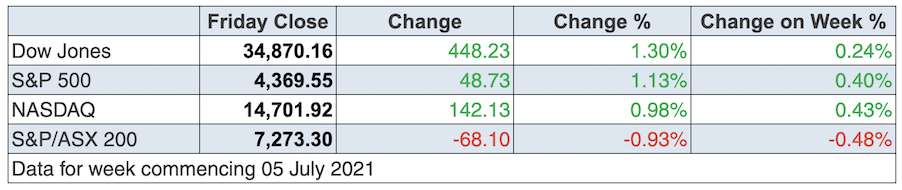

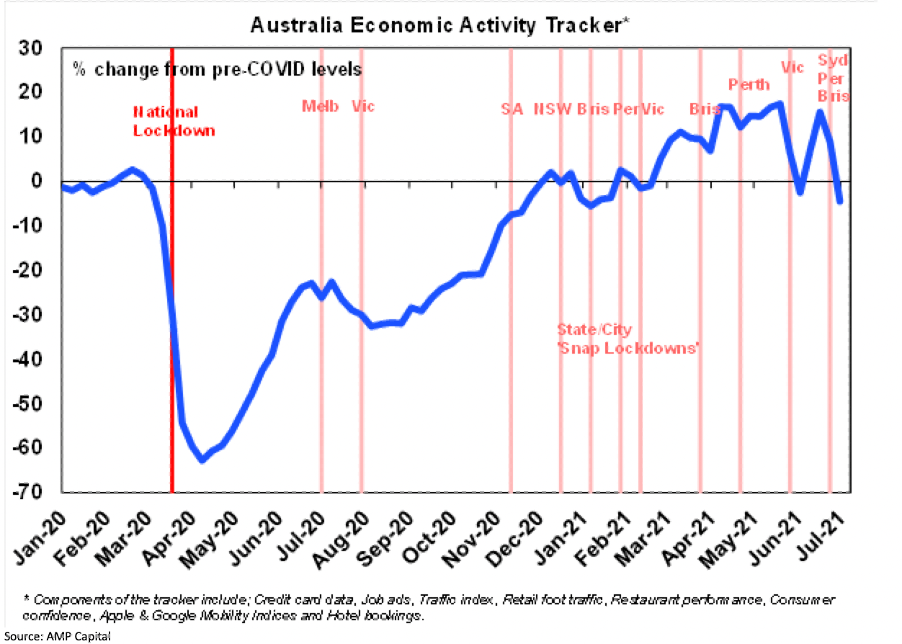

Just when it looked like the Delta strain Coronavirus outbreak would bring in the overdue correction, along comes Wall Street and its market influencers have taken stocks higher! The Dow ended up 448 points (or a big 1.3%), which a market optimist should love to see.

Virus aside, the US stock market is on the second longest stretch without a 5% pullback for the past five years, which at least makes you think that on the law of averages, a significant sell off is overdue.

This chart below shows how insistent the market is that buyers outnumber sellers. If this trend is challenged in the scariest part of the year i.e. September and October, it’ll be because the Delta strain gets out of control worldwide.

S&P 500 one year

So we have a big test coming and it will see if the combined might of vaccinations can offset the looming threat of the Delta strain that has thrown Sydney into a two-week lockdown, that could possibly turn into a four-week hit to businesses, workers and families.

It never pays to take US market positivity as unchangeable as it can turn on a dime, but suffice to say that while I’m not happy, we punted on AstraZeneca and copped a clot crisis, even if it is overblown. I’m glad the US that drives global markets has gone long Pfizer, Moderna and Johnson & Johnson!

For the moment, we can expect that a huge sell off isn’t around the near corner but AMP Capital’s Shane Oliver was preparing us for a few stock shocks ahead this week.

“Share markets fell over the last week, mainly on the back of worries that a resurgence of new coronavirus cases will derail the global economic recovery,” he said. So, it’s not just a Sydney and NSW threat. Remember that NSW is the biggest economy and has the greatest impact on Australia’s economic growth.

“The poor global lead along with the worsening coronavirus outbreak in Sydney necessitating an extension and tightening of its lockdown pushed the Australian share market down with sharp falls in retailers, health, IT and financial shares,” he added. “Consistent with the risk-off tone bond yields fell sharply, metal and oil prices fell, and the Australian dollar fell as the US dollar rose.” With this introduction to his newsletter yesterday, you would’ve thought that Wall Street could’ve been a tad negative overnight, but I should say that European markets joined the “we’re not scared” team taking on the Delta strain.

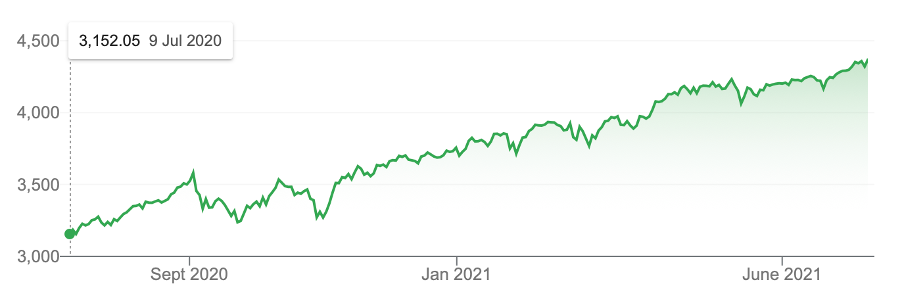

But we should be a little worried, given the Economic Activity Tracker chart below.

This has been our international badge of high achievement, where our tracker has been so much stronger than the US and Europe, but that’s changing as our vaccination programme disappoints and lockdowns return.

The best news of the week was that we’d see more Pfizer vaccines earlier than the expected September-October deadline but the company is now denying this story. This is in conflict with what ScoMo told Ben Fordham on 2GB yesterday. “He said this month that would increase to 2.8 million doses and by August Australia would get 4.5 million doses, ‘so that is quite a ramp-up,’” The Guardian reported. But it also led the story with this: “The pharmaceutical giant Pfizer says there is no change in the number of doses the company has contracted to deliver to Australia over 2021…”

Gotta hope the PM knows more than the company spokesperson!

Virus aside, we have seen a lot of potential market-affecting developments, such as:

- Increased confidence that the spike in inflation is due to pandemic distortions and transitory.

- Concern we have seen the best in terms of growth.

- Central banks not rushing to taper or hike rates.

- The bond market seeing yields fall, possibly because of concerns about the Delta variant hurting global growth.

- Ironically, these lower yields helped tech stocks zoom higher until our Friday trade.

- On central banks, Oliver makes this important point: “…while they are generally becoming less dovish, several developments over the last week indicate they are not rushing to the exits from easy money and are far from hawkish. Some are arguably even going the other way.”

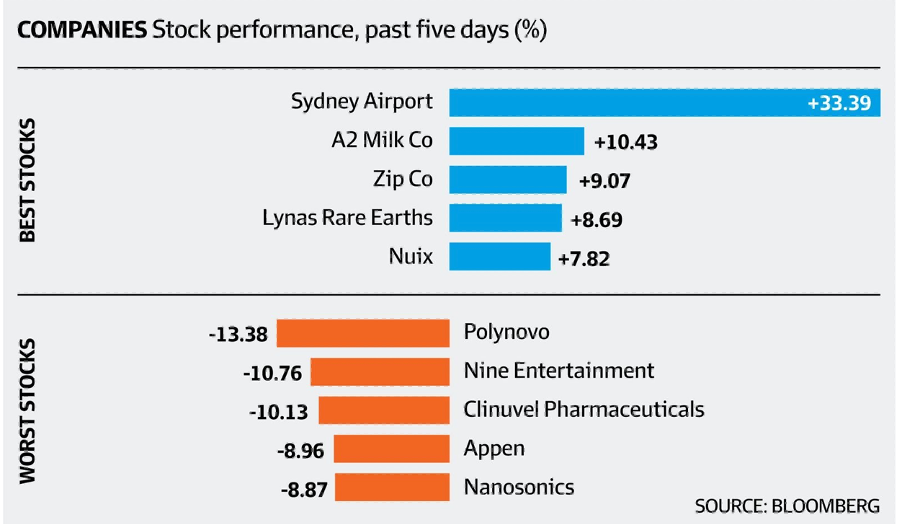

To the local story and the S&P/ASX 200 Index finished the week 35.3 points (or 0.5%) lower at 7273.3, with a 68.1-point (or 0.93%) drop on Friday with a renewed concern over the Delta strain of the Coronavirus lowering global growth expectations.

And the sentiment here wasn’t helped by the extension of lockdown restrictions in Sydney, with a growing belief that the spread of the virus into south-western Sydney will mean the lockdown will go beyond next month.

This kind of scenario has economic and corporate profit implications. Ultimately, that has to affect share prices and it is! That’s why the Index was off 0.93% on Friday.

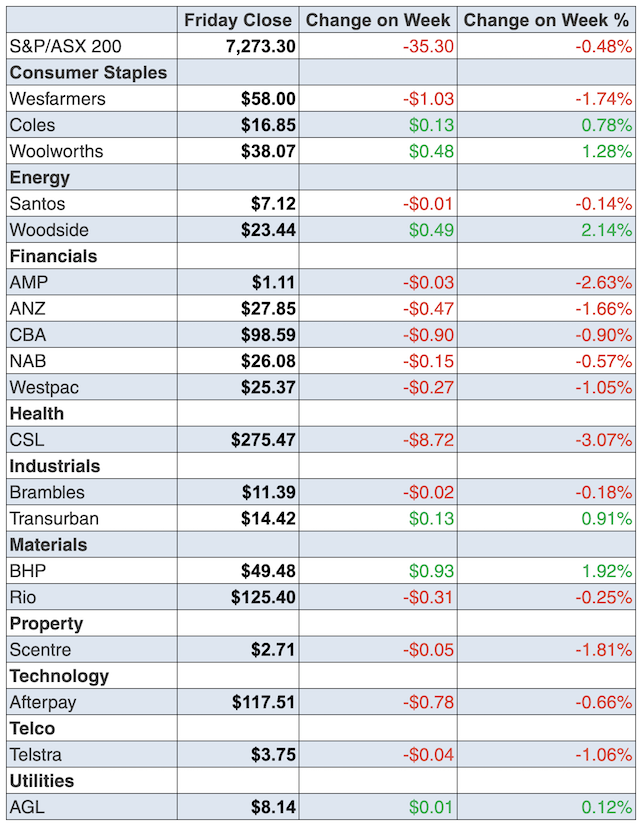

Banks had a rough week, with the CBA off 0.9% to $98.59, ANZ lost 1.7% to $27.85, NAB dropped 0.6% to $26.08 and Westpac gave up 1.1% to $25.37.

My tech stock stable was putting in some nice rises earlier in the week until they copped it on Friday. WiseTech Global lost 4.1%, Megaport 5.7%, Appen 8.69% and Xero 2.4%.

Here are the big winners and losers for the week.

CSL gave up 3.1% to $275.47 and again is moving into “buy me” territory. Crown lost 7.8% with the inquiry into its fitness for a licence to operate a gambling business not looking real flash, after allegedly underpaying its obligations to the Victorian Government!

The huge winner of the week was Sydney Airport, which put on a whopping 33% to finish at $7.73 after receiving a $22 billion takeover offer from super funds. Is this a sign that travel businesses have a future or what?

And at long last, A2Milk started to make a share price comeback. The share price rose 10.4% this week on news that it received a tick from the New Zealand Overseas Investment Office to purchase a 75% interest in dairy nutrition business Mataura Valley Milk.

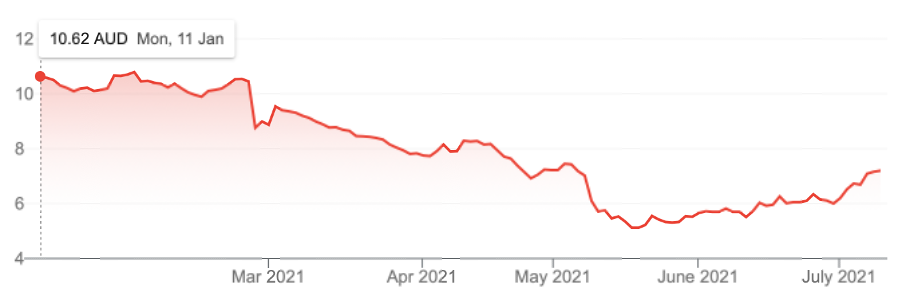

A2Milk (A2M) six months

Around mid-May, the share price was $5.04 and I kept suggesting that the company was too good to be a cellar-dweller for too long. So the 42.8% gain in eight weeks is nice to see! (My sister in Los Angeles took my tip so I’m especially glad that family feathers haven’t been ruffled!)

Also it was good to see Nuix and Lynas head up, with the latter both supported by Julia Lee and Michael Gable on my Switzer Investing show last Monday.

What I liked

- The Reserve Bank (RBA) has left the target rates for both the cash rate and 3-year government bond yield (April 2024 maturity) at 0.1%. The RBA will slow its bond-buying programme from early September, reducing its weekly bond purchases from $5 billion to $4 billion until at least mid-November.

- National payroll jobs rose by 0.3% over the fortnight to June 19, with wages up by 0.4% over the period. Jobs have risen 7.3% over the year to June 19 with wages up 6.8%.

- New vehicle sales totalled 110,664 units in June – the most in two years. Sales are up 0.4% on a year ago.

- ANZ job advertisements rose by 3% in June – a record 13thconsecutive month of gains. Vacancies are at 12½-year highs of 211,854 available positions.

- Retail trade rose by 0.4% in May to be up 7.7% on a year ago.

- Council approvals to build new homes fell by 7.1% in May but these are up 52.7% on the year – the strongest annual growth rate in 11 years.

- Consumer credit in the US grew by a record US$35.3 billion in May (survey: US$18 billion).

What I didn’t like

- The weekly ANZ-Roy Morgan consumer confidence rating fell by 3.9% to 107.8 – the third largest decline since the height of the pandemic in late March 2020. But understandably, it’s all lockdown related.

- OPEC squabbles which throws another curve ball at the oil price.

- The ‘final’ IHS Markit services index in the US fell from a record high 70.4 in May to 64.6 in June (survey: 64.8).

- The ISM services index in the US eased from an historic high 64 in May to 60.1 in June (survey: 63.5).

The sensible take on the stock market…

Provided the positivity of vaccinations trumps the negativity from the spread of the Delta variant here and overseas, then this from Mike Wilson, Morgan Stanley’s chief U.S. equity strategist in New York, makes a lot of sense. “The market is solidly mid-cycle and with that typically comes a 10-15% index level correction. We expect such a correction will create buying opportunities, given a still strong growth backdrop.”

Wilson favours financials, healthcare and materials but the magnitude of his sell off is on the high side while interest rates are so low. And I’m in the camp that says eventually vaccines will beat the Delta variant threat.

And with lockdowns and crappy weekend weather, make sure you check out below our stock tips of the week, where we had a good look at quality companies that the market is treating harshly at the moment.

The week in review:

- What quality companies do the analysts like, even if it takes until 2022 for them to deliver? Here are 5 blue chips set to bounce: Qantas (QAN), Amcor (AMC), Northern Star (NST), Lendlease (LLC) and Woodside (WPL)

- Everyone would like stocks that have good returns and no risk. They don’t really exist. But Paul Rickard has come up with 5 stocks where the downside risk isn’t as high as most: Amcor (AMC), Charter Hall Long WALE REIT (CLW), Coles (COL), JB Hi-Fi (JBH) and Medibank Private (MPL).

- James Dunn looked at 4 high-quality stocks that appear attractively priced right now: NEXT DC (NXT), TPG Telecom (TPG), Newcrest Mining (NCM) and APA Group (APA).

- Tony Featherstone wrote that ‘empty nester’ downsizing and an increased demand for budget accommodation could help fuel growth for these three stocks: Lifestyle Communities (LIC), Ingenia Communities Group (INA) and Aspen Group (APZ).

- Raymond Chan, head of the Asian desk at Morgans, chose Endeavour (EDV) as a “HOT” stock this week, while Michael Gable, Managing Director of Fairmont Equities, selected Wesfarmers (WES)

- Read a highlight from last week’s webinar to find out our views on how the banks will perform over the coming months.

- There were 3 upgrades and 13 downgrades in the first Buy, Hold, Sell – What the Brokers Say of this week, and 8 upgrades and 6 downgrades in the second edition.

- And in Questions of the Week, Paul Rickard answered your questions about selling Sydney Airport (SYD), investing long term for your grandchildren, the outlook for Nuix (NXL) and stocks to benefit from an increase to China’s birth rate.

Our videos of the week:

- Boom! Doom! Zoom! | July 08, 2021

- 6 under-price quality ASX companies set to rebound + 3 reliable income payers! | Switzer Investing

- Is News Corp a buy? Is Blue Bet a good punt? +3 big mistakes property buyers make! | Switzer Investing

Top Stocks – how they fared:

The Week Ahead:

Australia

Tuesday July 13 – Weekly consumer sentiment (July 11)

Tuesday July 13 – Overseas arrivals/departures (May)

Tuesday July 13 – NAB Business survey (June)

Wednesday July 14 – Consumer confidence (July)

Wednesday July 14 – Building activity (March quarter)

Wednesday July 14 – Provisional overseas travel (June)

Thursday July 15 – Employment/unemployment (June)

Thursday July 15 – Consumer inflation expectations (July)

Overseas

Tuesday July 13 – China International trade (June)

Tuesday July 13 – US NFIB Business optimism index 9June)

Tuesday July 13 – US Consumer prices (June)

Tuesday July 13 – US Monthly budget statement (June)

Wednesday July 14 – US Producer prices (June)

Wednesday July 14 – US Federal Reserve Beige Book

Thursday July 15 – China Economic growth (June quarter)

Thursday July 15 – US Export & import prices (June)

Thursday July 15 – US Industrial production (June)

Thursday July 15 – US Federal Reserve Chair Powell speech

Friday July 16 – US Retail sales (June)

Friday July 16 – US Consumer confidence (July)

Food for thought:

“Investment is the discipline of relative selection.” – Sid Cottle

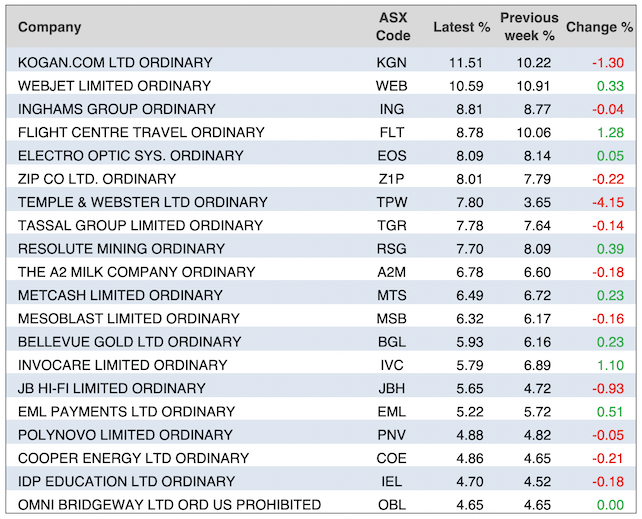

Stocks shorted:

ASIC releases data daily on the major short positions in the market. These are the stocks with the highest proportion of their ordinary shares that have been sold short, which could suggest investors are expecting the price to come down. The table shows how this has changed compared to the week before.

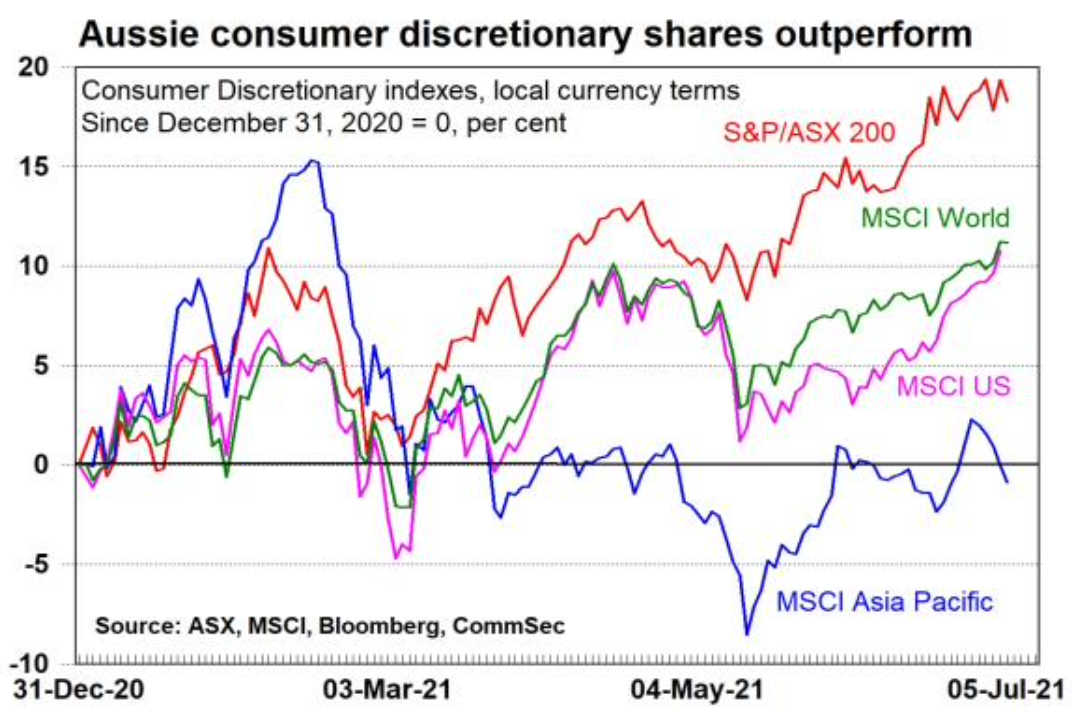

Chart of the week:

This week, CommSec’s Ryan Felsman highlighted the outperformance of Australia’s consumer stocks so far this year. The S&P/ASX 200 Consumer Discretionary index has risen by 18.3%, ahead of the MSCI World Consumer Discretionary index, which rose 11.2%, as well as the US and Asia Pacific Consumer Discretionary indexes:

Top 5 most clicked:

- 5 blue chips set to bounce – Peter Switzer

- 5 income favourites for the new financial year – Paul Rickard

- 4 quality stocks priced to buy – James Dunn

- Bright outlook for these 3 holiday park & lifestyle-community stocks – Tony Featherstone

- Questions of the Week – Paul Rickard

Recent Switzer Reports:

- Monday 5 July: 5 blue chips set to bounce

- Thursday 8 July: Bright outlook for these 3 holiday park & lifestyle-community stocks

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.