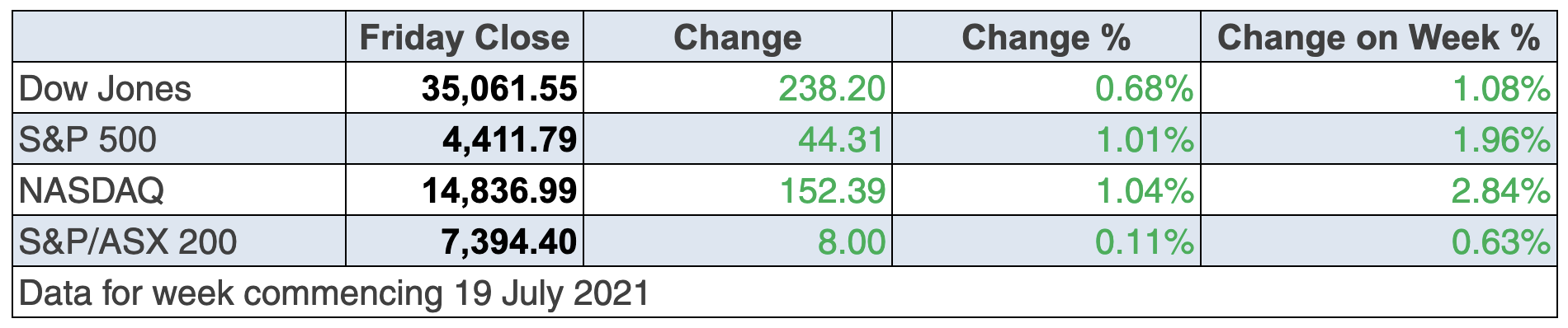

What just happened? On Monday, stocks were going to hell in a handbasket, with the Delta variant spooking markets worldwide. But by week’s end, US stock indexes were heading into record territory.

And tech stocks, that have of late been as popular as acne, are now back in favour on Wall Street, driving US stock market indexes into record territory.

How come?

Well, first there seems to be a current belief that the vaccination rates overseas will help deal with the greater contagious nature of this Delta strain of the Coronavirus. That’s a gamble or guess that could turn on a dime if the numbers shock politicians in the EU or the US in future weeks.

Helping the optimists’ case for buying stocks has been the two big E’s — earnings and the economy.

In the US, with nearly a quarter of the S&P 500 having already completed their show-and-tell, 88% have reported a positive surprise, according to FactSet. “That would mark the highest percentage of reported surprises within the S&P since 2008 if that figure holds throughout the earnings season,” says CNBC.

“Profit growth for the second quarter is expected to come in at 76%, according to Refinitiv, which would be the best growth since 2009. Profit margins have also held up in the face of rising inflation, with companies reporting average profit margins of 12.8% so far for the second quarter, above the historic range, according to S&P Global.”

This latter revelation is possibly the most important because the big surprises aren’t that surprising, given the Coronavirus crash and then the huge rebound driven by massive fiscal stimulus and record low interest rates.

Meanwhile, even in Europe, the stocks story has been very positive, which is interesting because these markets were the first to look spooked about the Delta strain threat to business and stock prices.

The July’s flash PMI (Purchasing Managers’ Index) readings on Friday showed euro zone business activity growing at its fastest pace in more than two decades, as an easing of social restrictions and expansion of vaccination programs unleashed pent-up demand. Also, the European Central Bank vowed a “persistently accommodative” stance, in light of its new inflation target. (CNBC)

And the same attitude was expressed by our central bank this week, as the lockdown threat looks to be more persistent than was thought a few weeks ago.

The Reserve Bank minutes of the July 6 Board meeting showed that the members concluded the following: “Given the high degree of uncertainty about the economic outlook, members agreed that there should be flexibility to increase or reduce weekly bond purchases in the future, as warranted by the state of the economy at the time, rather than a commitment to a specific rate of purchases over an extended period.”

That’s code for ‘if the economy needs more money to keep growing and creating jobs, the RBA will buy bonds in greater amounts’, which means more quantitative easing than they were hinting at not long ago.

Effectively, this is like the famous Mario Draghi promise when he took over the ECB and said: “Whatever it takes.”

So not only are we seeing great economic results driving earnings, but we’re also hearing central banks telling markets that they will fight the Delta variant and its potential to create recessions.

Stock markets love that kind of commitment!

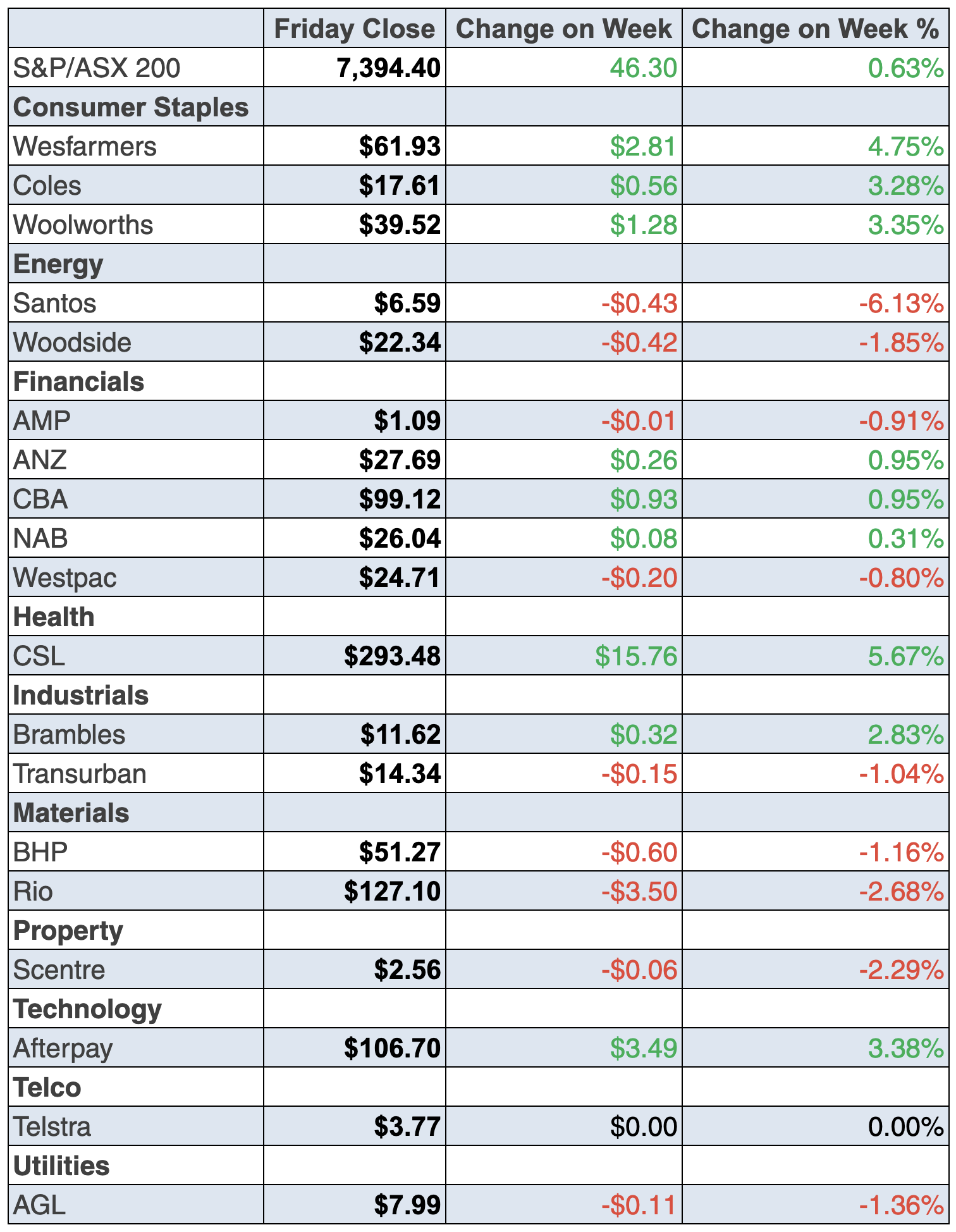

To the local story and despite the lockdown gloom, our market hit a record high finishing at 7394.4 for the week for the S&P/ASX 200 Index. That’s up 46 points.

That was a fair effort after we started the week with a big sell off on Delta strain concerns.

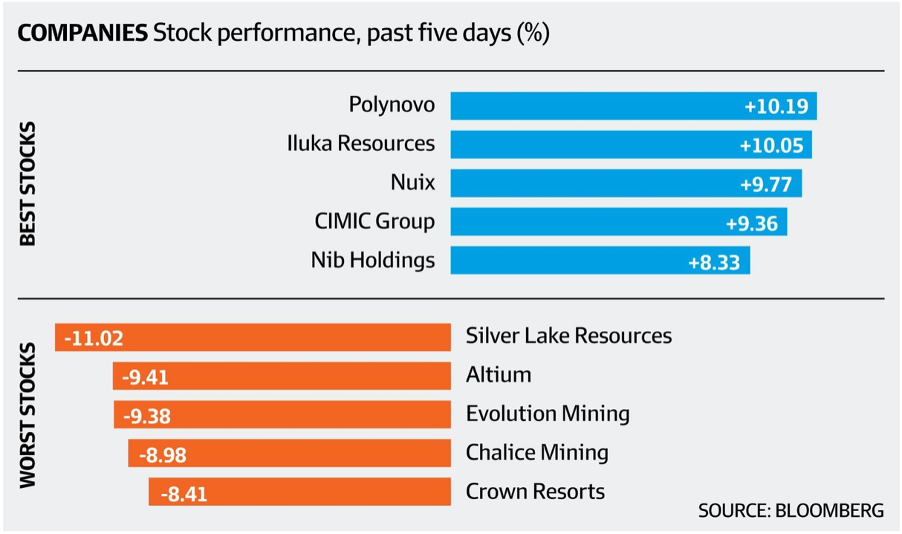

The star sector was healthcare, which has been in the outer of late. NIB was up 8.8%, ResMed 4.1%, Sonic 2.6%, Ramsay 2.4%, Cochlear 2.8% and old faithful CSL wacked on 5.7%.

Also, tech stocks came good, with Xero up 4.2%, Nuix 9.8% and Afterpay 3.4%, but Zip fell 0.1% despite a pretty good report. I’ll have the company’s CEO Larry Diamond on my TV show on Monday to see why the market didn’t rate the report.

Altium’s board rejected the takeover from US-based Autodesk and its share price fell 9.4%. The board better know what it’s doing or they should be shown the door. I hope they’re right. If they’re not, they should be bounced by shareholders.

Interesting story was BHP cracking a nickel supply deal with Tesla but its share price slipped 1.2% with market talk that iron ore prices have peaked.

That deal helped stocks such as Iluka, which rose 10% to $9.75, Lynas 4.2% to $6.43, Orocobre 5.6% to $7.69 and Pilbara Minerals, which was up 8.5% to $1.72.

Another surprise was the long suffering CIMIC, which was up 9.4% to $21.03 after a better-than-expected report, despite a $208 million fall in profit!

Here’s the Bloomberg/AFR’s winners and losers chart.

What I liked

- Citi Chief US Equity Strategist, Tobias Levkovich, told CNBC overnight that his team remains bullish on stocks and that buying the dips looks like a smart play. He pointed to the start of the Olympics and gave the example of those relays that we’ll soon see on TV, where the batons are passed from one athlete to another. He suggested that the “handover from liquidity to earnings support” will help stocks go higher but it still might not be trouble-free. I guess batons often get dropped in real relays!

- The value of merchandise goods exports rose by 7.5% in June to a record high of $41.3 billion.

- The goods trade surplus hit a record high of $13.3 billion in June, with the value of merchandise goods imports up 8.2% in the month to $28 billion.

- Skilled job vacancies fell by 0.5% (1,200 job ads) from 12½-year highs to 241,931 advertisements in June. While it was the first monthly decline since April 2020 (you can blame the lockdowns), recruitment activity is still up 43.8% (or 73,700 jobs) when compared to pre-Covid 19 levels. Going back to pre-virus numbers is a good comparison to make.

- The US leading index rose by 0.7% in June (survey: 0.9%).

- The European Central Bank said it wouldn’t hike rates until it sees inflation reach its 2% target “well ahead of the end of its projection horizon”.

- An expected lift in OPEC+ oil supply (following a new production agreement) drove the oil price lower. This is bad for energy stocks but good for economies.

What I didn’t like

- National payroll jobs fell by 1% over the fortnight to July 3 but were up 6% on a year ago. Greater Sydney payroll jobs fell 1.9% over the two-week period ended July 3 and this is the lockdown effect.

- Preliminary retail trade fell by 1.8% in June – the most in six months – to be 2.9% higher than a year ago. Victorian sales fell by 3.5% in June, with spending down by 2% in NSW. These bad readings again show the lockdown effect.

- The weekly ANZ-Roy Morgan consumer confidence rating fell by 5.2% (the most in 15 months) to an 8-month low of 104.3 (long-run average since 1990 is 112.6).

Could Australia’s stock market lag like our jab rates?

During the week I interviewed Chris Joye of Coolabah Capital. He’s been the guy who has been so accurate on his calls about the infection rates, the beating of the virus, the bond market, what the RBA is likely to do, house prices and much more.

He thinks he’s the smartest guy in the room, and in most rooms, he is! His view is that these lockdowns and our slow vaccine rollout will hold back our economy before a huge rebound next year.

This could mean our overall market index might lag the US and Europe, where vaccination rates are much better. But of course, if a worried ScoMo pulls a vaccine rabbit out of his hat, our lockdown/economic problems mightn’t last as long as doomsday merchants are predicting.

This week, CommSec’s Ryan Felsman made a sensible point in saying: “Investors in ASX-listed retailers could encounter some headwinds, with forced store closures (due to lockdowns) likely to impact July and August trading updates. Electronics giant JB Hi-Fi yesterday warned that its sales have suffered in recent weeks. Consumer demand could be weaker, given reduced government income support and uncertainty about the job market. And construction stoppages could affect hardware store sales.”

The bottom line is that while the market index might have headwinds, with some our best companies affected by the lockdowns, for the next six months it could be a time for some shrewd stock picking.

So check out these great stories of the week below…

The week in review:

- In my article this week, I wanted to make a less than confident but optimistic forecast about the share prices of four stocks – Zip (Z1P), Elmo (ELO), EML Payments (EML) and Tyro (TYR) – and my lack of certainty may increase the odds of me being right!

- Investing in a royalty company isn’t one of the most glamorous investment ideas, but it is an interesting proposition for income seekers, particularly when the yield on offer is 5% fully franked. Read Paul Rickard’s analysis of Deterra Royalties (DRR) this week.

- With demand for Nickel set to surge, James Dunn looked at six stocks that will you help you ride the nickel boom: IGO (IGO), Western Areas (WSA), Mincor Resources (MCR), Poseidon Nickel (POS), Nickel Mines (NIC) and Panoramic Resources (PAN).

- Investors could take a gamble on strong pent-up demand from punters when lockdown restrictions ease. Tony Featherstone has been reading the form of these 3 casino stocks: Crown Resorts (CWN), The Star Entertainment Group (SGR) and Sky City Entertainment Group (SKC).

- For our “HOT” stocks this week, Raymond Chan from Morgans selected Pendal (PDL) and Michael Gable from Fairmont Equities chose Dicker Data (DDR).

- There were 9 upgrades and 6 downgrades in the first Buy, Hold, Sell – What the Brokers Say of this week, and 3 upgrades and 10 downgrades in the second edition.

- And in Questions of the Week, Paul Rickard answered your questions about Metcash (MTS), Crown Resorts (CWN), CSL (CSL), Macquarie Group (MQG) and the Vanguard Australian Shares High Yield ETF (VHY).

Our videos of the week:

- Boom! Doom! Zoom! | July 22, 2021

- Are these ASX companies a buy: Webjet, A2Milk, CIMIC, AGL, Nuix & Tyro buys? | Switzer Investing

- A fund that did 40% last year! Chris Joye is negative on lockdown for economy + reliable stocks | Switzer Investing

Top Stocks – how they fared:

The Week Ahead:

Australia

Monday July 26 – CommSec State of the States

Tuesday July 27 – Weekly consumer confidence index (July 25)

Tuesday July 27 – Speech by the Reserve Bank Deputy Governor

Wednesday July 28 – Consumer Price Index, CPI (June quarter)

Thursday July 29 – International trade prices (June quarter)

Friday July 30 – Producer Price Indexes, PPI (June quarter)

Friday July 30 – Private sector credit (June)

Overseas

Monday July 26 – US New home sales (June)

Monday July 26 – US Dallas Fed manufacturing index (July)

Tuesday July 27 – US Home price indexes (May)

Tuesday July 27 – US Durable goods orders (June)

Tuesday July 27 – US Consumer confidence (July)

July 27-28 – US Federal Reserve policy decision

Wednesday July 28 – US Wholesale inventories (June)

Wednesday July 28 – US Advance goods trade balance (June)

Thursday July 29 – US Economic growth (advance, June quarter)

Thursday July 29 – US Pending home sales (June)

Friday July 30 – US Personal income/spending (June)

Saturday July 31 – China purchasing managers’ indexes (July)

Food for thought:

“If you’re looking for a home run – a great investment for five years or 10 years or more – then the only way to beat this enormous fog that covers the future is to identify a long-term trend that will give a particular business some sort of edge.” – Ralph Wanger

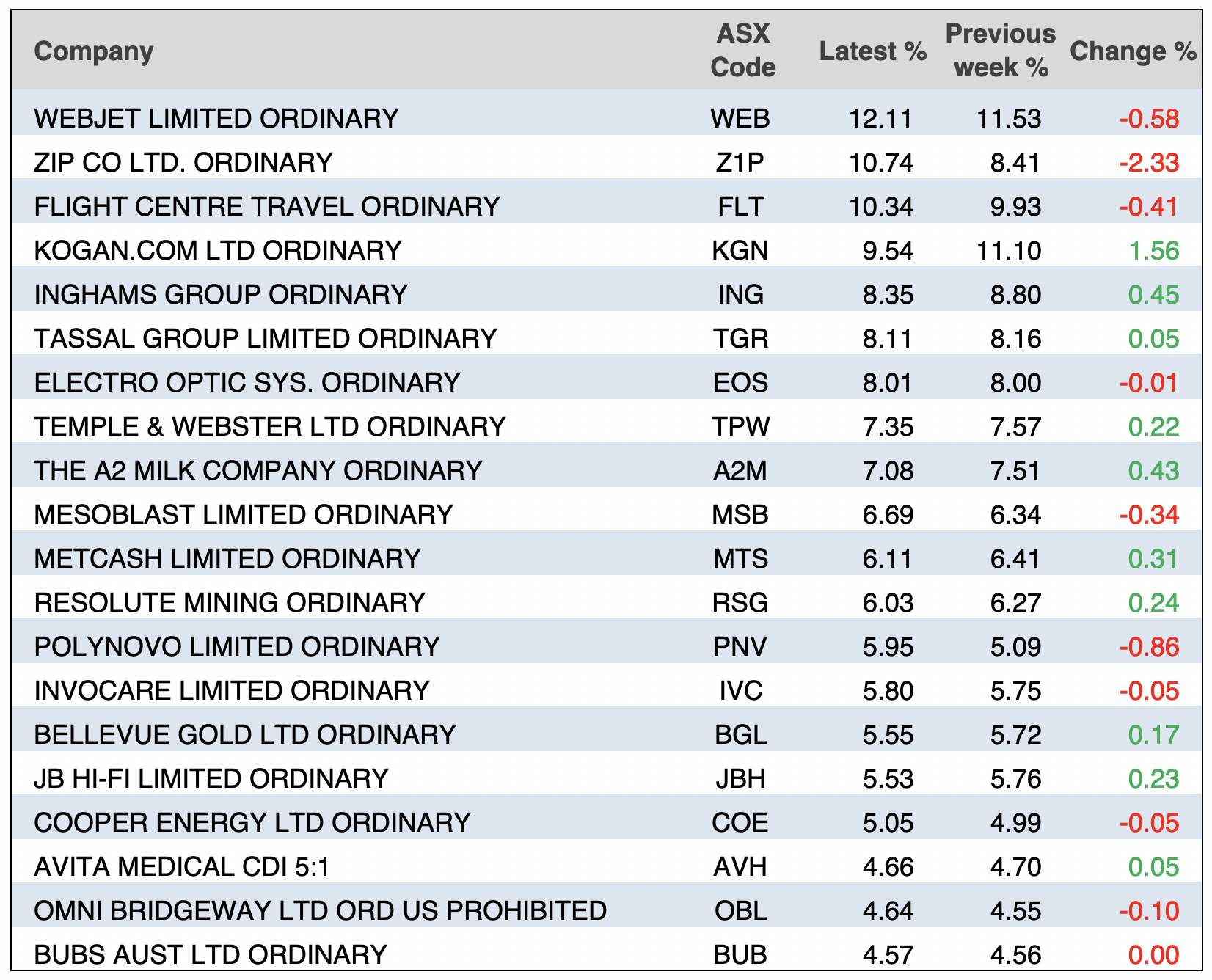

Stocks shorted:

ASIC releases data daily on the major short positions in the market. These are the stocks with the highest proportion of their ordinary shares that have been sold short, which could suggest investors are expecting the price to come down. The table shows how this has changed compared to the week before.

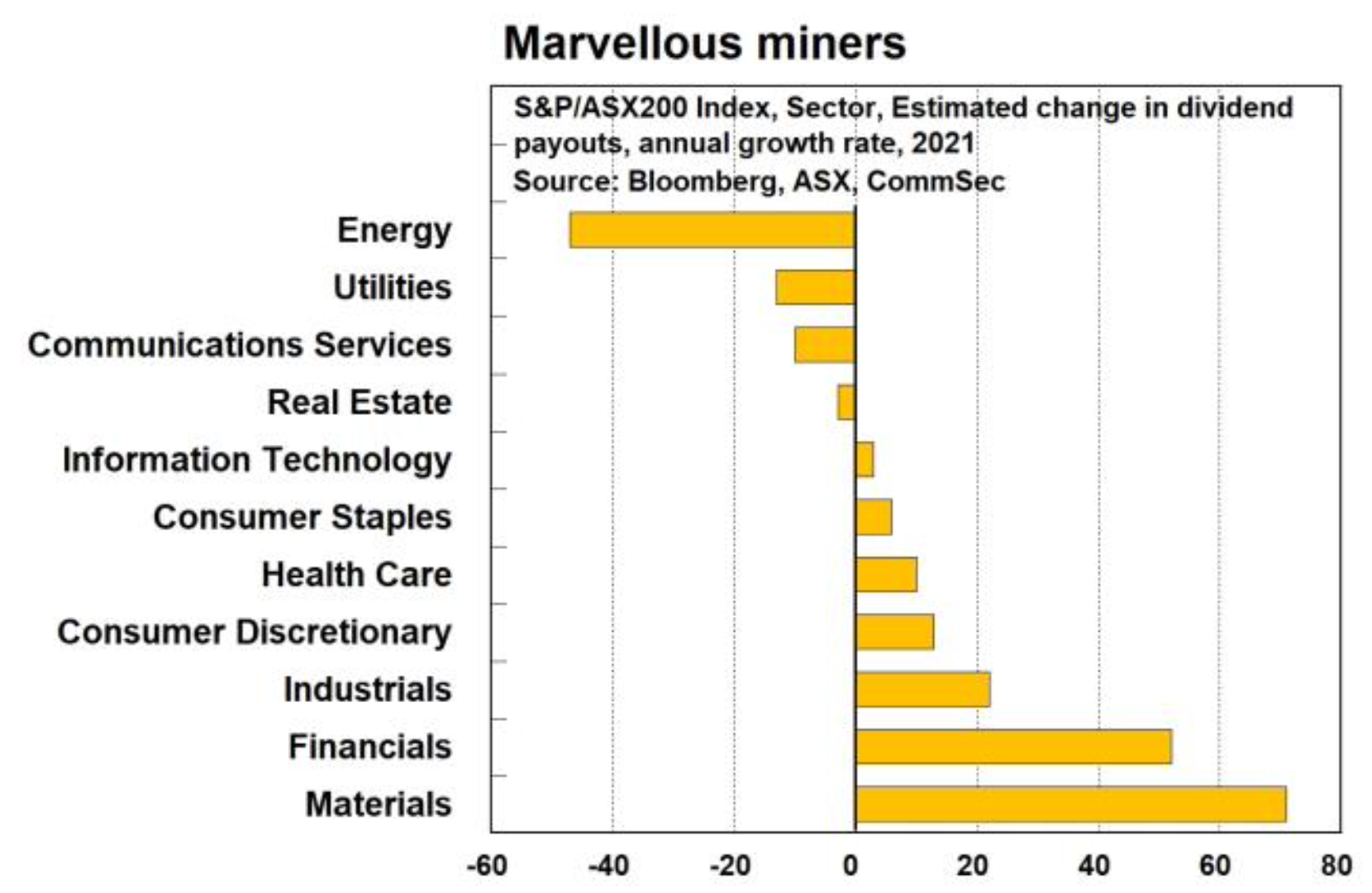

Chart of the week:

Bloomberg has estimated that materials companies will increase their dividend payments by about 70% in 2021, ahead of all other ASX sectors as shown in this chart from CommSec:

Top 5 most clicked:

- My 4 ZEET stocks: buy more? – Peter Switzer

- A stock with a forecast 5% franked yield? – Paul Rickard

- 6 stocks to ride the nickel boom – James Dunn

- 3 casino stocks an attractive long-term bet – Tony Featherstone

- My “HOT” stock: Pendal (PDL) – Maureen Jordan

Recent Switzer Reports:

- Monday 19 July: My 4 ZEET stocks: buy more?

- Thursday 22 July: 3 casino stocks an attractive long-term bet

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.