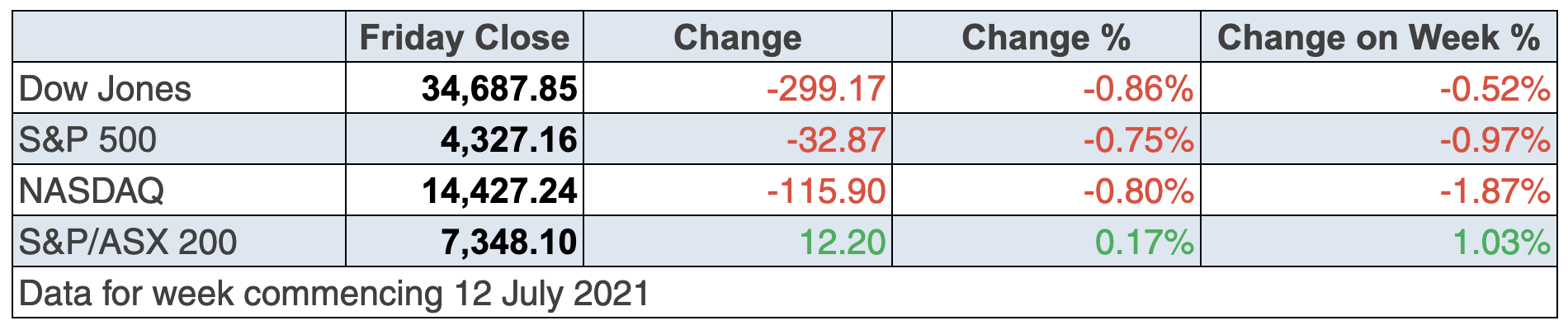

A weaker-than-expected consumer sentiment number trumped a better-than-expected retail sales result so US stocks were down on Friday. And while this is a reasonable explanation, in reality, the US market indexes have risen into record territory lately, so softness makes sense.

This negativity defied the first week’s company profit reporting, which was very positive for US corporates, but the hard-heads in the market get that. Some 18 S&P 500 companies beat analyst estimates for second-quarter earnings this week, and the average earnings-per-share result was 18% higher than expected.

However, the share prices of many of these companies fell on the news, but that’s the market for you! Of course, this is a short-term reaction. Those numbers are good for the longer-term investor who wants the overall market to head higher.

“Good earnings might have become an excuse for some investors to take profit. And with earnings expectations so high in general, it takes a really big beat for a company to impress,” said TD Ameritrade chief market strategist JJ Kinahan to CNBC. “Earnings absolutely matter, but in the short term, the Fed is still the girl everyone wants to dance with.”

He’s clearly referring to concerns about whether high inflation is transitory or not and when interest rates might rise.

Meantime, small caps and energy had a rough week on Wall Street but they have been outperformers, with the overall indexes caught between fears about the spread of the Delta strain of the Coronavirus, the longevity of the current surging inflation numbers and the very positive economic outlook on the US economy put forward by US Treasury Secretary, Janet Yellen.

European markets softened late this week, with investors concerned about the outlook for global growth after UK Covid-19 cases recorded the biggest increase in six months.

Adding to market concerns in the US, the Producer Price Index (PPI) rose by 1% in June to be up 7.3% on the year, which is the fastest in a decade. Meanwhile, the Consumer Price Index (CPI) rose by 0.9% in June to be up 5.4% on the year, which was the biggest rise in 13 years. Both inflation readings were greater than economists predicted.

However, the head of the Fed, Jerome Powell “…conceded that (Thursday’s) data on consumer prices exceeded expectations but he emphasized that it would be a mistake to respond prematurely to higher inflation.” (CommSec)

Against this, technology shares fell the most as a big fall in claims for unemployment insurance to 16-month lows pointed to the continued re-opening of the economy.

Why would that happen?

Well, first many tech/growth stocks did well during the stay-at-home phase of the Coronavirus. The reopening phase has been good for value stocks and a stronger economy is likely to push bond yields up, which have not been good for tech stocks in the past.

There is a conflict in some of this thinking by the market as growth should also be a plus for many tech stocks, as companies have the revenue to invest in new ways of doing business. However, the sellers have outnumbered the buyers for tech stocks this week, and it is what it is.

That said, these short-term plays create buying opportunities.

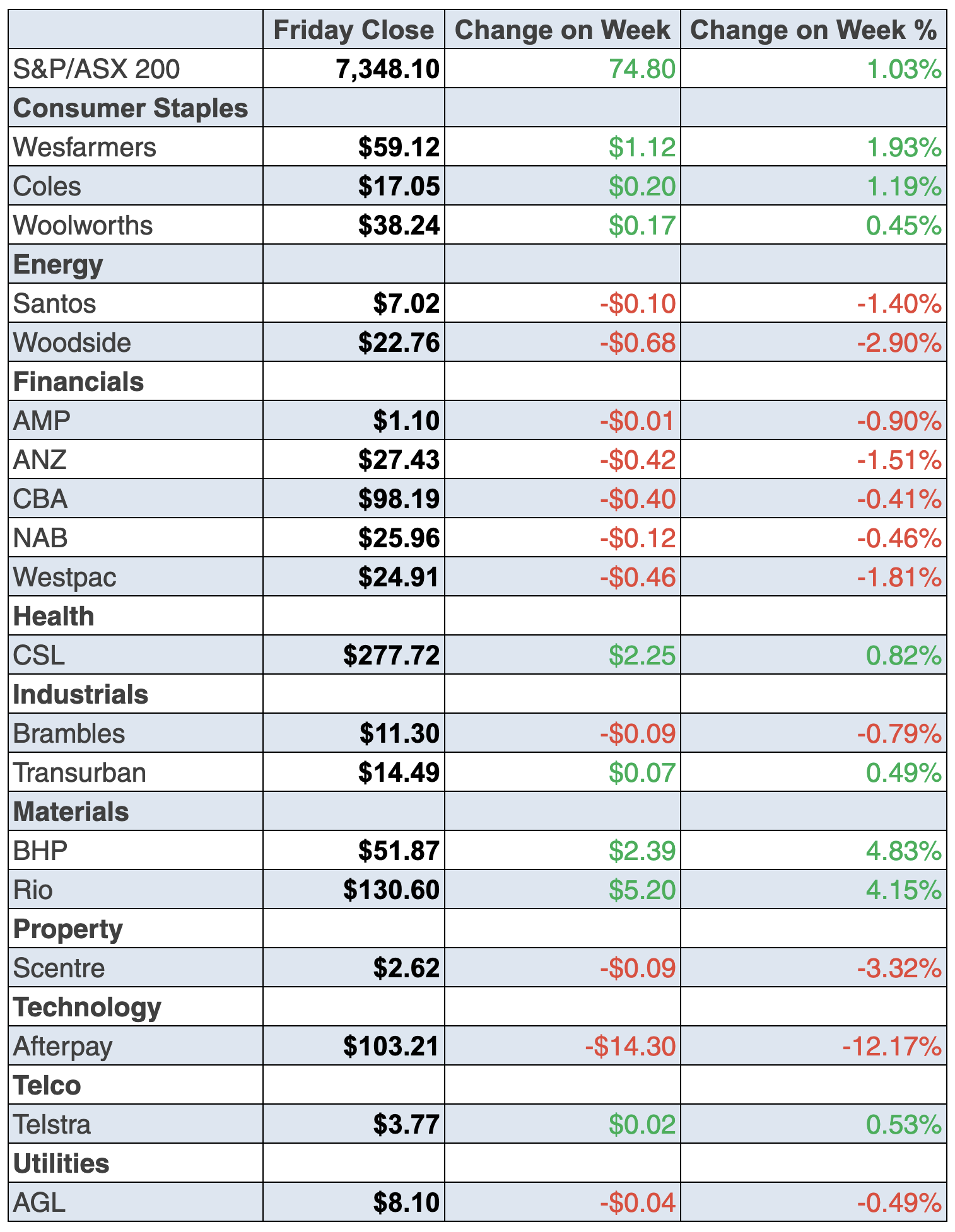

To the local story this week, and the ASX 200 was up 74.8 points (or 1%) to end at 7348.1. Miners had a strong week, while tech and buy now pay later stocks copped it, with fears that Apple, PayPal and the CBA could eat the lunch of the incumbents in the sector.

Afterpay was down 12.2% to $103.21, while Zip gave up 14.5% to $7.10.

Most tech stocks copped it, taking their lead down from the Nasdaq’s drop but Tyro lost 5.8% because lockdowns in Sydney and now Melbourne directly hit this business. I was reminded of this when I used my credit card to pay for breakfast on Friday morning on a Tyro terminal. The stock ended the week at $3.44.

The banks also had a negative week, with ANZ off 1.5% to $27.43, Westpac down 1.8% to $24.91, NAB 0.5% lower at $25.96, while CBA only gave up 0.4% to $98.19.

The big winners were the miners, with BHP up 4.8% to $51.87, Fortescue up 8% to $25.78, while Rio put on 4.2% to $130.60.

Takeover target of the week was Spark Infrastructure that has KKR and the Canadian pension fund (Ontario Teachers’ Pension Plan Board) hovering, with a $5 billion cash offer on the table. Spark’s share price spiked 17.4% to $2.63 on the offer.

With stock markets at high levels, defensive assets now look cheap and relatively safe.

What I liked

- Employment rose by 29,100 jobs in June after rising by 115,100 jobs in May. Full-time jobs rose by 51,600 and part-time jobs fell by 22,500 positions.

- The unemployment rate fell from 5.1% to a 10½-year low of 4.9% in June. The Tasmanian jobless rate stands at a 12-year low of 4.5%.

- The Westpac-Melbourne Institute Index of Consumer Sentiment rose by 1.5% in July. (Confidence dropped by 13.6% in Sydney and 10.2% in NSW, but rose 15% in Western Australia and 10.5% in Victoria.)

- The total number of dwelling starts rose by 0.2% to a 2½-year high of 51,662 units in the March quarter. Total house starts rose by 5.9% to a record high (since September 1969) of 36,395 units, to be up by 40.6% from a year ago. And at the end of March, a record 75,824 houses were being built.

- Labour costs grew at a 1.9% quarterly rate in June (the strongest growth rate since July 2010), with purchase costs up 2.1% (the strongest rate since October 2008). And final product prices lifted at a 1.5% quarterly rate in June – the strongest growth rate since July 2000. (This should be seen as a negative but the RBA wants inflation.)

- In seasonally-adjusted terms, private new detached home sales rose by 14.8% in June to 5,841 units. Over the year to June, sales were 44.9% higher than the previous year.

- US retail sales rose 0.6% in June, while economists surveyed by Dow Jones had expected a 0.4% decline.

- The NFIB business optimism index in the US rose from 99.6 to 102.5 in June.

- The Chinese economy (GDP) expanded by 1.3% in the June quarter (consensus: 1%).

- Also in China, retail sales expanded at a 12.1% annual rate in June (consensus: 10.8%).

- Industrial production grew at an 8.3% annual rate in June (consensus: 7.9%).

What I didn’t like

- The NAB business confidence index fell by 9.3 points (the most in 11 months) to 10.7 points in June. And the conditions index fell from a record high 35.8 points in May to 24.1 points in June, with the 11.7 point decline the biggest in 14 months. And yes, you can blame the lockdowns.

- The US consumer sentiment index from the University of Michigan came in at 80.8 for the first half of July, down from 85.5 last month and worse than economists estimated. Economists projected an increase.

- The Philadelphia Federal Reserve manufacturing index fell from 30.7 to 21.9 in July (survey 28).

Why stocks face short-term headwinds

The stock market has been very rewarding for the past financial year and it had to after the early experience of 2020, but now headwinds are growing. Fears about the Fed having to raise interest rates earlier than it wants to will persist as a nagging doubt for the market in coming weeks. And then there are Delta dramas with the virus that could hurt global growth.

When you put all this on top of the US stock market being up 17% at its highs year-to-date, and the S&P 500 having its second-longest stretch without a 5% pullback, you have to expect stocks will need great news before they surge again any time soon.

I’m tipping volatility and a slow grind higher against these headwinds.

And don’t forget to catch up on our big stories down below in the Report this week.

The week in review:

- Don’t be fooled by doomsdayers Dent & Co. Stick to stocks! Here are the 3 picks I shared this week: CSL (CSL), Qantas (QAN) and Elmo Software (ELO).

- One year ago, we published our “best of the best” – the long-term cornerstone stocks for your portfolio (Commonwealth Bank (CBA), BHP (BHP), CSL (CSL), Transurban (TCL), Goodman Group (GMG), Wesfarmers (WES), Woolworths (WOW) and Xero (XRO)). Paul Rickard has checked in to see how we are going and consider if any changes are warranted.

- Here are 3 of the best-positioned copper plays on the ASX from James Dunn: Oz Minerals (OZL), Sandfire Resources (SFR) and Aeries Resources (AIS).

- Tony Featherstone wrote that these two health insurance stocks offer value at current prices: NIB Holdings (NIB) and iSelect (ISU).

- Michael Gable, Managing Director of Fairmont Equities, selected Lynas Rare Earths (LYC) as our “HOT” stock this week.

- There were 8 upgrades and 11 downgrades in the first Buy, Hold, Sell – What the Brokers Say of the week, and 5 upgrades and 2 downgrades in the second edition.

- And in Questions of the Week, Paul Rickard answered your questions about retail property trusts, Deterra Royalties (DRR), Costa Group (CGC) and Emeco (EHL).

Our videos of the week:

- Boom! Doom! Zoom! | July 15, 2021

- Lockdown stocks you need to buy? + 8 stocks you should own! | Switzer Investing

- Buy RMD & CTD + 3 must have ASX stocks + OZ dollar rising & house prices slowing | Switzer Investing

Top Stocks – how they fared:

The Week Ahead:

Australia

Tuesday July 20 – CBA Household Spending Intentions (June)

Tuesday July 20 – Reserve Bank Board meeting minutes

Tuesday July 20 – Weekly consumer confidence index (July 18)

Wednesday July 21 – Preliminary retail trade (June)

Wednesday July 21 – Skilled job vacancies (June)

Thursday July 22 – Weekly payroll jobs & wages (July 3)

Thursday July 22 – Preliminary international trade (June)

Thursday July 22 – Detailed labour force (June)

Friday July 23 – Markit purchasing managers’ indexes (July)

Overseas

Monday July 19 – US NAHB housing market index (July)

Tuesday July 20 – China loan prime rates (July)

Tuesday July 20 – US Housing starts (June)

Tuesday July 20 – US Building permits (June)

Wednesday July 21 – US Weekly mortgage applications (July 16)

Thursday July 22 – US Chicago Fed national activity index (June)

Thursday July 22 – US Conference Board leading index (June)

Thursday July 22 – US Kansas City Fed manufacturing index (July)

Thursday July 22 – US Existing home sales (June)

Friday July 23 – US Markit purchasing managers’ indexes (July)

Food for thought:

“Look at market fluctuations as your friend rather than your enemy; profit from folly rather than participate in it.” – Warren Buffett

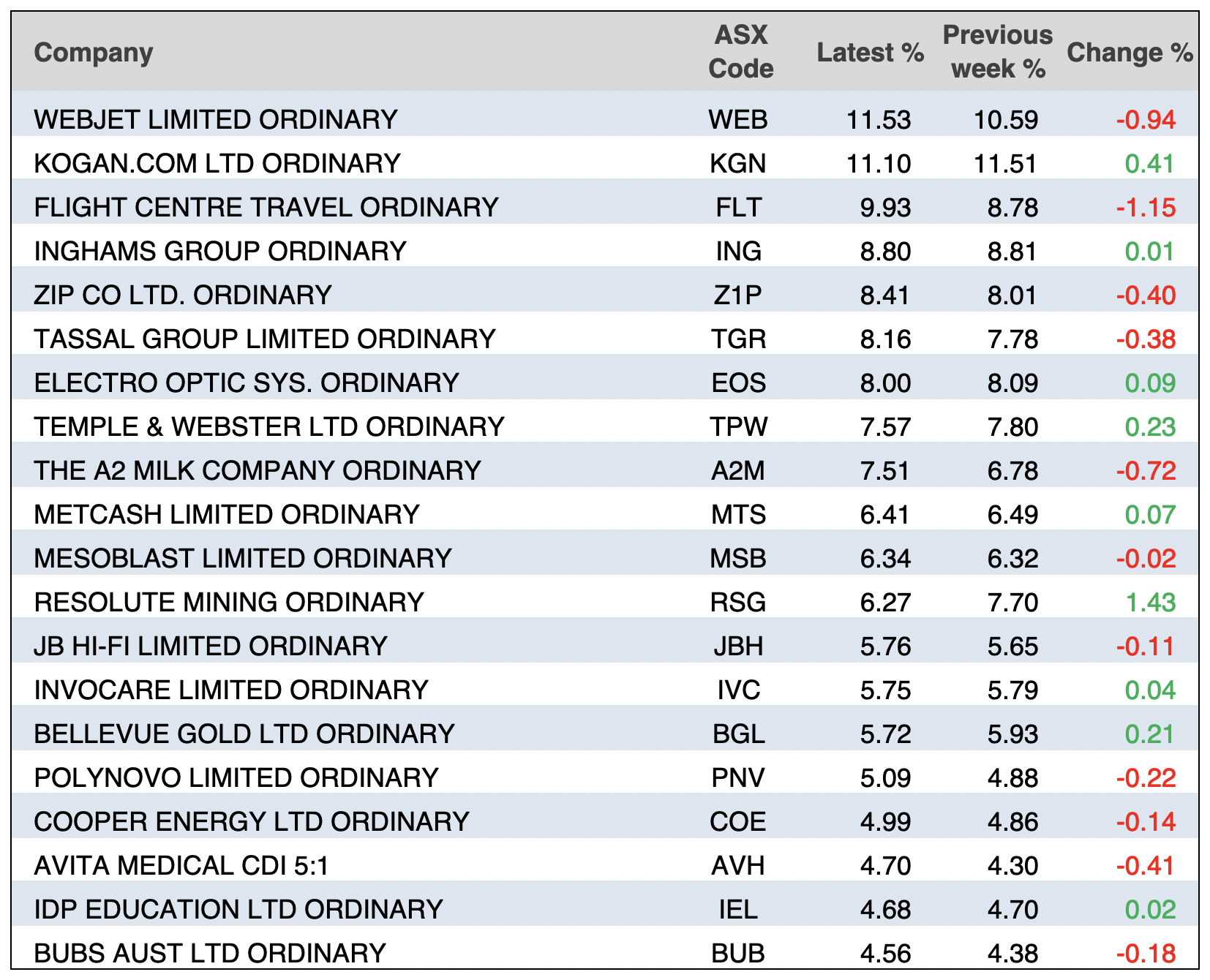

Stocks shorted:

ASIC releases data daily on the major short positions in the market. These are the stocks with the highest proportion of their ordinary shares that have been sold short, which could suggest investors are expecting the price to come down. The table shows how this has changed compared to the week before.

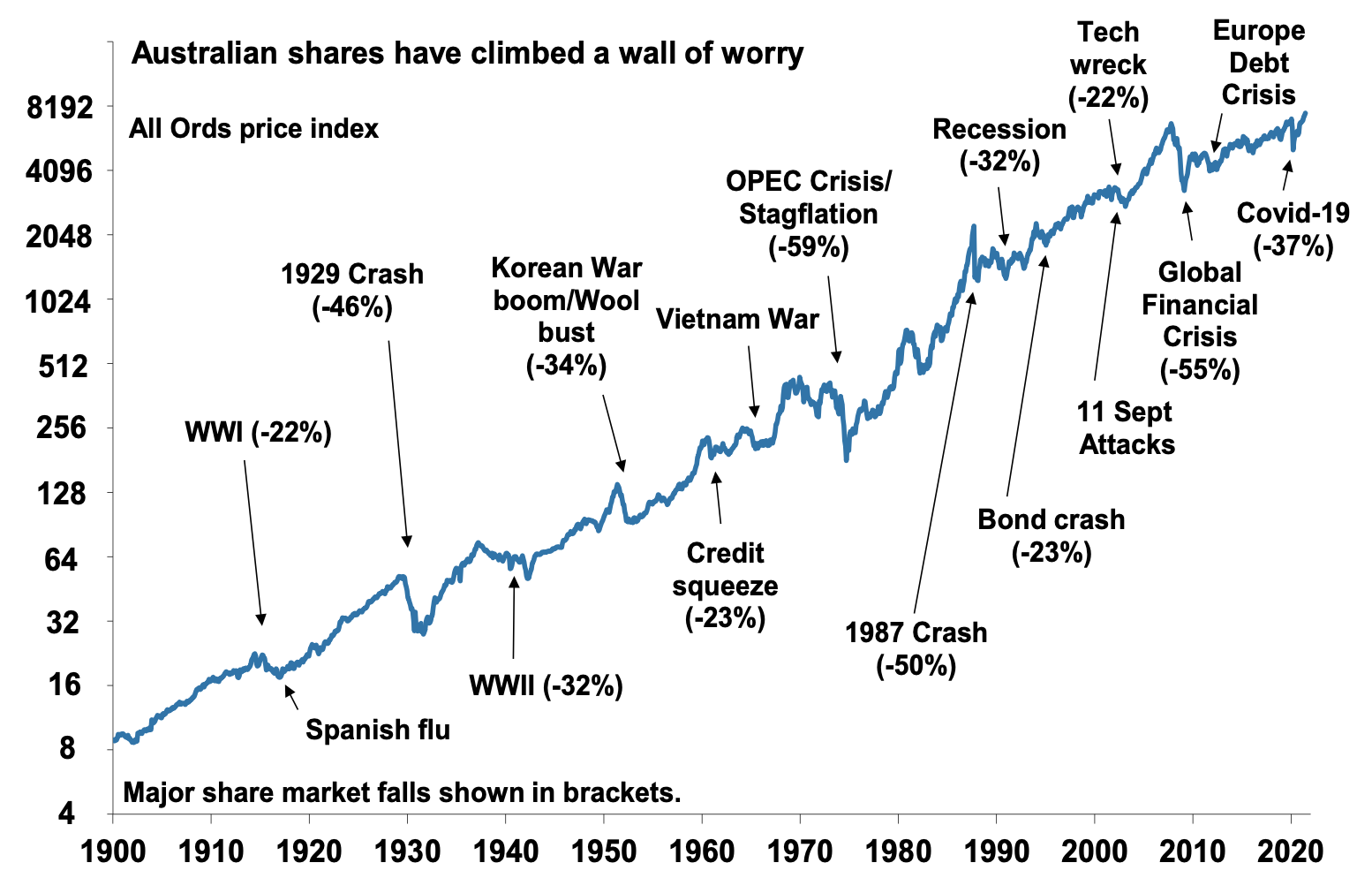

Chart of the week:

AMP Capital’s Shane Oliver published the following chart this week that looks at the consistent climb of the All Ords index since 1900:

Top 5 most clicked:

- I’m still buying stocks and here’s my latest three – Peter Switzer

- What are the stocks to buy if the market tanks? – Paul Rickard

- 3 copper stocks, two with fully franked dividends – James Dunn

- Buy, Hold, Sell – What the Brokers Say – Rudi Filapek-Vandyck

- 2 health insurance stocks to watch – Tony Featherstone

Recent Switzer Reports:

- Monday 12 July: I’m still buying stocks and here’s my latest three

- Thursday 15 July: 2 health insurance stocks to watch

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.