Recent Switzer Reports:

- Monday 26 July: I’m in love with these stocks!

- Thursday 29 July: One bank, one insurer, and a state that’s on the march

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.